The Best Personal Loans in Mississippi for 2026

Personal loans let you borrow money without putting up your home equity or a paid-off car as collateral. This gives a wide range of people access to cash for virtually anything they can think of.

People may use proceeds to pay for a home improvement project, to consolidate debt, or to go on a much-needed vacation.

Finding the right personal loan isn’t difficult but can take time. Some lenders offer competitive loans to win business, while others provide less competitive terms while hoping people don’t shop around.

To help reduce the time you have to spend to find the best loan, we found the top personal loan lenders in Mississippi. Here’s what you should know.

The Best Personal Loans in Mississippi

These three lenders stood out above the rest in Mississippi and are listed in no particular order:

- Wells Fargo

- Regions Bank

- Hope Credit Union

Wells Fargo

Wells Fargo’s personal loans offer a large range of possible loan amounts. If you qualify, you can take out a loan for as little as $3,000 or as much as $100,000. You can repay loans over one to seven years, depending on the term you qualify for and select.

Wells Fargo’s loans have competitive interest rates, no origination fees, no application fees, and no prepayment penalties. Funding can be paid out as soon as the same or the next business day after approval.

Regions Bank

Regions Bank’s fixed-rate personal loans offer competitive interest rates and quick online pre-approval. Loans can be funded as fast as the same business day of approval if you apply online.

The bank offers a variety of loan terms and doesn’t charge prepayment penalties, application fees, or origination fees. Loan amounts start as low as $2,000 and reach as high as $35,000 for non-customers and $50,000 for customers.

Hope Credit Union

Hope Credit Union’s Borrow and Save loans allow you to borrow $500 for six months or $1,000 for 12 months. These are extremely small dollar amount loans with concise terms. You do have to pay a $10 application fee, which equates to 2% of the loan amount if you opt for the $500 option.

Methodology

To find the top lenders in Mississippi, we used the FDIC’s June 2023 data to identify the top 50 banks based on each bank’s deposit market share–serving borrowers in major cities including Jackson, Gulfport, Southaven, Biloxi, and Hattiesburg.

Next, we examined each bank’s personal loans using these characteristics:

- Interest rates offered

- Loan terms available

- Loan amounts allowed

- Fees

Do Online Lenders Offer Better Personal Loans?

Most people likely consider their bank or credit union first when they’re thinking about getting a personal loan. However, many online companies also offer personal loans. You may be surprised to find out they’re worth considering.

Online lenders don’t have to pay for brick-and-mortar branches and can use that advantage to offer lower-cost loans. Many online lenders also use technology to their advantage to provide quick application decisions and fast funding.

You shouldn’t just pick one online lender and assume they’ll have the best offer. Online lenders have to compete with each other. Some offer better rates and terms than others.

You shouldn’t rule out physical lenders, either. They know they must compete with online lenders and have started offering quicker processing times, and funding times, and sometimes even compete with rates, too.

You may have established a relationship with your brick-and-mortar lender. This could help lock in relationship rate discounts. It can also allow you to argue your case if your application is on the fence of getting approved or denied.

To make sure you’re getting the best personal loan, you have to shop at both online and physical lenders. Get rate quotes to see what you qualify for before deciding whether an online or physical lender is better for your next personal loan.

What Loan Factors Are Most Important to You?

Lenders offer a wide range of personal loan options to appeal to the different needs of each customer. Each lender has different loan options and loan terms. When looking at lenders, you need to make sure their loans meet your needs.

Your needs won’t be the same as your neighbor’s. Your neighbor may want to get the money to repair a leaking roof as quickly as possible. You may want to shop around for the best rate for a non-urgent project.

Here are a few aspects you should consider when setting your priorities.

The amount available to borrow

Lenders each have different loan amount ranges. It’s common to see loans in the $5,000 to $25,000 range. Lower and higher loan amounts exist but may be harder to find.

Interest rate paid

The interest rate is one of the largest costs of a loan. Shopping for the best rate is often a priority. Even so, you may be willing to take a rate that’s slightly higher than the best rate for faster processing and funding times.

Fees paid

Application fees, origination fees, and prepayment penalties aren’t often found on most personal loans today, but some lenders still charge them. Late fees are standard if you make a payment late, though.

In particular, you should watch out for origination fees. These are often a percentage of the loan amount and reduce your loan proceeds. A 1.5% origination fee on a $30,000 loan results in a $450 fee and may lower your loan disbursement to $29,550.

Funding speed

Funding speed is how fast you get money from the loan after approval. Many institutions provide funding as soon as the same business day as approval. Others may take a few days, a week, or longer.

Length of repayment period

Each lender sets the loan lengths they allow. Three to five-year loan terms are typical. Shorter terms, such as one year, and longer terms, such as ten years, may be possible to find but aren’t as common.

