The Effects on Your Credit Score After Removing an Authorized User

Credit cards are a great way to pay for purchases. They let you make large purchases without having to carry around a lot of cash. They also let you earn rewards from your day-to-day shopping.

One feature of credit cards that many people find useful is the option to add someone else as an authorized user. When you add someone as an authorized user on your credit card account, they get a card of their own. They can use it to make purchases and can help to pay the bill, though technically you are legally responsible for any debts they incur.

Adding someone as an authorized user can also help their credit. The question remains, what effect does removing an authorized user have on your credit score?

Reasons to Remove an Authorized User

There are a number of reasons that you might want to remove someone as an authorized user on your credit card account.

Authorized user is ready to go solo

It’s very common for someone to add their child as an authorized user on their credit card account. It gives the child a way to make important purchases in an emergency. It can also help them build credit for some credit card companies report information to authorized user’s credit reports.

When your child gets older, you might not want them to have access to your credit card anymore. They might also be able to start building credit on their own. Many companies offer student credit cards for young consumers with a thin credit file, so recent high school graduates can start building their score on their own.

Once your child qualifies for their first credit card, removing them as an authorized user will let them build their credit on their own.

End of a relationship

Many couples add each other as authorized users on credit card accounts. This is convenient for joint expenses since either partner can make the purchase using a joint account.

If a relationship ends, it’s a good idea to remove your ex-partner as an authorized user from your account. Otherwise, they could spend your money without your permission.

Account is being closed

If you’re closing a credit card account it’s a good idea to remove the authorized users from the account. While it’s not the worst thing to forget to do this in advance, some cards will require it before allowing you to close the account.

Increase chances of approval for authorized user for new cards

Some credit card companies won’t extend more than a certain amount of credit to an individual. They also might not be willing to offer a new card to someone who has a lot of accounts on their credit report already. Removing someone as an authorized user will remove your card from their report, which may improve their chances of approval in these situations.

Impact on Your Credit

When it comes to getting credit cards, or any loan, your credit score is one of the most important things determining your chances of approval.

What is a credit score?

A credit score is a numerical representation of someone’s trustworthiness when it comes to borrowing money. A high score means lenders can trust you to pay back any loans you receive.

