An Uncomplicated Guide to Hacking Your Perfect Credit Score

Your credit score is like an adult report card that shows how responsible you are with your money, and how much of a liability you would be if a bank were to lend you money.

I know, it all sounds so boring. So, why should you care, and why does it matter?

In a few words, having a credit score that is considered “excellent” vs. “good,” can mean a difference of thousands of dollars the bank could “get you” for interest.

So, let me rephrase the two questions I just asked you: do you care about saving money? Do you care that you’re unnecessarily paying the bank extra money? My guess is yes…

Personally, I’ve felt the blow of dealing with bad credit thanks to my divorce and some careless mistakes I made in my 20s.

It’s been a constant source of anxiety and worry, but I’ve been able to raise my score up to the 650 mark, after learning about a couple of credit hacks for increasing my score.

Bad Credit Means You Get Punished… Here’s How:

| 1. You won't be able to open a credit card (not a "regular" one at least, although you could open a secured card, which requires you to put down your own cash as your credit line.) |

|---|

| 2. Loans (mortgages, auto loans, personal loans) will be more expensive, because banks will charge a higher interest rate as you can see from the tables below. |

| 3. You will probably have a hard time renting an apartment. |

| 4. You bear the burden of shame, because your score is labeled "bad." It's like having an "F" on your report card, while all of your friends have "A's." |

So, if you’re in this boat, learn how to master your score, it’s actually really easy.

Why Do I Have a Credit Score Anyway?

Credit scores were created from a couple of a few Stanford guys named Fair and Isaac, who developed a computerized credit scoring system for businesses back in the 1950s.

In the late ’80s, the Fair Isaac Corporation started issuing consumer scores for banks, dubbed FICO scores. (Raise your hand if you thought the word “fair” had to do with how your score was determined.)

Today, there are other credit scores floating around but the FICO score is the most popular.

How Is My Score Determined?

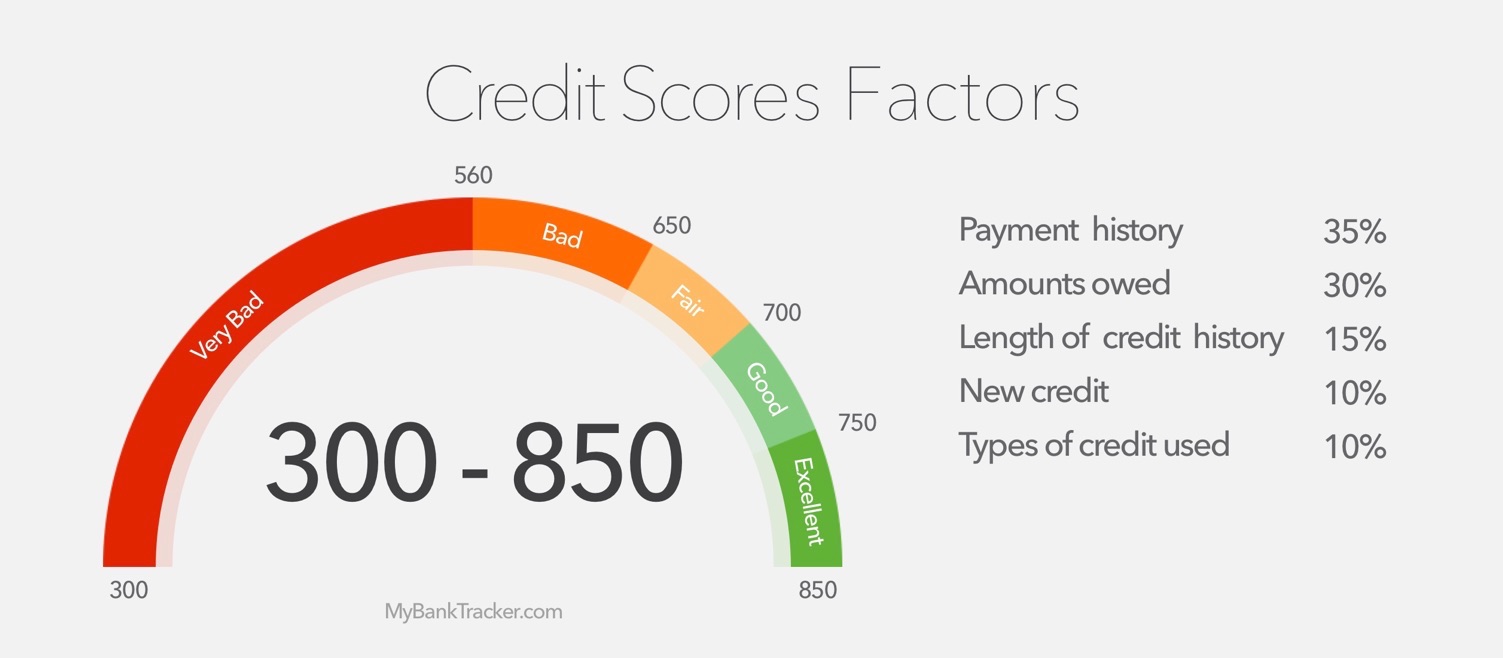

FICO scores range from 300 to 850 and they’re based on five factors:

1. Your payment history

2. How much you owe

3. The kinds of debt you have

4. How old your accounts are

5. How often you apply for new credit

Out of the five, your payment history is the most important. Paying your bills on time is the most basic thing you can do to grow your score.

Keeping your balances low and mixing up the kinds of credit you’re using also helps, but don’t go crazy applying for lots of new credit cards all at once, since that can drag your score down.

Credit Score Hacks to a Higher Score

1. Ask nicely, and piggyback off of someone else’s good credit

If you know someone who’s got great credit — a parent, sibling or spouse — asking them to add you on to one of their credit cards as an authorized user is a speedy shortcut to a better score.

