Huntington Bank Asterisk Free Checking Account 2024 Review

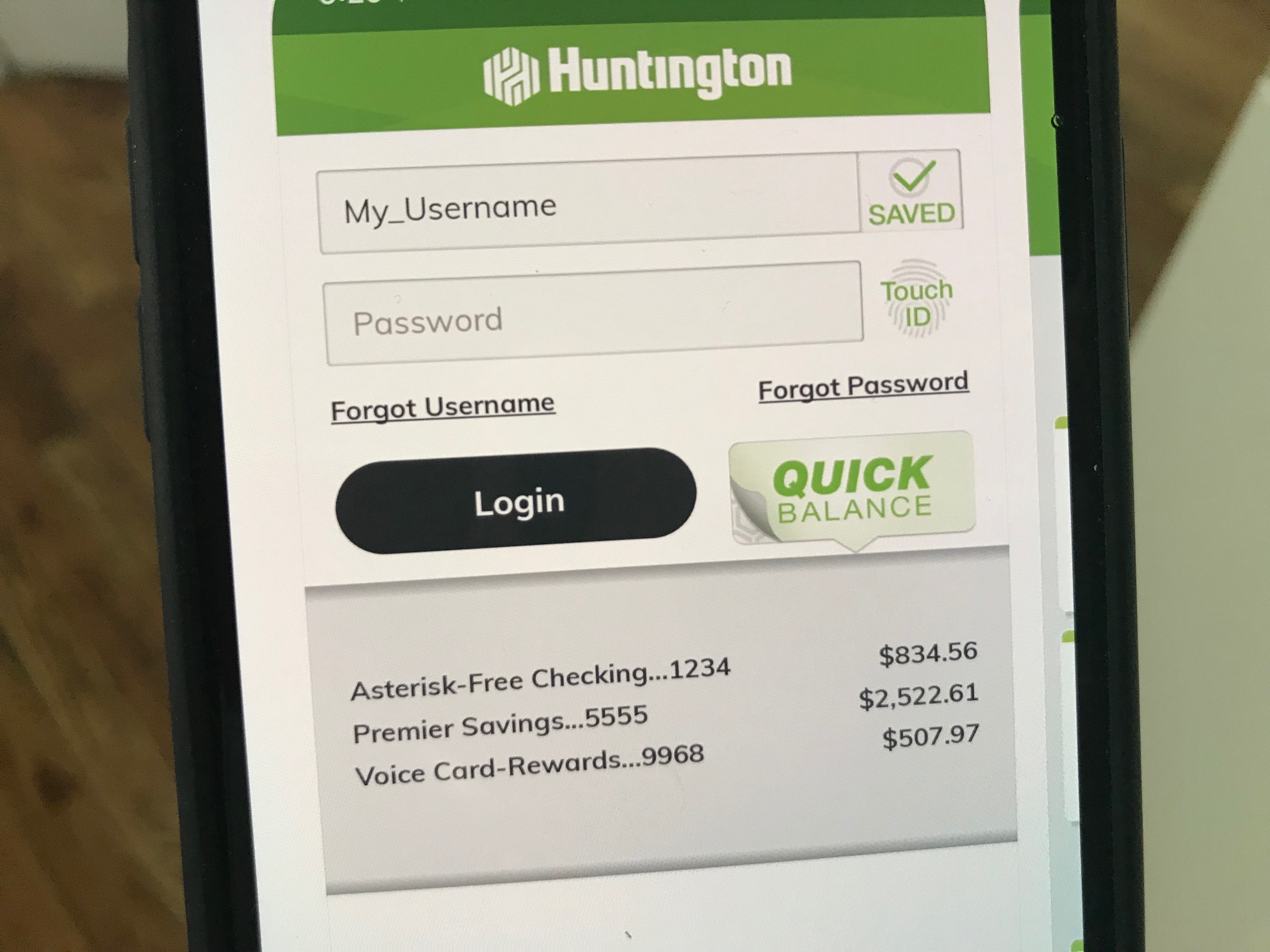

Huntington Bank App

Huntington Bank App

Huntington Bank is one of the largest regional U.S. banks with nearly 1,000 branches and more than 1,800 ATMs across eight states in the midwestern U.S.

Among the many services offered by Huntington Bank is the Asterisk-Free checking account. This account aims to be a simple, easy to use, checking account that doesn’t spring any surprises on account holders.

