Best Credit Cards for Good Credit Scores (700-749)

A good credit score can be any FICO credit score that falls within the range of 700 to 749. The FICO credit score is the one most commonly used by lenders.

It’s a numeric way for them to understand their level of risk in lending to you. If your score falls in this range, lenders will consider you to be a relatively low lending risk.

With a good credit score, you have more credit card options for future credit.

You’ll also be able to secure credit at lower interest rates. In other words, if you have a good credit score, you have more and cheaper options for credit.

Find which credit cards are the best for good credit, in our opinion:

Best Credit Cards for Good Credit Scores

| Card | Best for… | MyBankTracker Rating |

|---|---|---|

| Chase Sapphire Preferred | Best for Bonus Travel Rewards | 5.0 |

| Citi Custom Cash | Best for Tailor Cash Back Rewards | 5.0 |

| Capital One Venture Rewards Credit Card | Best for Simple Travel Rewards | 5.0 |

| Citi Double Cash | Best for General Cash Back | 5.0 |

| Capital One Quicksilver Cash Rewards | Best for Spending Abroad | 4.0 |

| Chase Freedom Unlimited | Best for Dining & Drugstores | 5.0 |

Chase Sapphire Preferred: Best for Bonus Travel Rewards

Chase Sapphire Preferred is one of the popular travel rewards credit cards because of plenty of ways to turn rewards points into free travel.

The rewards program allows you to earn bonus points on dining, online grocery purchases, select streaming services and travel.

Those points are worth 25% more when redeemed for travel through Chase Ultimate Rewards. So, a free flight that costs 50,000 points will only cost 40,000 points to redeem.

Additionally, these points can be transferred to partner airline and hotel loyalty programs to maximize these points even more.

The card has a $95 annual fee and no foreign transaction fees.

Read the full Chase Sapphire Preferred editor’s review.

Citi Custom Cash: Best for Tailored Cash Back Rewards

Citi Custom Cash Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

The Citi Custom Cash Card is aptly named for a cash back program that offers 5% cash back on your top eligible spending category per billing cycle (up to the first $500 spent) and 1% on all other purchases.

Basically, you avoid the hassle of having to figure out which cash back credit card to choose to maximize the rewards for your specific spending patterns — the card does the work for you.

The card has no annual fee.

Read the full editor’s review of Citi Custom Cash.

Capital One Venture Rewards: Best for Simple Travel Rewards

Capital One Venture Rewards Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

Capital One Venture Rewards offers a simple, yet generous travel rewards program. With this card, you earn 2 miles per dollar spent on every single purchase.

Most notably, you can redeem each mile at the value of 1 mile per cent for a statement credit on a travel purchase.

What that means is you don’t have to go through their rewards portal to book travel. You can book through your preferred websites – then get reimbursed by Capital One later.

Moreover, you get up to $100 in statement credits for Global Entry or TSA Precheck membership application.

The card does have an annual fee of $95 and no foreign transaction fees.

Read the Capital One Venture Rewards Credit Card editor’s review.

Citi Double Cash: Best for General Cash Back

Citi Double Cash Card offers you 1% cash back at the time of purchase, and another 1% cash back when you pay for your purchases.

This adds up to a total of up to 2% effective cash back on everything, with no limits.

Use it to pay for purchases that aren’t part of any other card’s bonus categories such as insurance premiums, health care bills, and tuition.

Other benefits include trip cancellation and interruption protection and worldwide car rental insurance.

You also receive damage and theft protection as well as extended warranty coverage on your purchases.

Finally, Citi has automatic forgiveness of your first late payment fee with this card, and it has no annual fee.

Read the complete Citi Double Cash Card editor’s review.

Capital One Quicksilver Cash Rewards Credit Card: Best for Spending Abroad

Capital One Quicksilver Cash Rewards Credit Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

The Capital One Quicksilver Cash Rewards Credit Card offers a simple 1.5% cash back on all spending — worthy of a spot in every wallet.

Notably, this card does not charge foreign transaction fees. So, you can also carry it around during your international trips for purchases abroad.

The card has no annual fee.

Read the editor’s review of the Capital One Quicksilver Rewards Card.

