6 Tips on How to Stop Living From Paycheck to Paycheck

Do you find that you make a decent income but can’t seem to break out of living paycheck to paycheck?

When is the last time you really looked at how much you were spending and saving? Do you know how to build your wealth?

About 78% of workers are living paycheck-to-paycheck to make ends meet, according to a recent study done by CareerBuilder. It’s a proven fact that if workers’ financial stress is on the constant forefront of their mind, their work performance will greatly decrease.

It’s time to get ahead of your stressful finances and free up your mind to better your work performance, financial situation, and overall life.

In this article, I outline six actions you can make today, to help you finally take control of your finances tomorrow.

1. Find out where all of your money goes.

The money you make doesn’t spend itself and until you know where your financial leaks are you won’t be able to do anything about them.

In a SunTrust survey, nearly a third of households earning $75,000 or more annually lived paycheck to paycheck. From that survey, 44 percent of those that said they lived paycheck to paycheck cited “lifestyle purchases” as the main reason they weren’t able to get ahead.

Nearly 70 percent said eating at restaurants was the biggest drain on their wallets. Spotting trends in your spending patterns isn’t that difficult — it just involves keeping track of where your dollars are going.

The first step is to use a solid expense-tracking apps.

For example, the Mint app automatically records your purchases and allows you to categorize and tag them so you can see at a glance what’s eating up the most money each month.

Once you identify what your financial Achilles’ heel is, you’re in a better position to make conscious decisions about cutting those expenses out so you’re not spending every last penny.

2. Refinance expensive debts.

If part of the reason you’re living paycheck to paycheck is because you’re servicing a decent amount of debt each month, getting rid of it is a top priority.

When you don’t have any savings you can use to wipe it out and your income and expenses are roughly the same, the best solution in the short-term is to make the debt more affordable.

Transferring your high interest credit cards to a card with a 0 percent rate is a good starting point.

The fee for transferring a balance is typically 3 to 5 percent of the amount so you’ll need to make sure the amount you’re going to save on interest cancels it out.

If you have student loans, consolidating your federal debts or refinancing your private loans can also yield a lower rate and potentially reduce your monthly payment.

Doing something as simple as signing up for your loan servicer’s automatic payment service can knock another 0.25 percent off the interest rate.

Did you know? You’ll need a solid credit score to refinance private student loans; otherwise, you’ll have to get someone to cosign before the deal can be approved.

3. Grow Your Emergency Fund

Start building an emergency fund. Today. Like right now. That means building some emergency savings so you can break the paycheck to paycheck cycle for good.

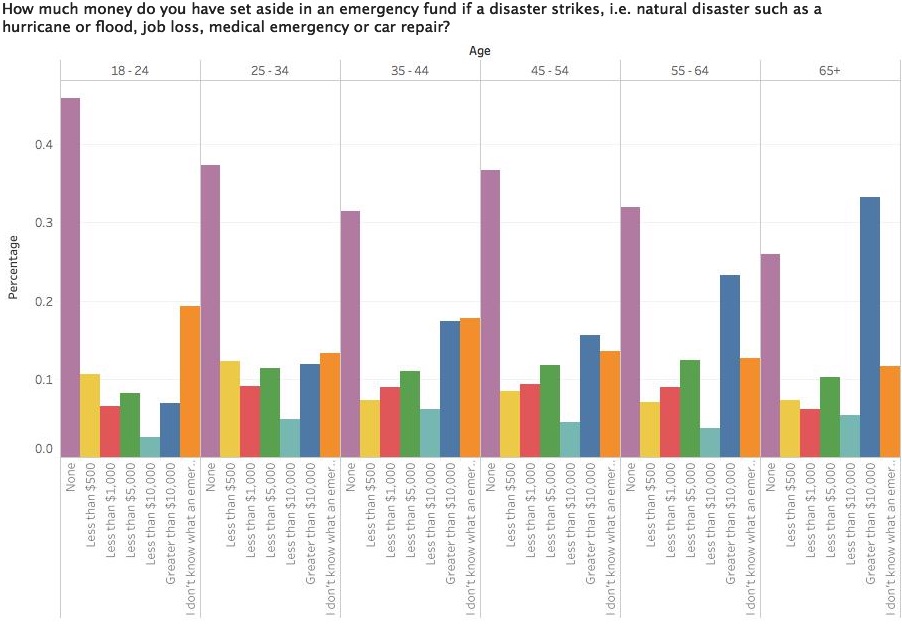

According to a recent study done by MyBankTracker, more than 4 out of 10 Americans claim that they don’t even have enough money set aside for a $500 unexpected emergency.

