The Best Personal Loans in Kansas for 2026

Many personal loans allow you to use the funds for anything you need without putting up collateral.

That means you can use the money to finance a home improvement, a wedding, or make a large purchase you’ve been putting off.

Those shopping for a personal loan should know not all personal loan lenders are equal. Some lenders prioritize profits by charging higher interest rates, origination fees, and application fees.

Others offer competitive rates and no fees other than those for making late payments.

To help you find the most competitive personal loan, we researched lenders in Kansas to find the top options. Here’s what we found.

The Best Personal Loans in Kansas

U.S. Bank

U.S. Bank’s personal loans require a credit score minimum of 660, although this doesn’t guarantee approval.

Based on approval, you could borrow between $1,000 and $25,000 for 12 to 60 months. U.S. Bank customers get more options with loan terms up to 84 months and balances up to $50,000.

These loans can disburse funds as fast as hours after you’re approved. U.S. Bank doesn’t charge origination fees or prepayment penalties and offers competitive rates.

Read our full review of the unsecured personal loans from U.S. Bank.

Wells Fargo

Wells Fargo offers extremely flexible personal loans. Potential loan amounts range from $3,000 to $100,000 and loan terms can be 12 to 84 months.

Wells Fargo offers competitive interest rates with no origination or closing fees. You don’t have to worry about prepayment penalties and funds can be disbursed as fast as the same or the next business day after approval.

Qualifying Wells Fargo customers may also get a relationship interest rate discount.

Read our review of Wells Fargo personal loans.

Bank of Blue Valley

Bank of Blue Valley offers personal loans with competitive interest rates and no origination fees. Their website states they offer 36-month loans, but other terms are available. You can borrow up to $5,000 but must have a Bank of Blue Valley Checking account for this loan.

Methodology

To find our top personal loan picks, we used June 2023 data from the FDIC to identify the top 50 banks in Kansas based on deposit market share–available to borrowers in major cities such as Wichita, Overland Park, Kansas City, Olathe, and Topeka.

Using this list, we looked at personal loan offerings at these institutions and evaluated loans based on these features:

- Interest rates

- Loan terms

- Loan amount ranges

- Fees

Do Online Personal Loans Beat Brick-and-Mortar Loans?

If you haven’t considered online lenders for your personal loan, you should. These lenders have added competition to the personal loan space and may offer highly competitive terms.

Online lenders usually don’t have high overhead costs. This allows them to offer low-fee loans with competitive interest rates. Pair this advantage with the technology to quickly provide loan decisions on most loans and you can see why these lenders are competitive.

Digital lenders often provide fast funds disbursement after a loan is approved, as well. While these factors can make online lenders seem superior, that isn’t always the case.

Comparison shop

Physical lenders, such as your local bank, know digital lenders exist. They’ll offer similar benefits to win your business if they want to be competitive.

Every lender, whether online or brick-and-mortar, will examine your loan application based on their own risk factors. This can result in different interest rates at each lender, even if your application is the same.

To make sure you’re getting the best loan, you should shop around at both types of lenders.

How to Prioritize Which Personal Loan Works Best

To find the best personal loan for you, you need to know your priorities. These may vary from person to person.

You may want a personal loan that will cost you the least amount in interest. Another person may be focused on fast funding.

Here are a few critical parts of personal loans that you can use to decide what’s most important to you.

Potential loan amounts

The amount you need to borrow may influence which lender you choose. Your options are likely more limited if you need a small or extremely large loan.

It’s common to find lenders that will loan $3,000 to $25,000. If you need a $1,000 loan or a $100,000 loan, you may need to look for more specialized lenders.

Interest rates charged

If every loan you’re considering has equal terms other than the interest rate, the lowest interest rate loan will result in the lowest cost. This is one of the largest factors influencing your costs. Shopping around to find a good loan with a low rate is often a priority.

Fees charged

For the most part, you want a personal loan with the fewest fees possible. Most loans still charge late fees for late payments.

Application and origination fees don’t exist at most of the top lenders, though. Prepayment penalties are rare today, too. This is great news for consumers.

The potential largest fee is the origination fee. It’s often a percentage of the loan amount and subtracted from your loan proceeds. A 1% origination fee on a $10,000 loan is a $100 fee.

Loan disbursement speed

If you’re in a cash crunch, loan disbursement speed can be key. Some lenders provide loan funds as soon as the same or the next business day after approval. Others may take a week or more to get loan funds to you.

Available loan lengths

Most lenders should be able to help if you want a three to five-year personal loan. Shorter loans, such as one year, and longer loans, such as seven to ten years, are rarer. They do exist but are harder to find.

Interest rate discounts

Before ruling out a lender, ask if they provide any interest rate discounts.

These often offer to lower your interest rate by 0.25% or 0.50%.

You may qualify if you have a relationship with the bank or set up automatic payments.

