The Best Rewards Credit Cards for Earning Points and Miles of 2026

If you’re using a plain old credit card every day that doesn’t offer rewards, you’re missing out.

There are plenty of credit cards with good rewards out there that pay you back for your daily spending.

We’re talking things such as travel perks, cash, merchandise, and more.

We surveyed the top credit card offers on reward points and miles, to find out which are best for your needs. We found that some cards offer more rewards per purchase than others; while there were a few with no minimum spend requirement at all!

In our opinion, after much analysis, these are the top rewards credit cards that you can find today.

The Best Rewards Credit Cards of 2025

| Credit Card | Best for | MyBankTracker Rating (1-5 Stars) |

|---|---|---|

| Capital One VentureOne Rewards Credit Card | Best for Airlines & Hotels | 4.0 |

| The Platinum Card from American Express | Best for Travel | 5.0 |

| Chase Sapphire Preferred Card | Best for Multiple Rewards | 5.0 |

| Capital One Quicksilver Cash Rewards Credit Card | Best for Cash Rewards | 4.0 |

| Chase Freedom Unlimited | Best for Cash back Bonus | 4.0 |

| Blue Cash Preferred Card from American Express | Best for Families | 5.0 |

Capital One Venture Rewards Credit Card: Best for Airlines & Hotels

The is a travel rewards credit card that offers unlimited 2 miles per dollar spent on every purchase.

You can redeem these miles for statement credits for travel purchases you’ve already made. The redemption value is 1 mile per penny. (For example, 10,000 miles would be equivalent to a $100 travel statement credit).

This card has a $95 annual fee .

Read the Capital One Venture Rewards Credit Card editor’s review.

The Platinum Card® from American Express: Best for Travel

See Rates & Fees. Terms apply.

The Platinum Card from American Express is the best for travel.

This card has a long list of benefits, including getting points back on every purchase and no foreign transaction fees!

Read the Platinum Card from American Express Credit Card editor’s review.

Chase Sapphire Preferred Card: Best for Multiple Rewards

The is popular because of its flexible rewards program.

If you redeem your points through Chase’s online travel booking portal, your redemption will come at a 25% discount.

Another perk of the card is that you can transfer the points to major frequent traveler programs including British Airways, Southwest Airlines, United, Hyatt, Marriott, and more.

You can also redeem your points for cash back, gift cards, merchandise, and experiences. This card has an annual fee of $95.

Read the Chase Sapphire Preferred Credit Card editor’s review.

Capital One Quicksilver Cash Rewards Credit Card: Best for Cash Rewards

In this era of expensive and difficult-to-get credit, it is important to know which companies are likely to be able to give you the most in return for your cash.

This card offers a simple 1.5% cash back on all purchases.

It’s an excellent choice for someone who doesn’t have a specific spending pattern and would prefer to earn a decent amount of cash back rewards on all spending.

Quicksilver Cash Rewards from Capital One Credit Card Review

Chase Freedom Flex: Best for Cash Back Bonus

is a cash back rewards credit card that offers 5% cash back on categories that change every quarter. Many of these bonus categories are season-appropriate. All purchases that don’t fall into these categories earn 1% cash back.

Your rewards balance is then stored as points that can then be redeemed for gift cards, merchandise, and travel or cash. This card has no annual fee.

Read Chase Freedom Flex Credit Card Editor’s Review

Blue Cash Preferred® Card from American Express: Best for Families

*See Rates & Fees. Terms Apply.

The Blue Cash Preferred Card from American Express is a card that is a great fit for families because of its very attractive cash back rewards program.

The main highlight is the ability to earn 6% cash back when shopping at U.S. supermarkets (up to the first $6,000 spent per year in this category). And, the card pays 3% cash back at U.S. gas stations, transit purchases, and 6% cash back on select U.S. streaming subscriptions, along with 1% back on other eligible purchases.

Blue Cash Preferred Credit Card from American Express Review

How We Picked

Every rewards credit card is designed for a specific type of consumer. Therefore, there is no single rewards card that is the perfect fit for everyone. We analyzed more than 40 credit cards for their popular rewards programs and compared their card fees, rewards potential, and card benefits.

These cards are ranked according to the potential overall value for consumers. Note that while some of the cards are from advertisers on MyBankTracker, they are truly the best cards that we’d recommend even if they weren’t affiliated partners.

What Credit Score is Required for Rewards Credit Cards?

