How to Check Your FICO Score

- Credit scores reflect your creditworthiness based on factors like payment history, amounts owed, length of credit history, new credit, and credit mix.

- You can access your credit reports for free annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

- Improving your credit score involves responsible financial habits like making timely payments, managing debt levels, and diversifying your credit types.

One of the most important financial numbers you need to keep an eye on is your credit score.

While there may be many different types of credit scores out there, the most important credit score is the FICO credit score.

It is used by most U.S. lenders to determine whether or not to approve you for credit cards, car loans, mortgages, and other lines of credit.

A high FICO credit score will increase your chances of approval.

Additionally, it can mean lower borrowing rates, which result in less interest paid over the life of a loan.

On the other hand, low credit scores make it difficult to qualify for lines of credit. Loans for bad credit also tend to be expensive due to high interest rates and fees.

If you plan to take out a major loan in the future, you could minimize your borrowing costs with a great credit rating. Therefore, it’s crucial that you know your FICO credit score.

What is a FICO Score?

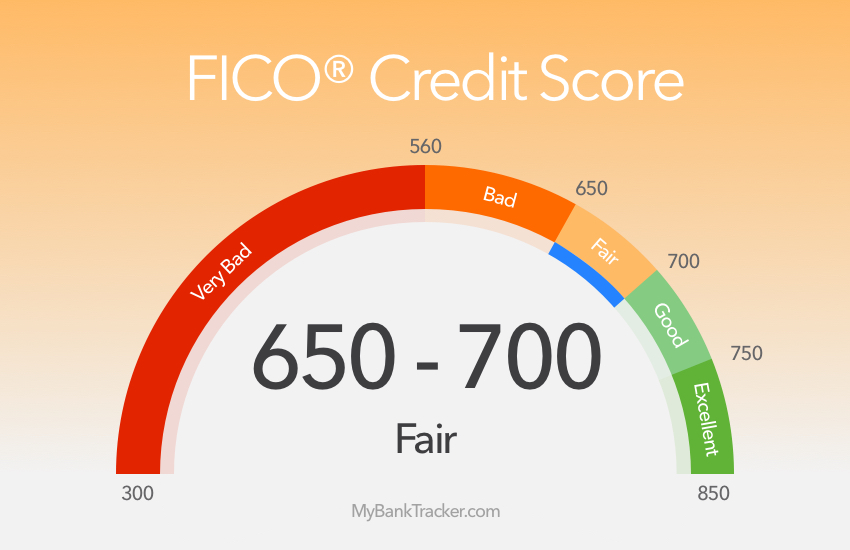

FICO, which stands for the Fair Isaac Corporation, is the leader in measuring consumer credit risk. A FICO score can range from 300 to 850. The different levels of the FICO score are usually divided as follows:

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

Although it might seem overwhelming and confusing, your FICO score is actually based on simple money activities. How you manage these activities can mean the difference between a good and an excellent credit score.

The exact formula to calculate a FICO credit score is not disclosed to the public. However, FICO does share what goes into determining your FICO credit score. It is calculated based on the following five factors:

Payment history – 35%

Your record with credit card payments is the biggest factor that affects your credit score. It’s crucial that you make payments on time for a good credit score. A single late or missed payment can have a major negative impact on your score.

Amounts owed – 30%

If your accounts are all maxed out, it could indicate that you are overextended. It’s recommended that you use 30% or less of your available credit.

Age of credit lines – 15%

The age of your accounts shows your experience with using credit. The older the accounts you have on your credit reports, the better your score.

Credit mix – 10%

Being able to juggle different types of credit is a good sign. For a higher credit score, you need a variety of types of credit including credit cards, retail accounts, installment loans, and mortgage loans.

New credit – 10%

If you have recently applied for a bunch of credit cards, it could indicate to lenders that you might be at a higher risk of default.

FICO uses the data in your credit reports to generate your credit score. Because credit reports at the different credit bureaus may contain different information on your credit file, your FICO credit scores can vary slightly.

How to Check Your FICO Credit Score

It’s important to make sure you are aware of your credit score, so you know what to expect when you apply for credit cards and loans. Further, if you are at the lower end, you can take matters into your own hands and begin working on improving your credit score.

Generally, there isn’t a no-strings-attached method of obtaining free FICO credit scores.

Buy it from FICO

FICO sells credit scores individually (usually around $20 each), in packages, or as a monthly subscription service. Credit scores can be expensive so it is suggested to purchase them when you really have to know your credit rating.

Check if your credit card offers it for free

More credit cards are partnering with FICO to provide free monthly credit scores to card customers. If you happen to have one of these credit cards, you can keep an eye on your credit without paying for it yourself.

Receive one with a denied credit application

Whenever you have been rejected for a new application for credit, the lender must tell you what your credit score was at the time of application.

Wait for special promotions

Occasionally, banks and other financial institutions will provide free FICO credit scores to their own customers.

Use the Discover’s free FICO score program

Discover, a major credit card issuer offers free FICO scores that are updated every 30 days.

There are many other companies — including the three major U.S. credit bureaus — that sell your credit scores. However, these scores are calculated using formulas that are different from FICO. Most free credit-monitoring firms will boast about free credit scores, which are not exactly the same ones used by lenders.

However, these free credit scores can still be used for the purpose of tracking improvement in your credit. If there’s an increase in such credit scores, you can expect your actual FICO credit score to do the same.

How Credit Scores Differ From Credit Reports

When you request a credit score, you’re often presented with just a number. You may also be informed of a couple of major factors that affect your FICO credit score. There is no other data on your personal credit.

For a comprehensive overview of your personal credit history, you should be looking at your credit reports.

They actually show data on your credit lines, including credit limits, balances, delinquencies, and more. This is the information that is used to generate your FICO credit score (or any credit score).

Credit Reports Are Really Free

Although FICO credit scores may come with a cost, credit reports can be retrieved for free.

Legally, everyone is entitled to a free annual credit report from each of the three major U.S. credit bureaus — Equifax, Experian, and TransUnion.

You can pull your free credit reports from AnnualCreditReport.com, a government-sanctioned website. You are never asked to provide payment information.

Unless you are preparing to apply for a major loan, such as a mortgage or auto loan, you can spread out your credit reports every four months. Using this technique, you can monitor your credit for free throughout the year.

Checking Your Score Doesn’t Hurt Your Score

Many people believe that their credit scores will drop when they check their credit scores or credit reports. This is not true.

Your credit scores are not affected when you pull your own credit file.

However, your scores could drop temporarily when you allow a third party, such as a lender, to view your credit profile. This commonly occurs when you are applying for new credit.

Improving Your Credit Score

Although it is possible, a perfect FICO credit score is very rare. Therefore, for many Americans and their credit, you’re likely to have room for improvement.

Furthermore, if you work on improving your credit rating and boost your score into the excellent range, you can qualify for better credit cards and loans, with lower interest rates and more attractive offers.

Our tips for improving your credit score by 100 points can help get you across that line and closer to an excellent credit rating.

One of the best ways to boost your credit score is to correct any inaccuracies or errors that might show up on your credit report.

Otherwise, on a daily basis, just making your payments on time and managing your accounts responsibly can go a long way in raising your FICO credit scores.