Can a Gym Ruin Your Credit Due to Unpaid Membership Fees?

More than 57 million Americans have some type of gym membership.

Gyms are a great way to get healthy, stay in shape, and take advantage of fitness classes. However, at some point, most people will want to cancel their gym membership.

Many people cancel their memberships without issue, but some unscrupulous gyms make it difficult to cancel your membership.

If your gym is giving you the runaround when you try to cancel, you might be tempted to refuse payment.

You can remove payment information or cancel your linked cards to stop paying your membership fees.

In other cases, your gym might just forget to stop charging your membership fees.

Learn how an unpaid gym membership can have on your credit.

Can a Gym Send Your Account to Collections?

In short, yes. If you fail to pay your membership fees, your gym can send your account to collections, which is a major negative mark on your credit report.

A gym membership is just like any other recurring bill.

If you don’t pay your cable bill or electricity, that account will be sent to collections. The same goes for an unpaid gym membership

The method you used to pay the bill does not matter.

Even if you used your debit card to make your monthly payments, the account can still be sent to collections.

This is because you’ve failed to fulfill your side of the gym membership contract.

What Does It Mean for an Account to Get Sent to Collections?

When you owe a bill to a company, that company has to convince you to pay the bill.

Usually, you’ll get a bill in the mail each month, which is the company’s way of reminding you to pay what you owe.

If you don’t pay, the company will usually stop providing its service to you.

For example, if you stop paying for your cable bill, the cable company can shut off your cable TV. If you stop paying your gym fees, the gym can deny you access to the gym.

If the cancellation of services doesn’t convince you to pay your bill, the billing company has to find another way to convince you to pay. Normally, they will send you letters informing you of your delinquent account.

If the company is unable to get you to pay your bill after a certain period of time, it will look for another way to make some of its money back.

One common solution is to sell your debt to a collections agency.

Collections agencies buy debts at a discount, then pursue the debtors for payment. If you owe $200 in unpaid gym membership fees, a debt collector might pay a tiny fraction of that amount for the right to try to collect payment from you.

This gives the gym some of its money back, and a collections agency a chance to make some money.

Collections agencies use a variety of tactics to try to convince you to pay your bill. These tactics might involve intimidation to try to scare you into paying.

In fact, the Federal Trade Commission has stated that collections agencies are among the most complained about businesses in the U.S.

If at all possible, you want to avoid letting your gym account go to collections.

How Does an Account in Collections Affect Your Credit?

Having an account in collections will have a significant, negative impact on your credit.

One of the tactics that collections agencies use to convince you to pay your bill is by placing a note on your credit report.

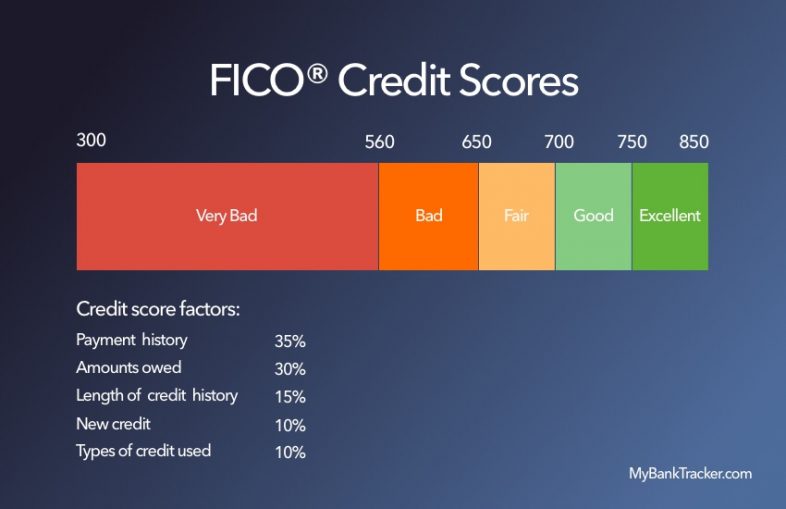

Credit ratings agencies rate consumers based on their financial history. If a person’s financial past indicates that they are good at paying their debts, they’ll have a good score.

If their history shows they are less likely to pay their debts, their score will be bad.

Having an unpaid account in collections shows a history of not paying bills that you owe.

This doesn’t look good to potential lenders, so it will cause a large drop in your score -- a decrease of 100 points would not be surprising.

How credit scores work

Your credit score is calculated based on data from your credit files.

Your payment history and the amount owed are the most important parts of the calculation.

Having an account in collections indicates that you’ve failed to make on-time payments in the past.

Because payment history has the largest impact on your credit score, even one account in collections can cause a huge drop in your score.

How to Handle a Debt Collection Call

Because debt collection agencies have a reputation for unsavory behavior, it’s important to know how to handle a debt collection call.

There are a lot of regulations surrounding what collections agencies are allowed to do.

Knowing your rights can help you handle the stress of dealing with calls from a collections agency.

Take notes

When a debt collector calls, you should make sure to take notes about the details of the call.

Write down the date and time of the call, the name of who you spoke to, and the name and address of the collection agency.

Also, write down the details of the debt that the agency claims that you owe.

Don’t admit responsibility

When you’re on the phone, the debt collector may try to intimidate you into admitting to owing the debt.

Do not admit to owing the debt.

It’s very common for debt collectors to contact the wrong person, or to contact you about a debt you’ve already settled.

Refusing to admit to the debt helps you avoid being forced to pay for a debt you don’t really owe.

Demand proof of the debt

Ask the person calling to send you proof that you owe the debt and that the collections agency owns the right to collect on the debt.

Collections agencies must provide this upon request and cannot continue to demand payment until the proof is provided.

Talk when you're ready

If you’re not in a position to handle a collections call, don’t be afraid to refuse to speak to the debt collector.

Tell them that you are busy or unable to take the call at the moment and hang up.

Then, take some time to prepare for the next time the debt collector calls.

Tips for Cancelling a Gym Membership

If you’ve decided to cancel your gym membership, you should make sure that your membership is truly canceled.

Take the time to go through the process properly and you can avoid the headache of worrying about an account in collections.

Get it in writing

One of the most important things to do when canceling a gym membership is to get written confirmation that your membership has been canceled.

This is true for almost any type of financial obligation.

Having written proof that you’ve canceled your account provides a nearly bulletproof defense against future claims that you failed to pay your bill.

One good way to get written confirmation of your cancellation is to cancel your membership in person.

It’s much easier to lose the confirmation letter if you have it mailed to you, so try to cancel in person if possible.

Send a notarized cancellation letter

If you can’t get written confirmation of your membership cancellation, try sending a notarized letter to your gym.

Send it in the mail using a service that provides confirmation that the gym has received the letter.

You can use this receipt to prove that you communicated your desire to cancel your membership to the gym. That can help you avoid future charges.

Communicate

The easiest way to avoid a hassle when canceling a gym membership is to make sure you follow the gym’s requirements for canceling a membership.

If you do everything by the book, the gym won’t have any way to claim you failed to cancel the membership.

Ask your gym to send you information on the process that is required to cancel your membership.

You can also look at your membership contract.

These contracts usually have language describing the cancellation process.

Follow the process to the letter to make sure that your membership is canceled.

And don’t forget to get written confirmation that the membership has been canceled.

Conclusion

Even if you never use a credit card to pay for your gym membership, your credit score can still take a hit if your unpaid membership is sent to collections.

Take the time to make sure that your membership is canceled to avoid the hassle of having an account sent to collections.