How to Calculate and Reduce Your Debt-to-Income Ratio

If you’re applying for a loan you’re probably worried about whether your credit is good enough to qualify for the loan.

In fact, what most people immediately think of when they think about loan applications is their credit score.

However, lenders look at more than just your credit score. You also have to take your debt-to-income ratio into account.

This ratio helps lenders know whether you can handle a new loan.

Learn what your debt-to-income ratio is and why it’s important.

Your Debt-to-Income Ratio

Put simply, your debt-to-income (DTI) ratio is how much debt you have compared to how much you make in a year.

If you have a high amount of debt and low income, you’ll have a high DTI.

If you have low debt and a high income, you’ll have a low DTI.

The lower your DTI is, the better it looks to a lender because it means you have the cash flow to afford the monthly payments on a loan.

Why Does It Matter?

Your DTI matters because lenders will look at it when considering whether you can handle a new loan.

Your credit score is a measure of how trustworthy you are when you borrow money. If you have good credit, a lender will know that you’ll do your best to make payments on your loans.

Your debt-to-income ratio measures your ability to make payments on your loans.

If you have $1 million in debt, but only make $20,000 a year, there’s no way you’ll ever pay the loans off. You might do your best, but you just won’t be able to with that level of income.

When they evaluate a loan application, lenders want to be sure that they will get their money back.

They want to see a combination of trustworthiness and ability to pay a new loan.

A good debt-to-income ratio will show that you have the income available to make monthly payments on a new loan.

That can help you qualify for the loans you need.

How to Calculate Your Debt-to-Income Ratio

Calculating your debt-to-income ratio is not very difficult.

Simply divide your monthly gross income by your monthly debt payments.

Your monthly gross income

Gross income is the amount of money you make before any deductions. That means you take the amount you make before taxes, insurance, 401(k) deductions and the like.

Income sources generally include:

- Wages

- Salaries

- Tips and bonuses

- Pension

- Social Security benefits

- Child support and alimony

You can see your gross wage on your paycheck and use that information to determine your annual gross income.

Your monthly payments

When determining your monthly debt payments, add up all the minimum payments required by your loans.

This can include (but not limited to) monthly payments on:

- Mortgage loans

- Personal loans

- Student loans

- Credit cards

- Auto loans

- Child support and alimony

If you pay rent right now, it is not included. Rather, your new mortgage payment would be added to the calculation.

Once you’ve determined your monthly gross income and debt payments, divide your debt payments by your income.

The result is your debt-to-income ratio.

Consider this example:

You have a gross income of $3,000 per month. Your estimate mortgage payment would be $1,000 per month. You have a student loan with a minimum payment of $250. You also have a credit card payment of $150 per month.

Your total debt expenses are all of those monthly payments added up:

$1,000 + $250 + $150 = $1,400.

So your monthly debt payments add up to $1,400 per month.

Your DTI is $1,400 / $3,000 = 46.67%.

What is a Good Debt-to-Income Ratio?

Generally, lenders like to see applications from borrowers with a debt-to-income ratio of 35% or less.

At this level, you probably have a good amount of money left over to spend each month. You can easily make rent and make monthly payments on your debts while affording other necessities like groceries.

The lower your DTI, the better it looks to lenders, but 35% is a good benchmark to aim for.

If you have a DTI of 50% or more, you’re in dire straits.

You’ll have a hard time getting a new loan because you’re already sending half of your monthly income towards debt payments.

In reality, you’re spending more than 50% on servicing your debt, since your gross income doesn’t include taxes, health insurance expenses, and the like.

If you have a 50% DTI, you need to take action to try to lower the ratio.

What Your DTI Ratio Means

| DTI Ratio | What This Means |

|---|---|

| 35% or less | This is the ideal debt-to-income ratio for most people who have any kind of debt. If you're in this range, you're in good-standing and your best bet is to avoid adding any other debts to your current situation. If do add more debt, make sure to make your monthly payments on time and pay it down as soon as possible. |

| 36% to 42% | Although this is not the ideal DTI ratio, it certainly is not a bad one. Keep paying down your debts in a timely manner and avoid incurring new ones, and you'll see your DTI go down in no time. |

| 43% to 49% | This ratio is a red flag. A DTI in this range indicates that you might be in some financial hardship. It's important if your DTI is in this range, to start aggressively paying down your debt to get it out of the red zone. Consider consolidating your debt to help reduce your interest rate and manage your monthly payments. |

| 50% or higher | This ratio is an extreme danger zone to be in. If your DTI ratio is 50% or greater, then half of your monthly income is going towards paying your monthly debts. You'll not only have a hard time getting approved for new loans or credit cards, but your credit score will also be taking a hit. In order to decrease your DTI ratio, you should be doing all you can to pay down your debt. If you're seriously struggling to pay down your debt and keep up with payments, consider filing for bankruptcy. |

Why 43% is an Important Debt-to-Income Ratio

One major break-point for your debt-to-income ratio is 43%.

This is a magic number for people who want to purchase a home. To get approved for a “qualified mortgage” you must have a DTI of 43% or lower.

Qualified mortgages tend to be the best option for borrowers.

They don’t allow some risky features such as balloon payments or negative amortization. They also don’t charge excessive upfront fees.

Lenders are also incentivized to make qualified mortgage loans because they get legal protections on qualified loans.

Because of this legal protection, it can be harder to find a lender willing to offer a mortgage to someone with a DTI higher than 43%.