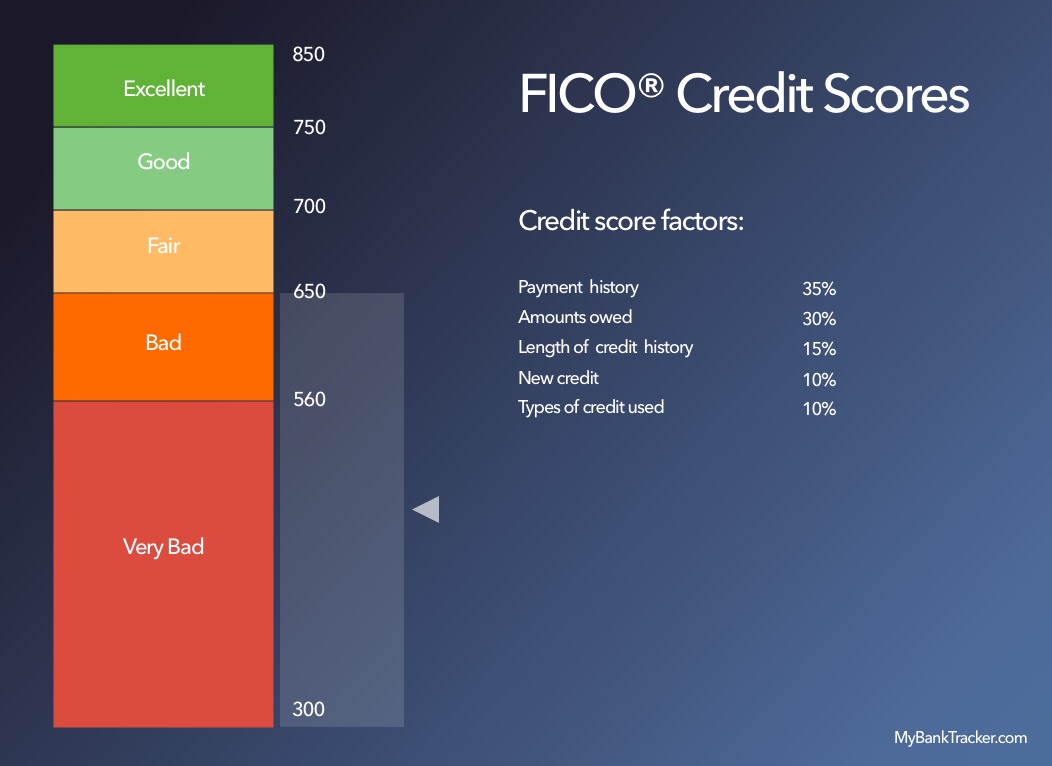

Usually, when someone talks about their credit score, they’re referring to their FICO score. FICO scores were first introduced in 1989 by Fair Isaac Corporation. Today, there are three companies, TransUnion, Experian, and Equifax, that track consumers’ FICO scores. These credit bureaus provide that information to lenders as needed.

How are Credit Scores Calculated?

Your credit score, which can range from 300 to 850, is calculated from five different factors.

Payment history

Your payment history is a measure of how good you are at making on-time payments on your debts. Every time you make a payment on time, your score goes up. If you make a payment late, your score will go down. The later the payment, the bigger the drop in your score.

Making on-time payments, over the course of months and years, is the best way to get a good credit score.

Amounts owed

There are two parts of your debt burden that impact your score.

The first is the total amount that you owe to lenders. The more money that you owe to your creditors, the worse your score will be. The less you owe, the better.

The second is the percentage of your credit cards’ credit limits that you are using. The lower your credit card balances as compared to their limits, the better your score will be.

Length of credit history

Having a long credit history means you have more experience with credit and debt. The more experience you have with handling debt, the more likely it is that you can handle it well. The longer that credit bureaus have had you on file, the better it is for your score.

Another thing that is considered is the average age of your credit card accounts. Opening and closing card accounts on a regular basis are bad for your credit score. Lenders want to see long-term relationships with other lenders.

New credit

Applying for a lot of new loans in a short period of time is a sign of financial distress. Why would you be applying for the loans if you don’t have a need for the money?

Each time you apply for a loan, your credit score will drop by a few points as the credit bureau notes the application on your credit report. Your score will recover over the course of two years. The effect of one application is small, but applying for lots of new loans can cause the effect to add up.

Mix of types of credit

Finally, your credit score takes the different types of loans that you’ve had into account. The more different types of loans (credit card, mortgage, car loan, personal loan, etc.) that you have had, the better it is for your score.

Your Credit Will Not Be Directly Affected

Removing an authorized user will not directly impact your credit score. That is because the number of people that you have authorized to use your credit accounts does not appear anywhere on your credit report.

The only impacts on your score will be indirect. If you remove someone as an authorized user, they will no longer be able to use your card to make purchases. Assuming your spending does not change, this will reduce the percentage of your credit limits that you are using. That will improve your credit score by reducing your debt burden. If you increase your spending because someone else is no longer using your card, there will be no effect on your score at all.

Impact to the Authorized User’s Credit

Removing someone as an authorized user can have an impact on their credit. What effect it has depends on a few factors.

Some, but not all, credit card issuers will report information about credit card accounts that you are an authorized user for. When you remove someone as an authorized user, the card issuer will stop reporting the account on the authorized user’s credit report. Some lenders will entirely remove the account’s history from the authorized user’s credit report.

This can help or hurt the person’s credit score.

If your account is in good standing, it will be bad for the authorized user’s score. They get the benefit of your payment history on the account, low credit utilization, and the length of time you’ve had the card. Make sure that the authorized user gets a new credit card so they can continue building their credit after you remove them as an authorized user.

If your credit card account has a high balance or you’ve missed payments, removing someone as an authorized user can help their credit. It will improve their credit utilization ratio and can remove missed payments on your account from their report. If someone is having trouble qualifying for a card of their own because they are an authorized user on your account, consider removing them before they apply for a new card.

Removing Yourself from Someone Else’s Account

Even if the primary cardholder won’t remove you as an authorized user, you can get yourself removed from the account. The best way to do this is to contact the credit card company and ask that they remove you as an authorized user. If the card company won’t do it, you can go through the dispute process with the credit bureaus to get the account removed from your report.

If you do this, make sure to destroy the credit card so you don’t accidentally use it to make purchases. You could be guilty of fraud if you make purchases on a card that you are no longer an authorized user of.

Conclusion

Removing an authorized user from your credit card won’t have much of an impact on your score. It can, however, impact the authorized user’s score, for better or worse.