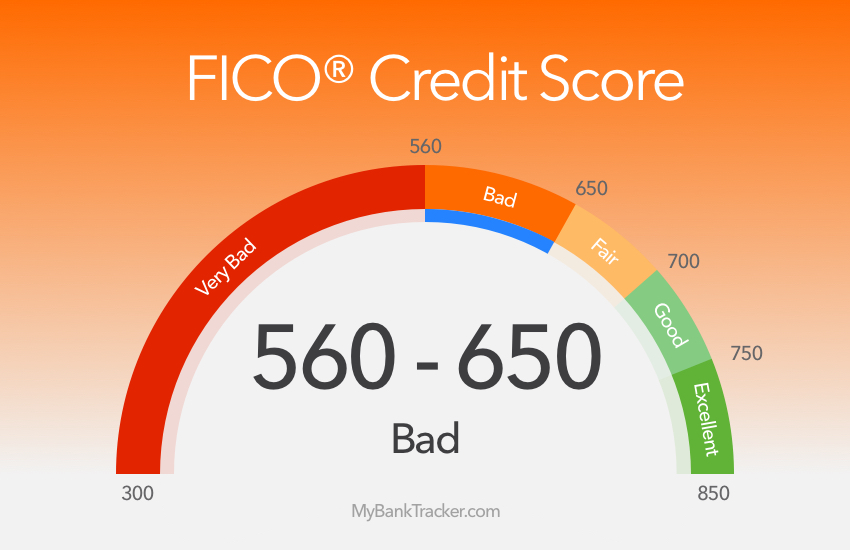

The Best Credit Cards for a Bad Credit Score (560-650)

Do you know what your credit score is? If your credit score falls in the range of 560-650, then your credit score would be considered to be “bad.” But how bad is that really?

While no one wants to have anything in their lives to fall into the “bad” category, if your credit score is currently there, you’re not alone.

Roughly 1 in 5 Americans have a credit score that falls into the “bad” range, according to the Fair Isaac Corporation (the creators of the FICO credit score).

There are credit cards for people with bad credit that can help you improve your score. All it takes is six months to one year of positive credit behavior to see an improvement.

According to our opinion, these are the top credit cards for low credit scores:

Best Secured Credit Card For Poor Credit Scores

When you’re just getting started improving your credit, a secured card is a great card to try since they’re easier to be approved for. The Wells Fargo Secured Visa Card is one of the best secured cards out there.

Wells Fargo reviews your account periodically to see if you’re ready to be upgraded from your secured card to a traditional credit card.

To qualify, you have to pay a $25 annual fee and put down a security deposit between $300-$10,000.

This $10,000 limit is notably higher than most secured credit cards. In fact, this limit sets Wells Fargo ahead of the pack for those looking to quickly improve their scores.

Best For Cash Back on Everyday Spending

Raising your credit score is a simple way to open up a great deal of financial opportunity in the future.

But what about being able to track your improvements as you go?

If you love to see your progress, then the Discover it Secured Credit Card is the best choice for you.

It comes with free access to your FICO score, updated monthly. That means you can watch your score improve as you use your card over time.

Even better, this card gives you a chance to earn rewards for your spending too. With Discover it Secured, you get 2% cash back for purchases made at restaurants and gas stations (for up to $1,000 spent per quarter).

You then get 1% cash back on everything else. Plus, you don’t have to pay an annual fee to get the card. You also don’t pay foreign transaction fees, penalty APRs for late payments, or a fee on your first late payment.

In other words, you earn rewards without losing earnings to excessive fees. The security deposit for this card can range from $200-$2,500.

Runner Up For Cash Back on Everyday Spending

There are a ton of credit cards for people with bad credit that still provide rewards for everyday spending. out there that provide rewards for everyday spending. Check out a few great options below.

Best No Annual Fee Credit Card

The Capital One Platinum Credit Card is a no-annual-fee credit card that was created for people with bad credit. After six months of on-time payments, Capital One will offer you access to a higher credit line.

This plays a major role in boosting your credit score. Additionally, Capital One has a free credit tracking tool to help you monitor your credit progress.

It tends to be more expensive for someone with a bad credit score to obtain a credit card. The reason for this is because they appear to lenders as though they’ve exhibited riskier financial behavior.

Commonly, credit cards for people with bad credit usually come with an annual fee of around $30. Not so with this card, though, which has no annual fee.

How Secured Credit Cards Work

Secured credit cards are designed to help people improve their credit. Generally, they look and work like typical credit cards.You can use them at any retailer that accepts your issuer.

The defining trait of secured credit cards is that they require you to pay a security deposit to be approved. The good news is that this makes it a lot easier for you to be approved.

The bad news is that your credit limit will match your deposit. That’s why these cards are good for credit building. (And why they’re bad for large purchases or emergencies.)

With secured cards, your credit limit is usually determined by your security deposit.

If you want a higher card limit, you’ll have to increase your security deposit (up to the card’s allowed maximum). The security deposit cannot be withdrawn or used to pay the monthly bill.

The only time you’ll get your security deposit back is when you close your card. (This could also apply if you transfer to a traditional credit card offered by the same issuer).

