Does Closing a Credit Card Hurt Your Credit Score?

Anyone who’s battled credit card debt before may understand the feeling of wanting the card to be removed from your life as quickly as possible.

When a credit card balance becomes too high to manage, it’s natural to want to cut it up and throw it away as if it never happened.

But, simply put:

You can’t destroy the evidence of credit card debt.

The question is, what can you do?

If you have an old, unused credit card lying around, it might seem like a good idea to close the accounts.

After all, it’s just one more account to keep track of .

While this might seem like a responsible move, it can actually hurt your credit score.

One of the easiest ways to not hurt your credit score, and even maximize it, is to keep old accounts open.

We’ve highlighted what do with old credit cards, how they may (or may not) affect your credit score, and the best ways to tackle credit card debt.

What You Should Do First

The first thing is obviously to make a plan to pay the debt off.

That doesn’t mean you’ll be able to pay it off in a few months — that will depend on your total card balance and the aggressiveness of your plan.

What it does mean:

You’ll get on the path to making it happen.

After that is where things can get tricky — how can you make sure the debt never happens again?

Do you have to cut the card up? Do you have to cancel it altogether?

The worst thing you can do is make this decision in a fit of panic, as both options can have just as long-term of an impact as the balance you’ve accrued.

Instead, evaluate the options to discover what will work best for you.

How Cutting or Closing A Card Affects Your Credit Score

If you’re dealing with debt, your credit score might not seem that important right now.

However, your credit score greatly impacts your access to future debt you’ll actually want to take on, such as for a car or home. It will also impact how much you’ll pay for such loans.

Therefore, even though paying off debt could feel like an emergency right now, don’t let that lead you to decisions that could hurt your credit score.

Here’s how both actions affect your score:

Cutting Up a Card vs. Closing a Card

| Cutting Up a Card | Closing a Card |

|---|---|

| No effect at all, as long as you continue to make payments on the card. | Your types of credit will be affected. |

| Your length of credit history will be affected. | |

| Most importantly, your credit utilization will be affected. | |

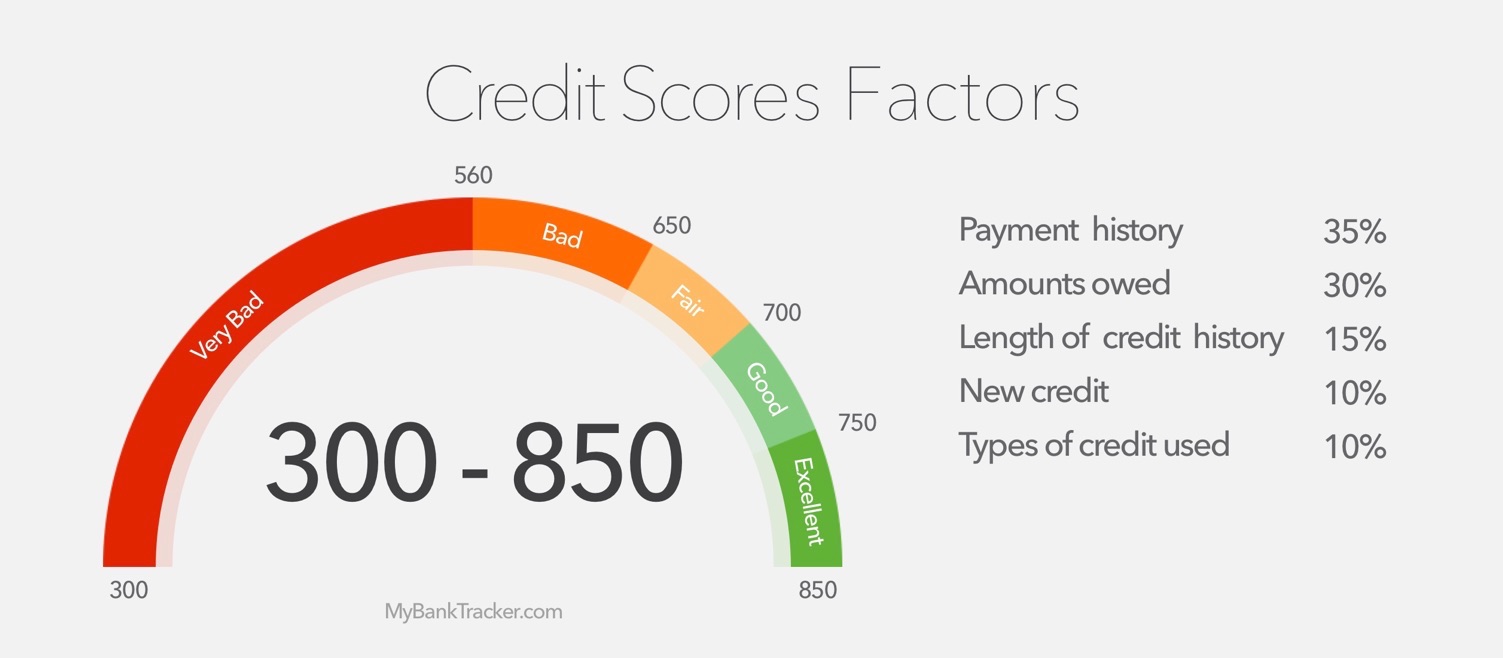

There are multiple factors that make up your credit score, but the most important factor to discuss in this case is your credit utilization.