What You Need to Apply for a Personal Loan

Personal loan applications aren’t complex, but having the right information available will make it easier. Expect to provide the following:

- Identity verification (Driver’s license, passport, etc.)

- Address verification (Utility bill, mortgage statement, etc.)

- Social Security Number

- Income and employment verification (W-2, 1099s, tax returns, etc.)

- Education level achieved

- Requested loan purpose

- Requested loan amount

- Requested loan length

Ways You May Increase Your Odds of Approval

Even if you have the ideal application, nothing guarantees a personal loan application approval. You should put yourself in the strongest position to get approved before applying to increase the odds.

Lenders look at several factors.

Two of the more important metrics you can work to improve are your credit score and debt-to-income ratio.

Debt-to-income ratio

Your debt-to-income ratio looks at your monthly debt payments divided by your monthly income. Lenders prefer to see a lower ratio. You can improve this ratio by decreasing your monthly debt payments or increasing your monthly income.

You don’t want to make extra payments on debt if doing so doesn’t change your monthly payment. Some debt, like credit card debt, will lower your payment if you pay off part of the balance. Focus on these loans to reduce your ratio.

You can also work to increase your income. You must be able to document the income, though. Picking up a part-time job or a side gig through an app, such as Uber, can help.

Credit score

You should also focus on your credit score. Start by getting a free copy of your credit report using AnnualCreditReport.com.

Look at your report from each of the three major bureaus, Equifax, Experian, and Transunion. If you find an error on the report that damages your score, dispute it.

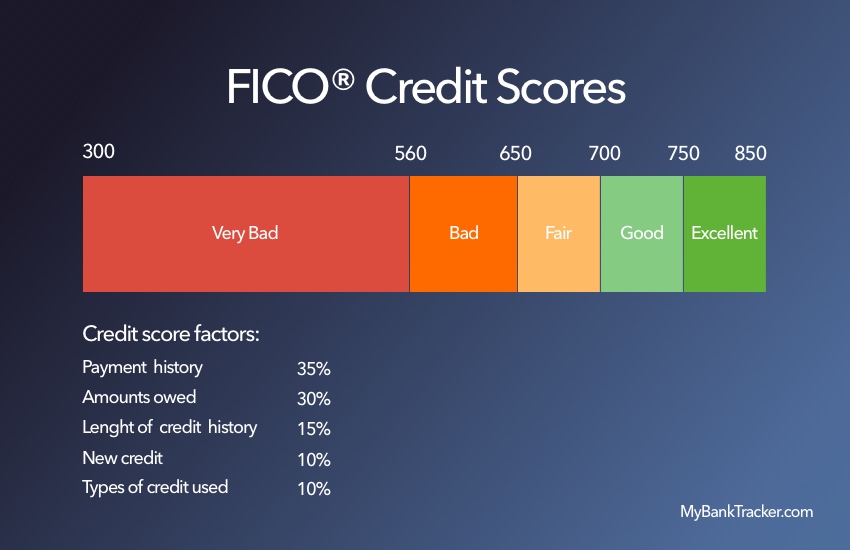

Your credit score considers many factors.

One you can impact is your credit utilization ratio. This divides your outstanding debt by your credit limits on your debt. You can work on lowering this by paying off debt.

Paying off revolving debt, such as a credit card, often has the most significant impact. Even so, each person’s situation is unique.

Evaluate and Decide on Your Next Personal Loan

If you’re ready to get a personal loan, you now have the knowledge necessary to find the best option for you. You can start by evaluating our list of the best personal loans in Kansas. Then, compare your top choice to online lenders.

Don’t forget to get rate quotes from multiple lenders. Each may evaluate your risk differently, resulting in different interest rates. Finding the lowest rate could save you a lot of money.

Frequently Asked Questions

How long does it take to get approved for a personal loan?

The personal loan approval process depends on your application and the lender. Some lenders may approve or deny your loan in seconds or minutes if your application doesn’t require additional information or human intervention.

The exceptions noted above usually add processing time that could take a week or longer in extreme circumstances. Other lenders just process loan applications slowly.

How long does it take to receive funds from a personal loan?

The processing time–from application to funding–varies for each lender. Some can fund loans within hours of getting approved. Others may take a week or longer to get the funds to you.

Can I use a personal loan for any reason?

A personal loan typically allows you to use the funds for whatever purpose you desire. That said, some specific loans may require you to use the funds for a particular purpose.

The most common example is a debt consolidation personal loan. Lenders may directly pay off your old debt rather than disbursing the funds to you.

Will applying for a personal loan affect my credit score?

Applying for a personal loan will impact your credit score. A lender will make a hard inquiry on your credit report as part of the application process. This usually lowers your credit score by a few points for a short time.

Preapprovals that use soft inquiries won’t impact your credit score. However, you must file a formal application before getting a personal loan.