The Positive Effect Secured Cards Have on Your Credit Score

Secured credit cards are great for your credit score. They’re easy to get, and they enable you to show positive payment behavior to future lenders.

In fact, if you keep using your card and pay it off every month (on time), you’ll see your credit score improve. It doesn’t even take that long to start improving either. Keep at it for 12 months, and your score will likely go up.

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

As soon as you see your credit score moving from bad to fair, start looking for the best credit cards for fair credit ranges.

If you’re not in a hurry, you could also wait. As your score goes from bad to fair to good, you can qualify for rewards cards. Once that happens, start looking for the best cards for good credit scores.

How Your Credit Score is Determined

The exact formula used for calculating your FICO credit score is undisclosed to the public so that consumers cannot game the system.

However, FICO does share the criteria that determine your credit score. There are five factors that affect your FICO credit score, and each one may hold a different weight:

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

Making all of your payments on time plays a huge role in your credit score. The second-biggest criteria is how much you owe in relation to how much credit is available to you.

Essentially, your credit score will be higher if you use less of your available credit. To achieve this, you can either pay down your debt or increase your credit limits.

Free Credit Reports to Track Your Progress

Everyone has free annual access to their credit report via annualcreditreport.com. Since there are three credit bureaus that generate your report, you can check one of them every few months. That enables you to check your credit report for free three times per year.

It’s important to note that your credit report won’t show your score, but it does give you a chance to make sure your report is accurate. (The data on your report will impact your score.)

This will help you catch fraud or reporting mistakes fast. And the sooner you catch those, the less likely have a negative effect on your score.

Raise Credit Limits to Boost Credit Scores

Many credit card issuers allow you to request credit limit increases online or over the phone. Others will automatically increase your credit limit over time.

Generally speaking, credit card issuers don’t offer these increases in the first six months of opening the account.

When you ask for a credit line increase, you’ll likely have to go through a credit check.

Since this could lead to a temporary ding in your score, wait until you know you have a chance at approval. (In other words, if your score is on the rise, you have a better chance of getting the increase.)

Earn Cash Back Even with Bad Credit

Cash back credit cards are usually only available to those with good or excellent credit scores. However, credit card offers for people with poor credit do exist.

With a cashback credit card, you accumulate rewards for your spending in the form of cash.

There’s usually a certain percentage that you get back once you meet a required spending amount.

How you can redeem your cash back will vary based on the card issuer, but usually it’s in the form of a check, direct deposit, or a statement credit. (A statement credit is a reduction in your credit card balance.)

Interestingly, there’s a slight loophole in how cash back credit cards work. For bonus cash back rates, the bonus cash back is awarded based on purchase location, not the items purchased.

Therefore, if you’d earn a high cash back rate at gas stations, all items bought at a gas station will be eligible for that rate.

On the flip side, another thing to keep in mind is that the benefits of a cash back credit card become nullified if you carry a balance on your card.

If you’re in a situation in which you pay more in interest than you earn in rewards, then you could get stuck in a dangerous debt loop. These cards (and all credit cards) are best used if you pay the balance off every month.

A Bad Credit Score Doesn’t Have to Be the End of Your Financial Growth

It’s never fun to see that your credit score is less than perfect. The good news is, no credit score (good or bad) is forever. No matter what your score is, it takes consistency to grow it to good standing. (Or maintain it if it’s already in good standing.)

That means you have the power to change your credit score. It won’t happen overnight, but if you maintain a few financial best practices, you’ll see improvements in as little as 6-12 months. What should you start with?

Obtain some form of credit. If you can’t get a traditional credit card, a secured card will work too.

Then, use that card to make small purchases each month and pay it off in full before the billing cycle ends. Keep doing that every month for six months to one year, and you’ll see a drastic improvement in your score.

Some people may want to tell you that improving your credit score is more complicated than this. I’m here to tell you that it’s not.

There are no shortcuts to a better score. And you don’t have to redo your entire financial picture to improve your score. You simply need to show lenders that you can use credit responsibly.

Be on time. Be consistent. Pay off the balance on your new card every month. This is the magic formula to a better credit score. And it will help you get to where you want to go for future lending needs.

Best Credit Cards For Bad Credit

| Credit Card | Notable Feature | Who It’s Best For |

|---|---|---|

| Wells Fargo Secured | Offers the potential of a very high credit limit for a secured card. | People with bad credit who have the funds for a large security deposit. |

| Discover it® Secured | Secured credit card that can help rebuild credit with no annual fee. | People with bad credit who want to repair their credit profile while also earning cash back on spending. |

| Capital One Platinum Secured | A secured credit card with an extremely low initial deposit requirement to help rebuild credit immediately. | People who have poor credit and don’t have a lot of cash for a big security deposit. |

| Credit One Bank® Platinum Visa | Rebuild credit without a security deposit. | People with bad credit who cannot afford a security deposit for a secured credit card. |

| Capital One Platinum Credit Card | Designed for people without good credit to help rebuild credit with no annual fee. | People with bad/average credit who want a credit card to improve their credit without a security deposit. |

| American Express Bluebird | Free prepaid account that offers check-writing. | People who want a low-cost alternative to a traditional checking account. |