Credit Card Closed? 6 Things You Need to Do Now

Sometimes, you’ll have one of your credit card accounts closed. Whether you requested the closure or the bank did it without prompting, once an account is closed, you won’t be able to use it to make purchases anymore.

On top of that, a closed credit card account can have other effects on your finances and credit score.

Learn what you should do when you have a credit card account closed.

These tips will limit the impact of the account closure and set you up to get a new credit card as soon as possible.

1. Find Out Why Your Account Was Closed

The first and most important thing to do is to find out why your account was closed. If you were not given a reason, contact the card issuer to ask.

There are many reasons for a credit card account to be closed, including:

- Prolonged inactivity - a long period without a transaction.

- Card discontinuation - the card product is no longer available.

- Fraud or theft - repeated cases of unauthorized purchases and suspicious activity.

- Default - you did not make payments toward your balance.

Your job is to find out exactly what caused your account to be closed.

Once you know why your account was closed, you can move forward.

If the account was closed because it was not being used, you’ll know that you should try to use future cards more frequently.

If your account was closed due to suspicious activity, you should go through your records to make sure that it didn't hurt your credit and that your identity wasn't stolen.

2. Try to Salvage the Account

Once a credit card account is closed, it’s not gone forever. Especially in cases where a card is closed due to inactivity or discontinuation, you might be able to salvage your relationship and history with the lender.

Having a credit card account close can have a large impact on your credit score.

The largest portion of your credit score is your history of on-time payments. One of the next largest aspects of your score is the length of your history and the age of your accounts.

Having an account close decreases the number of chances you have to make on-time payments. It also reduces the age of your accounts.

This can result in a huge decrease in your credit score, especially if the closed card has been open for a while.

Ask for the account to be re-opened or converted

Try to save your credit score from the impact of losing a good account.

If the card cannot be reopened, or you don’t want to keep the card due to things like annual fees, ask for a conversion. Many card issuers are more than happy to change a credit card account to a different type of card.

For example, if you have a Chase Sapphire Preferred card, you have to pay an annual fee. You can ask Chase to convert the account to a Chase Freedom card, which charges no fee.

Even if your account has closed, ask if it can be converted to a different product instead.

Make sure that the account is converted rather than asking the card issuer sign up for a new card product. Having the account converted means the card’s history is preserved. If you get a new card entirely, the history is lost.

3. Find Out if You Had a Balance Remaining

Just because a credit card is closed does not mean that you don’t owe any money.

A credit card issuer can close an account at any time, for any reason, even if you’re carrying a balance. An account being closed just means that it can no longer be used to make new purchases.

Make sure you know where you stand with regards to the account’s balance when you have an account closed.

If you do have a balance outstanding, make sure you get clear information as to what the amount owed is and how you can make payments. Then, do your best to pay off the debt as quickly as you can.

Once the balance on the account has reached zero, you are fully done with the account.

4. Remove the Account as a Payment Source

You probably use your credit card to pay for a lot of recurring charges.

Streaming services, automatic bill payments, and other things you don’t even think about getting charged to your card automatically. Beyond recurring charges, services like Uber or sites like Amazon save card information for payments.

The last thing you want to do is to try to use a closed account to make a purchase.

In the best case, the transaction is declined and you need to provide an alternative form of payment.

In the worst case, you miss a bill payment because the company tried to use your card for payment. That could result in costly late fees and could hurt your credit even more.

If an account of yours closes, gather the past 12 months’ statements.

Then, take the time to go through the statements and note any recurring transactions on them.

Also look for payments to online stores or other places that store payment details. By going through a full years-worth of statements, you’ll find weekly, monthly, quarterly, and annually recurring transactions.

Once you have a list of the companies that have your card info saved, go through and update your payment information. Make sure any future payments are taken from a card that is still active.

