10 Best Budgeting Apps To Help You Manage Debt

Though aspiring to a debt-free life is a wonderful thing, for many people it is a long way away. Student loans, car loans, mortgages, and credit card debt, and other forms of household debt are at all-time highs.

If you are one of the millions of consumers who have debt, you may be wondering what the best way to manage it, and ultimately pay it off, is. This article will take a look at ten apps designed to help you become debt free.

10 Best Apps to Track and Manage Debt

| App Name | Price | Device Compatibility |

|---|---|---|

| Mint | Free | • iOS • Android • Web-based |

| CreditWise | Free | • iOS • Android • Web-based |

| You Need A Budget (YNAB) | $83.99/year | • iOS • Android • MacOS • Windows |

| Prism Money | Free | • iOS • Android • Kindle Fire Devices • Windows Phones |

| Undebt.it | Standard account is free (premium account is $12/year) | • Web-based • Can be used on most devices with internet access |

| Debt Free – Pay Off Your Debt | $0.99 | • iOS |

| Clarity Money | Free | • iOS • Android |

| Experian | Free (with in-app purchases) | • iOS • Android |

| Strong Manager | $0.99 | • iOS |

| Unbury.me | Free | • Browser-based |

1. Mint

Mint, from Intuit, the creators of TurboTax, is a great tool that helps you track everything in your financial life. You can link all of your accounts to get a snapshot you’re your assets, debts, transactions, and monthly budget, all in one place.

How does it help track debt?

When you create a Mint account, you’ll be prompted to link all of your financial accounts. This includes your bank accounts, investments, your car loans, mortgages, and credit cards. Mint imports all of your information and will keep track of how much you owe on every debt you have.

Mint has a handy goals feature, which you can use to plan for goals you have. One option is the goal to pay off a specific loan.

Just tell Mint what loan you want to pay off. It will tell you how much it will cost if you pay just the minimum each month, as well as how long it will take. You can input higher payment amounts to see how much time and money you’ll save by avoiding interest. Then, you just need to stick to your payment plan. Mint helps with that because you can use its transaction tracking to make sure you’re not overspending.

What does it cost?

Mint is completely free to use. Intuit makes money on it by offering advertisements and referrals to financial services companies.

What devices is it compatible with?

Mint is available online through any computer with an internet connection. It also offers iOS and Android apps.

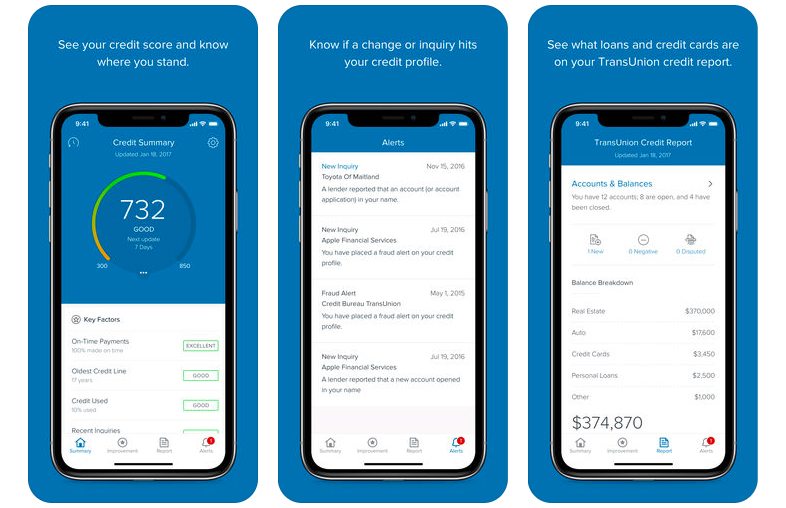

2. CreditWise

CreditWise is a credit-tracking and debt-monitoring tool offered by Capital One.

How does it help track debt?

