Where Can You Find Your Credit Score?

Having knowledge of your credit scores can help you make informed financial decisions. Whether you’re considering a new credit card, auto loan, or home purchase, knowing your credi.t score before applying can prevent any potential damage to your score.

Each time you apply for credit, your credit score takes a temporary hit. But if you know your credit score beforehand, you can gauge your likelihood of approval and limit the number of applications you submit. By doing this, you can minimize the negative impact on your credit.

Moreover, being aware of your credit score can also help you estimate the likely interest rates you’ll receive on your loan or line of credit. This information can aid in budget planning and ensure that you’re able to make timely payments.

The question is, how do you go about finding your credit score? The answer may vary depending on the credit score you want to obtain.

That means you can limit a number of applications you take out at once and go for the one you’ll likely to be approved for first. Taking out fewer applications equals to less of a hit on your credit.

That’s not the only way your credit score impacts your new loan or line of credit before you apply.

If you know your credit score ahead of time, you’ll have the ability to estimate likely interest rates you’ll receive on the loan or line of credit.

That can have an impact on your monthly payments and help you plan your budget accordingly before you sign on the dotted line for new credit.

But, how should you go about finding your credit score? The answer may depend on which credit score you want.

Which Credit Score Do You Want?

Lenders use credit scores to evaluate credit applications. Credit reporting bureaus compete to make the most predictive scores. What all this means for you is that you have more than one credit score – a lot more.

Fair Isaac Corporation (FICO) scores are the most widely used by lenders in the US.

However, the FICO score isn’t the only score. The three major credit reporting bureaus (Experian, Equifax, and TransUnion) also developed something called VantageScore Solutions.

The VantageScore is used by more than 2,000 lenders and seven of the ten largest banks. (Some lenders use both the FICO and the VantageScore.)

There are other credit scoring agencies as well, and some financial institutions even have their scoring software.

Confused yet? Adding, even more, fun to the mix, since there are three major credit bureaus, there are three different places that offer your credit report to lenders.

Each bureau may have a variety of information about your credit history (and some may not even be complete). That’s more room for error and interpretation on your score.

Finally, of the two major scores reported by three major bureaus, there are still, even more, components to change your score. Lenders may use a different scoring model based on the type of credit you’re applying for.

For example, FICO could report a different score for you based on industry-specific models, such as those for auto loans, credit cards, and more.

So, Which credit score should you check?

If you plan on working with a particular lender, you could start by asking which credit score they use.

If you have a general sense of your score, you may want to focus on the base FICO Score 8, the version most lenders use.

You don’t need to overthink the decision, though. The different FICO versions rely on the same general information to generate a score.

The importance of different data points may change based on the type of credit you want to apply for.

But that’s why it’s helpful to simply understand which range your credit score falls into. Even the industry-specific scores use the same fundamentals.

As you’re evaluating all this, keep in mind that your scores change over time as new information is added to your credit reports.

If you checked a credit score last year, or last week even, it could have changed drastically since then.

What Goes Into Your Credit Score?

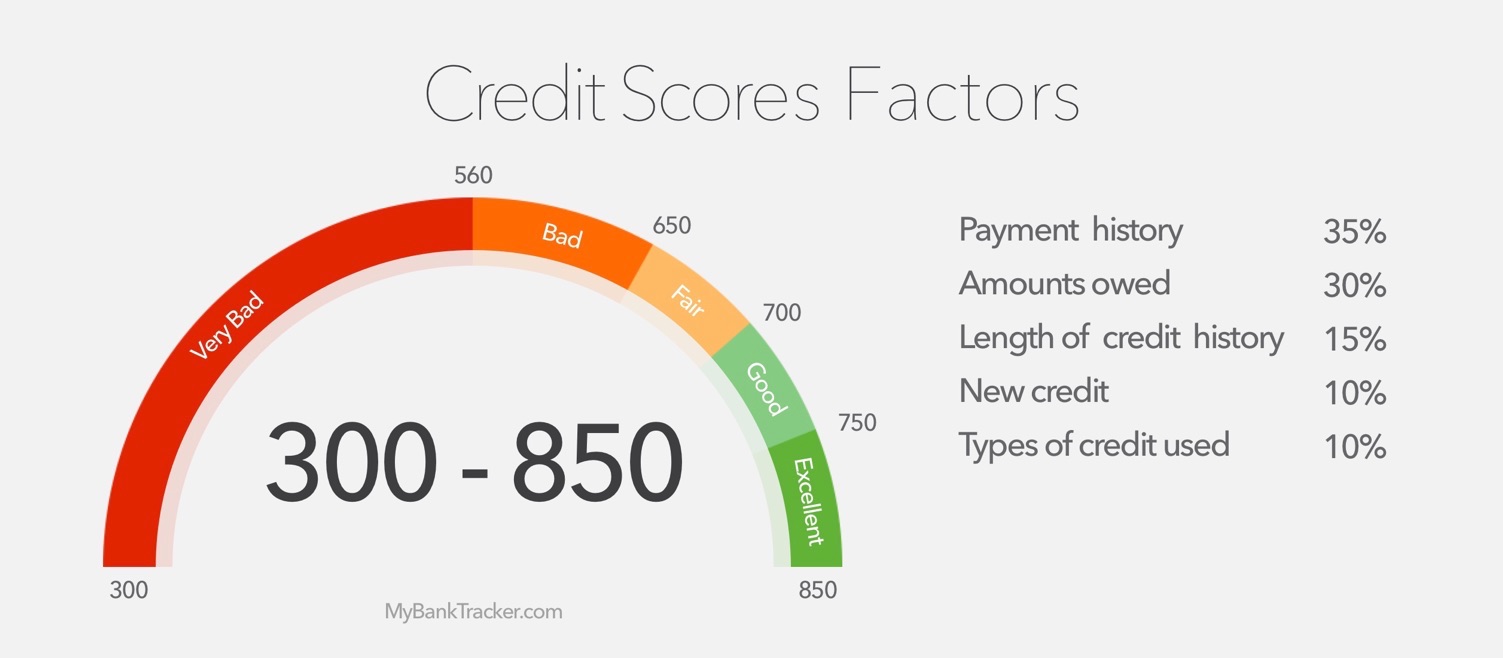

While the exact scoring methodology is a secret, FICO does share the major factors that influence your credit scores:

Payment History: 35%

Late payments, collections accounts, and information from public records, such as a bankruptcy or foreclosure. These derogatory marks, among others, can have a large impact on your score.

