What Banks Do With the Money in Your Savings Account

That old adage of how a penny saved is a penny earned is exactly how banks make money through the money you save with them.

When you put your hard-earned money in a savings account, the bank pays you interest. It’s a pretty sweet bonus to have for simply depositing money. Do you ever think about why your bank pays you interest, and most importantly, how does it afford to pay you?

Here’s how: The money your bank pays you interest with comes right from the savings or checking account you’re earning interest on. Part of how banks earn money involves leveraging your deposits to make profits, which, in turn, they pay back to you to keep your money with them.

How Banks Make Money

The banking business model is a matter of using customer deposits to offer loans, and from those loans, your bank earns interest that is transformed into interest paid to you.

This begins to explain where a bank finds the money to pay you interest. The money doesn’t materialize from thin air. Your bank needs to make money somehow, too, and what better way than savings account deposits?

Banks use your money to make money

Each time you make a deposit, your bank essentially borrows some of that money from your account and lends it out to other borrowers, whether it’s an auto or home loan, a personal loan, or credit.

Remember that time you took out a loan from your bank? The money you borrowed was culled from the deposits of other customers. The interest you paid on the loan balance added up as a perfect source of revenue for the bank, part of which they repaid back to those deposit makers.

Likewise, your deposits — from savings, certificates of deposit, money market accounts, etc. — go to fund loans for other people, and the interest they pay back becomes some of the interest you’ll earn on your account. Technically, you’re lending your own bank some money, and they pay it back, with interest, the same as on any loan.

But since banks are in the business of making money, they’ll never pay more interest than they can charge. A high-yield savings account may yield you interest to the tune of 1.25% APY, for example, but your bank might charge 5% on a loan (or higher, depending on the loan) — meaning that the amount they give back to customers is just a small fraction of what they may potentially earn on the whole.

The wider the difference between interest rates, the more profit a bank makes. For instance, a bank may offer the lowest current deposit interest rate, 0.06%, but set an 18% rate on one of their credit cards. The interest they pay is greatly offset by what they can earn from lending money. So if you deposit $5,000 into a savings account, you might earn a 1.00% interest rate, but your bank can lend out a majority of that money at a far higher rate, enough for a profit and to pay your interest.

Find the best rates

Unlock exclusive savings rates and gain access to top-tier banking benefits.

Why Doesn’t My Money Disappear?

So if the bank borrows from your deposits to make loans, why isn’t your savings/checking balance lower than your original amount? How can the money be loaned out but still be available for you to withdraw?

It sounds like your cash has the uncanny ability to be in two places at the same time — your bank account and on loan to someone else.

That’s not exactly the case; if it was, banks would loan out all their money, and you’d get an I.O.U. each time you try to make a withdrawal. Banks aren’t allowed to just loan every single dollar out.

Regulations on bank reserves

As per federal requirements, banks and depository institutions need to keep a minimum reserve of money on hand at all times, specifically so there’s enough cash flow to transact with depositors on a day-to-day basis. That means banks can only loan out a fraction of what they actually have on hand, giving them enough to build some profit from, but without depleting their vaults or customers’ deposit accounts through Federal Reserve funds.

This gives banks the ability to strike a lucrative balance. By receiving a deposit from you, they’ve earned your business, giving them some financial capability to loan that money out and earn some interest. In return for the favor, you’re repaid some interest too, a nice perk that serves to attract and retain new customers.

Some other ways banks make money and generate profit:

Fees

Banks charge fees to pay their regular operating expenses, and too basically stay in business. There’s a reason why a brick-and-mortar bank with physical walk-in branches may charge higher fees than a not-for-profit credit union or strictly online banking provider. They have employee salaries, electricity to turn on, and paper deposit slips to pay for.

Overall, most banks will charge some kind of fees. Overdraft fees, ATM fees, credit card penalty fees, minimum account requirement fees, teller fees, loan or account application fees, or early CD withdrawal fees are just a few examples of how a few dollars here, a few dollars there bring in major earnings for banks.

Underwriting/credit checking

Underwriting is basically a step that banks and lenders take before loaning money. It’s an initial series of steps taken before granting a loan in order to reduce their risk of losing money on a loan.

