What to Do If Your Student Loan Sold to Another Lender

Keeping up with your student loans is hard enough, especially if you took out multiple loans to get a degree.

Your lender can make things even more complicated if they sell your loans another servicer.

While transferring student loans is a pretty common practice, it can be a speed bump for unsuspecting borrowers who are trying repay their loans.

Here’s what you need to know if you’re worried about your student loans being shuffled off to another servicer.

Why Lenders Sell Student Loans

The lender you initially borrow with can also be the same company that services your loans. That means it’s the same company you make your monthly payments to.

That’s not always the case, however.

Sometimes, you might borrow your loans from one company, then they sell your loan to someone else and you make your payments to that company instead.

Both federal and private student loans can be sold at any time, to any loan servicer.

But why do lenders do this? It has to do with the lender’s ability to make new loans to new borrowers.

Lenders need capital to make new loans, so they sell off your student loan to another servicer. The servicer effectively buys out your loan and the lenders use the money they receive from the sale to lend to another student.

Bottom line, there’s nothing you can do to prevent your loans from being sold.

How Do You Know If Your Loan Has Been Sold?

If your lender sells your loans, they have to let you know.

You should receive a letter telling you that your loan has been sold and to whom. This letter should come well in advance of the switch so you have time to prepare.

Once your loan is sold, you don’t owe anything to your original lender. You’ll make your payments to your new loan servicer going forward.

No changes to loan terms

An important note here: having your loan sold doesn’t affect your loan terms.

You’ll still owe the same amount and your interest rate will still be the same. And, you’ll still be on the same repayment terms as you were before.

What can change, however, is your payment date and that’s why you need to pay close attention if you get the heads-up that your loans have been sold.

How to Protect Yourself If Your Student Loans Are Sold

When a change over happens from one lender or loan servicer to another, there are some specific things you need to do make the transition a smooth one. Here’s a rundown of what to pay attention to:

1. Continue paying your loans on schedule.

Having your student loans sold isn’t an excuse to skip a month of payments. It’s your responsibility to find out where your payment needs to go and when it needs to get there.

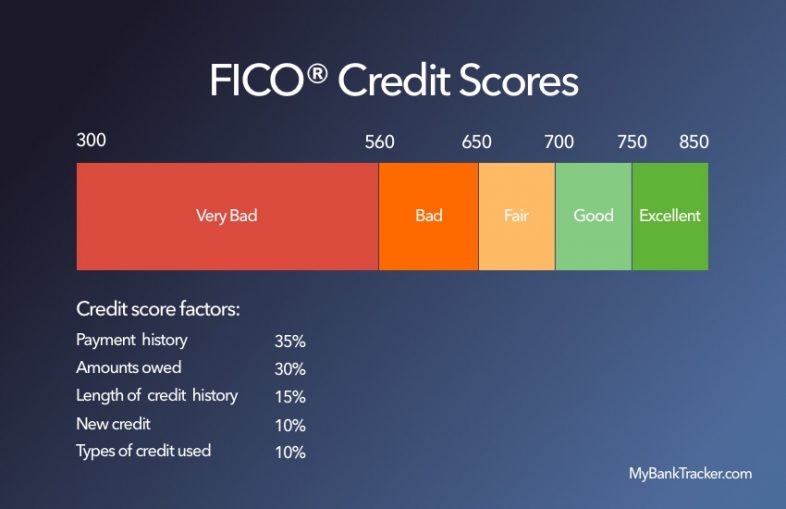

Missing a payment could leave a black mark on your credit report and hurt your credit score.

2. Make sure your new lender is receiving your payments.

If you make a payment to your old lender during the changeover, getting it applied to your account can become a hassle.

Your previous lender is responsible for sending it along to your new loan servicer but you can’t always count on that happening in a timely manner.

Generally, it can take up to 2 billing cycles for the payment to make it to the right place.

During the first 60 days, your new loan servicer won’t report any late payments to the credit bureaus but you shouldn’t assume that the money you sent will show up on time.

If you’ve got a payment stuck in limbo, you need to contact both loan servicers to find out when it will be applied. If it looks like you’re going to be late, making an extra payment to cover the gap can keep your account in good standing.

3. Update your contact information.

It’s important to make sure your new loan servicer has the right address and phone number on file for you.

That way, if your loan gets sold again, you won’t have to worry about not getting your notification letter.

4. Make sure payments are being applied correctly.

Paying extra towards your student loans each month will get you out of debt faster and cut down on what you pay in interest. The trick is to make sure those extra payments are being applied properly.

Unless you specifically ask your new loan servicer to put the extra money towards the principal, they’ll typically credit it towards your loan balance as a whole, starting with the interest first.

If you’ve been making extra principal payments to your old lender, you’ll need to make sure your new loan servicer is on-board.

Otherwise, you could end up on Paid Ahead status. That means the additional money you pay is credited as an advance on your monthly payments.

While you’d still be paying down your loan sooner you won’t be chipping away at the interest as quickly.

How do you know if your account is Paid Ahead? If your first statement from the new servicer shows a $0 balance or lists your next due date as several months in the future, that’s a big tip-off.

You’ll need to contact your new servicer to tell them how you want extra payments to be applied.

Tip: Ask your new loan servicer if there are any restrictions or limitations on how often additional principal payments can be made.