Amounts Owed: 30 %

The percentage of your available credit that you use. This is known as your utilization rate on revolving accounts, like credit cards, and having a lower utilization rate can improve your credit scores.

Length of Credit History: 15 %

The age of your oldest account, newest account, and the average age of all your accounts. Also, whether or not you’re actively using accounts.

Credit Mix: 10%

The different types of loans and credit accounts that you have, such as an installment loan and credit card.

New Credit: 10%

Whether or not you’ve opened an account recently. Opening several accounts could hurt your scores.

FICO creates your credit scores based on these factors, which it gathers from your credit reports and public records.

For industry-specific Bankcard and Auto Scores, your score can range from 250 to 900. However, base FICO scores range from 300 to 850, as does VantageScore 3.0. In all these cases, a higher score is better.

What may be more important than your specific score when you check it is what range of scores you’re in. FICO groups people into different categories depending on their score:

- Very Bad: 300 to 559

- Bad: 560 to 649

- Fair: 650 to 699

- Good: 700 to 749

- Excellent: 750 to 850

Keep in mind the fact that lenders have their definition of these categorical breakdowns. For example, Citi breaks FICO scores down into five categories with the top two being 740-799 and 800 or above.

How to Get Your Credit Score

As mentioned above, you have multiple credit reports and scores. Each contains information about your activity with different financial accounts.

Each one also has identifying information such as your name, address, Social Security number, and former employers.

You can get a free copy of your credit report from each of the three major bureaus once per year from AnnualCreditReport.com.

Unfortunately, there isn’t a centralized place to check all your credit scores. Instead, you’ll have to turn to different sources for different types of scores.

On myFICO, you can purchase your FICO Score 8 generated from the report at each bureau for $19.95 each.

If you do, you’ll also receive 9-10 FICO scores based on that bureau’s report and scoring analysis.

Another option is to sign up for FICO’s subscription services. That will give you access to your Equifax report and nine Equifax-based scores for.

For monthly updates, you’d pay $19.95 per month. For quarterly updates from all three credit reporting bureaus, you’d pay $29.95 per month.

You may find other websites selling access to credit scores, but be wary of purchasing a credit score if you don’t know which score it is. Some sites sell “educational” scores that may not accurately reflect the scores that lenders use.

Also, watch out for services that give you access to credit reports or scores with a free or cheap trial. You may wind up paying a monthly fee once the trial ends, as some companies make it difficult to cancel the subscription.

Where to Find Free Credit Scores

Rather than paying for a credit score, you could get a free credit score from a handful of financial institutions. For example:

Where to Find Free Credit Scores

| Bank | Details |

|---|---|

| Discover | offers theFICO Score 8 from Experian to all U.S. residents and residents of some U.S. territories (whether or not they’re Discover cardholders) |

| Citi | gives cardholders access to their FICO Bankcard Score 8 from Equifax |

| American Express | gives cardholders access to their FICO Score 8 from Experian |

| Bank of America | gives cardholders access to their FICO Score 8 from TransUnion |

| Barclaycard | gives US cardholders access to their base FICO Score from TransUnion, but doesn’t disclose the version |

| Chase | gives Slate cardholders access to their FICO Score from Experian, but doesn’t disclose the version |

| First National Bank | gives cardholders access to their FICO Bankcard Score 8, but doesn’t disclose the bureau |

| Commerce Bank | gives cardholders access to their Base FICO Score, but doesn’t disclose the bureau or version |

| Ally Bank | gives auto loan customers access to their FICO Score, but doesn’t disclose the bureau or version |

| USAA | gives members access to their VantageScore 3 from Experian |

This is not an exhaustive list. You may also find other banks, credit cards, or lenders that give you free access to a credit score. For example, Sallie Mae gives borrowers access to an updated quarterly base FICO Score from TransUnion.

You can also get your VantageScore 3.0 scores for free from at least nine different websites.

The bureau depends on which website you use, although several offer side-by-side VantageScore 3.0 scores from two bureaus.

Although not as many lenders use the VantageScore 3.0 as the FICO scores, it can give you a good ballpark range.

Picking the Score That Makes Sense for You

In a few situations, you may want to purchase access to a particular credit score because you know it’s the one that’ll be used to evaluate your application. But if you just want to keep an eye on your credit, consider one of the free options, such as Discover’s Credit Scorecard.

There’s Power in Knowing Your Score

If you’re not applying for new credit anytime soon, keeping tabs on your score might not seem worth the trouble. However, there’s power in knowing your score.

If you have a general sense of the range your credit score falls into and monitor it monthly or quarterly; you’ll notice quickly if your score falls out of range.

This could be an indicator of fraudulent activity on your credit file or maybe even a major reporting error.

These things are more common than you think and, the faster you catch the problem, the easier it will be to resolve it.

Just like you would be with your bank account balance, you should always be in tune with your credit score.