Should You Pay Off Student Loans Before Grad School?

Getting an undergraduate education is a huge accomplishment. But it can also signal the start of student loan repayment.

Many people pay for college with a federal or private student loan. In this case, repayment usually begins within six months of graduation. This gives you time to find employment and settle into post-college life.

But if you’re thinking about continuing your education, you may wonder whether it is better to pay off your current student loan first. Or pay off the loan while attending grad school.

There’s no wrong or right answer.

Many people don’t pay off their undergraduate student loans before continuing their education. Yet, others choose to pay down what they owe, and then apply to grad school. As a result, they end up owing less in the future.

Can’t decide which approach is right for you? Here’s what you need to consider before making a decision.

When Does It Make Sense to Pay Off Student Loans First?

The good thing about a student loan is that repayment can extend for 10 or more years. This results in low, affordable monthly payments.

Even so, some people don’t want this debt hanging over their heads for a decade.

So, they choose to work hard early in their careers and get rid of their undergraduate student loan quicker. Sometimes, within two or three years.

Working for grad school

Some of these individuals work full-time. This allows them to dump a large percentage of their income on their student debt and drop the balance sooner.

This approach can work if you have a solid financial footing to pay off your student loan before grad school.

You can spend the next few years paying off this debt and then apply to grad school with little or no debt.

Consider other financial goals too

But before you commit to the above strategy, make sure you consider your entire financial picture.

A plan that involves paying off student debt in record time could mean giving your student loan lender every extra dime you earn.

And when your entire focus is on student debt repayment, you might neglect other financial responsibilities.

Why Pay Off Credit Card Balances First?

Do you have high-interest credit card debt or maxed out credit cards? If so, it only makes sense to pay off this debt before paying off a student loan.

Yes, a student loan can be burdensome. But in most cases, the interest rate on a student loan is less than the interest rate on a credit card.

So, you’ll save on interest charges by getting rid of the credit card debt first.

Potential for more damage to your credit

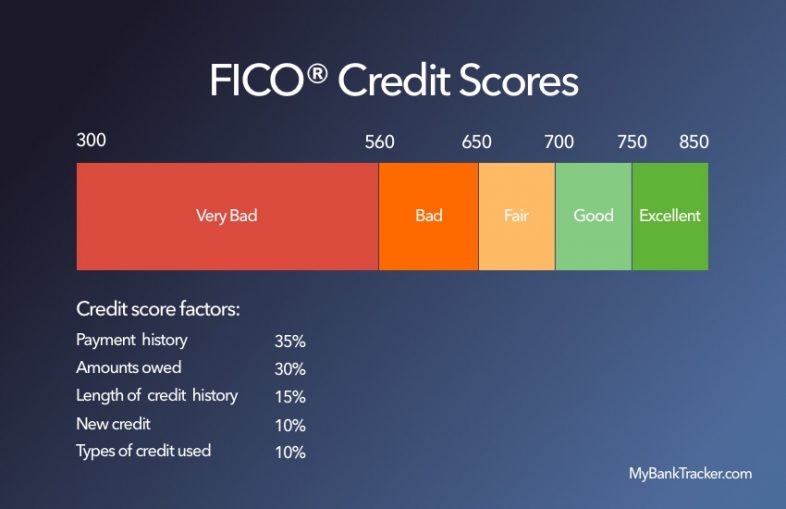

Keep in mind that while credit scoring models factor in how much you owe, student loan debt — even a large balance — doesn’t pose as much risk to your credit score as a high-balance credit card.

A credit card is a type of revolving debt, whereas a student loan is an installment loan.

Installment loans have fixed repayment amounts and terms. So, these aren’t as dangerous as a credit card, where the balance and minimum payments can fluctuate.

Maxing out a credit card or having a credit card balance greater than 30 percent of your credit limit can reduce your credit score.

Why Build an Emergency Fund First?

Not only should you focus on paying off credit card debt before student loan debt. You should also focus on building an emergency fund.

Many experts recommend at least a 3- to 6-month emergency fund, although you can save more.

If you have limited disposable cash, building emergency savings might be nearly impossible when you’re pouring all your extra money into student loan repayment.

Find the best rates

Unlock exclusive savings rates and gain access to top-tier banking benefits.

Paying off a student loan before graduate school is an excellent goal. But you should only do so if you’ve already achieved the above financial goals.

Don’t worry too much if you’re not in a position to pay off a student loan before grad school.

It’s understandable why you wouldn’t want to finish your graduate studies with too much debt. And why you wouldn’t want to juggle student loan repayment while attending grad school.

Several options can reduce what you owe, or help you avoid student loan repayment during grad school.

Compare Deferment vs. Forbearance

| Deferment | Forbearance |

|---|---|

Pros:

| Pros:

|

Cons:

| Cons:

|

Request a Deferment

Deferment isn’t usually an option with a private student loan from a bank or credit union. So repayment may begin after graduation regardless of whether you attend graduate school.

Deferment is an option with a federal student loan. This provision will either reduce your monthly payment, or postpone student loan repayment for a certain length of time.

During this time, you might not have to repay the principal.