Loan discounts

You may qualify for a lower interest rate on your loan with a discount. Discounts may be offered for your relationship with the bank before applying. Another common discount arises when you make automatic payments from a linked checking account at the same bank.

Gather This Information Before Applying

Filling out a personal loan application isn’t hard. It’s easier when you have this information ready before you apply:

- Identification (Driver’s license, passport, etc.)

- Address verification (Utility bill, mortgage statement, etc.)

- Social Security Number

- Proof of income and employment (W-2, 1099s, tax returns, etc.)

- Highest education achievement level

- Loan amount you need

- Loan usage requested

- Desired loan term

Prepare Your Finances to Potentially Increase Approval Odds

If you need to apply for a loan, you want to have the best chance of getting approved. Nothing guarantees approval. That said, lenders do look at some key metrics that you may be able to influence before applying.

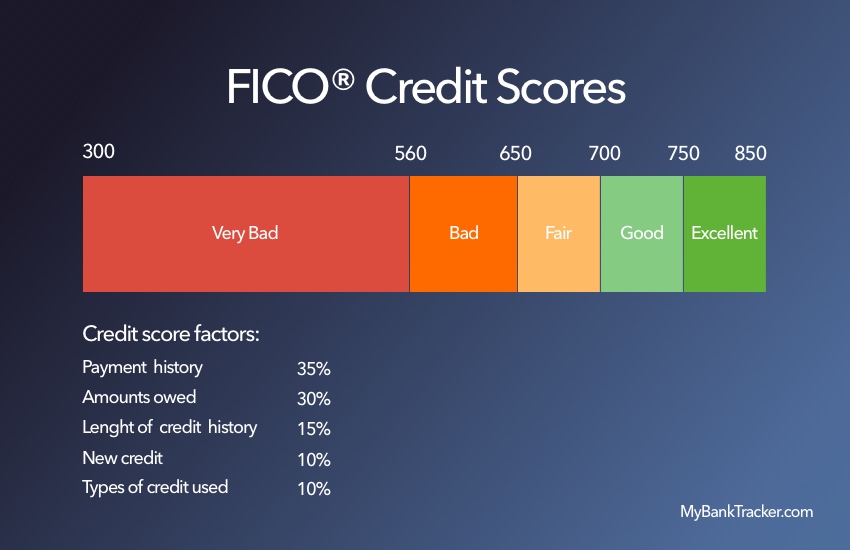

Your credit score

Lenders look at your credit score to help determine how likely you are to default on the loan. This score comes from information in your credit report.

Review your credit reports for errors and get any inconsistencies fixed before applying for a loan. You can get a free copy of your credit report from the three major credit bureaus at AnnualCreditReport.com.

You can also act on how you use credit to influence your score. One significant factor in the scoring formula is your credit utilization ratio. This measures the amount of credit you use against your credit limits.

Paying down a maxed-out credit card to a more reasonable ratio, such as 30% or less, could help improve your score.

Debt-to-income ratio

Another key metric lenders look at is your debt-to-income ratio. This compares your monthly debt payments to your monthly income. You can improve this ratio by decreasing your debt payments or increasing the amount of income you bring in.

Reducing debt payments only works if it results in a smaller monthly payment. Paying extra on a car loan won’t do this, but paying extra on a credit card balance might.

Increasing income could be an easier task, depending on your finances. Lenders will want documentation of the income. You likely want to pick up a part-time job or a side gig with earning documentation, such as being an Uber driver, to help increase income.

Take Action to Find Your Best Lender

Finding the best lender for your personal loan should now be more straightforward. After establishing your priorities, look at our list of the best personal loan lenders in Mississippi. Then, compare your top choice to online lenders.

Remember, each lender evaluates your application based on their rules. That means you may receive different terms and interest rates from each institution. You can use this to your advantage to shop for the best offer.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

Personal loan approval decisions can happen as quickly as seconds or minutes if automated decisions can be made. Sometimes, a lender needs more information or requires a human to evaluate the application. This can delay approval to days, a week, or more.

Other lenders use manual underwriting, where a loan officer considers every application. These processes usually are much slower and take days or a week or so.

How long does it take to receive funds from a personal loan?

Some institutions can get you the funds from a personal loan as soon as the same business day as approval. Others may take days, a week, or longer.

If timing is essential, check with a lender before applying.

Can I use a personal loan for any reason?

Each lender has its own rules. Many allow you to use the funds for any purpose.

Some specific loan types may require you to use the money for a stated purpose. Debt consolidation personal loans may require direct payment to your previous lenders.

Will applying for a personal loan affect my credit score?

Yes, a personal loan application results in a hard inquiry. This impacts your credit score negatively in most cases.

Soft inquiries may be used for pre-approval applications. These do not impact your score. They can not be used for a final loan determination.