The Best Personal Loans in Alabama for 2026

If you need funds for any reason and don’t have any collateral you want to put up to secure a loan, an unsecured personal loan may be an option worth considering.

Several lending institutions offer these types of loans. They usually come with fixed interest rates, set repayment periods, and don’t require collateral.

You need to carefully consider where to get your personal loan, though. Some lenders charge application fees and origination fees and charge high interest rates for their loans.

The best lenders allow you to apply for free, don’t charge origination fees, and offer competitive interest rates.

To help you find the best personal loans for your situation, we researched lenders in Alabama. Here’s what you need to know.

The Best Personal Loans in Alabama

PNC Bank

PNC Bank’s personal loans don’t have any application fees or prepayment penalties associated with them. You can borrow amounts as low as $1,000 or as high as $35,000, depending on what the bank will approve you for.

The terms for repayment vary and interest rates are generally fixed. Payments are required monthly with these loans.

Wells Fargo

The personal loans offered by Wells Fargo have no origination, closing, or prepayment penalties you have to pay. If you qualify, loan amounts can be as small as $3,000 or as large as $100,000.

Wells Fargo states their interest rates are competitive. Their loan terms vary from as short as 12 months to as long as 84 months. The bank explains they can fund your loan as fast as the same or next business day in many cases if you’re approved.

You can also qualify for a 0.25% relationship discount in some instances.

Truist

Truist’s personal loans start at a minimum borrowing amount of $3,500. The bank doesn’t charge origination fees and its fixed interest rates appear competitive.

The bank says most applications are approved or denied as quickly as 15 minutes. In these cases, your loan funds may be available on the same day.

Methodology

We started by focusing on the top 50 banks in Alabama based on deposit market share according to the FDIC’s June 2023 data–serving prospective borrowers in major cities including Huntsville, Birmingham, Montgomery, Mobile, and Tuscaloosa.

After narrowing down our list of banks, we focused on the following criteria:

- Interest rates

- Loan terms available

- Potential loan amounts available to borrow

- Fees associated with loans

Are Better Personal Loans Available at Online Lenders?

Online lenders have revolutionized personal loan lending. You don’t have to visit a physical branch to apply for a personal loan or to have a lender evaluate the information necessary to determine eligibility for a loan.

Online lenders may allow you to check for pre-approval without a hard inquiry, which could impact your credit score. They can process most applications almost instantly, allowing you to find out if you’ve been approved quickly.

Online lenders may be able to disburse funds quickly, too. You may be able to get your funds as soon as the same or the next business day.

Online lenders vs. brick-and-mortar lenders

Online lenders have much more competition than physical lenders. You can easily visit one of several potential loan originators’ websites with the click of a button.

For this reason, they may offer the most competitive loan options with the best interest rates and lowest fees.

Physical lenders know they aren’t the only option, too. As expected, this makes some physical lenders try to compete with online lenders.

Ultimately, you should compare both physical and online personal loan lenders to find the best option for you. However, you will likely find the most competitive personal loan options online.

How to Pick the Right Personal Loan for Your Needs

Each person has different reasons for taking out a personal loan. Some need money as fast as possible to pay a bill that can’t be late. Others may have more time to gather funds for a project they’re working on.

When evaluating lenders and loans, knowing what loan features are most important to you is vital. Here are a few ideas to help you find the best loan for you.

Loan amount

Each lender may have a different range of amounts they’re willing to lend. Most lenders have a minimum loan amount. These minimums could be as low as $100. They also have maximum loan amounts, such as $25,000 or $100,000.

These minimum and maximum amounts may not matter much for your situation. Lenders will only approve you for a loan amount they’re comfortable allowing you to borrow.

Interest rates

Interest rates are one of the key features determining how much a personal loan will cost you as you repay it.

Generally, the lower the interest rate, the less you’ll repay the lender. If all other factors are equal, a lower personal loan interest rate will likely save you money.

Fees

Each lender may have different fee schedules for their personal loans. You shouldn’t have to pay a fee to apply for most personal loans, but some lenders may charge a fee.

The biggest fee to watch out for is an origination fee. These fees are typically a percentage of the loan amount that must be paid to the lender to take out a loan.

A 1% origination fee on a $10,000 loan costs you $100. This fee results in you receiving only $9,900 from the loan disbursement.

Funds disbursement

Some lenders may be able to disburse the funds from an approved loan the same or the next business day.

Others may take up to a week to get the loan funds to you or the desired location.

Loan term

Lenders may offer different loan terms from each other. Some even offer different loan lengths based on your use of the funds.

Longer loan terms result in paying more interest if all other factors are the same. In general, longer-term loans often have higher interest rates, too.

