Betterment Robo-Advisor 2026 Review

Robo-advisors are changing how people invest, making building a portfolio online more convenient than ever.

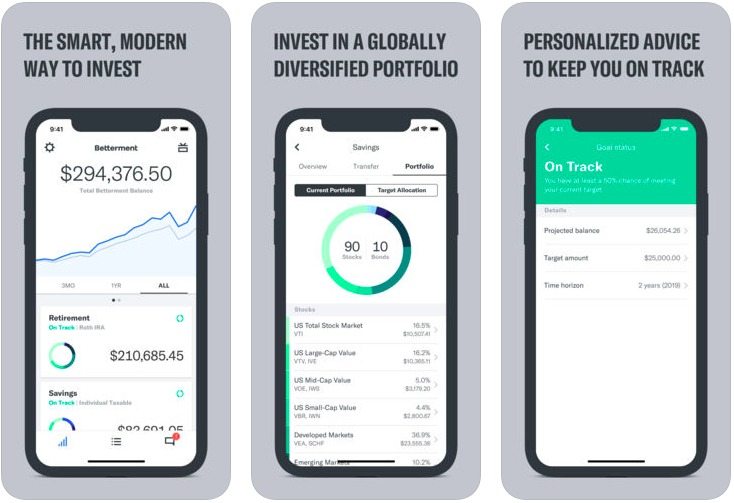

Betterment is a robo-advisor whose goal is to help you make the most of your money while keeping high investment fees at bay.

One of the most complex parts of investing is choosing where to put your money, and Betterment handles that part for you.

You tell Betterment your goals, and the platform chooses a portfolio based on your goals and how much risk you’re okay taking on.

The platform manages your portfolio for you, so there’s no heavy lifting. Essentially, you’re getting professional investing services at a bargain price.

However, betterment may not be suitable for every investor. We’ve broken down the finer points of investing with Betterment to help you decide if it’s worth a try.

Betterment is suitable for:

- Investors who prefer low-cost ETFs

- People who want to be able to track all of their finances in one place

- Taxable investing and tax-advantaged retirement saving

- Investing with a socially responsible bent

Betterment Pros & Cons

- $0 minimum investment

- IRAs are available

- Easy sign-up

- Tax loss harvesting and rebalancing are included

- Higher minimum required for premium services

- 529 and 401(k)s aren't covered

- Pricing increases as your assets increase

- No direct indexing, which is offered by Betterment competitors

Types of Accounts Offered

Betterment offers taxable brokerage accounts, including joint and trust accounts.

You can also invest in tax-advantaged accounts for retirement.

If you’re investing for your later years, your options include:

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- Rollover IRAs

- Inherited IRAs

Betterment doesn’t offer SIMPLE IRAs or solo 401(k)s. If you’re self-employed, you’ll have to stick with one of the other IRA options.

The platform also doesn’t offer 529 accounts, Coverdell Savings Accounts, or traditional employer 401(k)s, but you can get advice on managing them best.

Different Betterment Accounts

There are two basic account tiers at Betterment. The one you fall into depends on your account balance.

If your balance ranges from $0 to $99,999, you can sign up for the Digital Plan.

Here are the features and benefits you get:

- Personalized financial advice from Betterment experts

- Your choice of low-cost, globally diversified investment portfolios

- Automatic rebalancing

- Tax-efficient investing strategies

- Simplified financial management in one place

- Access to Betterment’s Customer Support Team

- Unlimited access to advice from licensed experts

The Premium Plan is available if you have a balance of $100,000 or more. You get all the benefits of the Digital Plan, plus in-depth advice on your investments outside of Betterment and life-stage financial planning.

The Digital Plan is good if you’re starting with investing. Once you’ve built some wealth, you can switch to the Premium Plan.

And if you already have $100,000 to invest, the Premium Plan could help map out your long-term financial vision.

Investment Options

Betterment’s investing strategy favors exchange-traded funds or ETFs. ETFs are low-cost funds that include a mix of investments for easy diversification.

The portfolios are designed to help you earn better returns based on your desired level of risk.

Generally, your portfolio options include a mix of stocks and bonds. Stock ETFs include:

- U.S. Total Stock Market

- U.S. Value Stocks – Large Cap

- U.S. Value Stocks – Mid Cap

- U.S. Value Stocks – Small Cap

- International Developed Market Stocks

- International Emerging Market Stocks

Each ETF offers different exposure to different types of stocks. Each one carries a different level of risk.

