How to Avoid Email Scams This Tax Season

Not many people like tax season. It can be stressful, complicated, and financially draining. But tax time is enjoyable for some folks — scam artists.

With Americans sharing so much personal and financial data over the tax season, identity thieves can have a field day trying to trick you out of your hard-earned money. Whether it’s over the phone, in person, or on the web — it’s important to stay vigilant so you don’t fall victim to a scammer.

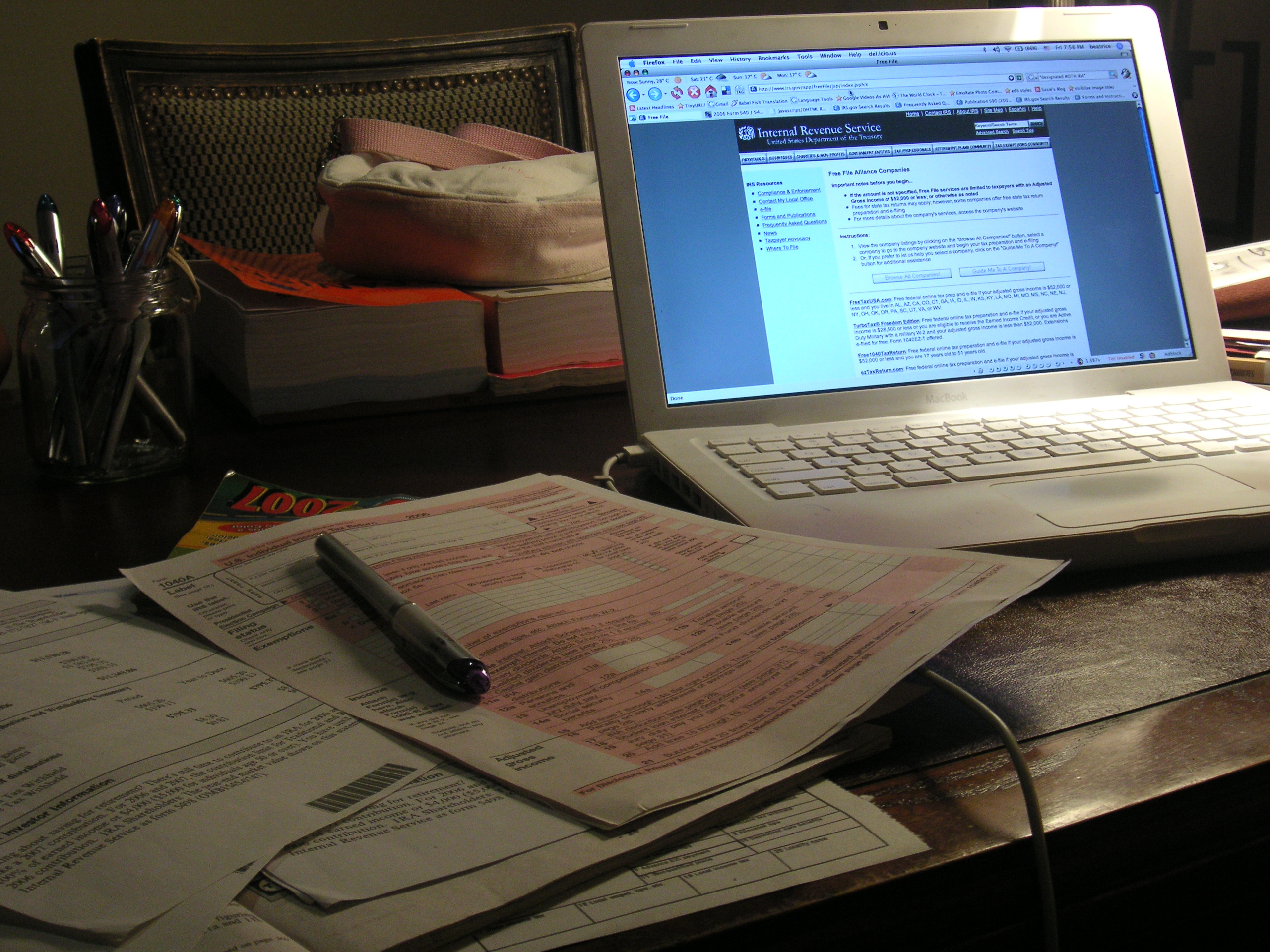

Many of the scams that occur during tax season occur over email. You might even receive an email featuring the IRS name or logo asking for financial data.

Be aware: it’s a scam because the IRS doesn’t send emails to taxpayers asking for personal information. This type of scam — when fraudsters try to trick people out of personal information over the Internet — is known as phishing.

When you receive unsolicited emails claiming to be from the IRS, or an IRS-related agency, don’t respond to it, don’t open any attachments, and don’t click on any links within the email. Report the scam using the email: [email protected]. Following a list of email-related scams to help you (and your money) stay safe while doing your taxes.

Email scams to avoid this tax season

An email that mentions the Electronic Federal Tax Payment System that specifies that tax payments made by the recipient through the EFTPS have been rejected. The email may contain a bogus link that downloads malicious software if it’s clicked.

Another email may promote an offshore account that can be used as a tax shelter. The email may request that you send money to avoid paying taxes. First, it’s illegal to keep money offshore just to avoid paying taxes. Second, these emails are a scam and the offshore tax shelters they’re promoting likely don’t exist.

An email from a bogus charity asking you to donate money in order to receive a tax deduction for last year. First of all, charitable deductions are taken for the tax year in which they’re made. Secondly, you shouldn’t make a charitable donation just for the tax benefits. If you want to donate to a charity, choose one that you believe in and can vouch for before giving money.

An email requesting an unusually large amount data like your Social Security Number, account numbers, or your mother’s maiden name. If you get an unsolicited email asking for a ton of personal information, be wary.

An email promising benefits that sound too good to be true, like an offer to get you a bigger refund or free money for participating in a survey. Scammers will try to bait you into responding with the unbelievable offers. But remember: if it sounds too good to be true, it probably is.

An email highlighting cheap, quick fixes. Just like offers for big tax benefits should raise a red flag, so should unbelievable offers to help you erase IRS tax penalties or only pay 1 percent of your tax bill. These are attractive offers — and most likely fake.

An email threatening you for inaction. If the email you receive threatens action if you don’t respond, it’s a sign that someone is trying to con you.

An email asking you to download something. If you receive an unsolicited email with a downloadable attachment containing information about changes to the tax code or other tax-related information, watch out. That download likely contains malware intended to harm your computer.

A few more additional tips to protect yourself this tax season:

- Don’t carry your Social Security card or documents containing it with you.

- Don’t give out personal information over the phone, in person, or on the Internet unless you have initiated contact and know where the data is going.

- Make sure your software applications and anti-malware program are up to date.

- Change passwords frequently and make sure you don’t choose something that would be easy to guess.

- Remember: the IRS doesn’t send unsolicited emails or texts to taxpayers.

- Be as vigilant offline as you are online. Scam artists may also try to con you via phone, direct mail or even by going door-to-door.

- Be careful when choosing a tax planner and downloading tax-related software.

- Never give out personal information to someone you don’t trust.