Credit utilization has a big impact on your score

Credit utilization refers to the percentage of debt you have compared to how much credit is available to you.

For example, if you have two credit cards with a line of credit of $5,000 each, then you have $10,000 available to you. If you owe $5,000 on one or both, then you’re utilizing 50% of your credit.

Ideally, your credit utilization should be no more than 30%, which means this scenario is already well over the ideal percentage.

Now, if you close either of the two credit cards, you only have $5,000 in credit available to you. If you owe $5,000 in total, that means you’re utilizing 100% of your credit.

See how closing a card can impact your score? The already high 50% utilization rate just jumped to 100%. This is way more than lenders want to see and will definitely hurt your credit score.

So, even when you’re in a situation in which your credit utilization is higher than you’d like it to be, you can make it better by simply creating a payoff plan to decrease your debt and your credit utilization at the same time.

That will have a positive effect on your score as you go – but closing the credit card will have a swift negative effect. And, if it’s not going to help you pay off the debt anyway, is it really worth it?

Should I Cancel My Credit Card or Cut it Up?

So, why can’t you just “destroy the evidence” by canceling or cutting up your credit card while you pay it off?

The reason is that either of these actions could have longer term effects – and those effects will depend on what got you to this point as well as what plans you have moving forward.

What Got You to This Point?

The first thing to evaluate is how your balance got to where it is right now.

Was it habitual overspending? A misunderstanding of how quickly credit card interest can increase your balance? An emergency that you had to use credit to handle?

If you answered “habitual overspending,” then your next goal should be focused on curbing that habit.

That could start with either cutting or closing your credit card. It should also be met with a serious look at your budget and your relationship with money.

If you answered “a misunderstanding of how quickly credit card interest can increase your balance,” then you have a choice.

You can keep your card open and use it once the debt is paid off now that you really understand how it works.

Or you can go the route of figuring out how to curb your spending, which may need to start with cutting or canceling the card.

The answer here depends on how much you trust yourself to give credit cards the gravity they deserve moving forward.

If you answered “an emergency,” then you might not need to do anything other than make a plan to pay off the debt while you also build up an emergency fund. That way future emergencies can be handled with cash, interest-free.

What Are Your Next Financial Goals?

After you have a clear understanding of what got you to this point, the next thing to evaluate is your next financial goals. Those will play into how you should handle your credit card, besides paying it off.

If debt payoff is the only thing on your mind right now, then it’s perfectly fine (in fact, it’s great!) to have a laser focus on that.

If you don’t trust yourself to keep off the credit, you could first start with cutting up the credit card.

If that doesn’t work because you’ve memorized the number or have it saved on too many websites as a payment method, then closing should be the next consideration.

However, if you have other goals in mind, such as buying a car or home, don’t close the credit card right away.

For various reasons that we’ll discuss in a minute, that will have an impact on your credit score. So, even though it can prevent you from spending, it could also prevent you from spending on the things you really want for your future.

Making the Decision To Cut or To Close the Card

Ultimately, there’s no reason to close a credit card because you have credit card debt unless you absolutely don’t trust yourself with credit right now.

The one scenario when it might make sense to shut the card down: if the card charges an annual fee and you’re not currently using it.

If you aren’t using the card, then you aren’t using the rewards program that you’re paying for.

Closing a card won’t help you pay the debt off and it certainly won’t help your credit score. So this option should only be used in an extreme situation in which you absolutely don’t want access to revolving credit anymore.

Cutting your credit card up, on the other hand, is not so extreme.

If you want to keep the card open but don’t trust yourself not to use it, you can cut it up without having any damage to your account. Some people will even freeze their card so they can have access to it again later.

The nice thing about cutting up a credit card is that it won’t affect your credit score. It’s a great method to prevent spending (as long as you also delete that card from websites you use as the automatic payment method).

And, if you want to open access back up later, you can easily call your issuer and ask for a new card on your existing account.

They’ll officially cancel the old card that you cut up (not the account) and put a new card in the mail to you.

Keep in mind, though, that cutting your card won’t help you pay off the debt.

This is only to be used as a way to prevent continued spending. Out of sight out of mind might work to prevent spending, but it will not work for paying off debt.

How to Pay Off Your Credit Card

You may have already noticed a theme here, but if not, I’ll just point it out now:

The best thing you can do in a situation of credit card debt is to pay it off.

This will help you increase your credit score, decrease the amount of money you’re losing to interest, and hopefully also show you what you can achieve financially when you give the goal laser focus.

The question is, how to do it? Credit card debt is easy to get into and hard to get out of.

If you’re dealing with just one credit card that needs to be paid off, the first thing you should do is find a way to lower the interest rate.

Interest is the most pernicious thing about credit cards, so the more you can lower it, the quicker you can pay the card off.

Apply for a Balance Transfer Credit Card

If your credit score is currently in good enough standing, then the best thing you can do is apply for a balance transfer credit card.

