The Best Mobile Apps for Filing Taxes in 2023

It arrives like clockwork every April: tax time. With how complicated the American Tax code is it’s easy to feel overwhelmed when you’re getting ready to file your taxes.

Many companies have made the majority of their money by trying to simplify the tax filing process for consumers.

These days, it’s even possible to file your taxes from your phone.

Depending on your tax situation, filing from a phone might be easier than using a computer or an accountant. You might even be able to file for free.

These are the best mobile apps for filing taxes.

Find out whether they’re right for your tax situation — so you can do it quickly and for free.

Best Apps for Filing Taxes

| App Name | Price | Platform |

|---|---|---|

| TurboTax | Free filing if you have simple tax situation For other situations price varies between $89 - $259 | iOS Android |

| H&R Block Tax Prep | Free filing if you have simple tax situation For other situations price varies between $29.99 - $84.99 | iOS Android |

| TaxAct Express | Free filing if you have simple tax situation For other situations price varies between $24.95 - $64.95 | iOS Android |

| TaxSlayer | Free filing if you have simple tax situation For other situations price varies between $17.95 - $47.95 | iOS Android |

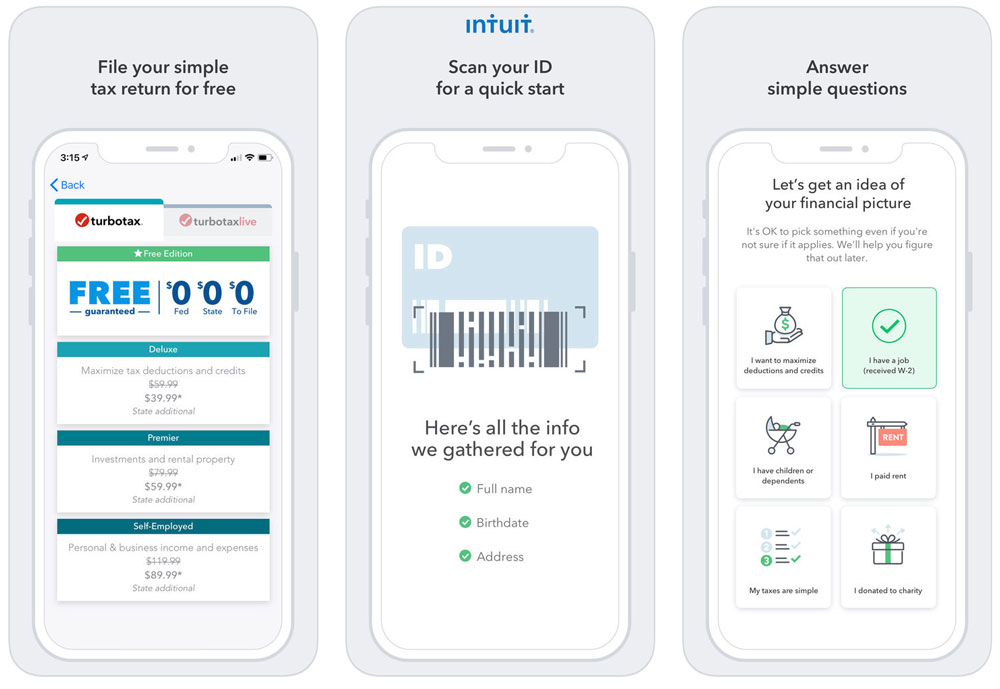

TurboTax

TurboTax iPhone App

TurboTax iPhone App

TurboTax is one of the best-known tax filing software on the market today.

When you file your taxes with TurboTax, the software will pose a series of questions to you. All you have to do is answer those questions honestly.

Occasionally, you’ll have to upload forms or input numbers for your income and expenses.

The program does all the rest for you, giving you a pre-filled tax form you can submit.

It even keeps a running tally of your refund, so you can see how much you’ll owe or be owed as you fill in your taxes.

TurboTax has a mobile app available for both iOS and Android that offers a number of cool features.

One really helpful feature is the ability to upload a photo of your W-2.

The W-2 is the tax form sent by your employer that lists how much you made last year and how much tax was withheld.

Once you take the picture with your phone, the app will load the correct values right into the tax forms.

You won’t have to go over the form and input each value manually.

TurboTax can handle almost any tax situation, so nearly everyone is eligible to use the smartphone app.

TurboTax offers a few different types of service, the price, and which you use depends on your tax situation.

To be eligible to file your return for free, you must have a relatively simple tax situation.

You cannot itemize deductions, be self-employed, have earned capital gains, or be involved in other complicated tax situations.

You also can’t earn more than $100,000 in a year or have any dependents.

H&R Block Tax Prep

H&R Block iPhone App

H&R Block iPhone App

H&R Block offers a tax return app to go along with its in-person tax preparation service.

You can file completely on your own, or integrate your use of the app with in-person meetings with a tax preparer.

Like TurboTax, H&R Block Tax Prep gives you the option of taking a picture of your W-2.

That means no manual entry of numbers from complicated forms and fewer opportunities for mistakes.

You can even freely switch between working on your taxes on your phone and doing them on your computer or tablet.

That makes it easy to get some work done on your taxes while you’re on the go.

H&R Block Tax Prep is available on iOS, Android, and Kindle Fire devices.

You’re eligible for free tax filing if you have a simple tax situation, much like TurboTax’s requirements.

