The Money Coach Answers Your Burning Financial Questions

MyBankTracker and Lynnette Khalfani-Cox, better known as The Money Coach, have joined forces for Financial Literacy Month. Reaching out on social media, readers sent in their burning financial questions. The Money Coach has answered the top 10 financial questions ranging from buying your first car to investments.

1. Q: Can I use my 401(k) to put a down payment on a house?

A: It is possible to use funds from a 401(k) for a down payment on a home, but I wouldn’t recommend it.

A 401(k) is an employer-sponsored retirement savings plan and since it provides tax benefits, withdrawing money from your 401(k) before age 59 ½ also has negative tax consequences.

Money taken out of your 401(k) prematurely is subject to a 10% penalty from the IRS, as well as ordinary income taxes, which could range from a low of 10% to as high as 39.6%.

So let’s assume you’re in the 25% tax bracket.

Withdrawing $20,000 from your 401(k) to buy a home means you’ll ultimately have to fork over $7,000 to Uncle Sam, including $2,000 in penalties plus $5,000 in taxes.

Borrowing money from your 401(k) isn’t advisable either. First, you’ll be losing out on earning potential retirement funds since your money isn’t invested.

Also, if you lose your job or leave your employer for any reason, borrowed 401(k) funds are typically due very quickly (usually in about 60 days or so), otherwise you face those nasty taxes and penalties.

2. Q: Is there an agreed upon “minimum” amount of money to invest?

A: There are no universal rules about a set “minimum” amount of money that you need to or must invest.

But generally speaking, if you’re just getting started and want to open an investment account, many financial services firms will want you to begin with a lump sum — usually about $500 or more — or invest a given amount of funds every month. If you take the latter approach, you’ll find plenty of brokerages and banks that will let you sock away as little as $25 or so monthly.

Just don’t be guided by artificial rules or bank policy when it comes to settling on an investment figure. Ultimately, several key factors — such as your overall finances, cash flow, risk tolerance, time horizon and your investment goals — should determine the amount of money you put at risk for investing.

3. Q: What’s the best place to look to buy a used car?

A: Buying a used car the right way requires research and planning, as well as good knowledge of competitive prices for the vehicle you want. That means you’ll get the best deal by comparison shopping and seeking out used cars in a variety of places: at local car dealers, through the classified section in your hometown newspaper, and even via Internet ads that you can find online and through major car sites such as

CarFax.com, KelleyBlueBook.com or AutoTrader.com.

4. Q: Can you increase your credit card limit too soon?

A: If you wait for at least six months to a year to request an increase in your credit card line, and you have a solid payment history, you’ll probably get approved with no problem. Just remember that asking for a credit line increase typically triggers a credit inquiry, which can affect your credit score.

Banks may reject a request for a credit limit increase that happens too quickly — say in 3 months or less from the time you received the credit card. Lenders and existing creditors that have just started doing business with you usually want to see your payment history and credit usage patterns before extending you additional credit.

5. Q: How long does it take to repair your credit if you have more than one repossession on your record? Is there anything I can do?

A: Negative information, including repossession, stays on your credit report for seven years. However, your credit score can start to rebound much more quickly. That’s because the credit-scoring system puts a lot of weight on recent credit activity.

So the further away that latest repossession occurred, the better off you’ll be. In other words, a repo that happened two years ago won’t hurt your credit score nearly as much as a repo that happened two months ago.

To help rebuild your credit, be sure to pay all your bills on time; don’t let a single obligation lapse! This one step is vitally important because your payment history is the single largest factor (35%) in calculating your FICO credit score. Even just one late payment can really sink your credit rating.

Also, pay down credit card debt to keep your revolving balances as low as possible. Finally, resist the temptation to apply for new credit unless you truly need it. Those credit applications generate “hard” inquiries that stay on your credit reports for two years.

