Key Questions to Ask Before Refinancing Your Student Loans

Bearing a high interest rate on your student loans can make it difficult, if not impossible, to make a dent in your student loan balance.

Luckily, that’s where refinancing comes in.

When you refinance your student loans, you are taking out a loan with a lower interest rate to pay off your student loan that has a higher interest rate.

The sooner you refinance, the sooner you can save money to better invest elsewhere.

However, there are some key factors you need to think about before you do so.

Although refinancing is an option everyone should consider if you have a student loan with an extreme interest rate, it might not always be the right time to refinance.

Find out which factors you should think about and the questions you should ask yourself before you refinance student loan debt.

3 Factors To Think About Before Refinancing

If you’ve weighed these possibilities and decide that refinancing is the right choice for you and your situation, then here are the factors you should consider to decide when the right time to refinance is.

1. Do you have a reliable income?

As part of the refinancing process, lenders will require that you disclose your income (as well as other personal credentials like your credit score, your occupation, and your undergraduate degree, if that’s what you are refinancing).

Usually, lenders will not give you a loan for refinancing purposes if they feel that your income is too low.

They do this mainly because they want to make sure they are getting their money back plus extra, and if there’s any indication that your income could fall short of making your monthly payments, they’ll slap a big red X on your application.

What you should be thinking about: If your income is below $45,000 a year, you may want to wait to refinance your student loans.

Not only will you be able to handle your monthly payments better with a higher income, but you are much more likely to be approved for a refinancing loan at a lower interest rate.

Have your 5-year game plan set up and work towards that dream job with a comfortable income.

Stick to these key steps in the meantime:

- Budget your money wisely

- Fund a savings account

- Grow your income

Be consistent with your finances and you'll increase your chances of getting approved for a refinancing loan at a lower interest rate.

There are great budgeting apps to help you effectively manage your money, so you can stash it into one of these high-yield savings accounts.

2. How good is your credit score?

Your credit score is probably your most defining quality when it comes to applying for a loan.

Your credit score mixed with other personal identifiers are how lenders decide what interest rate they are going to give you for a new loan.

The equation is simple: great credit score = lower interest rate, fair to poor credit score = higher interest rate.

Odds are, if you are just graduating college, your credit score is still in its baby stages of being great.

