What is a Good Credit Score Range?

Having good credit is the essential foundation to a healthy financial life.

The state of your credit is one of the most important factors when it comes to qualifying for and securing a low interest rate on an auto loan, a rewards credit card, or a mortgage, for example.

Your credit score is the numerical measure of your consumer credit health, the number that lenders look at when determining how creditworthy you are, i.e. how likely you are to pay money back that you’ve borrowed.

The most common used credit score is the FICO (Fair Isaac Corporation) Score, which has a range of 300 to 850.

According to FICO, 90 of the top 100 U.S. financial institutions use FICO credit scores. One competitor is the VantageScore. But how are these scores determined, and what exactly makes a good (or even great) credit score range?

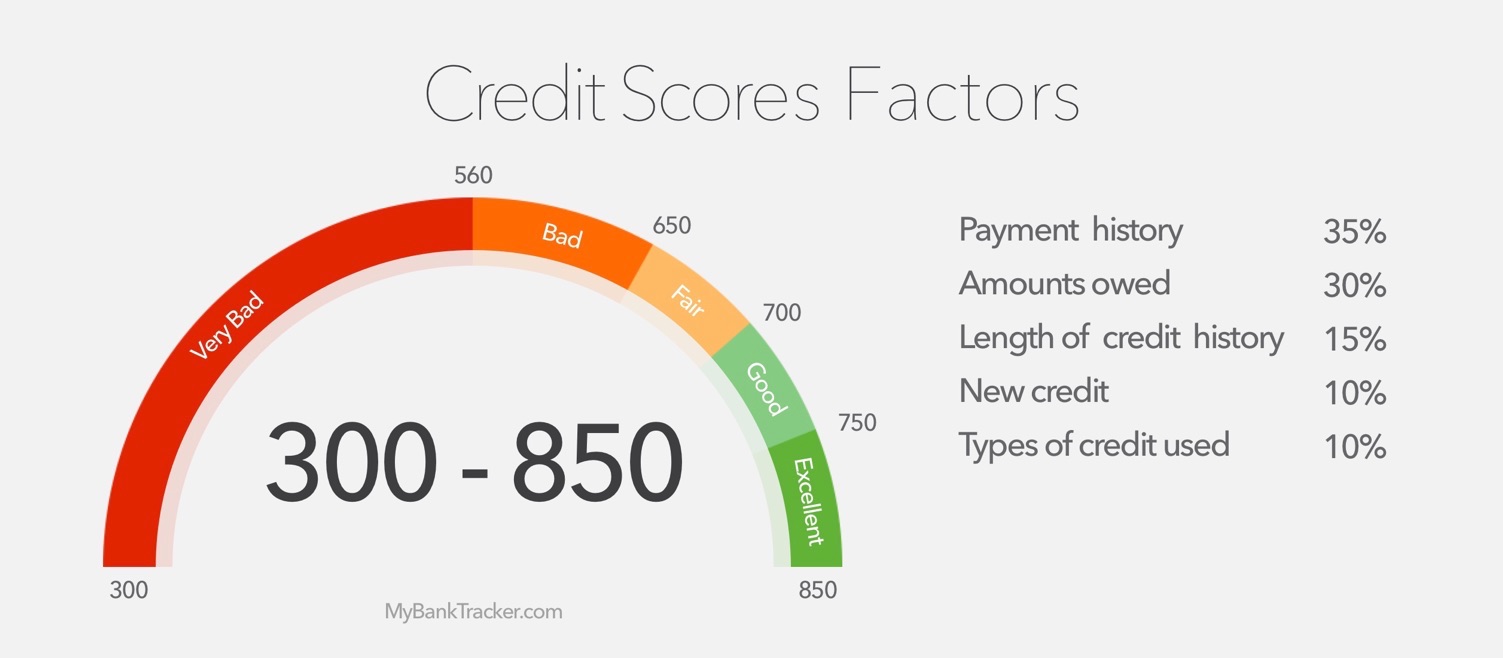

How are Credit Scores Calculated?

Your FICO scores incorporate all your positive and negative borrowing/lending activity, and breaks it down according to a few factors:

- Payment history: 35%

- Accounts owed: 30%

- Length of credit history: 15%

- Credit Mix: 10%

- New credit: 10%

All of this activity is reported to the three credit bureaus — Experian, TransUnion and Equifax — which is then listed on your credit report and, in turn, comprises the bulk of your credit score.