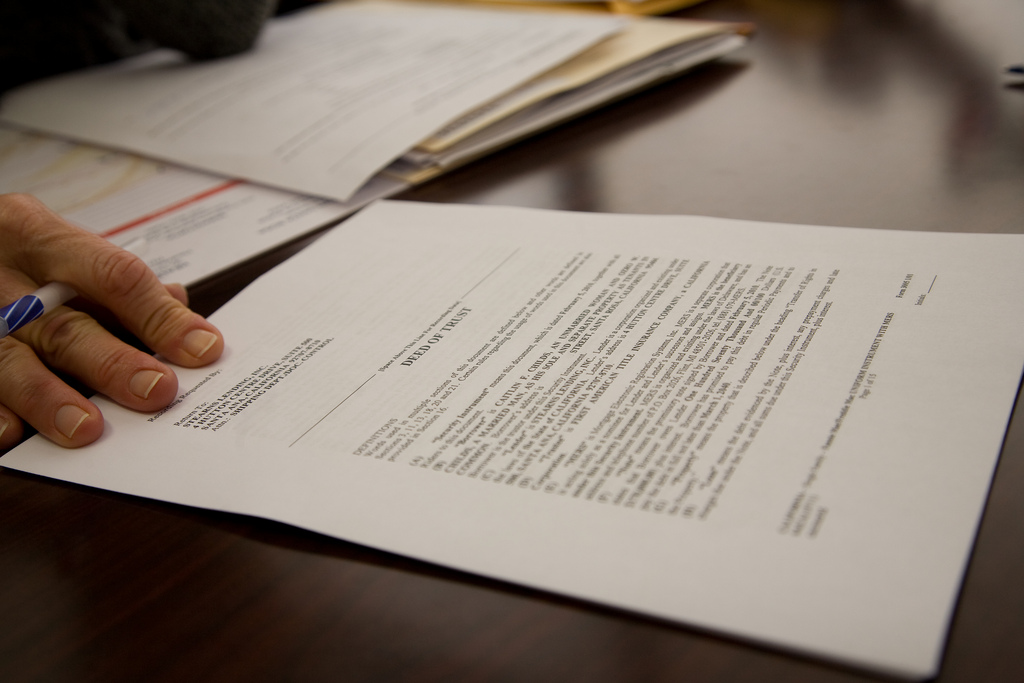

6. Q: I can’t locate the deed to my house. How can I protect myself?

A: Losing or misplacing a deed to a home probably happens more often than people realize. But there’s no need to panic about those lost papers. You can get a copy of a deed to your house from several sources. Your city records office, the county clerk, and even a local title company or mortgage banker should be able to pull a copy of your deed. Just be prepared to pay a modest fee for copies of these records.

7. Q: Which should I pay off first: student loans or credit card debt?

A7: For several reasons, it’s probably best to pay off credit card debt before paying off student loans. But that doesn’t mean you should put college debt entirely on the backburner or not pay it at all. It just means you should attack the credit card debt more aggressively.

Focusing more heavily on eliminating credit card debt is the smarter option because credit cards usually carry higher interest rates, and having high revolving debt (i.e. credit card balances) can have a very negative impact or your credit score. That’s not the case with student loans — even very high student loan balances.

Finally, as a practical matter, for many people paying off credit card debt may be more achievable as a short- or medium-term goal since the average college grad leaves school with nearly $30,000 in student loans and takes a decade or more to repay them.

8. Q: Are there penalties for paying my house off early or making double payments?

A: Most mortgage loans these days do not have pre-payment penalties, but to know for sure you’d need to review your home loan documentation. Regarding making double-payments, I’ve never heard of borrowers being penalized for that, although you should always make it clear to your mortgage lender (in writing) that you want any extra payments to go towards reducing your principal balance. That will cause you to pay less in mortgage interest over time.