If you’re looking to open a checking account, in this review find out what you need to know about the Huntington Bank Asterisk-Free checking account.

Get Free Overdraft Protection Transfers and 24-Hour Grace

Huntington Asterisk-Free Checking Account Pros & Cons

Though we’d all rather avoid it, nearly everyone will overdraft their checking account at one point or another.

Overdrawing your checking account can be painful. On top of the reminder that you don’t have enough money to cover a purchase, most banks will charge hefty fees for each overdraft.

Most banks let you set up overdraft protection transfers. If you do, money will be moved from your savings account to your checking account to cover potential overdrafts. Still, many banks charge a fee for each automatic overdraft transfer.

The Huntington Bank Asterisk-Free Checking account does not charge a fee for overdraft protection transfers. This can turn a costly mistake into just a mild inconvenience.

24-hour grace period

Another overdraft related benefit is Huntington Bank’s 24-hour grace. This program lets you avoid overdraft fees even if you don’t set up overdraft protection transfers.

If you ever overdraft your account, you can avoid the fee by depositing enough money to return your account to a positive balance before the end of the next business day. So long as your deposit meets those requirements, you won’t be charged an overdraft fee.

While you should do your best to avoid overdrawing your account, these features can help reduce the cost if you do overdraft your account.

Get a Discount on Mortgage Closing Costs

Banks like to build long-term relationships with their customers. As you deposit more of your money with the bank, the bank is able to increase the profit it makes off of your patronage. Banks also know that their existing customers will be more likely to open loans at the bank.

As you deposit more of your money with the bank, the bank is able to increase the profit it makes off of your patronage. Banks also know that their existing customers will be more likely to open loans at the bank.

To help encourage your banking relationship, Huntington Bank offers mortgage closing cost discounts.

Closing costs include the cost of loan origination fees, appraisal fees, title insurance, deed-recording fees, etc. These fees can add up to $1,000 or more.

If you have an Asterisk-Free checking account, you can get a $250 discount on closing costs if you apply for a mortgage from Huntington Bank.

Automatic Account Alerts Let You Keep Track of Your Account

The increasing digitalization of the American financial system has many aspects of people’s financial lives more convenient.

Unfortunately, these same advances have also made it easier for fraudsters and identity thieves to target people’s bank accounts.

With the risk of identity theft so high, it’s understandable that you want to keep a close eye on your money. Even if you’re not concerned about the potential for fraud, keeping an eye on your account gives you a better handle on your financial situation.

Huntington Bank offers free banking alerts that help you keep track of your account.

You can have alerts sent to you by e-mail or text.

You can customize what types of alerts you’d like to receive from a selection of nine different alerts, including low balance alerts, deposit alerts, balance alerts, withdrawal alerts, and more.

Getting these automatic account alerts can make managing your money much easier.

ATM Access

ATM access is one of the most important things to look for in a checking account. The goal of a checking account is to serve as short-term storage for the cash you use on a daily basis.

If you can’t get to your cash when you need it, your checking account isn’t serving its purpose, and one of the easiest ways to get cash out of your account is by visiting an ATM.

Huntington Bank operates more than 1,800 ATMs in the states it serves. These ATMs are free to use, so you can easily access your money if you’re in an area served by Huntington Bank.

Huntington Bank does not offer reimbursement for fees charged by other banks’ ATMs.

In fact, Huntington Bank will charge a $3 fee for transactions made at out-of-network ATMs. This makes it very important to find a Huntington Bank ATM when you need to withdraw cash.

Earn No Interest

The Asterisk-Free checking account does not pay any interest on your balance. Huntington Bank does offer other checking accounts that do pay interest, but these accounts may charge more fees.

Huntington Bank does offer other checking accounts that do pay interest, but these accounts may charge more fees.

No Monthly Fees

The goal of the Asterisk-Free checking account is to provide a simple to use, easy to understand checking account.

There are no “gotchas” to the account, and there are no monthly fees for keeping your money in the account. There’s no minimum balance required and no hoops to jump through. There are simply no monthly fees.

There’s no minimum balance required and no hoops to jump through. There are simply no monthly fees.

Other Fees

Though there is no monthly fee for this account, there are some other fees to be aware of. Most of these fees are not common, and you may never encounter them, but it is still good to be aware of the fees you may be charged.

The most common checking account fee, beyond the monthly maintenance fee, is the overdraft fee.

