PNC Bank Personal Loan 2024 Review

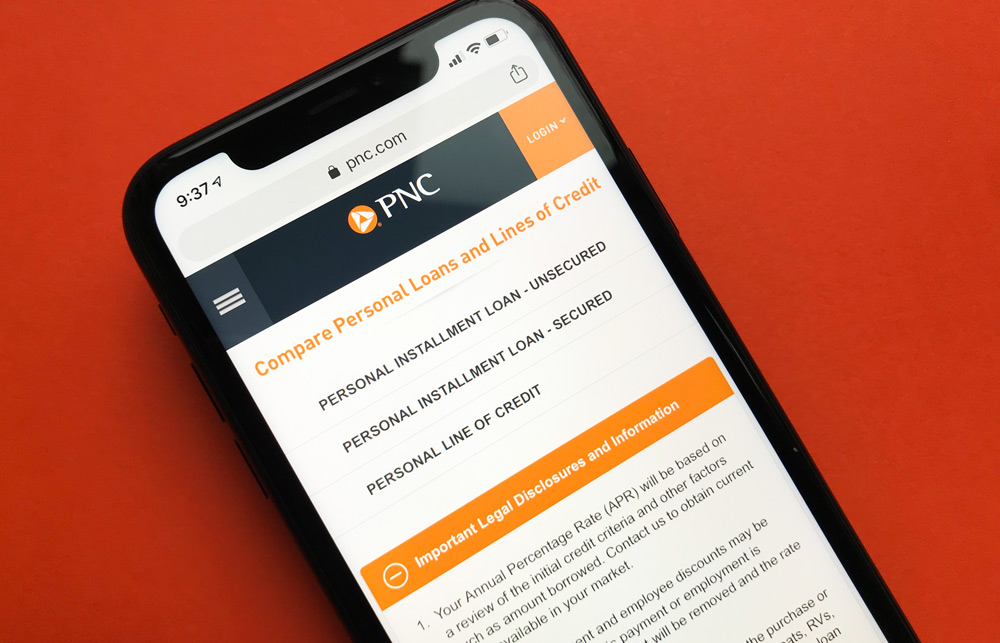

PNC Bank Personal Loans Website

PNC Bank Personal Loans Website

The good: PNC personal loans allow you borrow funds at a low minimum (if you don't need to borrow too much) and the interest rates are very low, especially if you have a PNC checking account. Additionally, there are no origination fees or prepayment penalties to worry about.

The bad: To qualify for the best rates, you're going to need an excellent credit score. Plus, the lowest rates apply to larger balances starting around $15,000.

The bottom line: PNC personal loans are great, low-cost options for most people, especially those who don't want to borrow too much.

As the 6th largest bank in the U.S. (by deposits), PNC Bank is likely to be on your list of options when you're looking for a personal loan.

Whether you need to fund home improvement projects, consolidate other debts, or pay for some other expense, a personal loan from PNC can help you in a financial crunch.

With that said, there are key factors of every personal loan that you should consider before applying.

In this review, we've broken down PNC's personal loans so that you can see the whole picture clearly.

Learn everything you need to know about PNC’s loans.

Low Borrowing Minimum and Multiple Terms

PNC allows you to borrow as little as $1,000 or as much as $35,000. Of the biggest U.S. banks, PNC has the lowest borrowing minimum.

This is an advantage for people who only need a small amount to get by -- taking out a larger loan is unnecessary and could lead to dangerous spending.

PNC Bank Personal Loans Pros & Cons

With a loan from PNC, you can choose a term of 1, 2, 3, 4, or 5 years.

Which terms you can get approval for depends on the amount you’ll be borrowing and your credit score.

Shorter term loans come with higher monthly payments but lower interest.

That means you’ll pay less in total for the loan. Longer term loans have lower monthly payments, but higher interest. That means you’ll pay more over the course of the loan.

Your goal should be to strike a balance between a monthly payment you can handle and the lowest total loan cost.