Chase Freedom Unlimited: Best for Dining & Drugstores

Chase Freedom Unlimited Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

Chase Freedom Unlimited provides bonus cash back for several common spending categories, especially dining and drugstores.

The card’s cash back program offers:

- 5% cash back on travel purchased through Chase Ultimate Rewards

- 3% cash back on dining and takeout

- 3% cash back on drugstore purchases

- 1.5% cash back on all other purchases

The card has no annual fee.

Read the full Chase Freedom Unlimited editor’s review.

What is a Good Credit Score?

When comparing the best credit cards for good credit, it helps to understand what it means to have a good credit score.

Generally, a good credit score is a score of 700+. But what counts as a good credit score can depend on the credit scoring model you’re using.

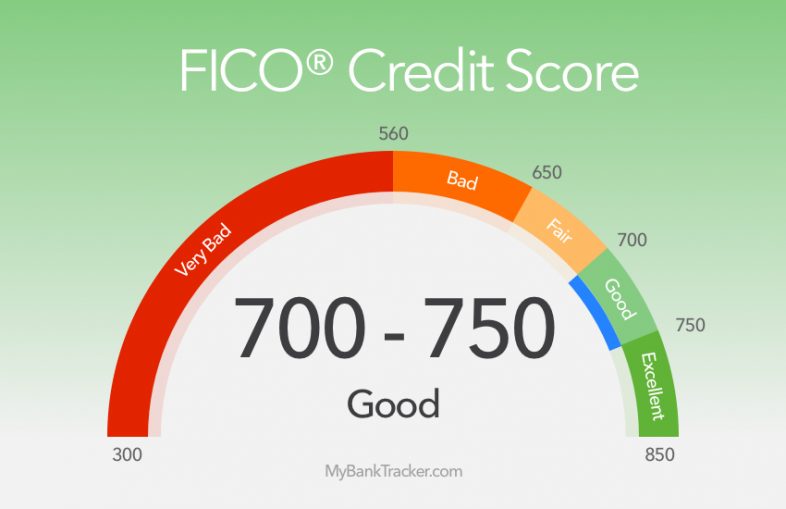

FICO is the most popular scoring model. These scores run from 300 to 850, with 850 being a perfect credit score.

Here’s what good credit looks like under the FICO model:

FICO credit scores are based on five specific factors. Each one carries a different weight for credit score calculations.

- Payment history: 35% of your score

- Credit utilization: 30% of your score

- Credit age: 15% of your score

- Credit mix: 10% of your score

- New inquiries: 10% of your score

Payment history is most important for credit scoring under the FICO model. So paying on time can help boost your score into the good credit range. But paying late could cost you significant points.

Credit utilization also matters. The wider the gap between your credit limits and your balances, the better.

Maxing out credit cards or carrying high balances can hurt your score. Closing old accounts with a balance still due can also work against you.

FICO credit scoring rewards you for using different types of credit (i.e. credit cards, loans, etc.) But it penalizes you for applying for new credit too often.

The VantageScore model looks at good credit differently. VantageScores are credit scores developed by the three major credit bureaus: Equifax, Experian and TransUnion.

These scores also range from 300 to 850. But what constitutes good credit is different from the FICO model.

VantageScores emphasize payment history, credit and credit utilization. But they give less influence to available credit, recent credit behavior and new inquiries.

Why a good credit score matters

First, it’s easier to get approved for loans or lines of credit when you have good credit.

Good credit sends a signal to lenders that you can be trusted to pay back what you borrow on time. So you’re less likely to be denied for credit when you have a good credit score.

That goes for credit cards but also loans. So if you want to get a car loan, buy a home or refinance student loans, a good credit score can help.

The other benefit of good credit is being able to qualify for lower interest rates.

The interest rate and fees you pay for a loan are what make up your annual percentage rate or APR. The lower the APR, the less you’ll pay to borrow.

Lenders typically reserve the lowest APRs for people who have good to excellent credit scores. That means having a good credit score could save you money on interest in the long run.

Having fair or poor credit, on the other hand, can make borrowing more expensive. You’re more likely to qualify for the highest interest rates with scores in this range.

Should You Get a Card With an Annual Fee?