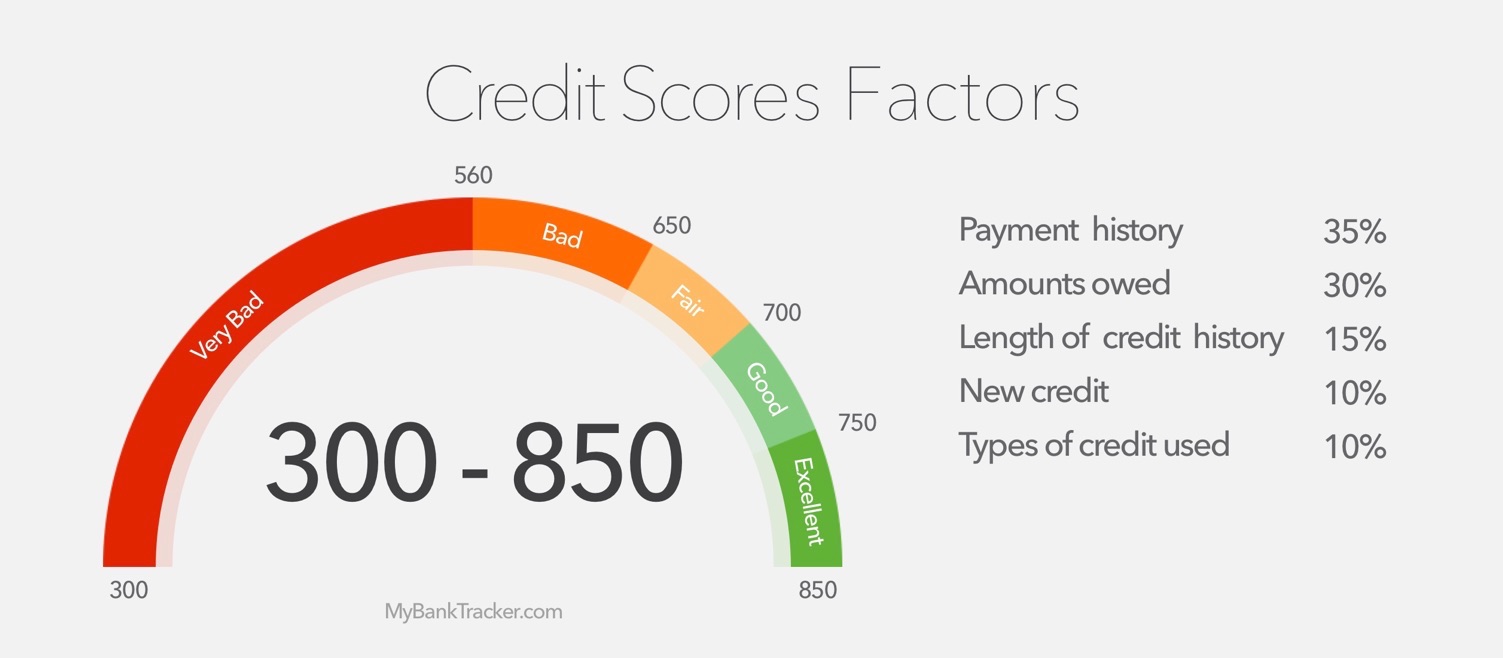

Rewards credit cards usually require a good credit score for approval. You have a solid chance of qualifying for most rewards credit cards if you have a FICO credit score of 700-850.

FICO scores are the most-used metrics for determining creditworthiness by lenders.

To help you stay on top of your score, many credit card companies now offer free FICO scores to cardmembers.

Interest Rates Are Higher on Rewards Cards

Rewards credit cards tend to come at a higher interest rate than other credit cards.

The exact interest rate will vary based on your credit score (The higher your credit score is, the lower your APR would normally be on any loan or line of credit. That includes credit cards with good rewards.)

Due to the higher APRs on rewards cards, they’re not a good idea if you struggle to pay your balance in full each month.

If you carry a balance, the interest charges are very likely to exceed the value of the rewards earned. If this is the case, you would save more money by applying for a low-interest credit card instead.

Tips to Get More Rewards

If you have a large purchase to make or a large bill to pay off, you can increase your rewards points by using your rewards credit card to do so.

This can work even on travel expenses or by picking up the check after an evening out. (Though you may want to ask your friends to reimburse you for their share).

Using a rewards card to pay for bills is a smart way to get some extra points. (Sometimes you can even do this with your rent.) Just make sure you can pay the balance off before the end of the billing cycle.

1. Redeem cash back to spend as you wish

Depending on the credit card, cash rewards can be redeemed in different ways.

Some cards allow you to deposit the earnings into a bank account or to use the rewards as a statement credit. (Redeeming rewards as a statement credit can help you reduce your credit card balance.)

2. Tailor the card to your spending habits

Most rewards programs have a base rewards rate that applies to all purchases. However, the real benefit can be seen with the bonus rates that apply to specific types of purchases.

For instance, many credit cards offer bonus rewards on travel purchases or grocery shopping. To earn the most rewards, focus your spending towards those bonus categories.

Before signing up for a credit card, review your spending to be sure that it is the best rewards credit card for you. That way you can truly maximize your rewards.

Review your past 6-12 months of credit card statements. This should give you a clear view on your spending habits. Then you’ll know how to match for the best rewards credit card for you.

3. Redeem your rewards points for the most value

Furthermore, look at the rewards that you’d like to redeem the most. Some programs may value your points differently based on the reward.

For example, the same 5,000 points you earn could get you a $50 gift card but only $25 cash back.

Don’t inadvertently get stuck with rewards that you don’t really want or need. Check how the redemption can change for each reward to prevent this.

Annual fees are not uncommon with credit cards that offer rewards. But if you can take advantage of those rewards, you should be able to more than make up for the fee.

Furthermore, some rewards programs allow you to transfer points to partnered airline or hotel loyalty programs, where those points may be worth more when redeemed toward a flight or hotel night.

4. Understand the bonus rewards categories

For certain purchases to qualify for a bonus rewards rate, the merchant category code (MCC) must match the bonus rewards category.

Therefore:

Rewards credit cards will issue bonus rewards based on where you make purchases, not on what you buy.

You can buy anything at a qualifying merchant and still earn the bonus rewards rate. So, if you’re earning a high bonus rewards rate at grocery stores, all purchases at the local supermarket will earn bonus rewards.

Each merchant has its own MCC, which can vary based on the card network. (Card networks include American Express, Discover, MasterCard, or Visa). Furthermore, each location of the same merchant company could have a different MCC.

There are three ways to identify the merchant code of a location or website:

- Check Visa’s supplier locator tool for a specific retailer by address

- Make a small purchase and check your credit card activity to see the transaction category

- Ask an associate at the store (preferably a cashier or manager)

Credit card companies tend to be very strict with their rewards policies, which you agree to when you sign up for a credit card.

It’s often very difficult to dispute a transaction’s eligibility for bonus rewards.

See the rates & fees for the mentioned American Express cards: Blue Cash Preferred from American Express (Rates & Fees; terms apply).