Choosing the right term is very important when you apply for a loan -- you pay the least possible without stretching your budget too thin.

PNC Personal Loan Calculator

Credit Score and Income Needed

PNC does not state any minimum income or credit requirements to qualify for a loan.

Instead, you’ll have to prove to PNC that you’ll be able to pay the loan off.

While a higher credit score and higher income will certainly improve your chances, there is no minimum for either.

However, we've reviewed many personal loans and based on the interest rates offered by PNC, you're likely to need good credit for the best chances of approval.

We can estimate this because an APR range that is on the low end (compared to personal loans from competitors) usually requires better credit scores. And, PNC's interest rates are rather low.

Fees and How Long It Takes to Get the Money

PNC bank does not charge an application fee or origination fee on its personal loans.

That’s a good thing because it means you pay less over the life of the loan. You also won’t pay a fee to pay the loan off early.

If you find a windfall and can pay the loan in full, there’s nothing stopping you.

The one fee to worry about is the late payment fee of $36. If you’re never late on a payment, you won’t have to worry about this either.

When you apply for a loan, the whole process takes 10-15 minutes.

Depending on the specifics of your application, you’ll get an immediate decision, or will have to wait for one.

Once your loan is approved, the money will arrive in your account within a few days.

Get an Interest Rate Discount for Setting Up Automatic Payments

One major perk of a PNC loan is that current PNC customers are that they can save some money by setting up automatic payments.

If you link your existing PNC checking account and set up the payments, you’ll get a 0.25% rate discount.

This benefit can add up to hundreds of dollars saved over the course of the loan.

How to Get Approved

Once you’ve decided to apply for a personal loan, you’ll need to figure out how to get approved for a loan. The first step towards getting approved is actually applying.

When you apply for a loan at PNC, you can apply in-person, online, or over the phone. However you apply, you’ll need to provide some information, including:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements or pay stubs

- Verification of employment

PNC uses this information to make a lending decision.

Though it may sound difficult to get the information and paperwork together, it’s important to gather as much as you can.

Providing a lender with as much information as possible gives you the best chance of getting approved for a loan.

If a lender has any questions, it will, at best, delay approval. At worst, you could be denied the loan.

Improving Your Chances of Getting Approved for a Personal Loan

There are a few things that impact your chances of getting approved for loans, personal or otherwise. These tips will help you maximize your chances.