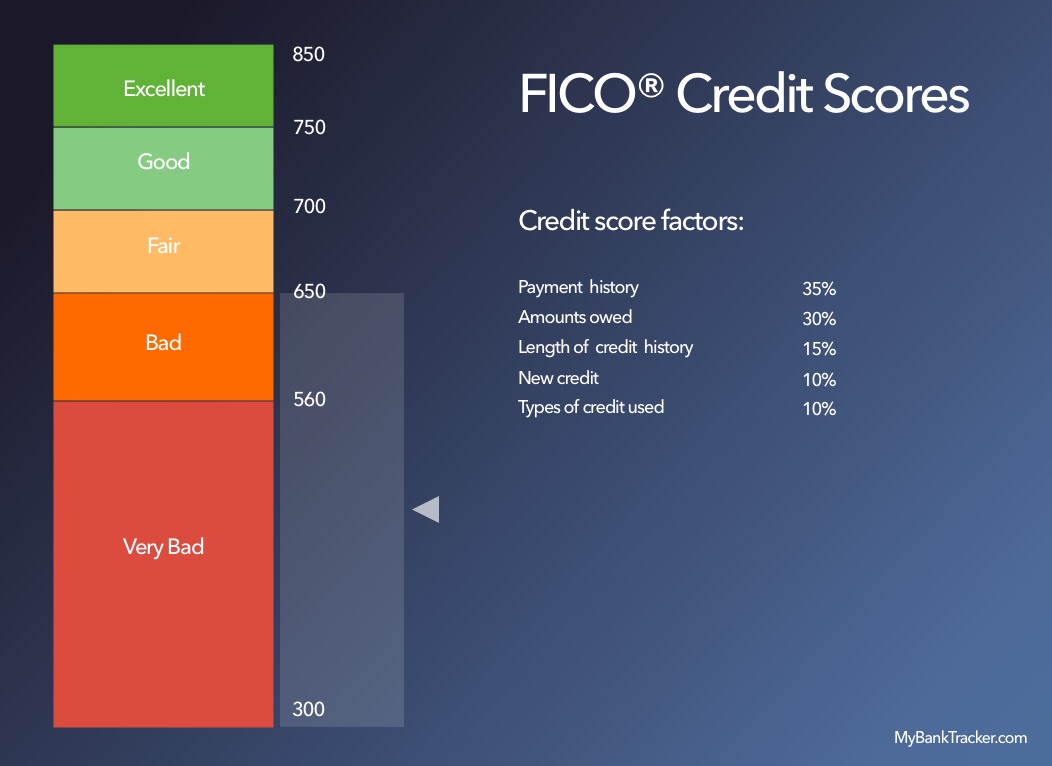

These are the 5 factors that go into determining your credit score:

It’s also important to make sure you do not have an excessive amount of hard inquiries on your credit report. A hard inquiry is when a lender pulls your credit report and reviews all of the lines of credit and loans you’ve applied for.

So this could mean, if you’ve applied for many student loans in the past, or have already tried to apply for a loan for refinancing purposes, those inquiries will show up on there.

This is a red flag to lenders because you’ll appear to be a greater risk, which could mean either a higher interest rate or a denial.

A good rule of thumb is to keep your hard inquiries below 6, every 2-5 years.

What you should be thinking about: Since the length of credit history, types of credit, and new accounts make up almost half of your credit score, it might be beneficial to hold off on refinancing until you have accrued more years of creditworthiness.

Studies show that more people are approved for loans with a better interest rate if their credit score is 650 and above (but ideally, the higher the better).

Continue to make your monthly payments on your student loan on-time and in full.

There are common steps that people use to give a boost to their credit. This will help your credit to grow and improve, plus prove to lenders that you are worthy of a loan and a fancy, new, low interest rate.

3. What stage are you at in your life?

The average student loan debt for a student as of 2017 is $37,712, with average interest rates around 6%.

Although the average debt is only around $37k, many students are saddled with much higher amounts, at a much higher interest rate.

When this is the case, and you’re hit with the harsh reality of having to pay back your high loan balance, you may want to immediately jump to refinance.

Here’s how you should think about refinancing depending on the point you’re at in life:

While you’re enrolled in school

Most lenders will not allow you to refinance while you’re still currently enrolled in school.

Not only will you have a hard time getting approved for refinancing because of your lack of creditworthiness, but many lenders require that you obtain your degree before you can even apply for refinancing.

If a lender does not require a degree to refinance your student loans, then most likely, they will require that you are not currently taking classes and have already begun to pay back your loans.

As soon as you graduate from school

The plus side to student loans is the grace period that’s tacked on to a repayment term.

A grace period is a 6-month window after your graduation date where lenders don’t require a payment towards your student loans.

So if you graduated in June, you are not expected to start paying back your student loans until December.

Although you certainly could refinance your student loans during this grace period, it doesn’t really make sense, since your payments have not started yet, and you can take advantage of this free time to start saving.

Remember: Even though you are not expected to make payments during this grace-period, the interest on your student loan still accrues.

This means that every month that you’re not putting money towards your student loans, your balance is increasing.

So it might be in your favor to start making payments monthly during this time, even if they are as little as $25.

"Upon graduation, I always recommend that a student loan borrower wait a couple of years before making the move to refinance their student loans," said Mike Brown, a research analyst at LendEDU. "The main reason for doing so would be to build up your credit history, and subsequently, your credit score."

1 year after you graduate from school

One year post-graduation, given you were able to get a job 1-3 months out of college, could mean that you’ve been able to make a decent amount of payments towards your student loans.

If you were able to make a partial dent in your loan balance - somewhere between $7,000 and $10,000 paid down - this time might be good for you to consider refinancing.

