The Best Second Chance Checking Accounts of 2024

Getting a regular checking account can be difficult when you have previous problems with banks.

In this article, I analyze the best checking accounts from the nation's largest banks that give you a “second chance.”

I review each account’s monthly fees and features before selecting the best overall second chance checking account that’s worth your consideration.

Nearly 10 million American households do not have a regular checking or savings account, according to the FDIC.

It is partially due to bad banking history (such as writing bad checks or unpaid overdrafts) that is recorded under someone’s ChexSystems report.

Banks have different ways to address this issue. Some banks may stop relying heavily on ChexSystems reports to determine if someone is eligible to get a checking account.

Other banks offer second chance checking accounts that cater to customers with negative ChexSystems reports.

Before diving into the accounts, here’s a brief refresher on ChexSystems:

A Quick Guide to ChexSystems

- In the same way that credit reports track your history with loans and lines of credit, a ChexSystems report records your history with banks accounts, specifically negative activity

- When performing customer screeniFCRA (Fair Credit Reporting Act), banks rely on CheckSystems to find black marks on your record.

- Common examples of negative activity include constant overdrafts, returned checks, account abuse, check fraud, and more. Each record stays on file for five years unless you dispute inaccurate information.

- A not so obvious hit can be caused from constant account openings and closing. Banks will pass on customers who are known to switch banks on a consistent basis.

- You can obtain a free ChexSystems report every year from ConsumerDebit.com.

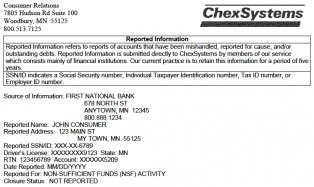

This sample ChexSystems report shows that this person has an overdraft problem.

This sample ChexSystems report shows that this person has an overdraft problem.Second Chance Checking Accounts

Of the top 10 banks in the U.S. by deposits, only one of them (Wells Fargo) provides actual second chance checking accounts. Other banks (Chase, PNC Bank) offer prepaid debit card accounts in lieu of second chance checking accounts.

Now, here’s the interesting tidbit. Another three banks (Capital One, Citibank, and U.S. Bank) said it won’t deny your checking account application solely based on a negative ChexSystems report.

Essentially, you can apply for any account at one of these banks and your ChexSystems report won’t have a major effect on the account-opening decision unless there is a very obvious case of fraud on your part.

Since it doesn’t make sense for someone with a bad banking history to go for a more expensive checking account, let's focus on the basic checking accounts from these banks.

The following accounts were listed because they are ideal for people with bad ChexSystems reports. The banks may still choose to pull your reports for review.

Here are the accounts from the top 10 banks that I analyzed:

Bank of America, TD Bank, and SunTrust -- the three remaining big banks -- do not offer second-chance checking accounts or similar alternatives.

Checking Accounts Fees & Features

Wells Fargo Opportunity Checking

A second chance checking account that has a $10 monthly fee (add $2 per month for paper statements). The fee is waived in the months that you make 10 debit card purchases, or keep a $2,000 daily balance, or post a total of $750 in direct deposits.

All in all, it is everything that you’d expect from any other basic checking accounts except for one thing: you cannot make deposits at an ATM -- you must visit a Wells Fargo teller or initiate the deposit electronically. Also, the account can only be opened by visiting a branch.

PNC SmartAccess Prepaid Visa

A prepaid card account that has a $5 monthly fee. The fee cannot be waived.

This is prepaid card account that performs very much like a checking account -- except you cannot write checks. You'll still be able to pay bills through online bill pay. You have a prepaid card that lets you make purchases. However, you will never be allowed to overdraw your account. Any transactions that will lead to a negative balance will be rejected.

Chase Liquid

A prepaid card account with a $4.95 monthly fee. It can be avoided only when linked to a Chase checking account.

Although it is advertised as a prepaid card account, it bears great resemblance to Chase’s basic checking account. The account’s fee summary lists out the services that are not available with Chase Liquid.

They include: check-writing, online bill pay, Chase QuickPay (person-to-person payments) and wire transfers. As a Chase customer, I can vouch for those great features. Not having access to them would be a major inconvenience.

Capital One 360 Checking

An online checking account with no monthly fee.

You can write checks, pay bills online and make person-to-person payments. In addition to free access to all Capital One ATMs, you also get free access to 38,000 ATMs under the Allpoint ATM network.

To top it off, your deposits earn interest (see other interest checking accounts out there). The biggest caveat to the account is that you cannot use a Capital One teller to perform transactions. For the perks and no monthly fees, I think it’s a very acceptable tradeoff.

Citibank Basic Checking

A regular checking account that has a $12 monthly fee. It can be avoided with one direct deposit plus one bill payment per month, or with an average $1,500 balance in the checking account or a linked Citibank savings account.

A typical basic checking account that lets you write checks, make online bill payments and offers free access to all Citibank branches and ATM.

Best Pick: Capital One 360 Checking

Capital One 360 Checking stands as one of the best checking account for people with bad ChexSystems reports. Boasting a long list of beneficial perks with no annual fee, it’s hard to beat.

Add on the fact that Capital One doesn’t rely heavily on ChexSystems and you’ve got a great “second-chance” checking account even though it is not designed for that purpose.