Some of the best credit cards for good credit charge an annual fee, which means you have to consider whether you’re willing to pay one or not.

If you have good credit, you have better odds of qualifying for premium rewards cards. The benefits of a premium rewards card can include:

- Better rewards on purchases

- More generous introductory welcome bonuses

- Upgraded features and benefits

- Introductory purchase or balance transfer APR offers

When it makes sense to pay an annual fee

The simple answer is that it makes sense when the card’s value to you outweighs the cost of the fee.

This can be value based on the rewards alone. Or it can include any added benefits the card offers.

So if you’re basing value on rewards, consider how you normally spend.

Look at your previous six to 12 months’ worth of credit card statements. How much do you normally spend each month? What purchases do you spend the most on?

This can help you estimate how much you could earn in rewards each year to offset an annual fee.

For example, say you’re considering a card that charges a $95 annual fee. The card offers 2 points per dollar on dining and travel, then 1 point everywhere else.

If points are worth 1 cent at redemption, you’d need to make $5,000 in dining and travel purchases to earn back the fee in rewards value. Or you could spend $10,000 on other purchases to earn back the fee at a rate of 1 point per dollar.

Your payments habits

Also, consider your payment habits.

If you always pay in full, then you’re not paying interest. This means interest charges won’t detract from the value of your rewards.

But if you carry a balance, then the interest you pay could wipe out some of the value you’re getting in the form of rewards.

Now, what about a card that charges a $550 annual fee?

In that case, you’re likely going to have to spend more to earn back the annual fee in rewards value. Or the card is going to have to come with some tempting benefits.

For example, paying that much for a travel rewards card might be worth it if you get benefits like:

- Fee credit toward TSA PreCheck or Global Entry

- Worldwide airport lounge access

- Annual airline travel credits

- Elite status in an airline or hotel loyalty program

- Access to exclusive hotels and resorts

- Travel discounts on rental cars or cruise packages

If you use all of those features, then a higher annual might be worth it. But if you don’t, you could be paying an annual fee for nothing.

Looking at the rewards and the card features can help you decide how much it could be worth to you, based on how you normally spend.

FAQs

What does it mean to be pre-approved for a credit card offer?

From time to time, you may get pre-approved credit card offers in the mail. But what does it mean?

Being pre-approved for a credit card offer means that you meet certain criteria for a credit card. But it doesn’t mean you’re fully approved.

You’d still need to apply for the card.

That means:

You have to provide the credit card company with your personal information, including your Social Security number.

A credit card pre-approval offer may not affect your credit. But once you apply for a new card, that can trigger a hard credit check.

Hard credit checks can show up on your credit report. Remember, they count toward 10% of your FICO credit score.

How high will my credit limit be?

The best credit cards for good credit can have different credit limits.

Your credit limit just means how much you can spend at any given time. If your card allows balance transfers or cash advances, you may have different limits for those transactions.

So what will your new card’s credit limit be?

The answer is that it depends. Specifically, it can depend on:

- Which card you’re approved for

- Your income

- Credit scores

- Typical spending habits

If you already have one card with the same card issuer, that can also come into play.

The credit card company may look at your payment history, transactions and credit limit for that card. That can be a guide when setting the limit for your new card.

The most important thing to keep in mind with your credit limit is that using it responsibly matters.

Since credit utilization makes up 30% of your FICO score, you can maintain a good credit score by keeping your balances low.

Does applying for a new credit card hurt my credit?

As mentioned, inquiries for new credit make up 10% of your FICO credit score.

When you apply for a credit card, it usually means a hard pull of your credit report. This can show up on your credit history and trim a few points off your credit score.

For that reason, it’s important to target which cards you want to apply for. Otherwise, you could end up with multiple inquiries on your credit report.

Applying for several cards in a short period of time could suggest to lenders that you’re desperate to borrow money.

That could mean getting denied for new credit cards. And your score will lose points as well.

The impact of credit inquiries fades but not right away. Typically, it takes two years for an inquiry’s impact on your score to lessen.

So as you’re looking for new credit card options, think carefully about what you need and want.

This can help you narrow down the list of cards so that you’re only applying for ones that are the best fit.