Why You Didn’t Get Your Credit Card Rewards

Have you ever made a purchase on your credit card hoping to earn rewards, but when you look at your statement, you didn’t receive anything?

If you’ve ever bought something with the expectation of earning credit card rewards but didn’t, find out what happened and how you can earn those rewards points for future purchases.

Walking into the local Walmart and equipped with the Blue Cash Preferred Card® from American Express card (see Rates & Fees; terms apply), you expect to earn 6% cash back at U.S. supermarkets purchases up to $6,000 per year (1% thereafter).

Lo and behold, when you check your cash back balance at the end of the month, you notice that the Walmart purchase only gave you 1% cash back.

If it was me, I’d certainly be upset about the missing 5% cash back earnings.

Just to give you an idea, the average American household spent $3,977 on “food at home”, according to the Bureau of Labor Statistics. This means the missing 5% cash back equates to $200 cash back, assuming that “food at home” means groceries.

Why didn’t you receive the full 6% cash back from Walmart? It’s quite simple — your credit card doesn’t recognize Walmart as a “grocery store,” even though it sells groceries.

The reason for the discrepancy lies in the way that your credit card company categorizes a particular store. It’s a common predicament when your credit card purchases aren’t categorized in a way that you anticipated.

Today, I delve into the technical side of how your credit card earns bonus rewards and how you can ensure that you get the most rewards out of your credit cards.

Merchant category codes: When grocery stores aren’t grocery stores

Each merchant location (e.g., retailer, restaurant, online website, etc.) that accepts card payments through a card payment network — American Express, Discover, MasterCard or Visa — has its own merchant category code (MCC), which could be different from network to network.

For instance, a store that sells books could be categorized as a “bookstore” by Visa while it is considered a “school supply” store by Discover.

Furthermore, if a store was part of a chain of stores, one location may be categorized differently than another.

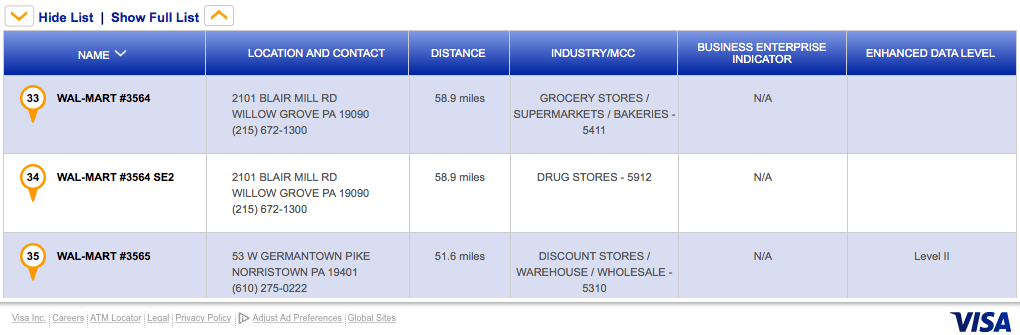

Here’s a great example: For Visa, regular Walmart stores have an MCC of while Walmart Supercenter stores have an MCC of.

Again, if American Express used the same MCCs for Walmart stores, you’d earn 1% cash back at Walmart while you’d earn 6% cash back at Walmart Supercenter (assuming you are a cardmember of Blue Cash Preferred Credit Card from American Express).

Knowing a store’s MCC before you make a purchase would prevent you from feeling cheated when you don’t earn as many rewards as you expected.

Credit card companies know that there would be times when card customers don’t get the rewards that they expected. Just look at the fine print that Chase, for example, uses to clarify its rewards policy:

“Please note we make every effort to include all relevant merchant codes in our rewards categories.

However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category.

When this occurs, purchases with that merchant won’t qualify for rewards offers on purchases in that category.”

For instance, it’s not the credit card company’s problem if you bought cough medicine at Pathmark and didn’t get bonus rewards because Pathmark is considered a grocery store, not a drug store.

It can get worse when merchants have different MCCs — just look at some examples of major U.S. merchants that have different MCCs based on their locations and what each location sells:

Popular brands and possible MCCs

| Merchant | Possible MCCs |

|---|---|

| 7-Eleven | Gas station, convenience store or grocery store |

| Walmart | Discount store, grocery store or drug store |

| Office Depot | Office supply store or general merchandise store |

| Barnes & Noble | Book store or restaurant |

| Sheraton Hotels | Hotel/motels or restaurant |

So now, let’s move on to my tips that would help you earn the rewards that you deserve.

How to never miss out on rewards

These are the three ways that you can check a merchant’s MCC:

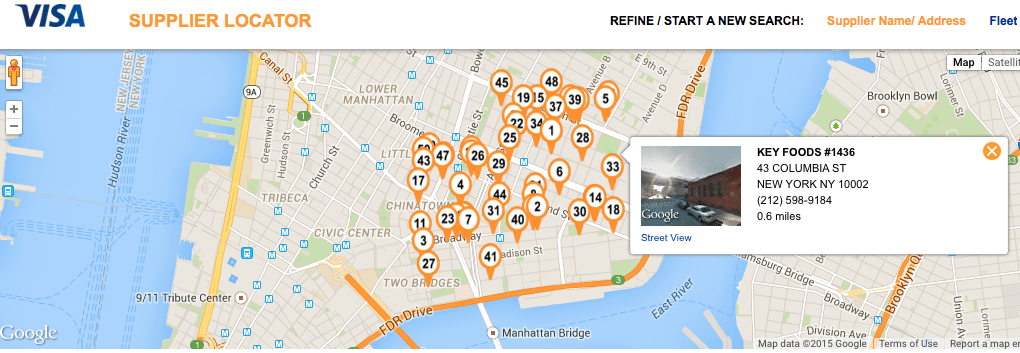

1. Use Visa’s supplier locator tool

Of the four major U.S. card payment networks, Visa is the only one that has a public directory of its partnered merchants and their respective MCCs. It is very likely that the merchant categorization is similar for American Express, Discover and MasterCard.