CreditWise helps track debt by giving you weekly snapshots of your credit report. You can see the age of your accounts, how many inquiries appear on your report, and other information. One of the things you can see is how much credit you have available, as well as how much you’re using.

What does it cost?

CreditWise is free for everyone, not just Capital One customers.

What devices is it compatible with?

You can get to CreditWise through the web, or Capital One’s iOS and Android apps.

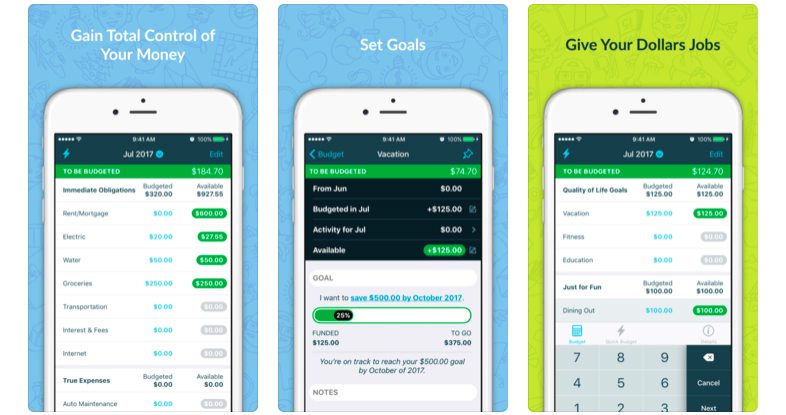

3. You Need a Budget (YNAB)

You Need a Budget is a budgeting software that can track more than just your budget.

How does it help track debt?

Like Mint, You Need a Budget (YNAB) tracks your accounts and spending. You can link accounts directly, or enter the information manually.

With YNAB, you can see all of your loan balances in one place, whether they be credit cards or other types of loans. You can also see every purchase you put on a credit card, so you can see the balances rise in real-time.

YNAB doesn’t offer a goal feature like Mint, so it’s up to you to create a payment plan. Once you do, YNAB can help you follow it by letting you track spending to avoid using too much cash on things other than debt payment.

What does it cost?

You Need a Budget costs $83.99 per year. It offers a 34-day trial, with a money-back guarantee.

What devices is it compatible with?

You Need a Budget works on Windows, MacOS, iOS, and Android.

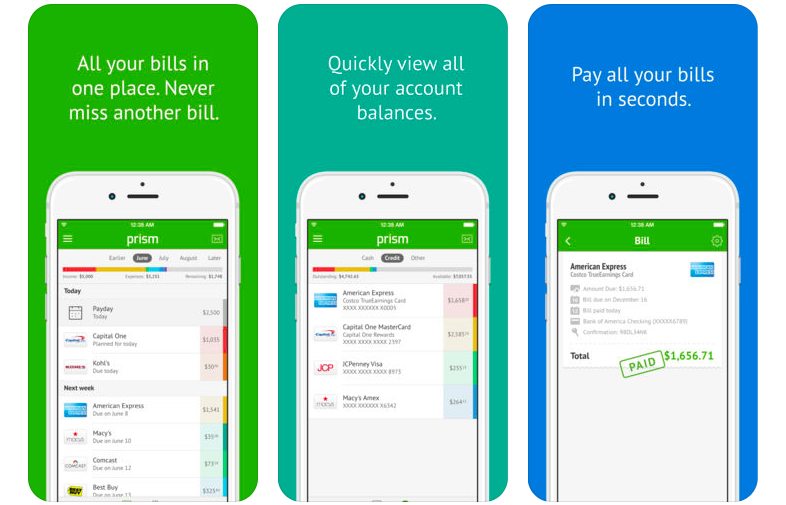

4. Prism Money

Prism Money is a bill tracking app that helps you know when payments are due.

How does it help track debt?

Prism Money helps you track due dates for bills, including payments to your creditors. When you set up an account, you’ll link your accounts to Prism. Whenever a bill comes, Prism will let you know. It’ll tell you the total amount of the bill, when it is due, and what account will be used to make the payment.