Though we’ve discussed the ways that Huntington Bank helps you avoid this fee, you might still wind up owing the fee.

If you overdraft your checking account, Huntington Bank will charge a $37.50 fee.

You can be charged as many as 4 overdraft fees per day, so you could pay as much as $150 in overdraft fees per day.

No fee will be charged if the account is overdrawn by less than $5.

As a courtesy, Huntington Bank will reduce the fee to $24 if you have not overdrawn your account in the past year.

Some other fees that you should be aware of include:

Huntington Asterisk-Free Checking Account Fees

| Type | Fee amount |

|---|---|

| Monthly Maintenance Fee | $0 |

| Out-of-Network ATM Fee | $3 |

| Overdraft Fee | $37.50 |

| Overdraft Protection Transfer Fee | $0 |

| Returned Item | $37.50 |

| Deposit Item Returned | $10 |

| Stop Payment | $31 |

| Incoming Domestic Wire Transfer | $15 |

| Incoming International Wire Transfer | $15 |

| Cashiers Check | $6 |

Managing Your Money

Your checking account is the nexus of your financial life.

Your paychecks and other income are deposited into the account, savings are moved out of the account, and bills are paid from the account.

Because of the important role your checking account plays in your life, it is important that you checking account be convenient and easy to use.

If you live in one of the states that Huntington Bank operates in, the Asterisk-Free checking account is pretty convenient.

There are more than 3,000 Huntington Bank ATMs and branches that you can visit to withdraw cash from.

The account also offers online convenience features that are standard these days.

You can view and make changes to your account from any phone or computer with internet access. You can also pay your bills online with Huntington Bank’s bill pay feature.

Mobile banking

Huntington Bank offers feature-packed mobile banking apps on iOS and Android devices.

They come with standard mobile banking capabilities such as the ability to view account balances and activity, pay bills, initiate transfers, deposit checks, and more.

The mobile check deposits are subject to a limit of $5,000 per month.

Note: Huntington states that mobile deposit limits may vary by account -- they may increase with time and/or relationship with the bank.

Other Huntington Bank Checking Options

If you're interested in becoming a Huntington banking customer, but aren't sold on this checking account, check out other additional checking account options also offered by this bank:

Huntington 5 Interest Checking

The Huntington 5 Checking account is a step-up from the basic checking account they offer.

With this interest-bearing checking account, consumers have the option to get relationship rates on savings accounts when you link it to this checking account.

In addition to that feature and the other great benefits Huntington offers, this account includes:

- A 10% bonus on points earned on your linked Voice Credit Card

- Five (5) non-Huntington ATM cash withdrawal fees waived and reimbursement for fees charged by another ATM owner

- No minimum deposit to open the account

This account bears a $5 monthly maintenance, unless you keep a total relationship balance of at least $5,000 in a combination of deposits held directly with us or investments made through their affiliate.

We've highlighted some of the main fees and features of the account below:

Huntington 5 Interest Checking Account Fees

| Type | Fee |

|---|---|

| Monthly Maintenance Fee | $5 |

| Minimum Opening Deposit | $0 |

| Stop Payment Fee | $31 |

| Overdraft Fee and Not-Sufficient Funds (NSF) Fee | $37.50 ($23 for first occurrence in 1-year period) |

| Non-Huntington ATM Fee | $3 (5 transactions waived per cycle) |

| Cashier's Check | $6 |

| Dormant Account Fee | $5 |

| Overdraft Protection Transfer Fee | $9 (first 2 transfers per month are waived) |

| Deposited Item Returned Fee | $10 |

| Incoming Wire Transfer Fee | $15 |

| Document Copies | $5 per copy |

The Competition

Huntington's basic checking account option is a clear winner when compared to similar alternatives from the larger national banks.

Still, there are so many options available that you should take the time to shop around for the best account you can find.

Look into local banks and credit unions, since they can sometimes tailor their services to meet your needs.

Online banks are popular because they offer low fees and great interest rates on free checking accounts.

Other than the monthly fees you’ll pay and how easy it is to access your money, you should consider these factors when choosing a checking account:

- Minimum deposit

- Fee waiver requirements

- Interest rates

- ATM access

Conclusion

The Huntington Bank Asterisk Free Checking account is a good choice for people who live in one of the midwestern states that the bank serves.

If you seek a free checking account that offers interest rates or has a more friendly ATM-fee policy (such as ATM fee refunds), we recommend an online checking account.