A balance transfer credit card is a credit card used specifically for debt payoff.

Typically, balance transfer cards come at a low or 0% interest rates for anywhere from 6-18 months. This period of low to no interest is your best shot at paying off your credit card debt.

While these are great tools, there are a few things to keep in mind. Here’s what you need to consider if you’re trying to pay off debt with a balance transfer credit card:

- If you don’t pay the balance off before the promotional rate expires, you could get retroactively charged on the entire balance with the new, higher rate

- If you can’t pay the balance off before the rate expires, the best thing you can do is apply for another balance transfer card to extend your time at low to no interest

- If you make a purchase on the balance transfer credit card, that purchase will be charged a separate APR – see the table below for an example of what a purchase on balance transfer card would look like

Credit Cards: Different APRs on Different Balances

| Credit Card Interest Rates | 15.99% APR on Purchases, 0% APR on Balance Transfers | 0% APR on Purchases, 15.99% APR on Balance Transfers | 15.99% APR on Purchases, 4.99% APR on Balance Transfers | 15.99% APR on Purchases, 15.99% APR on Balance Transfers |

|---|---|---|---|---|

| Purchase APR | 15.99% | 0% | 15.99% | 15.99% |

| Purchase Principal | $5000 | $5000 | $5000 | $5000 |

| Interest Charged on Purchase Principal | $65.71 | $0 | $65.71 | $65.71 |

| Balance Transfer APR | 0% | 15.99% | 4.99% | 15.99% |

| Balance Transfer Principal | $5000 | $5000 | $5000 | $5000 |

| Interest Charged on Balance Transfer Principal | $0 | $65.71 | $20.51 | $65.71 |

| End of Month Principal Owed | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 |

| Total Interest Charged on End of Month Principal | $65.71 | $65.71 | $86.22 | $131.42 |

| End of Month Balance Owed | $10,065.71 | $10,065.71 | $10,086.22 | $10,131.42 |

| Total Monthly Payment | $500 | $500 | $500 | $500 |

| – Portion of Monthly Payment Toward Lowest-APR Balance | $165.71 | $165.71 | $186.22 | $231.42 |

| – Portion of Monthly Payment Toward Highest-APR Balance | $334.29 | $334.29 | $313.78 | $268.58 |

| New Purchase Principal | $4,731.42 | $4,834.29 | $4,751.93 | $4,815.71 |

| New Balance Transfer Principal | $4,834.29 | $4,731.42 | $4,834.29 | $4,815.71 |

| New Total Balance | $9,565.71 | $9,565.71 | $9,586.22 | $9,631.42 |

Ultimately, as useful as a balance transfer can be, the only way to make it really work is to make a plan to pay it off before the rate expires.

Divide your card balance by the amount of months you have. That amount should be your minimum payment due as far as you’re concerned – no matter what the minimum payment on your statement says.

Even if you can’t hit that amount every month, you’ll get a lot further than you would by paying the minimum payment on your statement.

No matter what type of credit card you have, making minimum payments only is a surefire way to stay in debt.

Apply for a Loan to Pay Off the Credit Card

If you have trouble getting approved for a balance transfer credit card – or if you want nothing more to do with any type of credit card – then try for a loan.

Peer to peer loans through companies like Lending Club are a great way to pay off a credit card at a lower interest rate.

Another option is to ask your bank for an unsecured loan.

In both scenarios, you’ll get a lower interest rate than your current credit card and you’ll get peace of mind with a fixed payoff date.

As long as you make all your payments on time, you’ll know exactly when that debt will be paid off.

While you could also try something like a home equity loan or line of credit, this is not a great idea because that will put your home up for collateral on the credit card.

What does that mean?

If you default, you could lose your home. As much as you want to get out of credit card debt, don’t risk something like the roof over your head to make it happen.

Ask Your Card Issuer for a Lower Interest Rate

If none of these options work for you, there’s one more thing you can do: ask your card issuer for a lower rate.

While it might not seem like they would do that, especially if your card is maxed out, try it anyway.

They want you to pay the debt off too – so as long as you have a history of making your payments on time, they may be willing to help you by lowering your interest a bit.

In this case, you lose absolutely nothing by asking. Just remember to be nice and friendly, highlight your positive payment behavior, and explain why you want to lower your score.

Whatever you do, don’t be rude and don’t give a sob story. And if they say they can’t help you, ask to speak to their supervisor.

Be clear, logical, and assertive. The results might surprise you.

No Matter What You Decide, Don’t Panic

We’ve talked about a lot of options here – which can be awesome and terrible all at the same time. It’s great that there are many things you can do, but I understand how it can be overwhelming in times of deep worry.

So if you remember nothing else, remember this: don’t make any big decisions out of panic.

No, this is not a fun situation and, yes, you probably want to fix it as soon as possible. But you’ll make a lot better decisions when logic rules the game, not emotions.

You can resolve what’s happened so far. Do so by making decisions that will be good for you both now and in the future so you can create a financial picture that you’ll be happy with.

No hole is too deep to get out of when you have focus and determination, so go out there and decide what will be best for you. And remember to take these lessons forward so you never end up here again.