How to Apply for New Loans After Defaulting on Student Loans

Defaulting on a student loan is a serious problem.

If you find yourself not being able to pay your loans, it can lead to the withholding of tax refunds, wage garnishment, and potentially lawsuits.

Despite these consequences, recent studies show that people aged 24 and younger, have close to $2 billion dollars in delinquent loans (31 to 180 days delinquent).

Fortunately:

Bad credit caused by defaulted loans isn’t the end of the world.

It’s still possible to apply for a loan, even with bad credit.

We’ll dive in to how you can reapply for a loan by helping you understand how student loans affect your credit, and the detailing the steps you can take to come back from defaulting.

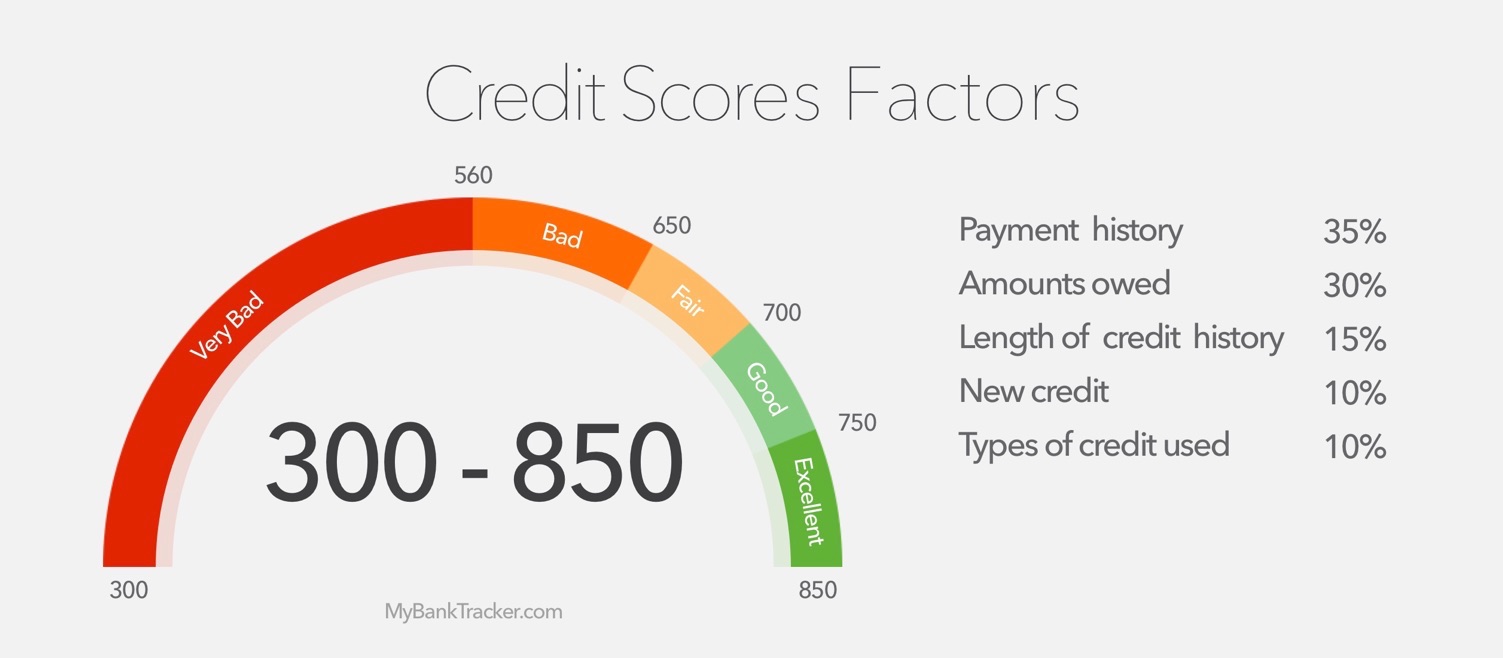

Student Loans Weigh Heavily on FICO Scores

Even if not in default, the average student loan debt of about $37,000 per student makes it one of the highest-balance debts for most people (second only to a mortgage).

According to MyFICO.com:

Approximately 65% of your FICO credit score is determined by the amount of money owed and the payment history of these debts.

Related: Can Your Credit Score Suffer Just Because You Have Student Loans?

A single late student loan payment is enough to cripple your credit score, making it much harder to obtain a mortgage, utilities, rental car/home, credit card, another loan, or even get a job.

Where Revolving Debt and Installment Loans Differ

On top of this,

Student loans show up on credit reports as installment debt, which is different than revolving debt.

Note: All credit cards, except for retail cards like a Best Buy or Sears credit card, are forms of revolving debt.

With revolving debt, the amount of available credit is taken into account.

For example, if you owe $1,000 on a credit card with a $5,000 limit, a creditor is more likely to give you a loan because you have $4,000 available credit that could be used to settle the debt.