You can schedule the payment from the Prism app without having to log into the biller or lender’s system. That makes it easier to avoid missing payments and racking up huge fees.

What does it cost?

Prism Money is free to use.

What devices is it compatible with?

Prism Money is available for iOS, Android, Kindle Fire devices, and Windows Phones.

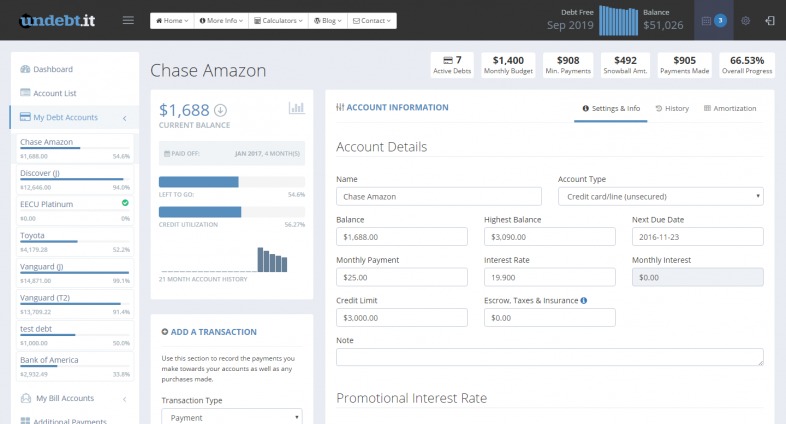

5. Undebt.it

Undebt.it is a “debt snowball management tool and payment planner” available through the web.

How does it help track debt?

Like most of these services, when you create an Undebt.it account, you’ll link your loan accounts to it. It will then let you track the balance and payment dates of each of the debts all in one place.

Where Undebt.it offers value is in its ability to create payment plans for you. You can choose from multiple payment strategies, including:

- Debt snowball

- Debt avalanche

- Debt hybrid

- Highest monthly payment

- Highest credit utilization

- Highest monthly interest paid

Each plan has its own benefits and drawbacks. Undebt.it can help you choose the one that is best for you and then help you execute it.

As a bonus, you can use the calculator without creating an account. You’ll just have to enter all of your debt information manually.

What does it cost?

Undebt.it is free to use. You can get a premium account with additional debt management features for $12 per year.

What devices is it compatible with?

Undebt.it is web-based, but mobile friendly, so you can use it from most devices with internet access.

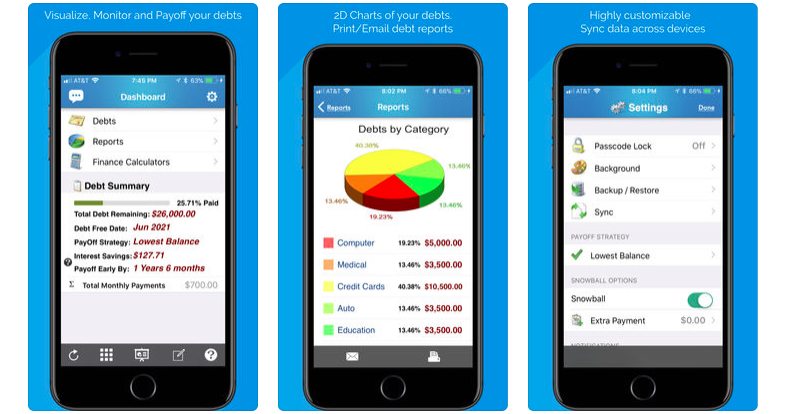

6. Debt Free – Pay Off Your Debt

Debt Free – Pay Off Your Debt is an award-winning app that helps manage your debt and save money.

How does it help track debt?

This app gives you a simple user interface that lets you track all of your loans in one place. You can use it generate reports showing your various types of debt and your progress towards paying each debt. You can also use it to track your payment due dates and amounts of each debt. If you’d like, it can notify you in advance of each debt’s due date.

It also features a number of tools that other apps don’t, including the ability to account for promotion interest rates, mortgage overhead costs, and extra payments.

What does it cost?

The app costs $0.99.

What devices is it compatible with?

The app is compatible with any iOS device.

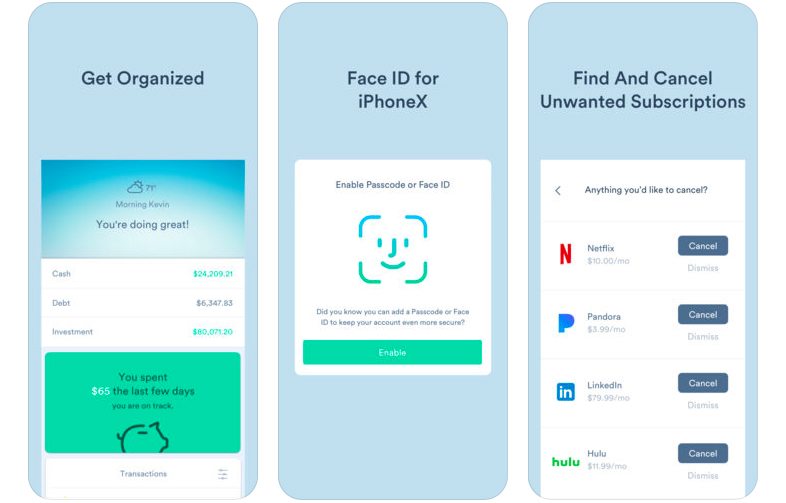

7. Clarity Money

Clarity Money is a financial tracking app and savings account all in one.

How does it help track debt?

Clarity Money works a lot like Mint, allowing you to link your accounts to the app. Every time you log in, the accounts will update, giving you live balances for all your accounts. This lets you see your credit card balances grow as you make purchases and see all your debts shrink as you make payments.

In addition to giving you a view of all your accounts, Clarity Money can help you avoid adding to the debt. It will provide personalized advice for saving money. It will also inform you of subscriptions you have that you may not use, and offer to cancel them on your behalf.

You can also use the app to create savings rules, like “save $10 every week.” You can use those rules to put money away for payments on debts.

What does it cost?

Clarity Money is free to use. It makes money through advertising.

What devices is it compatible with?

Clarity Money is compatible with Android and iOS devices.

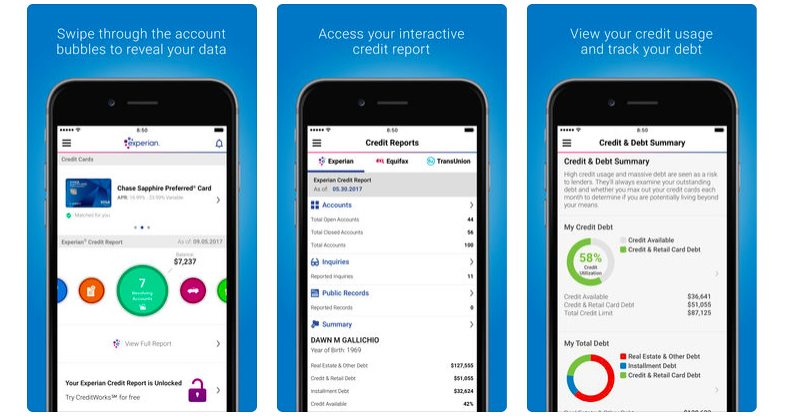

8. Experian

Experian is a U.S. credit bureau, so it’s no surprise they offer a credit-monitoring app that makes it easy to track your debt.

How does it help track debt?

Experian’s mobile app lets you keep a close watch on your Experian credit report. This makes it easy for you to track all of your loan accounts, and any changes that may occur. It also lets you stay on top of fraud because Experian will instantly alert you to any unexpected events that might affect your credit.

What does it cost?

Experian’s mobile apps are free with optional in-app purchases.

What devices is it compatible with?

The Experian apps are available for iOS and Android devices.

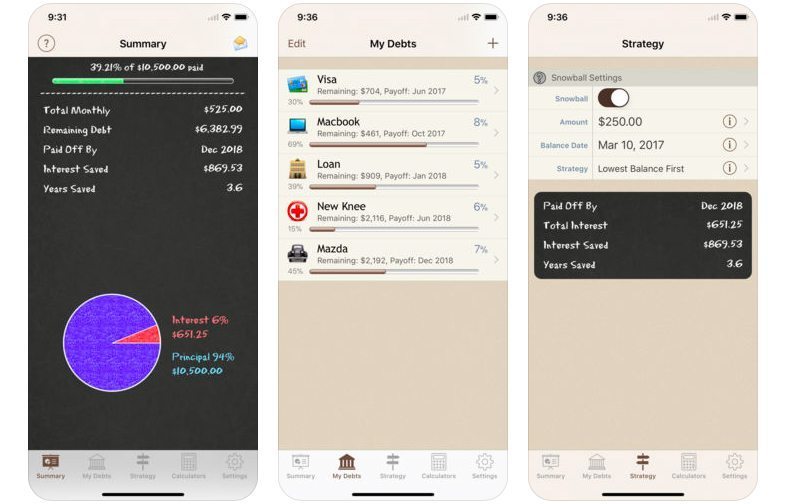

9. Debt Manager

Debt Manager is another iOS app that helps you pay off your debts.

How does it help track debt?

Debt Manager gives you an intuitive user interface that makes it easy to see all your accounts at a glance. You can import your various debts and it will automatically give you the total balance and help you choose a payment strategy.

You can enter as many debts as you’d like, and Debt Manager can handle complicated situations like introductory interest rates. It can also notify you of payment due dates so you never miss a payment.

You can track your payments in the app and use it to determine how much you’d save by making a change to your payment plan, such as increasing payment frequency.

What does it cost?

You can get Debt Manager for $0.99.

What devices is it compatible with?

Debt Manager is available for iOS devices.

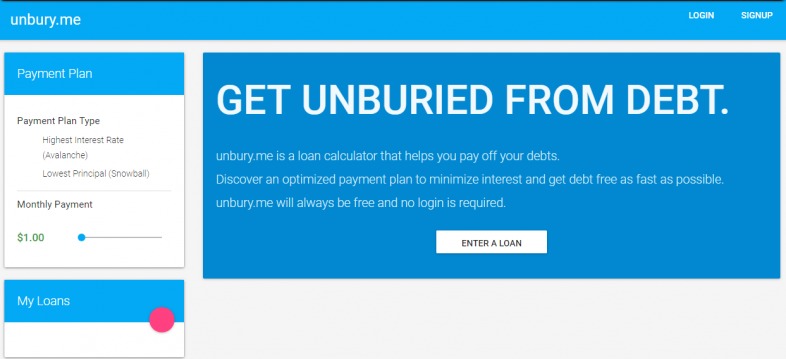

10. Unbury.me

Unbury.me is a web-based payment plan app.

How does it help track debt?

You can use the app with or without an account, but creating an account lets you save your loan information and makes it easier to run new simulations.

Once you create an account, you’ll have to enter your loan information, including the amount, interest rate, and minimum payment. Unbury.me will look at all your debts and tell you how long it will take to pay them off and how much you’ll pay in total.

From there, you can ask Unbury.me to create a payment plan, using either the avalanche or snowball method.

What does it cost?

Unbury.me is free to use.

What devices is it compatible with?

You can use Unbury.me is browser-based.

Conclusion

Handling debt can be stressful, so it’s natural to want some help. With one of these apps, you can track your debt, create a payment plan, and work towards being debt-free.