Does Your Age Matter When Applying for a Mortgage?

- Age cannot be a factor in mortgage discrimination, but lenders may scrutinize very young or old applicants more carefully.

- Young borrowers often face challenges like student debt and may benefit from loan programs with lower down payments such as FHA loans.

- Retirees seeking mortgages must demonstrate sufficient income from sources like pensions or savings to meet lender requirements.

Mortgages are long-term commitments. Most mortgages are intended last for fifteen or thirty years, so it will likely be decades before you pay one off, even if you try to make extra payments on the loan.

Depending on what stage of life you are in, buying a home can present different issues. The mortgage process will also present different issues based on your stage of life.

You might worry that lenders will be unwilling to lend to you because you seem too young to pay off such a large loan. If you’re older, you may worry that lenders won’t be willing to lend to someone who is at or near retirement.

We took the time to research how your age affects the mortgage process and what that can mean for you.

Cannot Discriminate Based on Age

One thing that you should know right off the bat is that lenders cannot base their lending decisions on your age. If a lender decides not to loan you money just because of your age, they are discriminating illegally.

Though it is illegal to discriminate based on age, it is true that many lenders will be less willing to lend to people who are very young or very old.

This might mean that they will take a closer look at the application of people who are very young or very old, to make sure the loan is a solid bet.

It can result in borrowers of different ages handling the mortgage application process differently.

Your Age Will Affect How You Approach Your Mortgage

Although age shouldn’t matter from the lender’s perspective, your own approach to lending may vary depending on the stage of your life.

Young Borrowers

Young borrowers are generally first-time homebuyers. This means that they are going through the mortgage application process for the first time. Lenders will generally have to provide more hand-holding with young borrowers to help them through the process.

Young borrowers also tend to have a lot of other types of debt, mostly student debt. This can make it difficult for them to purchase a home.

If you’re a young homebuyer, you’ll likely want to look into loan programs that don’t require a full 20% down payment.

One example, the FHA loan, requires just a 3.5% down payment but comes with additional requirements, such as PMI payments.

If you have a huge amount of student debt because you went through an expensive program, such as medical school, you might have trouble qualifying for any loan based solely on how much you already owe. You’ll need to find a lender that is willing to make a loan based on your potential for a high income in the future.

One thing that is common for young homebuyers is to purchase a “starter home” with the intent to move as your need for space expands. If you’re only expecting to stay in a home for a few years, consider an adjustable rate mortgage (ARM). ARMs have lower interest rates, which can make it easier to get approved for a loan. The downside is that your rate can increase once the lock-in period expires. Usually, ARMs lock in interest for the first 3 – 7 years.

Finally, check if your state offers a homebuyer assistance program. Many states offer these programs to help first-time homebuyers. They target young and low-income buyers to help them get on the property ladder.

Compare Your Personal Loan Options

Find a personal loan that better fits your borrowing needs:

Middle-aged Borrowers

Once you reach your late thirties, forties, or fifties, you might be looking to move to a new home. Whether you need a larger house to accommodate a growing family or want to downsize as your kids move out you might look for a new mortgage.

At this age, you’ve probably paid down the majority of your student loan debt but might have other debts to think about.

You may have auto loans and could be helping your kids with college expense or helping to support your parents.

People of this age are generally in their prime earning years but have a lot to handle financially.

The best thing to do if you’re in this age group and looking for a mortgage is to figure out a long-term plan.

Think about where you want to settle down, and whether you can commit to a new home for the long-haul. If you’re looking to buy a forever home, a 30-year mortgage can be a good idea.

Though your financial obligations might put a strain on your available cash, do your best to save up for a down payment. Having a large down payment can do a lot to help you get approved for a loan.

Also try to minimize your other loan balances, especially credit card balances. Having a lot of other debt can hurt your chances of approval.

Retirees

Retirees who want to buy a home find themselves in a unique situation. Lenders generally look at your monthly income and monthly debt obligations to determine whether you can pay back the loan you applied for.

If you’re retired, you don’t have a traditional source of income in the form of a job. You’re likely living on social security, your savings, and possibly a pension.