Our research shows that your approval chances are higher and your repayment terms could be better if you refinance with a loan balance of $75,000 or lower.

If anything, now is the time to start researching out possible lenders that offer low interest rates and good repayment conditions.

2-5 years after graduation

Now that you’re well into your adult years (unfortunately), chances are you’ve been able to hack a decent chunk off of your student loans.

At this point in your life, your income is probably steadier and hopefully higher than what it was when you first graduated.

If you feel that you are comfortable in your career, are making a decent, steady income, and have been able to grow your credit score, this timeframe is probably the ideal time to refinance your student loans.

Brown adds, "At this point, student loan refinancing companies will want to take you on as a borrower and will likely give you favorable repayment terms, including a friendly interest rate."

A Closer Look At Refinancing

As previously mentioned, refinancing is the process of obtaining a brand new loan with a lower interest rate and paying off your old loan with a higher interest rate.

When you refinance, you are taking out a new loan to cover the entire balance of your old loan.

This means you are not just taking out a new loan to cover your principal balance, but rather, a new loan to cover your principal balance plus the interest you’ve already accrued on your old loan.

For example, if you took out a loan for $20,000 to pay for your sophomore year of college with an interest rate of 6.34%, at the end of your sophomore year, your total loan balance would be $20,693.47 with interest ($693.47 in interest).

So if you want to refinance this loan by taking out a new loan with a lower interest rate, you would have to apply for a new loan in the amount of $20,693.47, at least.

By refinancing, you are creating new monthly payments for yourself.

You are ultimately cutting down the total cost you’ll have to pay back towards your loans.

New loan, new terms

Refinancing also allows you to pick a new repayment term, which could mean that your monthly payments might decrease, or stay the same to cut down your repayment time.

Consider the following example to better understand how repayment term and interest rate affect your monthly payments:

Imagine you have a student loan in the amount of $20,000 and you decide to refinance this loan through another lender to reduce your interest rate,

Refinancing Example

| Interest Rate | Repayment Term | Monthly Payment | Total Paid | |

|---|---|---|---|---|

| Old Student Loan | 8.37% | 10 years (120 months) | $246.58 | $29,589.96 |

| New Refinanced Student Loan | 6.44% | 7 years (84 months) | $293.52 | $24,655.28 |

In this example, by refinancing, your monthly payments are higher.

However, you were able to lower your interest rate, cut your repayment term down by 3 years, and save $4,934.68 by doing so. That’s the perk of refinancing. You can choose your terms that suit your finances, and your long-term goals.

If you choose to specifically go to a lender that specializes in refinancing, they will handle paying off your old debt for you, so you can sit back and just reap the savings.

The type of student loan matters

When you refinance, you are generally able to refinance both private loans and federal loans.

However, it’s important to note not every student loan refinancing lender accepts both types of loans.

Most lenders that specialize in student loan refinancing will refinance both federal loans and private loans, whereas certain big banks, like Wells Fargo, will only refinance your private student loans.

Top Student Loan Refinancers

| Lender | Borrowing Amounts | Available Terms | Eligible Loans For Refinancing |

|---|---|---|---|

| CommonBond | $1,000 to $500,000 | 5-, 7-, 10-, 15-, and 20-year terms (Hybrid Rate loans are only available for 10-year terms) | Both Private loans and Federal loans |

| Citizen's Bank | $10,000 to $90,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| Discover Bank | $5,000 to $150,000 | 10- and 20-year terms | Both Private loans and Federal loans |

| Earnest | $5,000 to $500,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| PNC | $10,000 to $75,000 | 10-, and 15-year terms | Both Private loans and Federal loans |

| SoFi | $5,000 to the amount your schooling costs | 5-, 7-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| Wells Fargo | $5,000 to $120,000 | 5-, 10-, 15-, and 20-year terms | Only Private loans |

The process of refinancing multiple loans together - whether those loans are multiple private loans, multiple federal loans, or multiple private and federal loans - is called consolidation.

