How to Raise Your Credit Score with a Single Phone Call

A high credit score could save you thousands of dollars in interest over time.

When you have excellent credit, you have access to the best credit card offers, loans with the lowest interest rates, and the lowest auto insurance and home insurance rates.

Most people raise their score above average by diligently paying their credit card bills and other loans every month, building up credit history slowly, and using their credit wisely. There are also, however, a couple of ways you can raise your credit score almost instantly.

Sound too easy? It’s often simply a matter of knowing how credit scores work.

How to Understand the Factors that Make Up Your Credit Score

The three major credit bureaus (Equifax, Experian, and TransUnion) all maintain reports of your credit history and assign you a score based on a number of factors.

Although your credit score will likely be slightly different between the three bureaus, the scores are generally all based on the same criteria:

Your Payment History

Anytime you make a late payment, that can potentially be reported to the major credit bureaus and impact your score.

But if you continually make on time payments, then that reflects very well on your report and score. One of the simplest ways to get and maintain a good credit score is to pay all of your bills on time, every time.

How Much Debt You Have

The amount of debt you have in comparison to how much debt you have access to is called your credit utilization ratio.

The lower your credit utilization ratio, the better your score will be. In a perfect world, you would have a credit utilization ratio of 30% or below. In other words, do everything you can to avoid maxing out your credit cards.

How Long Your Accounts Have Been Open

Another simple way to get and maintain a good credit score is to keep your accounts open – and not just your credit card accounts.

Account history for credit cards, student loans, mortgages, and other types of credit all factor into this portion of your score.

Even if you’re not using a line of credit anymore, you can benefit your score by keeping it open and showing a positive (read: long) history with your accounts.

How Much Time Has Passed Since You Last Opened New Line of Credit

There’s nothing wrong with opening a new line of credit when you need to, but applying for a slew of loans or lines of credit at one time is not good for your credit score.

Instead, choose carefully when you apply to reduce the amount of times your credit score takes a hit.

The Types of Credit You Have

Even though you want to maintain a low credit utilization ratio to improve your score, that doesn’t mean you shouldn’t have multiple types of credit.

In fact, having a variety of loans and lines of credit on your credit report can improve your score.

It may not be fun to pay for a mortgage or student loans, but in this case, it can actually improve your credit score (rather than simply having credit cards alone in your name).

Pay Attention to the Two Most Important Factors that Play Into Your Credit Score

The biggest factors that affect your credit score are your payment history and your credit utilization ratio.

Together, these two factors make up 65% of your score. Therefore, keeping a history of on time payments and avoiding utilizing all of the credit available to you can greatly help you improve your score.

How a Simple Phone Call Can Help You Improve Your Credit Score

So now that you know the factors that affect your credit score the most, let’s talk about how you can take action right now to improve them and give your credit score a boost. It all starts with a simple phone call to your lender.

Fix a Late Payment Mistake

We already mentioned that payment history is a huge part of your score – so let’s dig into what you can do if you miss a payment.

The best way to fix either of these issues is to call your lender directly. While that doesn’t sound like the most enjoyable thing to do, it can definitely be worth it.

As you get placed on hold or have to dial your way through a complicated phone tree, remember that one single late payment on your report can drop your score 90-110 points.

What to Say When You Call Your Lender to Fix a Late Payment

There are multiple ways to reach out to a lender, but for something like this, the phone is going to be the best bet. Here’s what to convey when you make the call:

Your payment wasn’t applied on time by mistake.

Perhaps you switched banks and forgot to update your auto payment information. Perhaps you bought something you were supposed to get reimbursed by your employer for, but the reimbursement came late.

Or perhaps you just forgot to make the payment because you had a really tough month. You don’t have to make up a story – everyone makes honest mistakes – you just need a good explanation to show that it’s an isolated incident.

You won’t make this mistake again.

Again, explain to them that this is an isolate incident. It will be easier to pull this off if you don’t have a history of late payments.

You’ve been a loyal customer of [insert bank name] for [X] years.

If you’ve been with this lender for awhile, now’s the time to highlight that – even better if you’ve never missed a payment before.

If you can remind your lender that you’re a reliable, trustworthy, and risk-free customer, then they’ll be more likely to want to help you out.

Request a removal of the late payment from the record.