5. Monitor Effects on Your Credit Report/Score

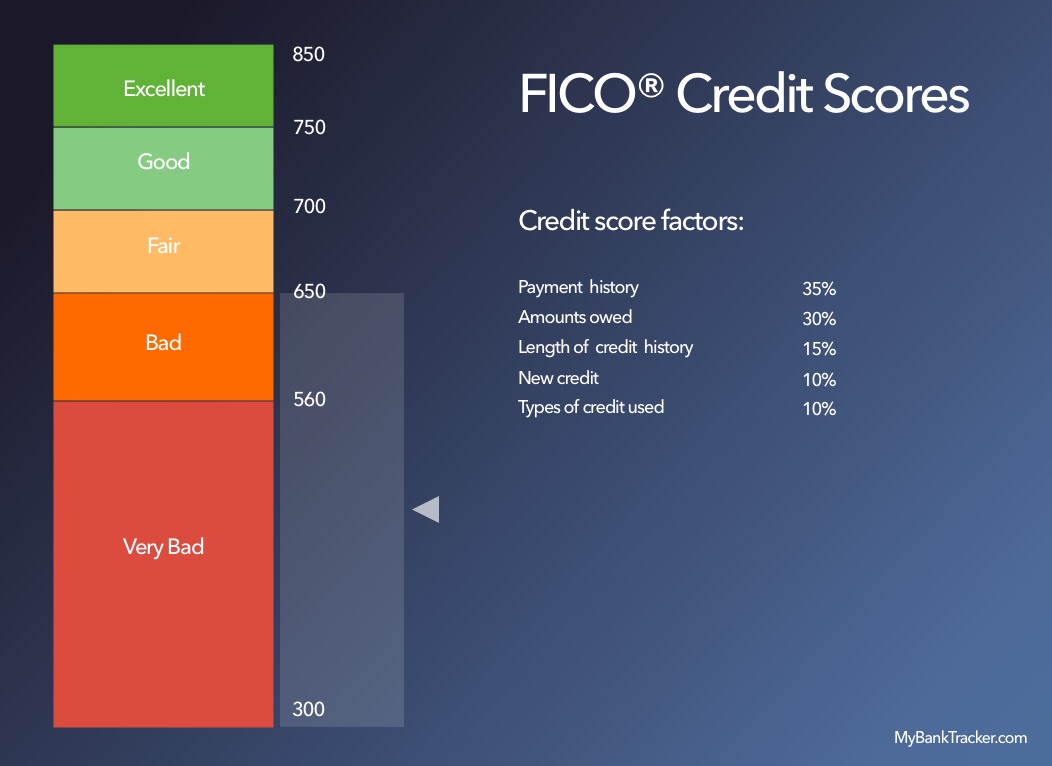

As mentioned, having a credit card account closed could affect your credit score. Your credit score is composed of the above criteria.

When you have an account closed, it affects the first three factors of your score.

The age of your accounts is a big part of your score.

If an old credit card account is closed, it could drop the average age of your accounts by a lot. This will have a big impact on your score. Do everything you can to keep older accounts open as they provide a great boost to your credit.

Your credit utilization ratio is the ratio of the amount you owe to the total of all your credit limits combined.

The lower this ratio the better it is for your credit score. When an account is closed, your total credit limit will decrease. This, in turn, will increase your utilization ratio, causing your score to dip.

Finally, the fewer accounts you have, the fewer payments you’ll be making each month.

This will slow down your progress when it comes to building up a history of on-time payments. While it won’t have a big effect immediately, it has a long-term effect on your credit’s improvement.

6. Give Your Credit Score a Boost

When you have a credit card account closed, you should take steps to counteract the effects it will have on your credit.

One thing to do is to request a credit limit increase on your other cards.

One thing that changes when you lose an account is that your credit utilization ratio increases.

Asking other card issuers to increase your credit limits reduces the drop in your total credit limit. That mitigates the effect that losing an account has on your utilization ratio.

Another option would be to make a significant payment on an existing loan.

Reducing how much you owe will also reduce your utilization ratio. You should be aiming for a utilization ratio below 30%, but the lower you can get it, the better.

Conclusion

Having a credit card account closed without warning isn’t a fun situation.

It leaves you with a lot of questions and some work to do to minimize the impact of the account closure on your financial life.

Follow these tips to reduce the effect of an account closure on your credit score and to get back on the path to good credit as quickly as you can.