There are two ways that I can use the free, public Visa supplier locator tool to my advantage.

Firstly, I can find a specific merchant by name and address.

If I’m unsure of a merchant’s MCC, I can look it up through this this tool. If a store won’t let me earn bonus rewards, I’ll know to look elsewhere for one that does.

Secondly, I can just choose to find all the merchants nearby that have a certain MCC. Use the tool to identify the neighborhood merchants that fall under my credit cards’ rewards categories.

I might discover some merchants that I didn’t think would provide bonus rewards (like when GNC, a retailer of health and nutrition products, is categorized as “convenience stores”).

Tip: Remember that you earn bonus rewards based on where you buy something — it doesn’t matter what you buy. So, the Amazon gift cards that you buy at U.S. supermarkets will still allow you to earn 6% cash back (for up to the first $6,000 spend at U.S. supermarkets in a calendar year) through Blue Cash Preferred Credit Card from American Express.

2. Do a small test purchase first.

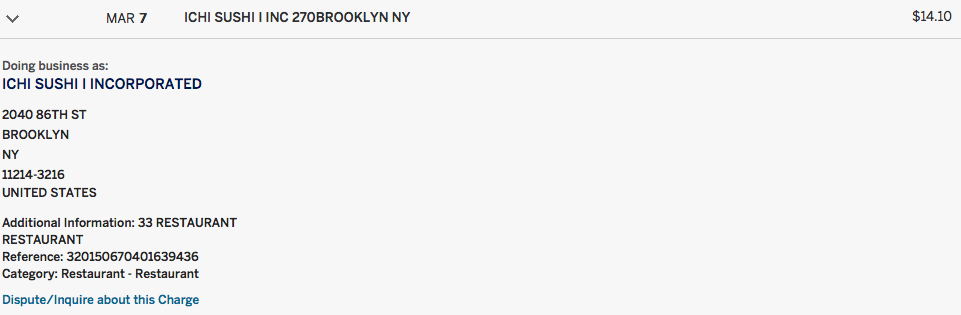

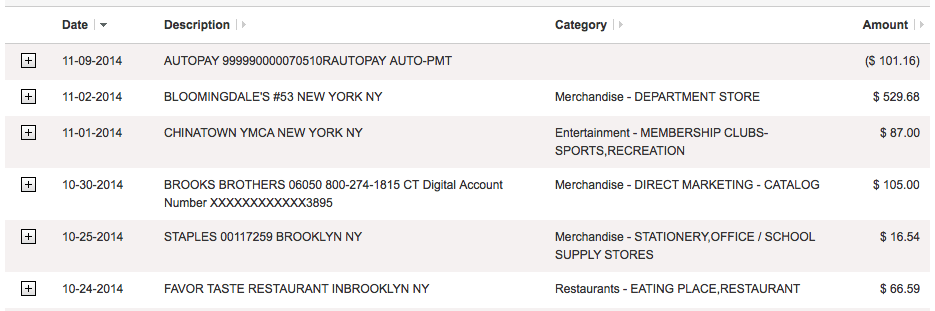

While the Visa supplier locator tool is a great way to see the MCC for a particular merchant, I often don’t know for sure until I see the transaction information show up in my account activity.

Therein lies the next way to check a merchant’s MCC, which is especially useful since the other three card payment networks don’t have a public MCC database.

Before I make a big purchase or make regular visits to a particular merchant, it doesn’t hurt to make a small purchase to test the waters. Then, I log into my online account to see the exact category of the merchant.

Below you can see how American Express shows this information on my Blue Cash Everyday Card from American Express account:

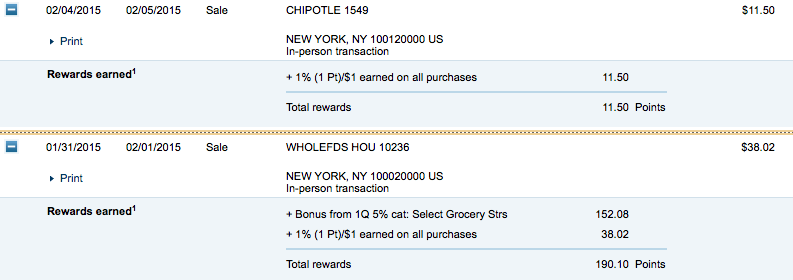

Here’s how Citi shows it for my Citi Dividend Platinum Select Visa Card:

I think Chase does the best job of displaying which purchase earn bonus rewards and which do not (this my Chase Freedom card):

Once I’ve confirmed the merchant’s category, I can go ahead to make bigger purchases at the merchant with confidence that I’ll earn bonus rewards.

3. Ask someone

When I don’t have the luxury for employing the two tips mentioned above, I just ask the cashier or a manager.

I’ve done it once out of curiosity at a 7-Eleven gas station while I was inside the convenience store.

cashier told me that card transactions were considered gas purchases. My purchase was recorded under the “gas station” category, not “convenience store.”

Conclusion

Now that you understand how credit card purchases are categorized by your credit card issuer, you can use this knowledge to not only earn the bonus rewards that you deserve, but to also find new ways to earn bonus rewards.

I’d love to hear how you used the above tips to rack up more rewards — share them in the comments below.