The Best Personal Loans for Home Improvement of 2026

Personal loans are flexible financial tools that give you money when needed. You can apply for a personal loan for nearly any purpose.

One common reason to apply for a personal loan is to finance home improvement projects.

Home improvement can be expensive, so you might want to take out a loan to pay for it. You might be tempted to consider a home equity line of credit (HELOC) or home equity loan. These can be viable options, but a personal loan can also fit the bill because of how customizable they are.

If you have a home improvement project in mind, we’ll cover how a personal loan can help you pay for it.

Compare Personal Loans

Best Personal Loans for Home Improvement

You can find personal loans from many lenders, but some offer a better deal than others.

We think these lenders provide the best personal loans for home improvement projects.

- SoFi

- Lending Club

- Earnest

- Lightstream

- Prosper

- Upgrade

SoFi: Best for Low-Interest Rates

SoFi Personal Loans Pros & Cons

- No origination fees or prepayment penalties

- Potential for a low APR

- Pre-qualification in minutes

- Requires excellent credit for the best APR

SoFi is an online lender that focuses on flexible, low-cost loans.

You can borrow as little as $5,000 from SoFi or as much as $100,000. That makes it easy to borrow exactly the amount you need to pay for your project, which makes it easier to avoid going over budget.

SoFi also doesn’t charge any origination or early repayment fees, making their loans even cheaper.

If you’re worried about losing your job and being unable to make loan payments, SoFi offers some protection against that. If you lose your job, you can pause your loan payments.

Interest will continue to accrue, but it will not impact your credit if you stop making payments. This can reduce some of the stress of taking on a loan.

Read our SoFi Personal Loans editor’s review.

Earnest: Best for Low Fees

Earnest Personal Loans Pros & Cons

- Low borrowing minimum

- No fees or prepayment penalty

- Loans funded within 2 business days

- Requires excellent credit for lowest rates

- Restrictions on how personal loan can be used

Earnest is another online personal lender. It touts its ability to gauge borrowers’ risk more accurately than other lenders. This means that Earnest can approve loans that other lenders won’t. It also allows Earnest to charge lower interest rates than other lenders do.

Earnest is able to gauge its risk so well by looking at more than just your credit score. Earnest will look at your saving patterns, investments, and career trajectory. If you have mediocre credit but a lot of promise, Earnest might be able to offer you a loan when other lenders won’t.

Earnest offers loans ranging from $5,000 to $75,000. It does not charge origination, early repayment, or other hidden fees.

Read our Earnest Personal Loans editor’s review.

Lending Club: Best for Borrowers of All Credit Ranges

Lending Club Personal Loans Pros & Cons

- No prepayment penalties

- Investors in your loan include regular people

- Potential for a high APR

- One-time origination fee applies

Lending Club offers loans to people with a wide range of credit scores.

If you’re having trouble getting a loan from a traditional lender, Lending Club might be able to help.

Read the Lending Club Personal Loans editor’s review.

Why Consider a Personal Loan Over a Home Equity Loan or HELOC

There are a few reasons to get a personal loan to fund improvement instead of a HELOC or home equity loan.

No collateral required

One benefit of a personal loan is that you don’t have to provide collateral (a security deposit).

With a HELOC or home equity loan, your home serves as collateral. If you start missing payments, your home could be repossessed.

Avoiding the need to offer collateral reduces your risk.

Faster to get, less paperwork

HELOCs and home equity loans require a lot of paperwork to open.

Personal loans are much easier to apply for, and you can get the money you need in days.

If you want to start your project sooner rather than later, a personal loan can quickly get you the money you need.

Longer repayment term

Some personal lenders offer loans with a long repayment term.

This can make finding a monthly payment you can manage easier, even if you’re borrowing a lot. HELOCs and home equity loans can be more restrictive regarding repayment terms.

Just remember that longer repayment terms result in higher total loan costs.

If you’re wondering how much your monthly payments might be with a personal loan, check out our loan calculator to help you figure out your monthly payments and the interest you might accrue on your loan:

Estimated Interest Personal Loan Calculator

How to Choose a Personal Loan for Home Improvement

When comparing personal loans to work on home improvement, you should mainly compare these three things.

Interest rates

The interest rate on any loan is one of the most important things to note. A loan’s interest rate (commonly denoted as the APR)will determine both the total cost of the loan and the size of your monthly payments. All else equal, you should look for the loan with the lowest interest.