By consolidating your debts together, you have one new monthly payment that could potentially be lower than your original monthly payments.

Consolidation is a great way to reduce the stress of remembering to pay different loans to different lenders.

If you are considering consolidating your federal loans only, you can do so through the Department of Education.

By applying for federal loan consolidation, you are combining multiple federal loans together to create one monthly payment, instead of having multiple different payments going towards multiple different federal loans.

If you do decide to consolidate just your federal loans together, you will still have the option to apply for loan forgiveness programs, and your interest rate will be determined by averaging out the interest on the loans that you consolidate.

The Downsides To Refinancing

Although refinancing has mostly positive benefits, there are some negatives that you should be aware of.

Loss of student loan forgiveness programs

If you refinance your federal loans, you are forfeiting the possibility of ever having those loans forgiven or reduced through income-driven repayment programs or loan forgiveness programs.

The choice to refinance your federal loans is irreversible - once you go down the refinancing path, your federal loans are no longer federal loans.

Refinancing is taking out a private loan that is funded by a bank, to pay for your federal loan, which is funded by the Department of Education, a federal agency.

The bank is now the sole operator in determining the guidelines of your loans, and thus your loans can no longer be regulated by the Department of Education.

Just to give you a general idea to really make sure you understand the possible implications of refinancing your federal loans:

Hypothetically speaking, if in 6 years Congress passes a new law stating that all federal student loans can be forgiven, you will no longer eligible for that opportunity, since your federal loans have been refinanced into private loans.

If you do choose to refinance your student loans, you do not have to refinance all of your student loans.

You can choose to only refinance your private loans, if you feel comfortable with the repayment terms of your federal loans, and want to hang on to the possibility of participating in a program to get those loans reduced or forgiven.

"As long as those loans are refinanced with a private student loan company, forgiveness is off the table and the loans must be repaid in full," Brown said. "You may still be able to pause your monthly student loan payments, but at nowhere near as friendly terms as the federal government will offer you."

Your monthly payments will change

Income-driven repayment programs can help you to better manage your monthly payments by basing them off of the size of your income.

If you refinance your federal loans, you not only lose out on the opportunity to apply for an income-driven repayment program, but you are then also responsible to meet the minimum monthly payment set by the lender you take your new loan out from.

This means that even if your income is low, you’re unemployed, or you’re having some other kind of financial crisis, you are still required to make your monthly payments set by the lender.

Similarly, by refinancing, you will no longer have the option to partake in any sort of loan forgiveness program.

Loan forgiveness programs do not typically lower your monthly payments, but they may wipe out your debt altogether, given that you work in a specific field and make the required monthly payments determined by the program.

Refinancing won’t help if you have bad credit

Refinancing your student loans is heavily reliant on your credit score.

If your credit score is fair to poor, lenders may not give you a lower interest rate, or worse, will not even consider lending to you.

Additionally, if your loan balance is exceedingly high -- upwards of $90k -- it might be harder to get approved for a refinancing loan. It’s even possible that with a loan balance so high, refinancing wouldn’t make a difference in your monthly payments.

If you do find yourself in a situation where you need to refinance your student loans but your credit score is lacking, consider adding a cosigner to your loan.

A cosigner may help you to get approved for a refinancing loan, as well as get a better and lower interest rate.

Final Thoughts

Refinancing your student loans is a decision that you have to make for yourself.

Although these are all factors to consider, it’s important for you to take a look at your own personal situation and decide if refinancing will help you financially, and emotionally, handle the stress of paying back your loans at the current point you’re at in your life.

Are you struggling to maintain your monthly payments? Do you work in a field that could allow you to have your loans forgiven one day? Is your interest rate eating up most of your monthly payments?

Thinking about these questions could help you decide if and when refinancing is the best decision for you.

Being in debt from your student loans can feel like you’re running a marathon with no end in sight. Fortunately, we’re here to keep you hydrated through that marathon and help you see the finish line of your student loans.