On the bonds side, bond ETF options include:

- U.S. High-Quality Bonds

- U.S. Municipal Bonds

- U.S. Inflation-Protected Bonds

- International Developed Market Bonds

- International Emerging Market Bonds

- U.S. Investment-Grade Corporate Bonds

- U.S. Short-Term Treasury Bonds

Bonds are generally considered to be safer investments than stocks.

When you sign up for a Betterment account, the platform asks you questions designed to help gauge your risk tolerance.

Once Betterment knows how much risk you’re comfortable with, it generates the portfolio options best suited to your goals.

Curated Portfolio Options

In addition to stock and bond ETFs, Betterment offers four other investing choices.

There’s a socially responsible portfolio designed for investors who want to make a positive impact with their money.

The Goldman Sachs Smart Beta strategy is focused on outperforming the market.

BlackRock Target Income is a 100% bond portfolio with different income yields.

You can set up a Betterment Flexible Portfolio if you have more than $100,000 to invest. This allows you more control over your investments if you want to tweak Betterment’s recommendations.

Can You Invest In Anything Besides Stocks and Bonds?

Other robo-advisors give you some variety with your investments.

For example, you might be able to invest in real estate through a real estate investment trust or buy cryptocurrency in your accounts.

Betterment doesn’t do that. They keep it simple by letting you invest in stocks and bonds only through ETFs.

What Are the Fees When You Invest With Betterment?

Fees are a big concern when you’re investing. The more you pay in fees, the more that eats away at the returns you’re earning.

Betterment charges an annual fee based on your account balance. Here’s how the fee compares:

Betterment Fees

| Digital | Premium |

|---|---|

| 0.29% per year for balances up to $99,999 | 0.40% per year for balances of $100,000+ |

The fee only kicks in if you have money in your Betterment account. You’ll never pay a fee when your account balance is $0.

The fee is taken right out of your balance each. But it’s the only fee you’ll pay.

There are no additional trading fees when you buy or sell an ETF and no transfer fees when you add or withdraw money from your Betterment account.

The Betterment Advantage: Tax-Efficient Investing

Besides fees, taxes can diminish your returns in a big way.

Betterment strives to make managing your tax liability as easy as possible.

They do that in two ways:

- Tax loss harvesting

- Strategic asset location

Tax loss harvesting is a technical term for buying and selling investments correctly.

If you owe taxes because you sold an investment for a gain, you can offset it by selling an asset at a loss.

With some robo-advisors, you may have to handle loss harvesting yourself. Specific platforms don’t even support it all.

Betterment ensures that you get the most tax benefit possible by periodically harvesting losses in your taxable accounts.

Tax-loss harvesting doesn’t apply to IRAs because these accounts are tax-deferred.

They also help you organize your investments by putting high-tax assets in IRAs and low-tax investments in taxable accounts.

And rebalancing is automatic.

Betterment checks your assets and adjusts to minimize the tax impact when you deposit or earn dividends on your investments.

Finally, Betterment shows you the possible tax implications before you buy or sell an investment.

They’ll also help you decide which order to buy or sell to keep tax costs as low as possible.

Altogether, those tax features can help you keep more of what you earn on your investments in your pocket.

Online and Mobile Experience

Like other robo-advisors, Betterment is designed for savvy people managing their money online.

You can log in to your account through the website or the Betterment mobile app.

Betterment makes viewing all your financial accounts, not just your portfolio, easy.

You can sync your bank accounts and outside investments, including your retirement plan at work and other brokerage accounts.

You can easily track your net worth, see how much your investments have earned, and the amount of tax losses harvested.

You’ll also see how much your outside investments cost you in fees and where you have cash available.

Overall, both online and mobile access are easy to navigate.

Research Tools

Investing can be a tricky subject, especially if you’re a beginner.

While Betterment gives you access to expert advice, it also provides some valuable research tools if you’d instead learn on your own.

For example, there’s a retirement savings calculator to help you decide whether you’re on track to reach your retirement goals.

There are also calculators to help you crunch the Social Security income numbers and the best IRA for you.

Betterment’s Resource Center includes helpful information on diversification, taxes, and retirement planning.

You’ll also find advice on general personal finance topics, like budgeting, credit, and paying off debt.

Should You Invest With Betterment?

Betterment could be an excellent choice for newer investors just beginning to build their portfolios.

But you should also look if you’ve been investing for a while and are considering changing your portfolio.

The combination of convenience, low costs, and tax-efficient strategies make Betterment suitable for someone comfortable investing online and who wants to save the most money possible.

If you’re a higher net-worth investor, you could also try it.

But, you may prefer working face-to-face with an advisor versus getting digital investment advice.