U.S. Bank Personal Loans 2026 Review

Personal loans are highly flexible financial tools that can get you some extra cash when you need it.

You can use a personal loan for nearly any purpose, including refinancing debt, home improvement, or covering an unexpected bill. No matter what you need money for, a personal loan can help.

U.S. Bank is a popular national bank that offers personal loans to its customers.

If you need a personal loan, in this review learn all of the details that you need to know about U.S. Bank’s personal loans.

Average-Size Loan Amounts and Terms

The reason to take out a personal loan rather than a mortgage or car loan is that you can use the money you borrow for any purpose.

Whether you need a large or small loan, a personal loan can help you meet your financial need. The only thing you have to do is find a lender who is willing to lend you the right amount of money.

U.S. Bank offers loans as large as $25,000 or as small as $3,000.

That range makes U.S. Bank a good lender for most situations, but you’ll need to look elsewhere to borrow a large or small sum.

After you decide how much you need to borrow, you have to choose the loan’s term. This is the amount of time it will take to pay the loan of assuming you follow the standard payment schedule.

Loans with long terms have lower monthly payments but result in more interest being charged over the life of the loan. Shorter term loans have larger monthly payments but cost less overall.

When you apply for a U.S. Bank personal loan, you can choose a term of:

- 12 months

- 24 months

- 36 months

- 48 months

That wide range will make it easy to find a loan term that makes sense for your situation.

When you choose the term of your loan, try to strike a balance between a monthly payment you can handle and a low total cost of the loan.

Aim for a monthly payment that won’t strain your budget, but that isn’t much smaller than you can handle. That will let you pay the loan off as quickly as you can.

Estimated Interest Personal Loan Calculator

Application Requirements

There are a few requirements that you need to meet when applying for a U.S. Bank personal loan.

Must be existing customer

The main requirement that you must meet to get a personal loan from U.S. Bank is that you must already be a U.S. Bank customer.

You cannot get approved for a personal loan without also having a U.S. Bank checking account or HELOC.

If you’re already a U.S. Bank customer, you can apply for the loan and will have a chance of being approved. U.S. Bank will look at your application and consider your credit score and annual income.

The better your credit and the higher your income, the better your chances of getting approved for the loan are.

Require credit score for the best rate

If you want to qualify for the best interest rate possible, you must have a credit score of at least 760.

This is generally considered excellent credit.

You also have to set up automatic payments from a U.S. Bank Consumer Silver, Gold, or Platinum checking accounts.

You can get an additional 1% off your interest rate if your loan will be used for qualifying Green Home Improvement and Energy Efficient purchases. This includes purchases such as efficient windows, new appliances, HVAC equipment, and other efficient appliances.

While you can get approved for a loan without meeting the requirements, other than being a U.S. Bank customer, meeting the additional requirements can significantly reduce your interest rate.

That can save you hundreds or thousands of dollars over the life of the loan.

Fees and How Long It Takes to Get the Money

When you’re comparing personal lenders, you’ll find that some specialize in getting money to you quickly, while others take their time in disbursing funds. U.S. Bank has a relatively quick approval process, getting your money to you in about a week from the time you apply for the loan.

If you need cash immediately, you might need to look for another lender, but U.S. Bank will work if you can wait a week.

The only fee that you have to worry about with U.S. Bank’s personal loan is the origination fee.

Unlike many personal loans, the origination fee on U.S. Bank’s personal loans is a flat $50. It’s not based on the size of your loan.

How to Get Approved for a Personal Loan

Once you’ve decided to apply for a personal loan, you’ll want to do whatever you can to make sure your application is approved.

The first step, of course, is submitting an application. During the application process, you’ll be asked to provide information that the lender will use to make a decision on your application.

The information you’ll be asked to provide will often include:

- Name

- Address

- Date of birth

- Proof of identity, such as a driver’s license

- Social Security number

- Annual income

- Proof of income, such as bank statements or pay stubs

- Verification of employment

While getting all that paperwork together may sound daunting, it’s important that you do it properly. An incomplete or unclear application will reduce your chances of getting approved for the loan.

At best, it will slow the process down as the lender will contact you to ask clarifying questions. At worst, your application will be rejected outright.

