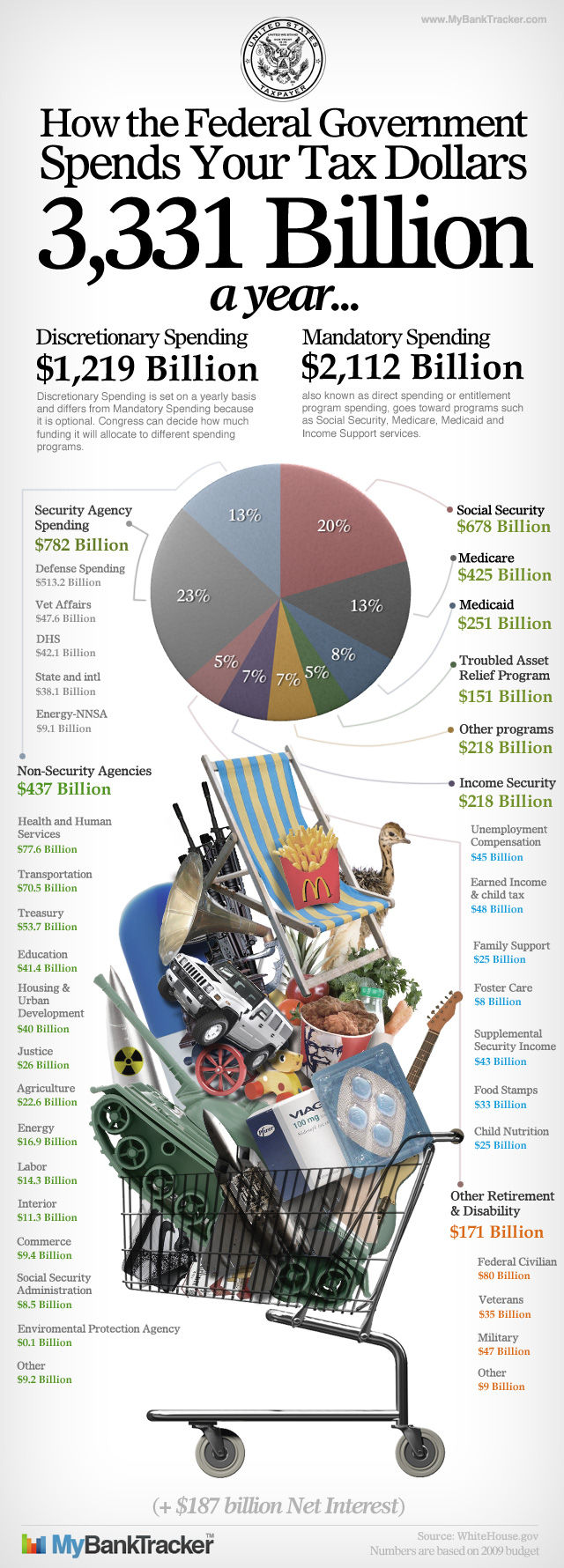

How the Federal Government Spends Your Tax Dollars: Infograph

You've read about them, complained about them and paid them. Taxes annoy every American over the age of 14 and continue to be a hot-button issue, but do you know how your tax dollars are being spent?

With the recent recession and ever-growing national debt, taxes have been in the spotlight more than ever. According to the Tax Policy Center, "Individual income taxes and payroll taxes now account for four out of five federal revenue dollars." Given that fact, it is important to know where your money is going.

Government spending can be broken down into three categories: Mandatory spending, Discretionary spending and Interest. Each category is equally important, but our Government has the most flexibility with Discretionary spending where they can decide the budget needed for different programs under security agency spending and non-security agency spending. This is often the topic of debate for politicians and policy makers alike.

Sources: In order to compile this infograph MyBankTracker used the 2009 Budget from the White House website. For the specific subhead numbers MyBankTracker used estimated projections based off of The Spending Outlook found on the Congressional Budget Office website.