How savings buckets can transform your financial goals

If you’re trying to save for the future but never seem to have enough left for the goals that really matter, a savings account with “savings buckets” might be just what you need. Think of savings buckets as digital folders inside one account. You can create separate mini accounts for your emergency fund, dream vacation, home down payment and more, and all without juggling multiple bank accounts. Savings buckets are a powerful tool for better personal finance organization.

Not every bank offers this feature yet, but you’ll find this option with institutions like Ally Bank, Discover, SoFi and the Wealthfront Cash Account. Ready to make saving simpler and more motivating? Let’s look at how savings buckets can help you reach your goals faster.

What are savings buckets and how do they work?

Savings buckets are a digital tool that lets you divide one savings account into multiple goal-based sections. Instead of opening separate accounts for each purpose, you can create “buckets” within a single account – one for emergencies, another for travel, a third for a new car and so on. This is how savings buckets work: by dividing your savings into distinct categories, you can manage multiple financial goals, track your progress, and prevent overspending by creating mental barriers to spending funds set aside for specific objectives.

Each bucket tracks progress toward its individual goal while keeping all your money in one place and earning the same interest rate. Account holders can view their total balance across all buckets, making it easy to monitor all your savings in one place and see how close you are to reaching your goals. You can easily move money between buckets or adjust goals as your priorities change, making it a flexible, organized way to save intentionally and stay on top of your financial plans.

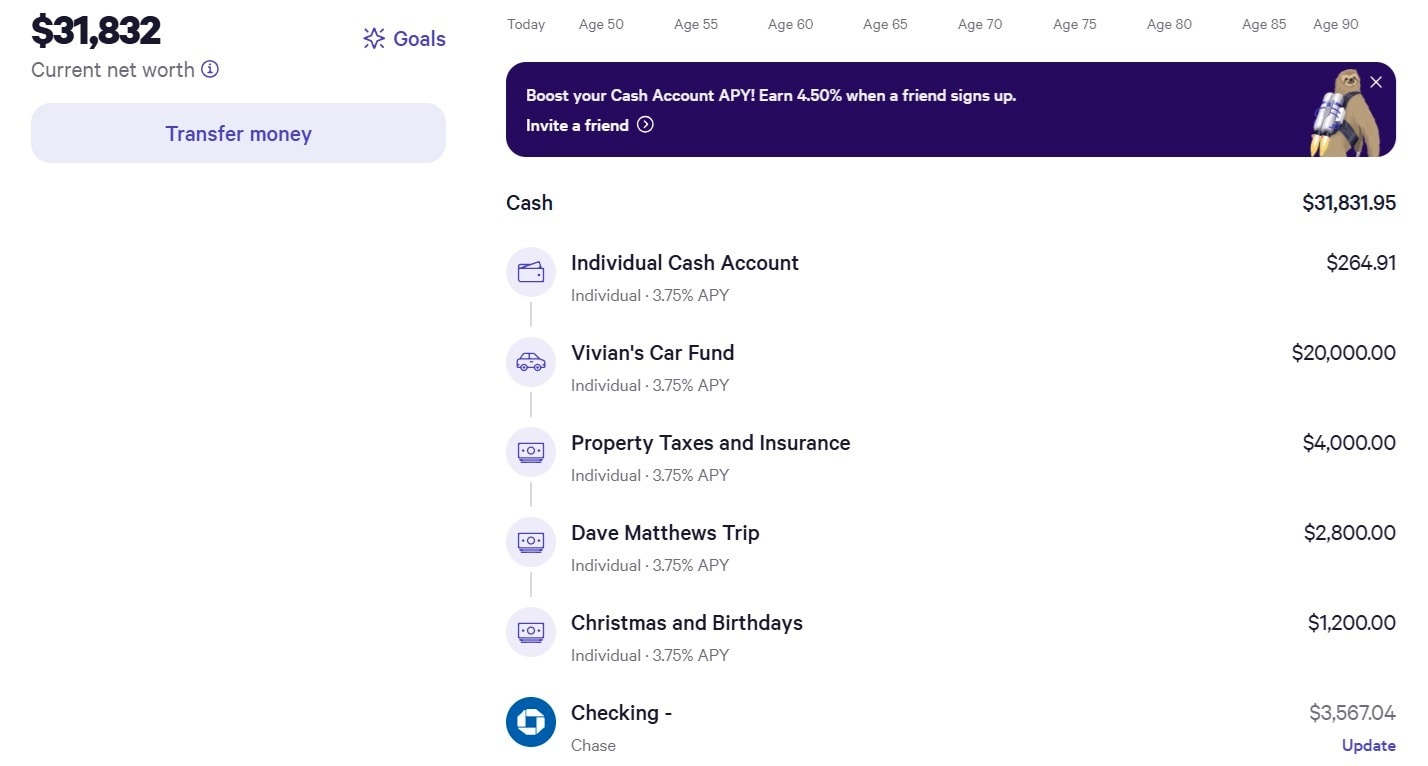

Take this screenshot from my own Wealthfront Cash Account, for example. This account earns interest without any fees, and it lets me set up savings buckets for a variety of needs.