Living on a fixed income can make it difficult to meet the income requirements that lenders have. It might also make it difficult to handle unexpected expenses that pop up during the home buying process.

If you’re trying to sell your home to buy a new one, that can make it easier to get approved because you can bring a large down payment to the table.

If you’re trying to buy a second home or vacation home, you might have trouble. To convince a lender that you can pay the loan, you might have to jump through a few hoops.

How to Improve Your Chances of Getting a Mortgage, Regardless of Age

Here are a few tips that will help you get approved for a mortgage, regardless of how old you are.

Strengthen your credit

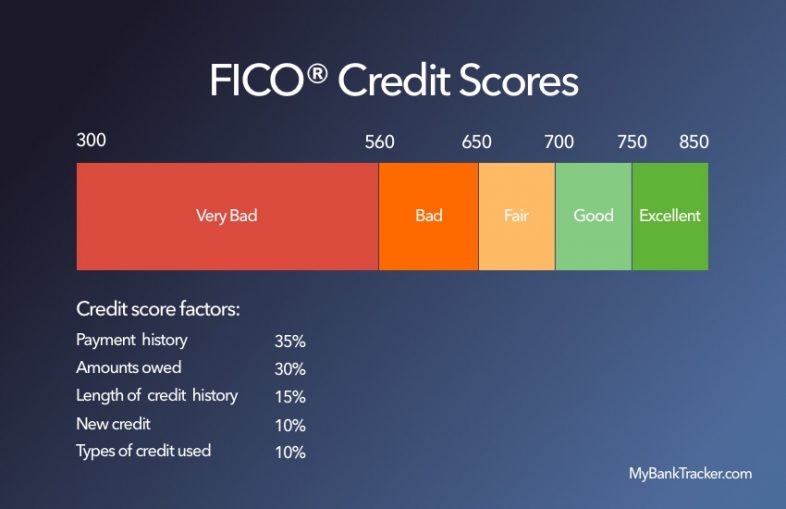

When you apply for any kind of loan, the lender will look at your credit score.

Your credit score is a number ranging from 300-850 that indicates your trustworthiness as a borrower. A high credit score means that you are good at repaying your debts. A low credit score indicates that you are a default risk.

Your credit score is made up of five factors:

The most important of these factors is your payment history. Do everything you can to make sure that you don’t miss payments. Even one missed payment can result in a huge drop in your credit. The amount of money that you owe is the second biggest factor.

If you’re applying for an important loan, like a mortgage, try to pay down your existing debts and avoid using your credit cards.

Also, avoid applying for other loans or credit cards in the lead-up to your important application.

Cut down on debt or boost income

Lenders primarily care about whether you’ll be able to pay back the loan they give you. One thing they use to measure your ability pay back a loan is your debt-to-income ratio.

Your debt-to-income (DTI) ratio is calculated by dividing your total monthly loan payments and housing bill by your monthly income. So, if you have a $250 car payment, a $1,500 rent bill, and a $4,000 monthly income, your debt-to-income ratio is 43.75%.

The lower your DTI ratio, the better it looks to a lender because it means you have more money to spare to pay for a new loan. Generally, lenders like to see a DTI ratio of 35% or less, but the lower you can get it, the better. If your DTI approaches 50%, you’ll have trouble qualifying for any loan.

What Happens if Someone with a Mortgage Passes Away?

When someone passes away, all of their assets and liabilities become the property of their estate. The executor of the deceased’s will becomes responsible for managing the estate.

If the will states that the house should pass to a specific beneficiary, subject to the mortgage, that person takes ownership of the house.

It then becomes their responsibility to pay off the mortgage if they want to keep the house.

If the will states that a beneficiary should receive the house, not subject to the mortgage, the estate will pay the balance of the loan.

In the event that the estate cannot pay off the balance of the mortgage and whoever receives the home cannot pay either, the lender will repossess the home.

Mortgage payments cannot be avoided, even if someone without the ability to pay it off passes away and wills the home to someone else.

Conclusion

Though lenders cannot discriminate based on your age, how you approach the mortgage process will vary with how old you are.

No matter how old you are and where you are in life, knowing your goals will help you get the right mortgage.