Discount availability

Discounts may be available at some personal loan lenders. In particular, you may qualify for a relationship discount at some institutions. Others may offer a discounted interest rate for setting up automatic payments, as well.

What You Need to Apply for a Personal Loan

Applying for a personal loan is relatively straightforward. Each lender may require different documentation. In general, here’s the information you may be requested to provide:

- Proof of your identity (Driver’s license, passport, etc.)

- Proof of your address (Utility bill, mortgage statement, etc.)

- Social Security Number

- Proof of income or employment with verification (W-2, 1099s, tax returns, etc.)

- Information about your highest level of education

- Desired loan purpose and amount

Improve Your Chances of Getting Approved

Nothing can guarantee you’ll get approved for a personal loan. That said, preparing your finances and your credit ahead of time could potentially help improve your chances of approval.

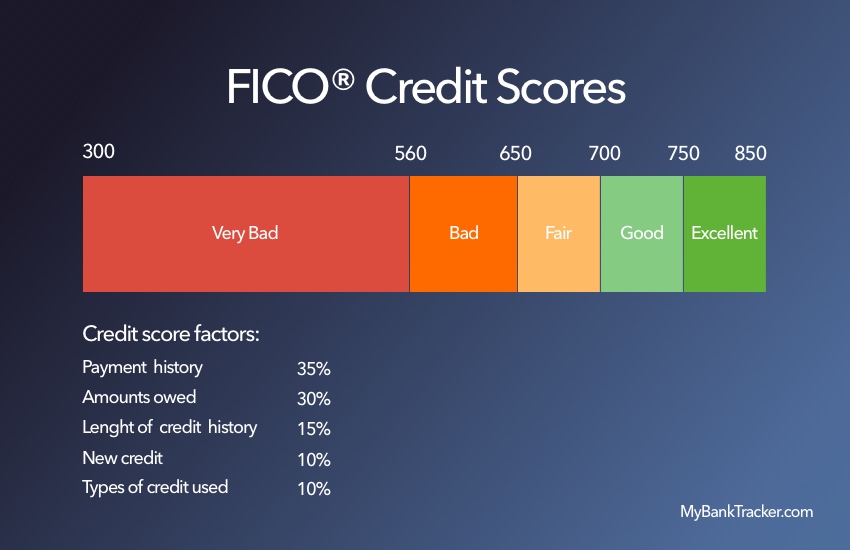

Review your credit

Start by taking a close look at your credit report. You can request this for free from AnnualCreditReport.com (officially authorized by federal law).

Look for any errors or inaccuracies and contact credit bureaus to fix them. Fixing a negative error could help increase your score.

Credit utilization ratio

One of the significant factors you can improve quickly is your credit utilization ratio. This is the amount you’ve borrowed compared to the maximum loan amount that you’re able to borrow.

By paying down existing debt, you lower this ratio. This could help your credit score, depending on your specific credit profile. This can be easier on revolving credit lines, such as credit cards, compared to larger loans, such as mortgages.

Debt-to-income ratio

Another way you can help your approval odds is by decreasing your debt-to-income ratio. You can do this by lowering your monthly debt or increasing your income.

The fastest ways to increase income could include getting a part-time job or starting a side hustle, such as driving for Uber.

Find the Best Personal Loan for Your Situation

Each person may have different priorities and needs for a personal loan. Check our top personal loan lenders in Alabama and compare them to any online lenders you may be considering.

Then, choose a lender that best fits your needs. Don’t forget to look for the lowest overall cost of borrowing when evaluating lenders, as this can make an enormous difference in the amount you repay.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Each lender processes personal loan applications in different ways. Some lenders may be able to approve or deny your loan almost instantly. Other lenders may require a manual review process that could take a few days to a week or so.

If speed is important to you, choose a lender that processes applications quickly.

How long does it take to receive funds from a personal loan?

Like with loan approval times, the time it takes to receive funds from your loan varies by lender.

Some lenders may be able to get you funded as soon as the same day or the next business day. Others may take up to a week to get the funds disbursed.

Check with your potential lender before applying if the timing of disbursement makes a difference to you.

Can I use a personal loan for any reason?

Many personal loans allow you to use the funds for any reason. Some personal loan types, such as debt consolidation personal loans, may require you to have the funds disbursed to the other lenders, though.

Check with a lender before applying to see if any restrictions exist on the money disbursed from the loan.

Will applying for a personal loan affect my credit score?

Applying for a personal loan will impact your credit score. A loan application requires a hard inquiry on your credit report. This usually has a slightly negative impact.

Some lenders may allow you to apply for pre-approval without formally applying for a loan. In these cases, the lenders may only use a soft pull which may not affect your credit score.

Even so, you must formally apply to get the loan. This will have an impact.