Now it’s time to make the request. You’ve explained the incident, you’ve highlighted that it’s an isolated incident, and you’ve shown that you’re a good customer.

If you’ve made your case well and your lender is flexible, they should strike the missed payment from the record on their end and with the credit bureaus and maybe even reimburse any late fees you were charged.

Don’t forget to take notes during the call.

For future reference, write down the name of the customer service rep you talked to and the date and time of the call.

Then check your credit reports in the next few weeks to verify that the late payment has been removed from all three credit bureaus. (If the fix only shows on one of them, you’ll need to contact the credit card company again.)

If the call doesn’t go well…

Oftentimes a lender is willing to work with their customers, but there will be times when they are totally inflexible.

If that happens to you, you could ask to speak to a supervisor.

If that doesn’t work and you feel like your lender isn’t on your side, you could consider switching to a different lender that’s more flexible in instances like these.

A great way to do this is to do your research and read bank and credit card reviews to ensure that you’re choosing the right type of lender for you.

What to Say When Asking Your Lender to Raise Your Credit Limit

We’ve talked a lot about fixing late payments, but remember that raising your credit limit can also greatly impact your score. Doing so can improve your credit utilization.

In reality, there are two ways you can improve your credit utilization: pay down balances on your credit cards or increasing your credit limit.

But since increasing your credit limit is the faster method, let’s talk about how you can do that. Even if you don’t need the money, raising your credit limit will boost your credit score because you’ll lower the total debt to total credit available.

I did this when I needed to make a big purchase – a deposit for a bucket list vacation – and I didn’t want my balance to go over that 30% threshold because I’m also planning on refinancing soon.

So I logged into my credit card account at Barclaycard, went to the customer service section, and clicked on the option to request a credit increase.

The bank’s online form made it super easy to make the request. I just needed to fill in my employment and income basics and the amount of additional credit I wanted.

Initially, I requested $5,000 more. The site pulled my credit report and quickly responded that they couldn’t meet that request, but did offer a $3,000 increase, which I accepted.

In a couple of minutes, I had increased my credit limit by 20% more – similar to the 22 percent credit limit increase MyBankTracker editor Simon Zhen achieved.

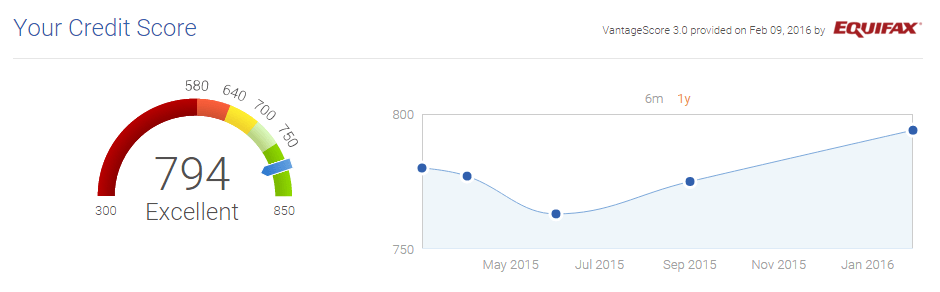

After getting the credit line increase in June, my credit score jumped about 12 points by September. (And I continued to raise it by reducing my overall debt usage.)

Twelve points might not seem like a lot, but every point counts when you’re planning on applying for a loan.

Not all credit card issuers offer an online option to request a credit increase, but if yours doesn’t, just call customer service. You’ll probably just need to share your salary and employment information and wait while they pull your credit reports.

If I tried this with all my credit cards, my credit score would probably have risen even more–although each time you request a credit line increase, the issuer could pull a “hard” credit inquiry on your credit report, which does drop your credit score by a few points.

So this isn’t something you want to do every month (nor would you be able to).

It’s similar to getting a new credit card: The additional available credit raises your credit score but also temporarily takes off a couple of points because of the credit inquiry.

However, getting an overall boost in your score with the lower credit utilization proves to be worth it in the end.

You Have the Power to Improve Your Credit Score

Whether it’s fixing any late payments or decreasing your credit utilization through a credit limit increase, you have the power to improve your credit score even when you can’t do other things like pay your debt off overnight.

No matter what kind of credit score you have or what financial situation you’re in, don’t forget this fact.

There’s always something you can do to improve where you are now – and one positive step forward often leads to many more. For now, it can start with a simple phone call.