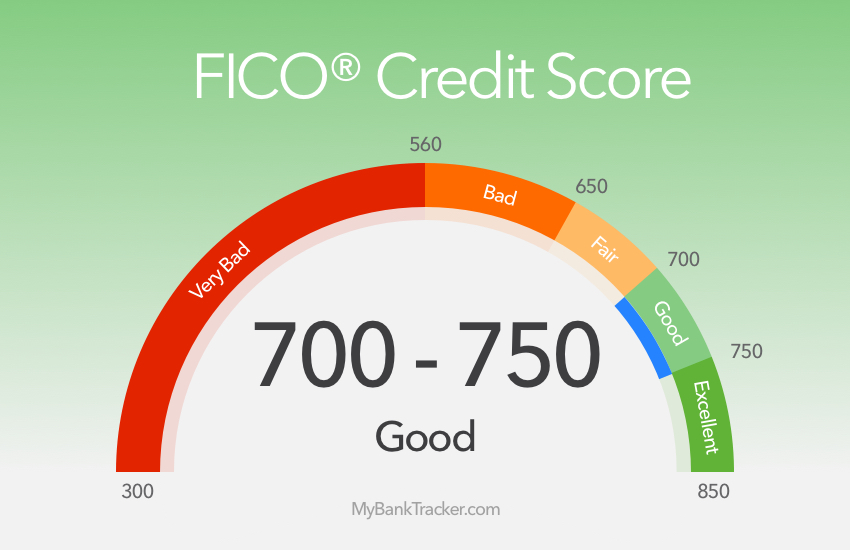

What is a Good Credit Score Range?

Scores are broken down into a few categories, from poor to excellent:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Bad: 300-579

The average credit score in the United States is 706, according to FICO.com — which puts it in the “Good” credit range.

This number has steadily climbed since October 2005, when the average score was 688.

The higher echelons of the scale — 750-799 and 800-850 — have increased just slightly over the years, according to FICO.com.

In April 2005, 20.4% of consumers held a 750-799 credit score range. In April 2019, it was at 20.7%.

The highest range, 800-850, was at 16.2% in April 2005. By April 2019, that had risen to 22.3%. Is it an indicator that Americans are getting better with their credit habits?

How Much Credit Card Does Your Credit Score Give You?

Naturally, the higher the credit score, the better types of lending products and interest rates you’ll be able to land.

When it comes to credit cards, you may better qualify for a certain card depending on your score.

For instance, if you have bad or no credit, a secured credit card is an ideal “starter” card.

What about some cards for credit scores that aren’t bad or excellent, but fair to good?

There are credit cards designed for people with average credit. Look, they may not have flashy rewards or perks, but they set the stage for credit score improvement. In time, you’ll qualify for more lucrative credit card offers.

Consumers with excellent credit are more likely to get approved for premium rewards credit cards with extravagant travel credit cards or powerful cash back programs.

How Much Mortgage Does your Credit Score Buy You?

By far, your credit score can make or break the type of mortgage loan you’ll be able to get when buying a home, since the interest rate you qualify for informs how much your monthly payment will be.

Consider how much you’re likely to save according to your credit score. Take a 30-year FRM, in Connecticut, with a loan amount of $100,000:

Take a 30-year FRM, in Connecticut, with a loan amount of $100,000

| FICO Score: | APR: | Monthly Payment: | Total Interest Paid: |

|---|---|---|---|

| 760-850 | 3.419% | $445 | $60,033 |

| 700-759 | 3.639% | $457 | $64,462 |

| 680-699 | 3.814% | $467 | $68,032 |

| 660-679 | 4.026% | $479 | $72,410 |

| 640-659 | 4.453% | $504 | $81,403 |

| 620-639 | 4.994% | $536 | $93,124 |

A borrower with average credit (620-639) ends up paying $536 per month on a 4.9% APR, for a total $93,124 interest paid.

Compare that to the person with excellent credit (760-850), who obtains a 3.4% APR, $445 monthly payment and $60,033 total interest paid.

Here’s how much more the borrower with excellent credit ended up saving:

- Monthly payment: $91

- Total interest paid: $33,091

The bottom of the table also illustrates how much more you’ll pay if your score were to lower — here, we’ve given a hypothetical example of a 700-759 range.

For instance, the borrower with a range of 680-699 could pay an extra $3,569 on their mortgage; drop that down to 620-639, and you may be saddled with an extra $28,662.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

How to Raise your Credit Score

If avoiding such huge differences in interest rates and payments are important to you, it’s imperative that you always make sure to keep building your credit score in every way possible (also, see how to improve your credit score by 100 points):

Don’t close old cards; open few new ones

Opening and closing too many accounts can wreak havoc on your credit score.

According to MyFICO, closing down cards won’t give the impression of having less credit debt, and opening new accounts won’t help your score, either.

Always pay your bills in full

Even if it’s on time, a partial payment is like a slap in the face to your lender; it tells them they’re only good enough for some of the money you owe them.

Even if you make it up the next payment cycle, it’ll still hurt your credit.

Always pay your bills on time

Late credit card or loan payments reflect poorly on your credit report and can negatively affect your credit score.

Keep credit card balances on the low side

If your monthly credit card balance is too high, too often, it can offset your credit-to-debt ratio, which tells the credit bureaus that you’re relying on credit too much, and this can put a dent in your score.

Check your credit report and score often

Make sure you check your credit report at least once a year; inconsistencies may affect your score in error.

Likewise:

Take a look at your credit score from time to time to see which range you’re in, and set goals to see where you’d like it to be.