Ideally, your emergency fund should be large enough to cover anywhere from three to eight months’ worth of expenses, depending on your income, what your bills are and how many people your income supports.

[RELATED: The Best Savings Accounts for Your Emergency Fund]

When you’re just getting to the point where you’re in a position to save, trying to get all of that together at once can be totally overwhelming but breaking it down into smaller bites makes it less daunting.

For example, let’s say your initial goal is to save $5,000 over the next 12 months.

That comes out to about $96 a week you’d need to save or $14 a day.

Focusing on hitting that daily or weekly target isn’t as intimidating as trying to save big chunks of money all at once.

Don’t forget to ditch your big bank’s savings account for a free online account that will earn you more money on interest.

4. Increase your 401(k) by at least 1 percent.

Chances are your employer probably offers decent benefits, some of which might include a 401(k) or similar retirement plan.

Just like with your emergency fund, you can increase your retirement savings in small steps.

Bumping up your contribution amount by 1 percent each year, for example, isn’t going to make a huge dent in your take-home pay but it will make a big difference in the size of your nest egg, over time.

If you can, make it a point to max out your 401(k) since you can contribute up to $18,500 a year (if you’re under the age of 49). If you can’t, increase your contributions as aggressively as you can.

For instance, if you get a raise, increase the amount you’re putting into your 401(k), so you don’t even see the increase in your paycheck. Saving money in these accounts offers several benefits that you can’t afford to pass up.

First, you’re building your nest egg while reducing your taxable income. A higher salary means a higher tax bracket, which in turn means more money Uncle Sam takes out of your check.

2020 Tax brackets

| Tax rate | Income |

|---|---|

| 10% | $0 – $9,875 |

| 12% | $9,876 – $40,125 |

| 22% | $40,126 – $85,525 |

| 24% | $85,526 – $163,300 |

| 32% | $163,301 – $207,350 |

| 35% | $207,351 – $518,400 |

| 37% | $518,401+ |

Deferring some of your salary into a 401(k) reduces the amount you owe taxes on during the year. There’s also the chance to score free money if your employer matches part of what you put in.

Contributing 10 percent of a $75,000 salary from age 35 to 65 would yield give you a balance of about $735,000, with a 7 percent annual rate of return.

If your employer offers a 50 percent match up to the first 6 percent of your salary, your balance would grow to $955,000.

Tip: If you’re enrolled in a high deductible insurance plan, check to see if it offers a Health Savings Account. The money you save in one of these accounts is tax-deductible and withdrawals for qualified medical expenses are always tax-free.

5. Scale back on credit cards if you’re in debt.

Living paycheck to paycheck makes it tempting to turn to credit when you’re running low on cash but that’s not territory you want to venture into lightly.

While a credit card can be an excellent tool for building your credit score or earning rewards, there’s a right and wrong way to use it.

The two most important things you can do when it comes to credit is to always pay the bill on time and only charge what you can afford to pay off each month.

If you’re already in debt from credit cards or student loans, you’re better off leaving your plastic at home and sticking to cash or debit in the meantime.

6. Get renters insurance.

More than a third of Americans rent versus owning a home and surprisingly, 66 percent of them don’t have insurance to cover their personal items against fire, theft or other loss.

Cost is cited as the number one reason but basic coverage is actually very affordable.

A typical renters insurance policy costs between $15 and $30 per month, according to the National Association of Insurance Commissioners.

For example, on a $30,000 policy the premiums would run about $25 a month.

Renters insurance is especially important when you live paycheck to paycheck and don’t have a completed emergency fund.

If something happened and you lost everything, your policy would give you enough money to start over, which would save you from having to turn to credit to fill the gap.