Signing on as an authorized user on someone else’s account instantly transplants their payment history onto your credit report.

As long as they’re paying on time and keeping their balances low, your score benefits, even if you never use the card.

There’s one potential downside to being an authorized user. If the person whose account you’re listed on misses a payment, the negative mark will show up on your credit report too.

2. Increase your credit card limits

Increasing your available credit is something you can do in just a few minutes over the phone or online. Getting approved isn’t too hard if you’ve always paid on time and you haven’t maxed out your account.

The reason you want to do this is to increase your credit utilization ratio, which is a fancy term for how much debt you have compared to your total credit limit. The higher this ratio, the lower your credit score tends to be.

Do you have a secured credit card instead? Here’s what you can do: just hand over more cash to the credit card company to increase your deposit.

Opening another credit card can also bump up your limit. Just keep in mind that you’ll lose about 5 points off your score every time you apply for a new account. Shop around for a credit card that fits your spending lifestyle.

3. Make ‘micropayments’

If you’re still paying your credit card bill once a month, stop. Switch to a weekly or biweekly schedule — here’s an example that explains why.

Let’s say I have a $20,000 credit line but I have $15,000 of credit card debt. That means I’m using 75% of my available credit. Instead of paying $1,000 once a month, I can break that up into weekly payments of $250 each.

The more I pay before the next billing statement, the more I’m shrinking my utilization ratio, which means my score will go up.

4. Ask your landlord to report your rent payments to credit bureaus

Thanks to a new rule, your timely rent payments can now be included in your credit score formula. It’s up to the landlord, whether he/she reports it, so just ask.

5. Be a watchdog

OK, maybe this one isn’t so much of a hack, but it’s really important because you could be on your merry way to building your credit with the four hacks listed above, but if you’re not checking for things like mistakes on your credit report, it’s all pointless.

Here’s what to do:

- Get your three free credit reports from AnnualCreditReport.com. Stagger them so you get one every three months.

- Sign up for CreditKarma or BillGuard to get credit notifications in case a thief tries to do something shady like open a credit card in your name.

- Report any mistakes to the credit bureaus. This is usually done by writing a letter.

But What if I Recently Improved My Score?

There are a few moves you should make if you’ve recently improved your credit score.

First, if you’re paying high interest on your credit cards (say, 15% or more), transferring them to a card with a 0% rate should be at the top of your list.

Second, refinance your student loan debt if you borrowed from a private lender, as it can bring your rates down. The same goes for your mortgage if you own a home.

Aside from making your debt more affordable, there are other ways to cash in on a higher score.

If you normally use a rewards card to earn points, miles or cash back, for instance, a jump in your score is a great excuse to upgrade to a card with even more perks.

Never, Ever Pay for Your FICO Score

Up until a couple of years ago, you had to pay to see your score, but now you don’t have to look any further than your bank to get a free FICO score.

Discover, Chase, Citibank and Bank of America are just a few of the banks that offer free scores to customers who have an eligible credit card.

All you have to do to see yours is log in to your online account and the scores are updated once a month so you can track your progress.

I’ve also included a comprehensive list of U.S. credit cards that currently offer free FICO scores to cardmembers:

U.S. Credit Cards with Free FICO Scores

| Card company | Cards with free FICO scores (Last updated: 11/25/20) |

|---|---|

| American Express | All consumer credit and charge cards |

| Bank of America | All consumer credit cards to receive free FICO scores |

| Barclaycard | All consumer credit cards to receive free FICO scores |

| Chase | All consumer credit cards to receive free FICO scores |

| Citi | All Citi-branded credit cards (not co-branded credit cards) |

| Commerce Bank | All Commerce Bank consumer credit cards |

| Discover | All consumer credit cards to receive free FICO scores |

Don’t Be Fooled By Imposters

Not all credit scores are considered a FICO score. Though they may look like a FICO score, they’re not.

Experian, Equifax and TransUnion have their own scores and there’s also the VantageScore, which is is a joint effort between the three credit bureaus.

If you sign up for free credit monitoring through a service like Credit Karma or Credit Sesame, the score you get is based on one of these models.

The problem with alternative scores is that banks don’t usually use them to gauge your creditworthiness.

When you apply for a mortgage or a credit card, your FICO score is what’s going to sway the bank’s decision, not one of these look-alikes.

Why Do I Need Good Credit?

A high credit score is a golden ticket when you need a loan. Banks will fight to get your business and you’ll also snag the lowest interest rates on what you borrow.

Let’s say you’re ready to buy your first home so you apply for a $225,000 mortgage.

You’ve got a 665 credit score so the bank offers you a 30-year loan with a 4.4% interest rate. When it’s all said and done, you’ll pay close to $180,000 in interest.

If your score was 765 instead, your rate would drop to 3.8%. That doesn’t seem like a huge difference but it adds up to nearly $30,000 in interest you’ll save over the life of the loan. That’s 30,000 reasons to work on boosting your score, pronto.

Perfect Credit Scores Aren’t Just a Myth

The holy grail of FICO scores is 850, but according to Fair Isaac, only about 0.5% of consumers ever get to claim bragging rights for a score this high.

Still, that doesn’t mean you can’t join the ranks of those who’ve achieved a perfect score or at least come pretty close to it.

The secret lies in following the steps we’ve outlined here. Start with the simple things like paying your bills on time, chipping away at your balances and holding off on applying for new credit too often.

If the only kind of debt you have is student loans, get a credit card to add some variety to the mix.

From there, you can move on to asking for a higher credit limit, pay your bills more often or get added to someone else’s card as an authorized user.

The more effort you put into hacking your credit score, the faster you’ll see results.