8 Signs That Will Bust Your Financially Cheating Spouse

Finances, in the end, can make or break a marriage. And hiding or lying about spending habits, especially finances that are shared, can turn once blissful newlyweds toxic.

A common mistake couples make before jumping the broom is never having that awkward money talk. According to The New York Times, couples who roll the dice increase their odds of divorce papers being filed due to financial strain by 45 percent.

Never mind whether you should moving in together before or after the nuptials. How much debt will each person bring into the union? How well are individual finances managed? How large are those student loan payments? Will a bad credit score put a damper on plans buying a house, getting that better job, or growing a family? These are questions that every couple should ask one another. But, some people end up marrying a completely different person, financially speaking.

Do you have financial red flags in your relationship? If you want your marriage to survive, they are not to be ignored.

Here are eight signs that your spouse is a financial cheater.

1. Is your spouse always playing defense?

Discussing finances should not escalate to an argument. If there’s nothing to hide, that is.

Two responsible adults should be able to openly talk about issues necessary to maintaining each others livelihood. If your spouse is defensive whenever money is discussed, it may be a sign of spending guilt. Other signs of a person harboring financial guilt include bouts of depression, mood swings, weight gain or loss, or if the person becomes increasingly secretive and distant.

Warning signs should be addressed as early as possible. Getting to the root of the issue through open communication is not only beneficial to the marriage, but far cheaper than a therapist.

2. You uncover a secret account.

Forget a few extra lunch receipts you find laying around. If you have uncovered an account not disclosed to you previously, it opens the door to endless speculation and mistrust. And it doesn’t have to always be a spending account. Hiding a large rainy day fund or retirement fund could be a deal breaker.

We have addressed situations where it would be understandable if a spouse maintained a secret savings account. Women, in general, are encouraged to maintain a secret security account in the event of a abuse or divorce. But is the extra precaution to hide the funds necessary in a healthy, trusting relationship?

When discussing marital finances prior to wedding bells ringing, a security account in case of divorce should not be surprising in the era of prenuptial agreements and cheating clauses. When in doubt, a full-disclosure policy is best for managing both personal and joint finances.

3. You are never included in managing the finances.

One partner insisting on taking control of the budget ledger is not only unfair, but could be the first steps to a controlling relationship.

In order to stand your ground and ensure an even financial playing field, suggest having complete transparency of all finances. Link all bills, accounts and debt accounts to an app like Check.me or Level Money. Even if you don’t balance the checkbook, each spouse can see where the money is going from your smartphone or computer.

4. You never see paycheck stubs.

We understand that most working adults now have direct deposit. However, for your records, a pay stub is still available to view and to print. To never actually have proof of your spouse’s income allows each party to state whatever figure they want.

If a couple is living paycheck to paycheck or having children in the picture, a few missing dollars added up can spell financial disaster. And, while it may seem only necessary to see pay stubs if a spouse is self-employed or works as an independent contractor, maintaining copies of pay stubs, no matter if you are a W-9 or 1099 kind of employee, is key to keeping accurate finances.

5. Spending habits don’t match up with the occupation.

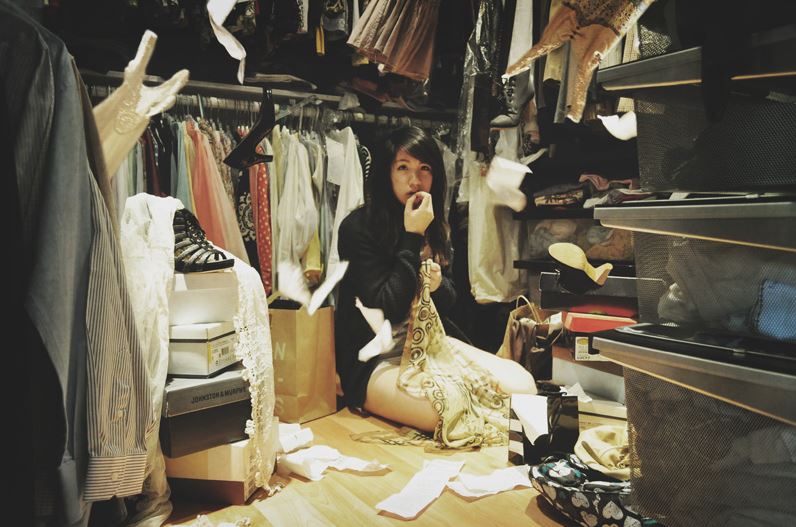

Does your grad student spouse that works a part-time retail gig always eat out? Or does your entry-level office clerk have a pretty impressive wardrobe? Out-of-control spending can serve as type of self-medication for a much deeper issue.

According to physician Elizabeth Hartney, PhD, compulsive spending is fueled by the lack of self esteem, a search for control, or in order to approval from others.

Being married to a shopaholic does not mean a road to divorce. There a number of low cost and even free support groups that can help get the marital finances back on track and the spending under control.

6. New credit cards in your name that you didn’t apply for?

Just to be clear, this is identity theft.

According to WND.com, a spouse cannot legally sign the other spouse’s name without having power of attorney privileges. And even with a power of attorney in place, it’s wise to always have the consent of the other spouse, written or verbal, before signing any dotted line on their behalf.

Don’t let the security of your identity fall by the wayside in the midst of planning your wedding. If you plan on changing your name, there are some additional security precautions you may need to consider.

7. Debt collectors are calling.

The financial damage has been done. But now, there’s no hiding it.

Don’t turn the ringer on silent when debt collectors call. Your spouse’s debt, in some states, is now your debt.

If a marriage license is filed in a community property state, any debts or assets that a couple incurs during the course of a marriage, even if one party has no knowledge of the assets or accounts, is considered marital debt. Therefore, both spouses are responsible for repaying the debt.

So, take a deep breath, take the calls together, a discuss what your repayment options are available.

8. The second cell phone.

Finding a second cell phone usually identifies a painful reality.

Infidelity can result in a number of costs besides the participation and concealment of an affair. A trial separation can result in a temporary move, meaning additional rent and moving costs. If both parties agree to work through their issues, therapy or marriage counseling doesn’t come cheap. And, if divorce papers end up being filed, there’s legal and court costs, possible alimony, child support and spousal support payments, and splitting, possibly even losing, assets and property.

If the dreaded second cell phone is found, confront the situation immediately and figure out how deep a financial and emotional hole the marriage is in.