You can request deferment from your student loan lender. Keep in mind, interest will continue to accrue if you have an unsubsidized federal loan. If you have a subsidized loan, the government pays your interest.

To be eligible for deferment, you need to be enrolled in school at least half time. This option is also available with Direct PLUS Loans and Family Federal Education Loans (FFEL) PLUS.

Also, you may be eligible if you’re enrolled in an approved graduate fellowship program or an approved rehabilitation training program. Or if you’re unemployed, experience economic hardship, or active-duty military.

Ask About Forbearance

Another option is a forbearance if you don’t qualify for deferment.

Forbearance can also suspend or lower monthly federal student loan payments.

This provision is only available for:

- Direct Loans

- Perkins Loans

- Federal Family Education Loan (FFEL) programs

This provision is for 12 months. But you can request another forbearance at the end of this period.

To be eligible, you must be unable to make your monthly payment due to financial difficulties, a change in employment, or medical expenses. Interest continues to accrue in forbearance.

Eligibility Criteria For Deferment and Forbearance

| You’re eligible for DEFERMENT if… | You’re eligible for MANDATORY FORBEARANCE if… | You’re eligible for GENERAL FORBEARANCE if… |

|---|---|---|

| You’re in school at least part-time | You’re enrolled in a medical or dental internship, or you’re enrolled in a residency program (only Direct Loans and FFEL Program loans are eligible and you would use this request form to file for it) | You’re having financial difficulties |

| You’re unemployed or can’t find full-time employment | Your student loan monthly payments are 20 percent more than your monthly gross income (only Direct Loans, FFEL Program loans, and Perkins Loans are eligible and you would use this request form to file for it) | You have medical expenses you’re having trouble paying for |

| You’re experiencing economic hardship | You’re serving in an AmeriCorps position (only Direct Loans and FFEL Program loans are eligible and you would follow this link to request it) | There is a change in your employment |

| You’re serving in the Peace Corps. | You’re in the process of qualifying for teacher loan forgiveness (only Direct Loans and FFEL Program loans are eligible and you would use this request form to file for it) | Your loan servicer allows any other reasons they find acceptable |

| You’re on active duty military | You’re a member of the National Guard, but not eligible for military deferment (only Direct Loans and FFEL Program loans are eligible and you would use this request form to file for it) | |

| You’re in a graduate fellowship program | You qualify for partial repayment under the U.S. Department of Defense Student Loan Repayment Program (only Direct Loans and FFEL Program loans are eligible and you would use this request form to file for it) | |

| You’re in a rehabilitation training program for the disabled | ||

| You’re working toward cancellation of your Perkins Loan |

Get on an Income-Based Repayment Plan

Income-based repayment plans are also available with federal loans. This is another option if you’re repaying an undergraduate loan while attending grad school.

This program uses your income and family size to determine your monthly student loan payment. This monthly payment amount can increase or decrease over the years.

Your payment will not exceed 10 percent to 20 percent of your discretionary income. Repayment can be as long as 20 to 25 years.

The program forgives any remaining balance at the end of your term.

Pay Student Loan Interest While In School

If you’re approved for deferment (with an unsubsidized loan) or forbearance, you may not be required to make a payment at this time.

But since interest accrues during these periods, you could end up owing more than your original balance.

One way to avoid a higher balance is to make interest-only payments while attending grad school.

This isn’t required but recommended.

Interest-only payments will not only save you money, they can result in a lower monthly payment upon graduation. You’re chipping away at your debt while in school, thus paving the way for a better financial outlook later on.

Earn Income While In Grad School

Look for different ways to earn income while in grad school.

This will make it easier to repay a student loan or make interest-only payments.

Understandably, you want to complete your grad school education as quickly as possible. But rather than attend grad school full-time, consider attending school part-time.

Part-time grad student

You can then work part-time or full-time.

And with this income, you can possibly forgo a deferment or forbearance and begin paying down your undergraduate debt.

Or at the very least, make interest-only payments.

Plus, when you work full-time after getting your undergraduate degree, and then take your time completing grad school, you might be able to pay for grad school out-of-pocket and avoid extra debt.

Of course, this will only work if you’re able to cut your monthly expenses. This might include living with your parents while working and attending grad school. Or getting roommates and splitting household expenses.

Assistantships

You can also look into teaching assistantships to reduce how much you pay for grad school.

This involves working for the school. In exchange, you’ll receive a discount on tuition or a stipend for living expenses.

Determine the value of grad school

Also, consider whether graduate school is even necessary to advance your career.

A postgraduate program is expensive. So don’t continue your education for the sake of saying you have a master’s degree or PhD.

Will grad school result in more income? If so, how much more can you expect to earn after completing grad school?

Compare the cost of the education with your potential salary after completing an advanced degree.

Depending on your field or area of study, grad school may not result in a significant income boost.

Conclusion

If you’re able to pay off student debt or begin repayment before attending graduate school, go for it.

It’s always a good idea to put something toward existing debt, even if you only make interest-only payments. The more you pay today, the less you’ll owe later.

But don’t worry if you can’t pay off the debt before grad school. With so many provisions available, there are ways to manage undergrad debt while completing an advanced program.