Within my Wealthfront Cash Account, I currently save for the following:

- My youngest child’s car, which I am done saving for

- Property taxes and insurance for our home and cars, which I save for monthly and pay out of this account as each bill comes due

- A Dave Matthews concert we booked for this winter, which is at an all-inclusive resort in Mexico

- Christmas and birthdays for my children and other family members, which I save for monthly and pay out of this account as needed

In the past, I have also had a vacation savings fund that I added to monthly. However, I recently started a new slush fund for general vacation spending with another bank in order to earn a banking sign-up bonus.

Key benefits and features of savings buckets

While you can always save for multiple goals at once within a single account, pooling all your money in one place has its downsides. For example, a single savings account with $3,000, $5,000 or $10,000 blurs the lines when it comes to how much funding you have set aside for different expenses. A single savings account also makes it more difficult to see progress as you work toward different savings thresholds.

On the flipside of that, savings accounts with buckets do the opposite and make it easier to accomplish the following:

Goal setting and progress tracking

Banks with savings buckets make it considerably easier to set multiple savings goals at once. You can use money buckets to save for almost anything, from a down payment on a new home to a wedding or the adoption of a child.

Using a goal-oriented method with savings buckets allows you to align your savings plan with your spending patterns and allocate extra money toward your goals. Having funds separated in different money buckets makes it easier to know where you’re at in your savings strategy – and how far you have to go. Savings buckets help you monitor your savings progress for each goal, so you can track how close you are to reaching each target. You can also set up recurring transfers to automate your savings plan, making it simple to save consistently without manual effort. It can also help you figure out how much you need to save monthly (or per paycheck) to reach your savings goal faster. If you’re saving up $5,000 for new kitchen appliances and you currently have $3,000 saved toward that goal, for example, you can set a new goal to save $2,000 in savings buckets over however long you think it will take.

Interest accrual

Another benefit of a savings account with buckets is the fact that all your funds are earning the same interest rate. This means your money is working for you and earning interest as you work to save more each month.

Obviously, this is an area where you’ll want to be picky as you shop around. Some accounts may have fees that could reduce earnings, so it’s important to review the fee structure carefully. Additionally, making qualifying deposits or setting up an eligible direct deposit can help you earn a higher APY with some banks. Ideally, you’ll go with a high-yield savings account (HYSA) with buckets that earns a competitive interest rate and doesn’t charge any fees.

Simplification

Another benefit of savings accounts with buckets is the fact you don’t have to open different savings accounts with different banks (or the same bank). You can open one HYSA with buckets and set up subaccounts for all the goals you’re saving for. This is different from using multiple savings accounts, where each goal requires a separate account, which can be harder to manage. With savings buckets, you can easily withdraw money from each bucket as needed for your specific goals.

Having a linked checking account can make it even easier to transfer funds between your checking and savings accounts, helping you manage your finances more efficiently. Some banks will automatically transfer funds into your savings buckets based on your preferences, so you can reach your goals effortlessly. If your account offers ATM access, you also get the convenience of withdrawing cash directly when you need it.

This setup makes saving for multiple goals much simpler. You can visually see how close you are to reaching each milestone, which can be incredibly motivating.

Best high-yield savings accounts

Types of savings buckets to consider

You can use a high-yield savings account with buckets to save for almost anything – and for almost any amount of time. Consider the following goals you could save for as you compare bank accounts with buckets and/or subaccounts:

- Adoption expenses: With adoption expenses climbing as high as $30,000 or more in some cases, it makes sense to save early if you want to adopt a child. An account with savings buckets can help you earn interest on your adoption fund as you save, which helps your money grow faster.

- Emergency savings (emergency funds): Most experts recommend having three to six months of expenses in a separate fund. This money can be used in the event of unexpected expenses, a job loss or a loss in income. Labeling a bucket as your emergency fund can help you stay prepared for life’s surprises.

- Future home repairs: If you know you’ll need a new roof or new siding in the coming years, an account with money buckets can help you save for this goal separately from your other savings.

- Home down payment: Whether you plan to put down as little as 3.5% on a home with an FHA home loan or you want to put down at least 20% of the purchase price to avoid private mortgage insurance (PMI), saving up for a down payment on a home can take time.

- Medical savings: You can use savings buckets to save for future medical bills you are planning for, or even for unexpected medical bills. You can also save monthly for dental expenses, including regular dental cleanings and X-rays.

- New car: Bank accounts with buckets make it easy to save separately for a new or used car while earning interest all along.

- Taxes: If you’re self-employed, a HYSA with buckets can help you set aside funds for quarterly estimated tax payments.