Your credit score can significantly affect the interest rate of the loans you’ll be approved for, so try to boost your score as much as you can before applying for a loan.

Loan terms and borrowing limits

If you need to borrow money to fund a home improvement project, there’s not much point in borrowing less than you need.

All you’ll have is an unfinished project and insufficient funds to finish the project. Make sure you can get a large enough loan to pay for the whole project.

Also, see what kind of loan terms the lender offers. Long-term loans have lower monthly payments but cost more in total.

Go with a lender that offers a loan with a long enough term that you can handle the monthly payment.

Fees

Many personal loans charge origination fees, which are added to the balance at the start of the loan.

This and other fees will add to the total cost of your loan. Try to find a lender who charges no or low prices.

Common Personal Loan Fees

| Type of fee | Typical cost |

|---|---|

| Application fee | $25 to $50 |

| Origination fee | 1% to 6% of the loan amount |

| Prepayment penalty | 2% to 5% of the loan amount |

| Late payment fee | $25 to $50 or 3% to 5% of monthly payment |

| Returned check fee | $20 to $50 |

| Payment protection insurance | 1% of the loan amount |

Can You Deduct Interest Paid to Finance Home Improvement?

In some situations, you can deduct the interest you pay on home improvement loans, but you cannot deduct the interest on a personal loan, even if it is used to finance home improvement.

For a home improvement loan’s interest to be deductible, it must be secured by the home being improved.

How to Increase Your Chances of Approval

There are a few ways to improve your chances of getting approved for a personal loan to fund a home improvement project.

Increase your credit score

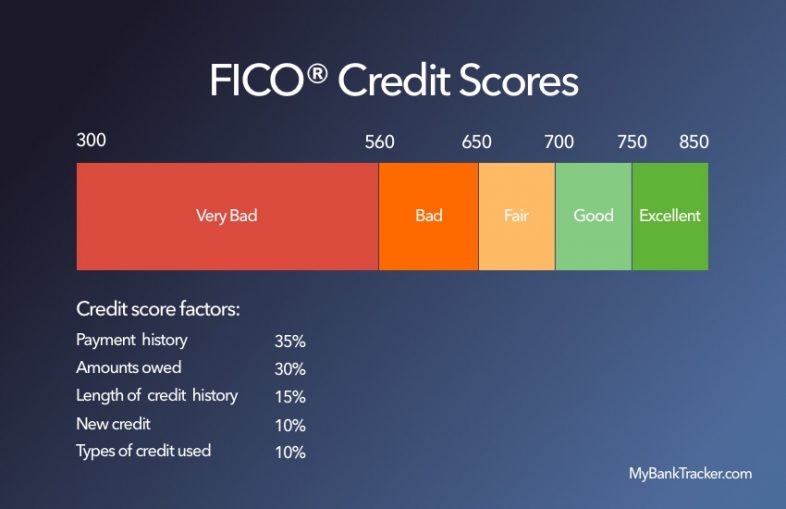

The most significant factor in your application’s credit score. Your credit score is a numerical representation of your financial trustworthiness in the eyes of lenders.

Your credit score is a numerical representation of your financial trustworthiness in the eyes of lenders.

The most critical factor in your credit score is your payment history. The second most important factor is the amount of money that you owe.

Unfortunately, your payment history is the most challenging factor to improve. You’ll need to make on-time payments on your debts over months and years to improve. A single missed payment can have a significant effect on your credit score.

In the short term, you can give your score a slight boost by:

- Paying down existing loan balances

- Avoid using your credit cards in the lead-up to your application

- Don’t apply for other loans before applying for a substantial loan

Lenders consider more than just credit scores

Nearly every lender will look at your credit score when making a lending decision.

However, some lenders will look at more than just your credit score. If you have poor credit but have a way to show that you’re working to improve your finances, look for this type of lender. They might be able to offer a loan where other lenders won’t.

If you have poor credit but have a way to show that you’re working to improve your finances, look for this type of lender. They might be able to offer a loan where other lenders won’t.

Autopay for a rate discount

Many of the lenders that offer personal loans are banks. Banks like to create long-term customer relationships, often providing relationship discounts on loans.

One common type of discount is the automatic payment discount.

If you get a personal loan from a bank with a checking account, you can save as much as 0.50% off the interest rate by signing up for automatic payments.

Conclusion

Home improvement projects can get expensive very quickly. If you need help paying for home improvement, a personal loan can quickly get the money you need.

If you need help paying for home improvement, a personal loan can get you the money you need quickly.