The key 43% ratio is also the DTI limit for FHA loans, which let you buy a house with a smaller down payment.

Other loan programs have different DTI ratio. For example, the VA requires a DTI of 41% or lower.

How to Lower Your Debt-to-Income Ratio

There are two ways that you can lower your debt-to-income ratio: make more money or pay off your debt.

Prove higher income

Making more money is a more difficult way to improve your DTI.

Everyone knows that it can be difficult to get a raise at work. Even if you get a promotion, you might only get a raise of a few percents. That can make increasing income a slow way to improve your DTI.

You can also try to find a side job to increase your income.

One obvious downside of this is that you’ll be trading some of your free time for more money, which will put you under additional stress.

Plus, you have to make sure that the income is documented.

You can’t use under-the-table pay in your DTI calculations. If you cannot show the source of the income, lenders won’t consider it in your application.

Reduce monthly debt obligations

The better way to lower your DTI ratio is to focus on your debt. You can make additional payments on your existing loans to lower your DTI.

Another option is to consolidate your loans or to refinance them. This can help you save money by reducing the interest rate on your loans. It can also reduce your monthly payment, which helps your DTI.

Another benefit of paying down debt to reduce your DTI is that it will help your credit score.

Paying down debt is the best way to improve your odds of getting a loan because it helps with two different factors lenders consider.

Your Credit Score Matters Too

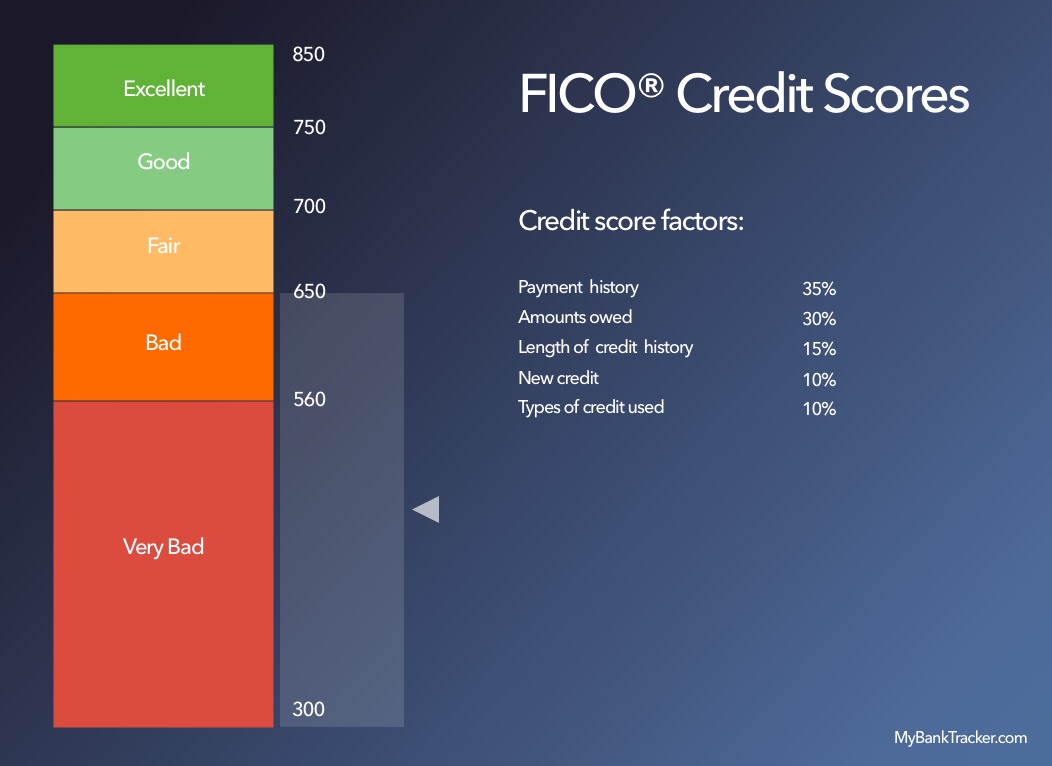

Of course, when you’re applying for a loan your credit score matters too.

Your debt-to-income ratio measures your ability to make payments on a loan.

Your credit score measures your trustworthiness and how likely you are to actually make the payments.

Even if you have a DTI of just a couple percent, you won’t get a loan with a terrible credit score.

Payment history

Your payment history is the largest factor in your credit score.

As you make on-time payments each month, your payment history improves and your score goes up. If you miss a payment, your credit score will take a big hit.

Unfortunately, it takes a long time to build a good payment history.

Amounts owed

The amount that you owe is the second biggest factor in your credit score and is easier to effect in the short-term.

Try to pay down your existing debts to improve your score. Make extra payments each month if you can.

You can also stop using your credit cards for daily expenses to prevent those balances from appearing on your report.

Again, a benefit of this is that paying down your debts will also reduce your DTI, giving your application’s chances an even bigger boost.

No new, unnecessary borrowing

Finally, lenders don’t like to see a lot of recently opened loans when they look at a loan application.

If you’re applying for an important loan in the near future, avoid applying for unnecessary loans or credit cards before your important loan application.

Conclusion

Your debt-to-income ratio is an important measure of your ability to make payments on new loans.

Try to keep your debt-to-income ratio as low as possible.

At a minimum, aim to keep the ratio below 43%, as that will keep you eligible for the majority of major lending programs.

Wondering how much a personal loan might cost you? Check out our personal loan calculator to help you figure out your possible monthly payments and accrued interest: