What’s a Perfect Credit Score Really Worth?

Your credit score has a huge impact on your financial life and it influences whether you’re able to get a credit card, finance a car or buy a home.

The higher your score, the easier it is to qualify for new loans and the less you’ll pay in interest for what you borrow.

Achieving a perfect score is considered the Holy Grail of personal finance and it’s something that only a small percentage of consumers are able to do.

It can take years to get your score to perfect status and it requires a commitment to practicing good financial habits. The question is, how much does having a perfect credit score really benefit you in the long run?

We dug a little deeper to find out what a perfect credit is worth. If your goal is to push your score into the perfect or near-perfect range, we’ve got some useful advice on how to get it there and what you can expect once you do.

What qualifies as a perfect credit score?

Pinning down a perfect credit score ultimately depends on which scoring model you use.

FICO scores, which are issued by the Fair Isaac Corporation, range from 300 to 850, with 850 being the highest score you can attain.

According to Fair Isaac’s internal data, approximately 19.9% of the population has a FICO score in the 800 to 850 range.

At the other end of the spectrum, just under 5% of consumers have a score of 499 or less.

The majority of Americans, 58.1% to be precise, have scores ranging from 600 to 800.

Overall, the national average FICO score comes in at 695, which according to Fair Isaac is an all-time high since the company began tracking it.

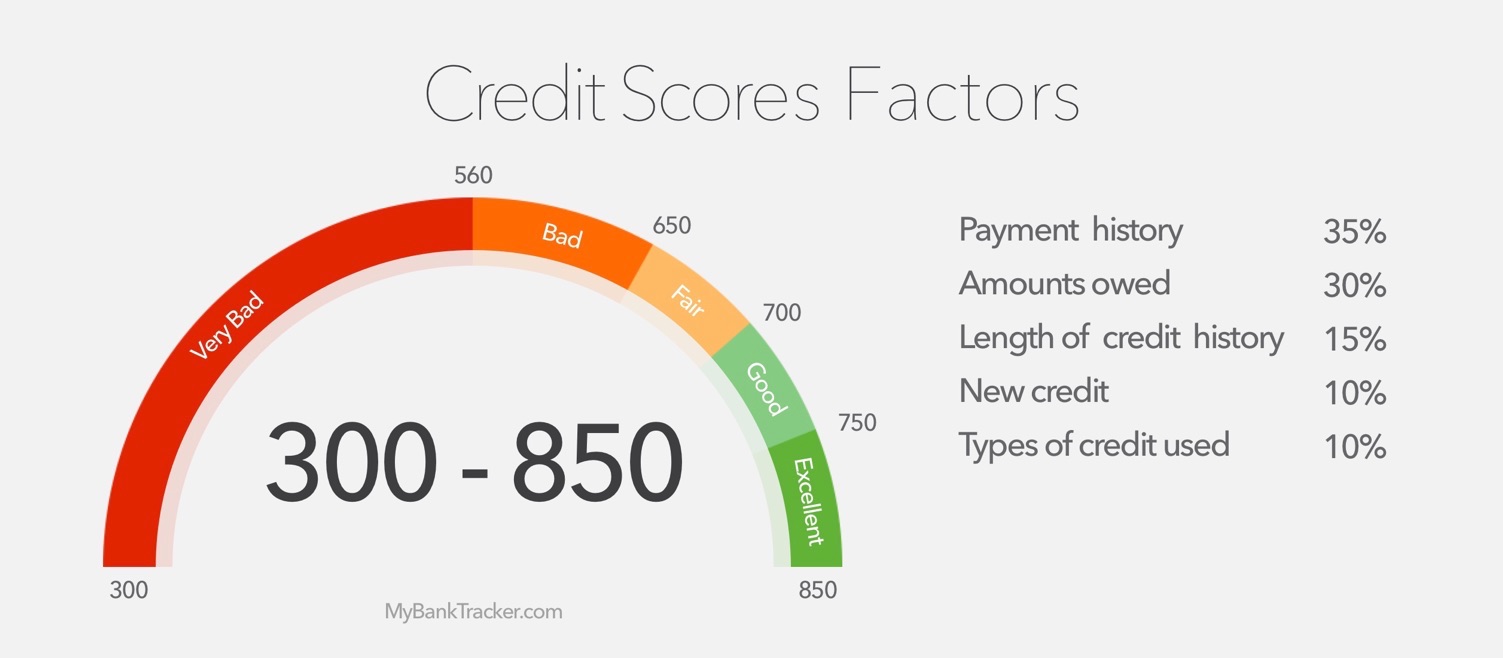

So how are FICO scores calculated? While Fair Isaac doesn’t disclose a specific formula to the public, it’s common knowledge that the following five factors play a part in how your score adds up:

Payment history

Approximately 35% of your FICO score is based on your payment history.

A positive payment history can help to drive your score up while late or missed payments can bring it down. Even one late payment can cause your score to drop by up to 100 points and the higher your score is to start, the worse the damage.

Amounts owed

Another 30% of your FICO score is determined by the total amount of debt you owe.

The more available credit you’re using at any given time, the more that can hurt your score. If you want to get close to a perfect credit score, you should aim to use 30% or less of your overall credit line at any given time.

Length of credit history

Time is on your side where credit is concerned and 15% of your score is based on the length of your credit history.

This refers to how old each open account on your credit report is as well as the average age of your accounts combined. A longer credit history shows lenders you’re fiscally responsible and it benefits your score.

Inquiries for new credit

Each time you apply for credit it shows up as an inquiry on your credit report. These inquiries account for 10% of your FICO score and each inquiry can shave as much as five points off at a time.

Types of credit

Lenders want to know that you can use different types of credit wisely and your overall credit mix represents 10% of your credit score calculation.

Taken together, these five elements are the key to securing a perfect FICO score.

If you’re consistently paying your bills on time, keeping your balances low, keeping older accounts open, limiting how often you apply for new credit and utilizing different kinds of credit responsibly, those moves can put you on the right track towards hitting the 850 mark.

Perfect vs. excellent credit: what’s the difference?

While 850 is considered a perfect score, it’s not the only score lenders view in a favorable light.

In general, a FICO score of 760 or higher is considered excellent and at this point, lenders don’t make much of a distinction where loan approval or interest rates or concerned.

In short, an excellent score is just as good as a perfect score in terms of your ability to qualify for loans or get the lowest rates.

Here’s an example that demonstrates how lenders view an excellent score versus a perfect one.

Let’s say you want to take out a $250,000 mortgage to buy a home and you have a credit score of 785.

According to myFICO’s mortgage calculator, your score would qualify you for a rate of 3.394%, which would put your monthly payments at $1,108 and cost you nearly $149,000 in interest over the life of the loan.

Now, assume that you have an 850 credit score instead. When we plugged in the numbers using the same loan amount, we were given the exact same loan terms.

The bottom line: A perfect score looks good on paper but, when it comes down to borrowing money, an excellent score will benefit you just as much.

Credit cards for perfect credit

In terms of credit cards, having an excellent or perfect score can be an advantage, particularly if you want to be able to earn upper-tier rewards.

Cards that demand a higher credit score to qualify typically offer more generous new account bonuses, more opportunities to earn rewards and additional built-in perks.

For example, the is reserved for credit users with excellent credit scores.

Read Chase Sapphire Preferred Card Editor’s Review

Members continue to earn double points on travel and dining and those points can be transferred to selected frequent traveler programs on a 1:1 basis.

There is a $95 annual fee but for someone with excellent credit who spends a lot on travel, this card can open the door to some substantial savings.

Excellent or perfect credit also makes a difference in terms of the kind of promotional offers you’re eligible for.

For instance, if you need to transfer a balance from one card to another and you’re looking for a 0% offer, the best deals require a higher credit score.

, for instance, usually offers a great introductory APR period but only for people with excellent credit.

Read Citi Simplicity Credit Card Editor’s Review

Tip: If you have excellent or perfect credit and need help choosing a card, let MyBankTracker help with comparing card offers.

Why you shouldn’t settle for a “good” credit score

While there isn’t much of a dividing line between excellent and perfect credit, the gap between a good score and an excellent one is much wider.

A good credit score, which would typically be in the 700 to 759 range can still make approval decisions easier but it puts you at a disadvantage where interest rates are concerned.

Going back to our previous example with the $250,000 mortgage, having a score of 755 would qualify you for a rate of 3.616%.

That would raise your monthly payment to $1,139 a month, which doesn’t seem like a huge jump until you consider the overall interest cost.

By the time you pay your home off, you’d have shelled out an additional $11,000 in interest.

Good credit also makes a difference where credit cards are concerned.

Take the , for example. This card is designed for people with average credit and it offers unlimited 1.5% cash back on every purchase.

Read Capital One QuicksilverOne Cash Rewards Credit Card

That seems like a pretty sweet deal but it comes at a price in the form of a $39 annual fee. You’d have to spend $2,600 a year just to earn enough cash back to cover the fee.

Now, consider the , which is geared towards people with excellent credit.

Read Citi Double Cash Card Editor’s Review

With this card, you earn 1% cash back when you make purchases and another 1% back when you make a payment.

There’s no annual fee and unlike the Capital One QuicksilverOne Card, you can get a 0% introductory rate on purchases and balance transfers.

If you use credit regularly, that’s a good incentive to try and take your score to the next level.

The final verdict

While a perfect credit score can open the door to the best financing deals, you shouldn’t fret too much if you’re still a few points shy of reaching 850.

As we’ve already shown, anything over 760 is likely to yield the most optimal interest rates and credit terms.

Instead of wearing yourself out trying to achieve perfect status, focus on making smart credit moves so you can get your score into an excellent territory.

Once you get to that point, you’ll be able to cash in on major savings when you borrow and unlock the best credit card offers on the market to boot.