With no monthly fee, the Capital One 360 Checking account is just too good of an option for people that have a bad ChexSystems report.

You’re getting the same account as someone with a clean ChexSystems report -- for no monthly cost. I can’t see how you can do better than that.

Other options to consider

Honorable mentions go to Chase Liquid and U.S. Bank Easy Checking because they are solid choices for anyone who still wants to bank at branches.

With Chase Liquid, you are paying the lowest monthly fee of the bunch. With U.S. Bank Easy Checking, I feel that you get the best set of fee-waiver options among the group.

Second chance checking account fees compared

| Account | Monthly fee | Fee waiver |

|---|---|---|

| Wells Fargo Opportunity Checking | $10 (or $12 with paper statements) | Make 10 debit card purchases, or keep a $2,000 daily balance, or post a total of $750 in direct deposits. |

| PNC SmartAccess Prepaid Visa | $5 | Cannot be waived. |

| Chase Liquid | $4.95 | Cannot be waived. |

| BB&T MoneyAccount | $5 (or $3 with $1,000 load during previous month) | Cannot be waived. |

| Capital One 360 Checking | $0 | Not applicable. |

| Citibank Basic Checking | $12 | Post 1 direct deposit + 1 bill payment, or keep a $1,500 balance |

| U.S. Bank Easy Checking | $6.95 (or $8.95 with paper statements) | Post total direct deposits of $1,000, or keep a $1,500 balance. |

I gave honorable mentions to Citibank Basic Checking and U.S. Bank Easy Checking because, in the end, you want to closest thing to a checking account. These two accounts are actual checking accounts with great leniency when it comes to bad ChexSystems reports.

Second chance checking account features compared

| Account | Noteworthy features | Can you write checks? |

|---|---|---|

| Wells Fargo Opportunity Checking | Cannot make deposits at a Wells Fargo ATM. | Yes. |

| PNC Foundation Checking | Subject to $100 daily limit on ATM withdrawals and debit card purchases. Money orders only cost $0.49 each. | Yes. |

| Chase Liquid | No online bill pay, Chase Quickpay or wire transfers. | No. |

| BB&T MoneyAccount | Cannot make deposits at BB&T ATMs. Online bill pay is available. | No. |

| Capital One 360 Checking | Access to online bill pay and person-to-person transfers. Free access to Capital One and Allpoint ATMs. Deposits earn interest. You cannot use Capital One tellers. | Yes. |

| Citibank Basic Checking | Free access to online bill pay and all Citibank branches and ATMs. | Yes. |

| U.S. Bank Easy Checking | Free access to online bill pay and all U.S. Bank branches and ATMs. | Yes. |

Noteworthy Tips

Online bill pay is the same as check-writing

When you use online bill pay, the bank writes the check and sends it off for you. Technically, if you put a person’s name as a payee, the bank will still send a check to that payee. So, even if you can’t write checks, you can use online bill pay (works with the BB&T MoneyAccount, for instance).

Be ready for disadvantages of prepaid cards

If you prefer to go the prepaid route, you may be able to have your paycheck automatically deposited to the card but what happens if someone writes you a personal check? You could try taking it to the bank the check was issued from, but without an account, they will most likely charge you a fee. There are plenty of check cashing services out there but you’ll also have to cough up a fee to use them.

Ask for an account upgrade after six months

Chase and PNC Bank will allow Liquid and Foundation Checking customers, respectively, to upgrade to a regular checking account if they can show good banking activity in the past six months. If you’ve had an account for that long, it doesn’t hurt to ask.

Other Checking Accounts That Don’t Rely on ChexSystems

With more than 7,000 banks in the U.S., there are bound to be more banks out there that are more forgiving of negative marks on ChexSystems reports. Here are some smaller U.S. banks that also provide checking accounts to people with bad banking histories:

-

- Bank of Arkansas Opportunity Checking

-

- CenterState Bank Fresh Start Checking

-

- Fort Sill National Bank (all accounts)

-

- Great Western Bank

-

- Peoples Bank (Paris, TX)

-

- Rio Bank Fresh Start Checking

-

- Santander Bank (all accounts)

-

- Urban Trust Bank Opportunity Checking

-

- USAA Free Checking

-

- Washington Savings Bank Rewards Card Checking

-

- Woodforest Bank Second Chance Checking

Final Words of Advice

Second chance bank accounts are a solid option for people who have had issues previously with their banking institutions.

If you find that you are consistently having problems with being approved for bank accounts (second chance or standard accounts), make sure to follow these tips to ensure you get back on the right track:

Review your report: To understand what is causing you to be denied, visit ChexSystems and request a copy of your report. By law you are allowed a free copy once every 12 months.

Pay what you owe: As you review the report, you will be able to figure out which bank or banks reported you and why. If you legitimately owe the bank money, contact them and ask to work something out. If you reach negotiations, you can ask them to remove their ChexSystems report on you. Once an agreement is made between you and the bank, make sure to get it in writing. You never know whom you are speaking with, and ChexSystems is known to make contacts for proof.

Dispute what you don’t owe: When there are instances you feel you are the one in the right, contact the bank and plead your case. Just bringing the issue to their attention may be enough for them to realize their mistake and remove the black mark.