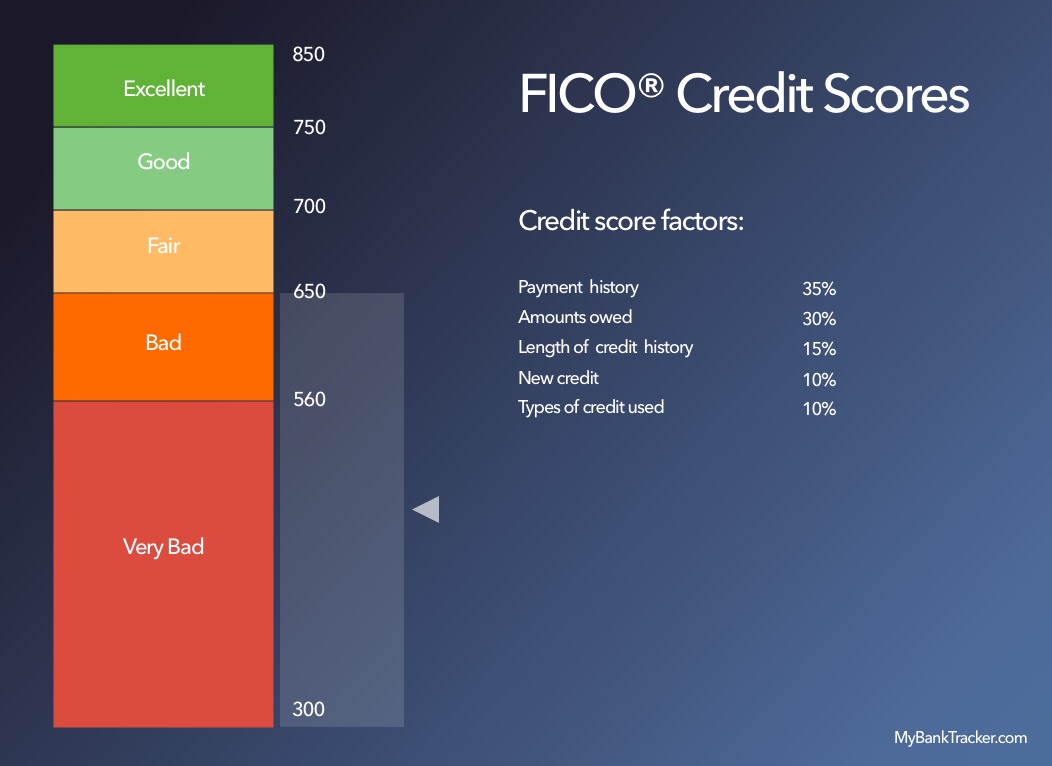

Increase Your Credit Score

The most obvious thing to do is to increase your credit score.

Your credit score impacts all aspects of your ability to borrow money, from the amount you can borrow to the interest you’ll have to pay.

Your credit score is a numerical representation of your financial trustworthiness.

The higher your score, the more likely you are to pay your debts. The lower it is, the more likely you are to default, causing a lender to lose money.

To improve your credit score, the best strategy is to make on-time payments over the course of months and years.

Unfortunately, when you need a personal loan, you usually don’t have that long to wait.

There are some short-term tricks to give your score a boost.

One thing you can do is decrease the amount of money you owe. The more you owe, the riskier it is for someone to lend you money.

Stop using your credit cards in the month before you apply for a loan.

Also, try to make extra payments on your existing loans. That can give your score a boost in a pinch.

Another trick, if you know you’ll be needing a loan in the near future, is to avoid applying for new credit cards in the lead up to applying for the loan.

Every loan application temporarily drops your score by a few points. Plus, getting new accounts will reduce your average age of accounts, dropping your score further.

Reduce Your Debt-to-Income Ratio

Another thing to do is to reduce your debt-to-income ratio.

This ratio is the amount you owe, divided by how much you make in a year. The lower this ratio, the easier it will be for you to pay off any new debts you take on.

One way to do this is by increasing your income. This can be difficult, but you can try finding a side-job or working towards a raise or promotion at work.

If you do opt to find a side-job, make sure you can prove the income to the lender. If you can’t prove that your side-job is producing income, the lender won’t take it into account.

The better route is to reduce your existing debt. Try to avoid using your credit cards before applying for the loan, and send any extra cash towards existing debts.

This has the additional benefit of improving your credit score, giving your chances an even bigger boost.

How Does It Compare?

PNC isn’t the only bank that offers personal loans. You should take the time to shop around and find the best option for you.

When you’re comparing loans, consider these factors:

Look at the interest rate

Lower rates mean lower payments and a lower total cost of the loan. Find the lowest rate you can, so long as it isn’t at the expense of other, essential features.

Pay attention to fees

Some loans charge origination fees which are tacked onto your initial debt.

So, if you borrow $10,000 and pay a 2% origination fee, your first bill will show a balance of $10,200, plus interest. The lower the origination fee you can find, the better off you are.

Make sure the lender offers a loan term that’s right for you

Some lenders specialize in loans that have a short term.

Other lenders will offer loans with repayment plans that last 5, 6, or 7 years.

Remember to strike a balance between a monthly payment that you can manage and a low total cost of the loan.

Conclusion

PNC is a major national bank that offers flexible personal loans to its customers.

It is good for those who are looking for a small personal loan. But, you're likely to need great credit to qualify.

If you don't have good credit or need a larger personal loan, the other lenders showed above are much better options.