On most loans, underwriting involves checking the creditworthiness of an applicant — their credit score and history — to gauge how likely they are to repay the money they’ve borrowed. It’s a way to calculate a bank’s financial risk, versus reward, before lending money. Without this process, banks would loan money to anybody, increasing the chances of delinquent/defaulted loans that can lose a bank money.

Commercial underwriting isn’t how a bank earns money; the repayment of a loan is. But it’s a process a financial provider goes through to ensure that it doesn’t lose money in order to earn it.

Investment underwriting

With investing, underwriting takes on a slightly different definition, albeit one that’s based around minimizing risk. Say a company goes public and starts selling stock to investors on the stock market. Banks need to assess the risk of losing money on the stocks/securities being sold; if they can’t sell enough stock or fund enough buyers at the price they’ve set, the bank stands to lose money by reselling the stock at a far lower price. For investors, that would be like your employer telling you that they can’t afford to pay you after you’ve been promised a certain amount of money.

If it’s stock that’s in high demand (like Apple, for one), there’s no doubt that it’ll sell; but in cases where most investments are involved, underwriting assesses the risk of losing money so a bank can earn it.

Getting the Most From Your Deposits

When you make a deposit, your bank is making money from your money and paying a portion of it to you. Money goes in, interest eventually comes out. With that, you should do your best to earn the best interest rate possible; if your bank is making money off of you, you should try to make as much money as you can off of them!

Choose high-yield deposit accounts

High-interest-bearing products like CDs are a smart alternative to leaving money in a standard savings account. By agreeing to keep your money on deposit for a predetermined period of time, your interest rate goes to work and earns you dividends. (You can also strategically reinvest the money, such as with CD laddering.)

With CDs, the longer the term, the higher the interest rate. If you like immediate liquidity and access to your money, choose a high-yield savings or checking account that balances high interest rates with the convenience of everyday banking.

Opt for an online bank

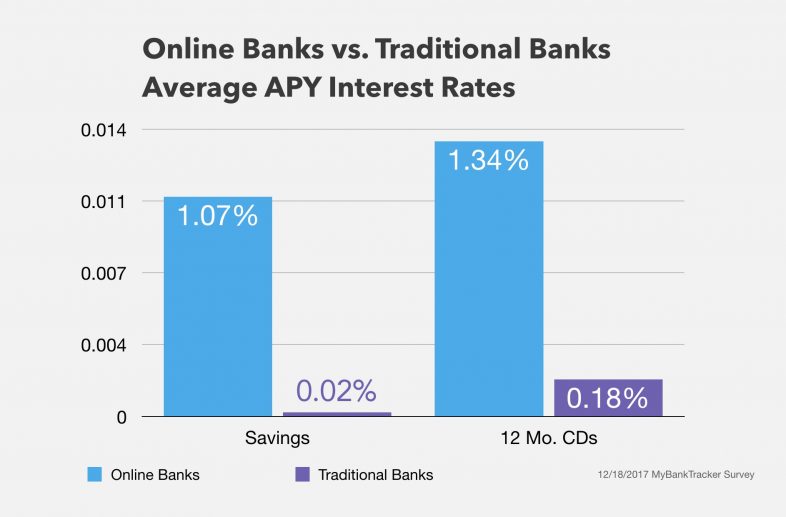

Online banks tend to offer lower fees and higher interest rates than what you’d get from a major national bank. The reason? They have an absence of physical branches and overhead/operational expenses. Without those costs to contend with, online banks can instead pay the money they earn from repaid loans to what counts most: its customers. They can afford to offer higher interest rates on their deposit products, just one attractive selling point for customers who want higher earnings and a more convenient banking experience.

Go for a credit union

Credit unions are nonprofits without a conventional stockholder structure. Here, customers are the shareholders, and your deposits, the capital a credit union needs to stay in business. As nonprofit, credit unions have no outside stakeholder funding, and rely on the business of its depositor base. In turn, that means whatever profits the credit union earns gets turned around back to you, the customer, in the form of better products, fewer fees, and bigger APYs.

Conclusion

Banks use your money to make money to make you money; it’s the natural cycle of banking business that keeps you and your bank profiting from each other.

With that in mind, the most proactive thing you can do if you have a deposit account is to make sure you’re getting a good savings rate. Shop around for the right products and the right bank, to maximize your earning potential. Interest is passive income, but by taking an active role in finding the best interest rate possible, you can make your money go further than ever.