Related: How to Calculate and Reduce Your Debt-To-Income Ratio

What Your DTI Ratio Means

| DTI Ratio | What This Means |

|---|---|

| 35% or less | This is the ideal debt-to-income ratio for most people who have any kind of debt. If you’re in this range, you’re in good-standing and your best bet is to avoid adding any other debts to your current situation. If do add more debt, make sure to make your monthly payments on time and pay it down as soon as possible. |

| 36% to 42% | Although this is not the ideal DTI ratio, it certainly is not a bad one. Keep paying down your debts in a timely manner and avoid incurring new ones, and you’ll see your DTI go down in no time. |

| 43% to 49% | This ratio is a red flag. A DTI in this range indicates that you might be in some financial hardship. It’s important if your DTI is in this range, to start aggressively paying down your debt to get it out of the red zone. Consider consolidating your debt to help reduce your interest rate and manage your monthly payments. |

| 50% or higher | This ratio is an extreme danger zone to be in. If your DTI ratio is 50% or greater, then half of your monthly income is going towards paying your monthly debts. You’ll not only have a hard time getting approved for new loans or credit cards, but your credit score will also be taking a hit. In order to decrease your DTI ratio, you should be doing all you can to pay down your debt. If you’re seriously struggling to pay down your debt and keep up with payments, consider filing for bankruptcy. |

Installment loans are one-time only, and the account will always be maxed out during the calculations.

This means if you owe $10,000, but your loan was originally $40,000, you do not have $30,000 available credit.

So, with a $11,000 total debt, you still only have $4000 available credit, which puts you closer to maxing out your overall available credit.

This makes you a riskier borrower in the eyes of any future creditors, who will be hesitant to lend you money.

The Costs of Bad Credit on Utilities and Rentals

Having a bad credit score doesn’t automatically disqualify you for a loan, but you’ll have higher interest rates and will be required to pay a higher down payment.

To illustrate this, take a look at wireless voice and data plans:

When signing up for a wireless plan, with a company like AT&T Wireless, you’ll have to pay a $440 deposit.

With Sprint or Verizon, this deposit can go as high as $1,000.

On top of this, you’ll have to buy the phone up front instead of spreading the cost into the monthly payments.

Although AT&T is advertising various BOGO offers for a free second device when purchasing an iPhone or Samsung Galaxy smartphone, you’ll be unable to take advantage of the offer because of bad credit.

These high deposits come up when renting an apartment, house, or car, and connecting electricity, water, or Internet service.

These deposits create a financial barrier to entry in which liquid assets are necessary and are held until you make 12 months of on-time payments.

How Bad Credit Affects Collateral Loans

In the case of auto and home loans, lower credit scores lead to higher interest rates.

The average interest rate for home loans is 4.37%, while a perfect credit score can get you 0% interest on many new cars.

With bad credit, most car dealerships won’t lend to you without a 20-30% down payment, and interest rates climb above 20%.

Mortgage borrowers with credit scores below 600 are considered subprime, and lending to these high-risk borrowers is one of the major causes of the 2007 mortgage crisis as massive defaults led to a collapse in home prices.

With a higher subprime interest rate, the down payment will be higher, and the interest rate quickly climbs.

Obtaining a Loan with Bad Credit

Despite having bad credit from a student loan, it’s still possible to get a personal, business, or collateral loan – it just takes more work and will likely cost more.

Here’s a quick breakdown of what you need to do based on the type of loan you’re looking to obtain:

Personal Loan

The first place you should look for a personal loan is your bank. Your bank can see more than just your credit history.

They also see your income, spending habits, and how much money is in your checking and savings accounts.

If you have enough income, it’s possible your bank will approve you for a loan. It’s less risk for them because they have direct access to pull payments from your account.

If your bank denies you, there are online services, which provide unsecured installment loans to people with low credit scores.

How Your Credit Score Can Affect Your Next General Loan

| Credit Score Range | HELOC | Home Equity Loan |

|---|---|---|

| 620-639 | 10.680% | 10.164% |

| 640-669 | 9.180% | 8.914% |

| 670-699 | 7.680% | 7.414% |

| 700-719 | 6.305% | 6.639% |

| 720-739 | 5.055% | 6.139% |

| 740-850 | 4.680% | 5.837% |

Auto Loan

Cars are lower cost than houses and easier/cheaper to repossess.

This means that while you may be a subprime mortgage borrower, you could still be a prime auto borrower.

Avoid used car lots that advertise to people with poor credit, as these have the highest interest rates.

Dealerships often partner with auto lenders, and it’s best to seek out an auto loan before looking for a car.

This gives you an idea of how much you can afford to spend.

If you go to the dealer, they’re likely to focus on monthly payments, which can be lowered by extending the term, costing you more in the long run.

