Creating a Budget: College Student Edition

Most people say that to begin managing your finances you need to write up a budget, but that notion is slightly skewed. Budgets necessities vary across different ages and backgrounds, this story takes a look at budgeting for college students.

As a college student your expenses are minimal (tuition aside), so your budget should focus on tracking surprise expenditures. These are practically any expenses outside of rent and food, such as taking a trip or fixing your computer if it crashes.

Story Highlights:

- You do not need to write up a full-blown budget.

- Track all irregular and unplanned expenses incurred for the month.

- Funds in a savings account should offset unexpected expenditures.

- The month’s surplus (or deficit) should be used wisely

If you have never written up a budget before, then most likely all the urging to start an Excel sheet tracking all income and expenses will not prevail because you are convinced that your own methods of budgeting your money work. That’s true. Most college students can grasp their spending without an artificial tool.

Generally, you know how many times you’ve been to Burger King that week and how much you spent on clothes (if anything). If you live off campus, you know how much rent is (same every month) and what you spent on the last electric bill (because energy is so expensive).

Creating a budget does not have to be an arduous task, nor should it. In fact, the budget is just an estimate of income and expenditures for a set time frame to allow you to see your expenses, which can in turn let you cut out the junk.

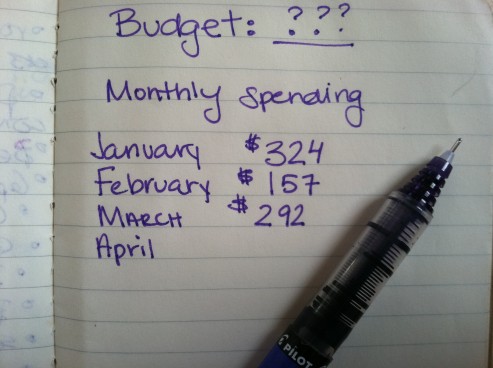

Therefore, keeping track of unplanned expenditures constitutes the most important aspect of the student’s budget: bailing your friend out of a tight spot, flying to Cali one weekend, or driving to a rival college to support your team. This budget:

- Should ideally be funded by a high-yielding savings account, which you contribute to on an incremental basis

- Will ultimately evolve into your emergency savings account after you graduate

- Reaches maturity when you realize that you, and not your parents, have to solely cover an urgent car repair or a large copay on a medical bill.

And just like budgeting, anything you do with your finances will be so much easier if you could visualize what is going on. This means understanding credit cards, checking accounts and CDs; taking advantage of cash-back, points and miles; and utilizing interest-free checking and building a CD ladder.

Transparency is the name of the game. If you can be more transparent with your money, you’ll become a smarter, more effective spender and saver and you will not be nervous to see your bank statement or credit card bill.

In order to effectively manage your money and allow yourself to have a good time in college without penny-pinching, you will have to know:

- How to effectively manage the money you can spend each month

- How much money to put aside to receive the highest yielding savings and where to put it

- What to do with whatever is left over

To best prepare yourself, you have to know all the options: checking and savings accounts, CDs, bonds, stocks, treasuries, even IRAs to consider. But knowledge is not everything; you must also use these tools in the most effective way. Setting up a college budget will allow you to make the best decisions with your money.

Key Takeaways

- Get a broad sense of where all your money went at the end of each month, including food, alcohol, and taxis (if applicable).

- Calculate exactly how much you spent on irregular, unplanned expenses.

- It’s important to contribute to a savings account that you can access when necessary.