Improving Your Chances of Getting Approved for a Personal Loan

Other than filling out the application properly, there are a few things that you can do to improve your chances of getting a personal loan.

Keep this tips in mind in the leadup to your application.

Raise your credit

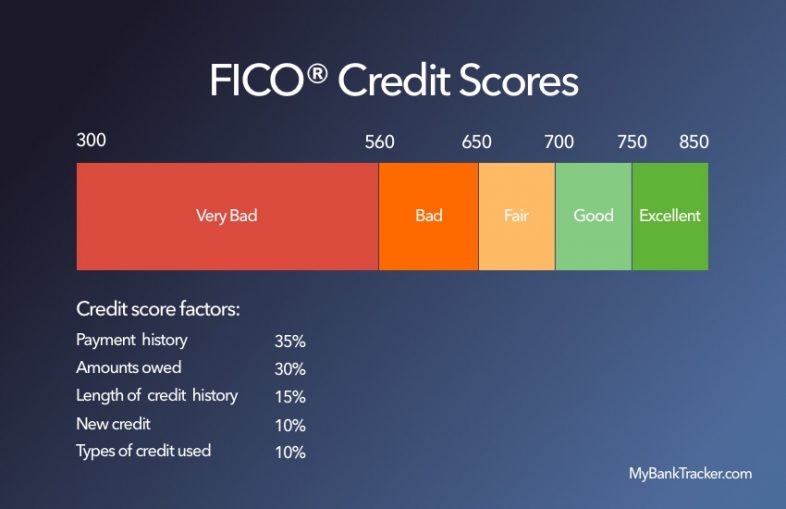

The thing that has the largest effect on your application’s chances is your credit score.

Your credit score gives lenders a quick indication of your financial trustworthiness. A good credit score indicates that lending to you is not risky. Bad credit means that lending to you is risky, so lenders might think twice.

Good credit gives you access to more loans and also gives you lower interest rates on the loans you do qualify for. That’s why maintaining a good score is important.

Your payment history has the largest effect on your score, followed by the amount you owe. What that means is that making on-time payments on all of your debts, over a long period of time, is the best way to increase your score.

The second best way to improve your score is to pay down your existing debt as much as possible.

Unfortunately, both of these strategies are the slowest way to improve your score. Thankfully, there are a few short-term credit-boosting tricks.

First, make sure that you stop applying for new credit cards or other loans in the months before any important loan application.

Each time you apply for a loan, the lender will make a “hard pull” on your credit report. Each hard pull reduces your score by a few points. Your score recovers somewhat after a few months and completely after two years.

Avoiding unnecessary hard pulls can help you keep your credit score high.

Next, try to reduce your debt balances as much as possible. One way to do this is to stop using your credit cards in the months before you apply for the loan.

If your cards’ balances drop over the months leading up to your application, it will help your score and look good to lenders.

Reduce your debt-to-income ratio

Your debt-to-income ratio also plays a role in your application’s chances. This ratio indicates how much of your income must go to monthly bill payments.

You can calculate your debt-to-income ratio by dividing your monthly income by the sum of your monthly minimum payments on your debts and your rent bill. So, if you make $3,000 a month and your rent and bill payments add up to $2,000, your debt-to-income ratio is 67%.

You can improve this ratio by increasing your income or paying down existing debt. Paying down your debts also increases your credit, so we recommend you use that strategy if possible.

If you do pick up a side job to improve your income, make sure the income is documented. Lenders won’t consider under the table income in loan applications.

How Does It Compare?

U.S. Bank is far from the only lender that offers personal loans. Take the time to compare all of the loans available to you.

Start by looking at the loans’ interest rates. Go for the lower rate because you’ll save money over the life of the loan.

Next, look at the fees each loan charges. You want to choose the loan with lower fees. You might have to do some math to figure out which loan is cheaper when you combine the interest charges and fees.

Finally, make sure that the loan you’re looking at actually meet your needs. If you need to borrow more than the lender is willing to lend, or need a loan term that isn’t offered look elsewhere.

Conclusion

A U.S. Bank personal loan is a great choice for someone who is already a U.S. Bank customer.

If you don’t already have a U.S. Bank account and aren’t interested in opening one, look into other lenders.