Even with bad credit, shop around for the right car and try to buy as new as possible to keep repairs to a minimum.

A used car costs less up front but requires more maintenance over the life of the loan, which could end up costing more.

How Your Credit Score Can Affect Your Next Car Loan

| Credit Score Range | 60-Month new Car Loan | 40-Month Used Car Loan |

|---|---|---|

| 500-589 | 14.824% | 16.325% |

| 590-619 | 13.74% | 15.086% |

| 620-659 | 9.398% | 10.186% |

| 660-689 | 6.747% | 7.599% |

| 690-719 | 4.656% | 5.322% |

| 720-850 | 3.331% | 3.778% |

Home Loan

A subprime mortgage is much more difficult to get than it was before the collapse of the housing bubble in 2007.

Regulators cracked down on predatory lending practices, putting many subprime lenders (such as Countrywide Home Loans) out of business. Anyone with a credit score below 650 is a subprime borrower.

Obtaining a subprime mortgage loan should be done through the FHA, which lowers the down payment requirement from 20% to as low as 3.5% and is much more likely to be approved for borrowers with bad credit.

If you served (or are currently serving) in the military, you can qualify for a VA loan, which is guaranteed by the Department of Veteran Affairs.

Complete eligibility requirements for a VA loan are listed on the VA website.

How Your Credit Score Can Affect Your Future Mortgage Rate

| Credit Score Range | 30-Year Fixed Rate Mortgage | 5-year fixed rate mortgage | 7/1 ARM |

|---|---|---|---|

| 620-639 | 4.684% | 4.016% | 4.506% |

| 640-679 | 4.138% | 3.47826% | 3.96% |

| 660-679 | 3.708% | 3.04% | 3.53% |

| 680-699 | 3.494% | 2.826% | 3.316% |

| 700-759 | 3.317% | 2.649% | 3.139% |

| 760-850 | 3.095% | 2.427% | 2.917% |

Fixing Bad Credit from Student Loans

The recession from 2007-2009 created a surge in predatory lending practices, with cash advance and cash-for-gold businesses popping up all over the country.

Utilizing these types of quick-fix financial services is expensive and ill-advised, however, as they do not improve the root of the problem, which is a low credit score.

Here’s 5 quick ways to get your credit score back on track:

1. Obtain Credit Report

Improving your FICO credit score is only possible by finding ways to settle the student loan debt (and any other debts listed).

The first step is to request a free copy of your credit report from the three major credit bureaus, Experian, Equifax, and TransUnion.

You can obtain your credit report from AnnualCreditReport.com for free, from all three credit bureaus, once a year.

Under federal law, you’re entitled to a free copy of your credit report from all three agencies once every 12 months.

If you’ve already applied for a loan and been denied for bad credit, the creditor is required to offer you a copy of your credit report as well, so you can see exactly where you stand and why the decision was made.

Armed with this knowledge, you can create a financial plan to increase your credit score.

2. Prioritize Debt

The first debt you should prioritize is your mortgage, and the second should be your student loan as these are the largest debts with the biggest effect on a credit score.

Keeping these two bills current is enough to raise your score within six months, as credit reports typically only show the status of each account for the last six months (although seven years are accounted for in the score).

It’s easy to blow off a student loan to keep credit cards from cancellation for nonpayment, but the student loan is more important in the long-run.

3. Apply for Financial Hardship Exemptions

If you’re unable to pay a student loan due to financial hardship, apply for a deferment or forbearance.

Once approved, these options give you a 6- to 12-month break to get your finances in order. The loan will show current on a credit report during this time.

Deferment and Forbearance Pros & Cons

| Pros | Cons |

|---|---|

|

|

4. Re-Enroll in College

Continuing your education is another option for people having trouble paying their student loans.

Enrolling in school part-time with at least six credit hours per semester delays payments of a student loan (and in the case of subsidized loans, it also halts interest accrual).

However, it’s important to know that if you defaulted on your current loan, you would be ineligible for any further student loans until the account is brought current through a payment plan.

5. Apply for Bankruptcy

It’s a common misconception that student loans can’t be included in bankruptcy, but this is not true.

It’s harder to discharge a student loan during Chapter 7 or Chapter 13 bankruptcy, but not impossible.

Student Loans in Chapter 7 Bankruptcy vs. Chapter 13 Bankruptcy

| Chapter 7 | Chapter 13 |

|---|---|

| You have little to no income to pay off your debt (and you’re able to prove it) | You have a fair amount of income that allows you to pay off some of your debt |

| Most if not all of your debt will be erased and there will be no repayment plan | Your debt is restructured – so a repayment plan will be set up to suit your disposable income |

| Process to absolve debt could take 3 – 5 months | Agreed upon repayment plan could last 3 – 5 years |

It’s true that courts are often reluctant to include student loans in bankruptcy, but few people even try because they’re under the incorrect assumption that they don’t qualify.