- Vacations: You can also use high-yield savings accounts with buckets to save for an upcoming vacation, or to build up a slush fund for all your future travel.

- Weddings: With the average cost of a wedding at $33,000 this year, according to TheKnot, couples may need to save for years to have the cash ready for the big day.

How I use savings buckets for regular expenses and bills

While bank accounts with buckets make it easier to save for long-term goals, you can also use these accounts for regular expenses and bills you pay often. You can use any bank account with savings buckets for this purpose, including an Ally Bank account. I personally use my Wealthfront Cash Account to save for two sets of ongoing expenses:

- Birthdays and Christmas: I save $300 per month for birthdays and Christmas for my two children and other family members, which leaves me with $3,600 annually to cover these expenses. I transfer this money monthly to my Wealthfront account, then I spend it as needed to cover the cost of gifts. Setting up recurring transfers can automate your savings, making it easier to stay on track.

- Property taxes and insurance: I also save $1,000 per month for property taxes and insurance. This amount helps me save $12,000 per year, which covers the property taxes on my home and our homeowners, auto and umbrella insurance for the year.

Some banks also offer surprise savings features that help you save extra without thinking about it, by automatically moving small amounts of money into your savings buckets based on your spending habits.

The key to using banks with savings buckets for ongoing expenses is figuring out how much something costs you each year and breaking it down into a regular savings goal.

Let’s say you owe $6,000 annually for homeowners insurance, auto insurance on several cars and an umbrella insurance policy you renew each year in July. In that case, you could save $500 per month in a savings account with buckets to reach the $6,000 amount each year.

Getting started with savings buckets

If you believe savings buckets could help you get your savings where it needs to be, you have some upfront work to do. The following steps can get you on a path to saving for a range of important goals and needs.

Step 1: Compare bank accounts with buckets

First off, you’ll want to compare different banks that let you set up savings buckets or subaccounts. Key factors to consider with each bank include the interest rates they offer, account fees that apply and minimum opening balance requirements.

Ideally, you’ll find a bank that earns a competitive interest rate and doesn’t charge any fees.

Step 2: Outline your savings goals

Next, you’ll create a list of specific goals you want to save for. These can range from short-term objectives like a new wardrobe for work or a weekend getaway to longer-term ambitions such as a down payment on a home or a wedding.

You can also set up savings buckets for recurring expenses like property taxes, quarterly estimated tax payments, insurance premiums, holiday spending, and more.

Step 3: Determine monthly savings for each goal

Once you have outlined the goals you want to save for, you need to determine how much to save up — and how much you can afford to save each month (or each payday). This will depend on your current income and expenses, and if you’re willing to cut current spending to allocate more funds to savings.

As an example, let’s say you hope to book a cruise next year that will cost approximately $5,000, including flights. If you have 12 months to save for the trip, you might decide to save $417 each month in a subaccount for your cruise.

$417 X 12 months = $5,004

Maybe you want to save up $40,000 for the down payment on a home, and you think it might take three years to reach your goal. In that case, dividing $40,000 by 36 months means you will want to save $1,112 per month during that time.

$40,000 / 36 months = $1,111.11

Step 4: Automate the process

Some bank accounts with money buckets allow you to set up automatic transfers on a schedule that suits you—whether that’s monthly, every payday, or another timeline you prefer.

These automatic transfers take the guesswork out of saving by moving money regularly from your checking account into your savings buckets. This “set it and forget it” method helps you consistently contribute toward your goals without needing to remember each time. Additionally, setting up direct deposit can further streamline your savings, as some banks enable you to allocate portions of your paycheck directly into specific savings buckets. Many banks also offer higher APYs or bonuses when you receive eligible direct deposits, making automated savings even more rewarding.

Common questions about savings buckets

What’s the difference between savings buckets and multiple accounts?

Savings buckets are subaccounts within a single savings account, whereas multiple accounts are different accounts you have with the same bank or different banks.

How many savings buckets should I create?

You can create as many savings buckets as you need, or as many as you want to keep track of.

Do I earn interest on all my savings buckets?

You’ll earn interest on all the money in your savings account, even if you have funds separated into different money buckets or subaccounts.

Are there withdrawal or transaction limits for savings buckets?

Withdrawal and transaction limits will depend on the bank you choose. Make sure to check for limits and rules that apply before you select a bank.

Can I change my bucket structure after setting it up?

Most banks with savings buckets let you change up your subaccounts however you want. This includes changing the name or tag for each subaccount, moving money around and more.

The bottom line

Savings buckets can make reaching your financial goals simpler, more organized and far less stressful. By dividing one account into multiple goal-focused buckets, you can clearly track progress, prioritize your spending and stay motivated as you see each goal get closer.

Pairing buckets with automatic transfers also keeps your savings consistent and effortless. Whether you’re saving for short-term treats or long-term milestones, adopting a savings bucket strategy can help turn your financial goals into reality.