Are You Responsible for Your Spouse's Debt?

Getting married often means combining assets.

You bring the solid oak dining table you inherited from your grandfather, your spouse brings a serious collection of vinyl records.

But does marriage mean combining debts as well? What happens if you divorce, or if your spouse passes away?

What if a spouse’s debt goes to collections? Can creditors call you and ask you to pay it off?

Here’s what you need to know about how your spouse’s debt can affect you.

Be aware that state law plays a big role in when you are responsible for a spouse’s debt.

It’s a good idea to learn the laws in your state or to talk to someone like a CPA who can help you understand them.

When Are You Responsible for Your Spouse’s Debt?

You are not responsible for any debts your spouse takes out before marriage.

This can often include major debts like student loans. If your spouse has credit card debt before marriage, you aren’t responsible for that either.

After marriage, you are generally only responsible for your spouse’s debts if you and your spouse co-sign a loan or open a joint credit card.

If both of your names are on the account, you are responsible for paying off any debts incurred by your spouse — and vice versa.

Authorized users are different

It’s important to note that being an authorized user on a credit card is not the same thing as being a joint account holder.

If you are an authorized user on your spouse’s credit card, you are not responsible for paying off the debt on that card.

However, if your spouse is an authorized user on your credit card, your spouse could run up debt that you would be responsible for paying off.

State of residence matters

If you and your spouse live in a community property state (covered more in depth below), you may be responsible for your spouse’s debt even if you are not a co-signer or joint account holder.

In community property states, debt and assets generated after marriage are considered shared property.

Any debt a spouse incurs before a marriage is not considered shared property, so you are not responsible for that debt.

Check your state’s laws to determine how community property rules might apply to you.

Can Your Spouse’s Debt Impact Your Credit?

In most cases, your spouse’s debt will have no effect on your credit.

The same goes for credit scores.

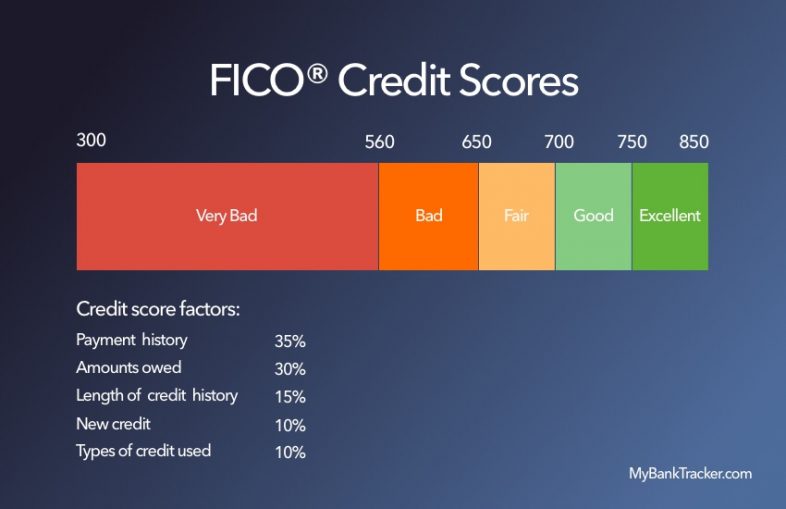

If yours is high and your spouse’s is low, don’t worry — your spouse’s credit score won’t bring yours down.

You and your spouse have separate credit histories, and they don’t get averaged just because you got married.

When debt is shared

There are a few situations in which spousal debt can affect your credit.

If you and your spouse apply for a joint credit card, loan, or mortgage, the lender will check both of your credit scores.

If your spouse has bad credit or a lot of debt, you’ll probably get offered a higher interest rate than you might have received if you’d applied for the credit card or loan on your own.

If your spouse’s credit is bad enough, your application might get denied.

Building credit together

If you’re the spouse with bad credit, there are a couple of ways that you and your partner can work together to improve your credit.

If your spouse makes you an authorized user on one of their credit cards, that card’s payment history gets added to your credit report.