5. Reinstate auto-pay.

Setting up automatic payments for your loans means you always pay on time.

It’s also an easy way to shave a few extra dollars off your balance if your loan servicer offers an interest rate reduction for doing so.

Some lenders, for instance, offer a discount of 0.25 or 0.50 percent off your rate when you choose auto-pay.

When your student loans are sold, you need to make sure your automatic payments transfer, especially if you’re still getting an interest rate reduction.

It might be a relatively small amount, but it can add up to some decent savings in the long run.

Say you owe $30,000 at 5 percent and you’re on a standard 10-year repayment plan. If your monthly payments are $325, a 0.25 percent rate reduction would save you a little over $500 in interest over the life of the loan.

Now imagine how valuable a rate reduction would be if you’re unfortunate enough to be stuck with six-figures in loan debt.

6. Verify your account status.

Your new loan servicer is required to honor your existing loan terms but that doesn’t mean there’s no room for error when your loans are sold.

If you’ve signed up for an income-based repayment plan or you’re currently on forbearance, for example, these types of arrangements should carry over, but it doesn’t always happen that way.

If the new servicer is expecting a different payment amount or your interest rate has changed, call them to find out why. This is especially important if your loans are supposed to be in forbearance and you’re not financially able to make payments.

If you do nothing, you run the risk of defaulting on your loans. That can seriously hurt your credit and put you at risk for collection actions.

7. Keep an eye on your credit.

Having your student loans sold can affect your credit negatively in a couple of different ways.

If your credit takes a hit, that can make it harder to get approved for new loans. And, you might get stuck paying higher rates on loans if you have a lower credit score.

Here are some scenarios that could negatively impact your score:

Falling behind on payments because you weren’t aware your loans were sold

If you never received your notification letter, it’s entirely possible that you might not even know your loans were sold. By the time you realize what’s happened, the clock’s already ticking on the 60-day grace period. If you end up paying late after the grace period has expired, your lender can report it on your credit history.

Old lender doesn’t forward your payments

As mentioned earlier, the old lender is supposed to forward any payments made during the switch to your servicer. If they fail to do that, your new servicer might assume that you just haven’t paid. In that case, you can end up with a late payment reported to your credit.

Selling loans can affect the age of your credit report

The older your accounts are, the better for your credit score generally. You can run into problems if your student loans are the debt you’ve had the longest. If your loans are sold and the old accounts are listed as closed, that could drag your score down.

Any time your student loans are sold, it pays to stay on top of your credit. Take a look at your credit reports immediately after your loans are sold to make sure payments are being reported accurately.

If you see an error on one or your loan accounts, dispute the information with the reporting credit bureau as soon as possible.

What to Do If You’re Not Happy With Your New Loan Servicer

Some student loan servicers can be easier to work with than others. If your new servicer turns out to be a nightmare, there are a couple of things you can do.

First, you can file a complaint with the Consumer Financial Protection Bureau.

If you have federal loans, you can also approach the Student Loan Ombudsman. This group helps borrowers resolve disputes related to Direct, Federal Family Education, and Perkins loans.

If those options don’t get you anywhere, you could consider leaving your loan servicer altogether. But how do you do that? There are two ways: you can consolidate your loans, or refinance them.

But how do you do that? There are two ways: you can consolidate your loans, or refinance them.

Consolidating vs. Refinancing Student Loans: What’s the Difference?

These two terms sound similar but they work differently. Consolidating your loans means combining all of your loans into a new loan. Generally, consolidation is something to think about if you have federal loans, although it can also be done with private loans.

Consolidating your loans means combining all of your loans into a new loan. Generally, consolidation is something to think about if you have federal loans, although it can also be done with private loans.

When you consolidate federal student loans, your new interest rate is the average of what you were paying across all your loans before. In that sense, consolidation doesn’t necessarily save you any money.

But it is a way to streamline your loans into a single monthly payment with a new loan servicer. You could also lower your monthly payments this way, but that usually means extending your loan term. A longer loan term means you repay more money overall.

You could also lower your monthly payments this way, but that usually means extending your loan term. A longer loan term means you repay more money overall.

Benefits of Refinancing Student Loans

Refinancing also allows you to combine multiple loans with a new loan servicer. The difference is that refinancing is usually done through private lenders.

When you refinance, the lender sets your rate based in part on your credit score. If you’ve got great credit, or you’re refinancing with a cosigner who has great credit, that could result in a lower rate. You may also end up with a lower payment.

Between the two, refinancing has the potential to make your loans less expensive, while helping you ditch your old loan servicer.

But, there’s a catch: if you refinance federal loans through a private lender, you lose certain benefits.

Those include being able to take a deferment or forbearance on your loans, or enroll in an income-driven repayment plan. Some private loan servicers offer similar benefits, but not all of them do.

Before you refinance federal loans, consider what you could be giving up. If you’re refinancing private loans, go back and check your credit first. If you have a lower credit score, you might need a cosigner to get the thumbs-up for a refinance.

When In Doubt, Ask

If your loans are sold and there’s something you don’t understand, don’t hesitate to reach out to your old loan servicer or your new one.

Either one should be able to answer your questions about the transfer of your loans. The worst thing you can do is stick your head in the sand when your loans are sold.

Being proactive means you don’t run the risk of falling behind and possibly hurting your credit.