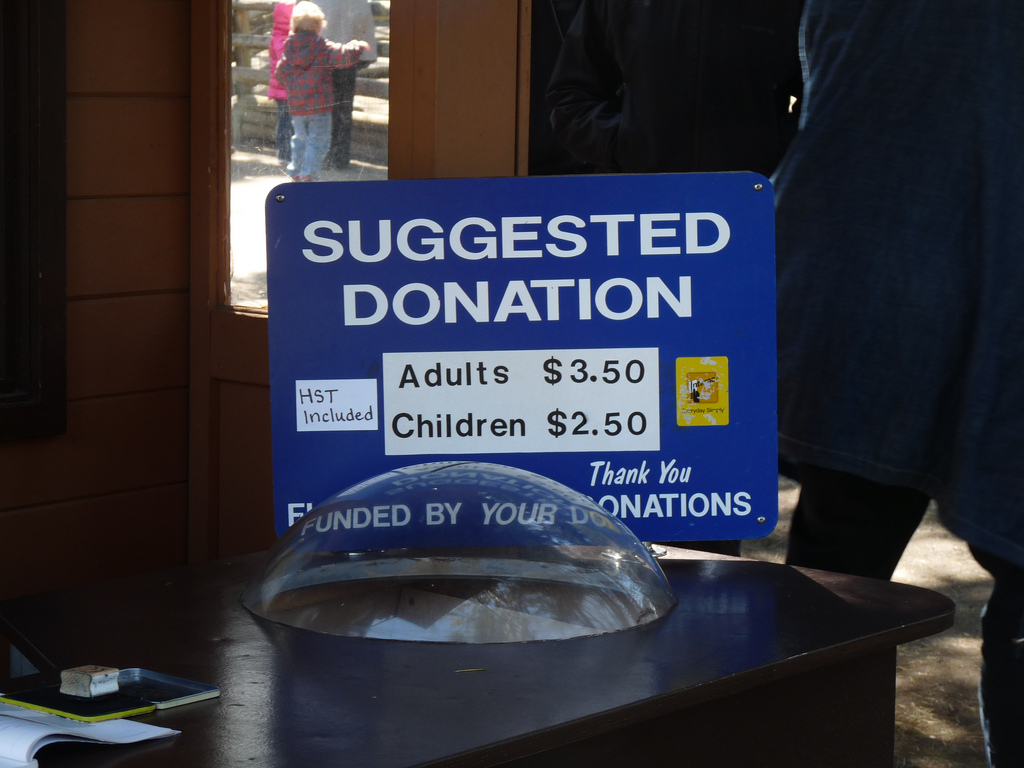

9. Q: I own my own business. If I make a contribution to a nonprofit, that can either be classified as a personal charitable contribution or a legitimate business expense. Right?

A: Your business structure determines how tax deductions for charity are treated. If you have a sole proprietorship, you and your business are essentially treated as one in the same. You can only deduct charity donations on Schedule A, where you itemize your own personal deductions. But your small business can’t claim a business deduction for a charity donation.

If you own a partnership, Limited Liability Company (LLC), or an S Corporation, then yes, you can take a deduction for a contribution to an IRS approved charity as either a personal deduction or a business expense. In the end, it doesn’t matter much, though, because if you take your contribution as a business deduction, that deduction passes through to you, for you to claim on your personal tax return.

The one difference is for those who own a C corporation. If the donation (cash, inventory, etc.) came from the business, then only the corporation can deduct the charitable contribution.

10. Q: At what age should I draft a will?

A: You should draft a will as soon as your personal and financial circumstances dictate that having a will is prudent. For most people, this means having a will is crucial once you have kids and/or once you amass any assets whatsoever — say, $1,000 in a retirement plan; tangible property such as electronics or furniture that decorate your home or apartment; or personal assets that have sentimental value or emotional significance to you (think: your grandmother’s wedding ring that was passed down to you).

The beauty of a will is that you can express your wishes for how any or all of these things should be distributed to family, friends or charity. And having a written will can reduce the potential for family fighting over your belongings. Even if you’re dead broke, and own nothing of value, if you have minor children, you should absolutely create a last will and testament.

When a parent (of any age) dies intestate — which is just legalese for saying that he or she passes away without a will — then the state gets to step in and determine not only how that person’s assets should be distributed, but also what should happen regarding custody of that individual’s minor children. The person the state says should watch over your kids might not be what the same person you would have chosen.

So to all parents who have procrastinated about this matter: do yourself and your family a favor: make a will ASAP.

Learn more about Lynnette Khalfani-Cox at AskTheMoneyCoach.com or TheMoneyCoach.net.