Makes all of their payments on time, your credit score will improve.

Also, you and your spouse could open a joint line of credit together and maintain good credit behavior to build credit.

But, be aware that if one spouse racks up debt or misses payments on the card, both of your credit scores will suffer.

What Happens to Joint Credit Accounts in Divorce?

Credit card companies don’t care if you’re divorced; if your name is on a joint credit account, you are responsible for those debts even if you are no longer married to the other person on the account.

It’s a good idea to pay off and close all joint credit accounts prior to finalizing your divorce.

If you don’t take this important step, your former spouse could continue to rack up debt on your joint accounts.

If that debt isn’t paid off, your credit score could take a hit and you might start getting calls from debt collectors.

Don’t leave joint accounts open after divorce.

There’s too much risk involved, and even a well-meaning former spouse might miss a payment or make a financial mistake that affects your credit.

What Happens if Your Spouse Passes Away?

Dealing with a spouse’s death is hard enough, and many people wonder if they’ll also have to deal with their spouse’s debts.

In most cases, you do not have to pay your deceased spouse’s debts unless you are a co-signer on a loan or a joint account holder on a credit card.

However, some states require spouses to pay certain types of debts. You might be responsible for your spouse’s debts if the purchases were made to benefit the family.

If a spouse puts all the household groceries on a credit card, for example, you might be required to pay off that debt even if you are not a joint account holder on the card.

In community property states, a deceased spouse’s debt becomes your debt even if you are not named on the credit account — but any debt your spouse incurred before your marriage is not your responsibility.

Take some time to review the laws in your state to learn which debts you might be responsible for paying off after your spouse’s death.

What if a Debt Collector Comes After You for a Spouse’s Debt?

Federal law states that debt collectors can contact spouses, but state laws vary.

Some states require the debt owner to give spousal consent before a debt collector can contact a spouse about a debt.

You are not required to pay a spouse’s debt unless you are a co-signer or joint account holder.

However, if a spouse’s debt goes into collections, it’s likely to affect your life even if you are not responsible for paying the debt.

Your spouse might be required to appear in court, and their wages might get garnished.

A creditor could seize your spouse’s property, and could even come after the cash value of the property you and your spouse sold.

In community property states, a creditor could seize shared property — which includes income — as well.

Which States Are Community Property States?

The following states have community property laws:

- Alaska (couples can choose whether to follow community property laws)

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Each state’s laws are different, so it’s important to know how your state’s laws might affect your and your spouse’s debts.

How to Reduce Your Responsibility for Your Spouse’s Debts

If you’d like to reduce your responsibility for your spouse’s debts, here are a few tips:

- Avoid co-signing loans with your spouse. If your spouse purchases a new car, for example, make sure the loan is in your spouse’s name only.

- Don’t open joint credit cards.

- Don’t open joint bank accounts either. With joint accounts, your spouse could withdraw part of your paycheck to pay down their debts.

- Talk to your spouse about their debts and make a plan to get those debts paid off. That way, you won’t have to worry about being responsible for those debts in the future.

- If your spouse doesn’t have a lot of debt but does have bad credit habits (such as making late payments), talk about how to improve those habits. That way, your spouse’s credit score will improve and you’ll get better interest rates on any joint debt you take out in the future.

- If you and your spouse are getting divorced, pay off, and close all joint accounts before the divorce.

- If you live in a community property state, know the laws and how they might affect you. Then, talk to your spouse about how to manage your shared property and avoid getting into debt.

Even if you aren’t directly responsible for a spouse’s debts, it’s still a good idea to talk with your spouse about money management.

Approach the conversation as something you and your spouse are going to do together, and discuss whether it’s time to create a budget and set aside extra money for debt repayment.

Maybe your spouse can transfer a credit card balance to a card with a 0% intro APR.

Maybe it’s time to consolidate some debts, or sell some property and put the money towards the debt.

Whatever you choose to do, making the decision together is likely to strengthen your marriage — and your finances.