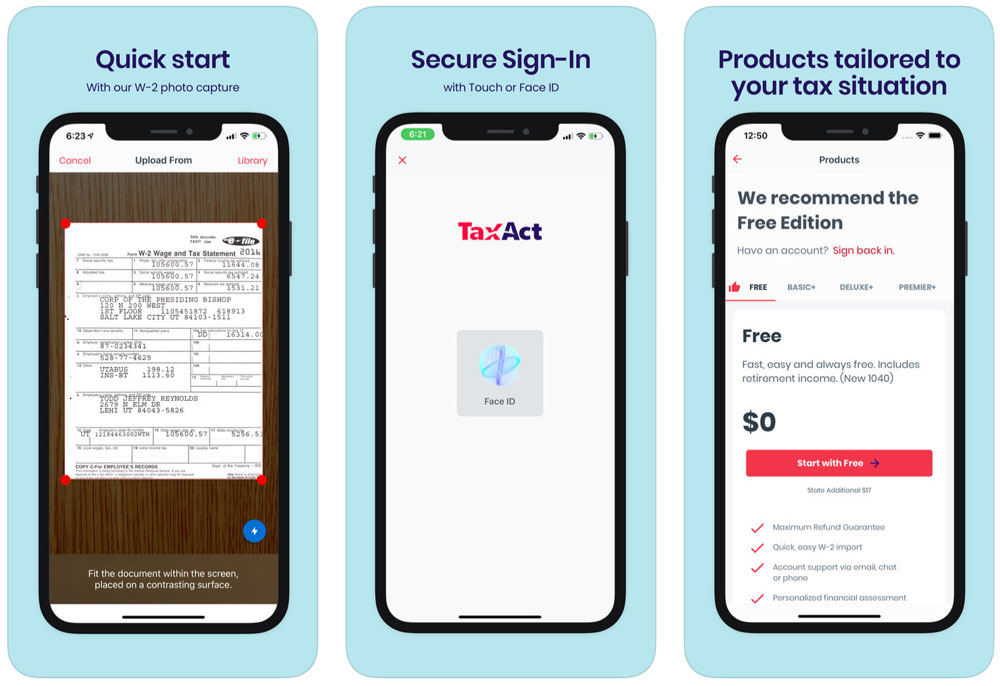

TaxAct Express

TaxAct iPhone App

TaxAct iPhone App

TaxAct Express is the mobile tax filing solution from TaxAct. It covers a wide variety of tax situations and is downloadable on any iOS or Android device.

TaxAct lets you file standard W-2 wages, receive dependent credits, education credits, saver’s credits, and earned income credits.

You can also file more complicated forms like 1099-DIV and 1099-INT for dividend and interest income.

If you have a simpler return, you can file for free, but even if you have a complicated situation, TaxAct Express is very cheap.

It’s most expensive plan is right around $50, beating out the prices of TurboTax and H&R Block.

If you’re not sure what version of TaxAct is right for you, you can start filing for free.

Once you’ve decided you like the software and know which version you should purchase, you can purchase it.

There’s no obligation to purchase once you’ve started.

TaxAct also offers a $100,000 accuracy guarantee.

If an error in the software causes you to receive a smaller refund or owe money to the IRS, TaxAct will reimburse you, up to $100,000.

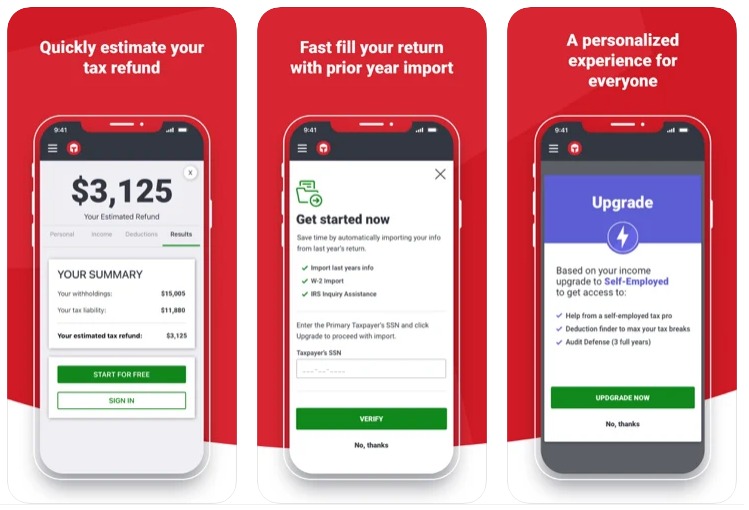

TaxSlayer

TaxSlayer, available for iOS and Android devices, helps you estimate your taxes early so you can start budgeting for tax-time.

The company offers a calculator to estimate your taxes by entering your W-2 or just a copy of your paycheck.

That means you can get started on your taxes early, long before you have all the forms you to actually file.

TaxSlayer will use that information to gauge how much you’ll owe or be owed when you file your taxes.

If you find out that you have a big tax bill coming, you can start saving early.

TaxSlayer offers four different flavors of its software. TaxSlayer Simply Free does not cost anything to use.

If you have a W-2, are not claiming dependents, and you just need to file a basic form 1040, you may qualify to use TaxSlayer Simply Free.

Active-duty military personnel are eligible to file federal tax returns for free through the TaxSlayer Classic.

How We Picked

The best mobile apps for taxes were selected from a pool of eight (8) mobile apps that were available to general consumers on the Apple App Story or Google Play Store.

The following factors were considered when choosing the winners:

- Easy of use and navigation

- Cost of tax filing services

- Client assistance via the apps

Mobile Tax Apps That We Analyzed

| App |

|---|

| TurboTax |

| H&R Block TaxPrep |

| TaxSlayer |

| TaxAct Express |

| TaxCatalyst |

| Taxfyle |

| TaxesToGo |

| Credit Karma Tax |

Troubleshooting and Tax Help

Taxes are complicated. That’s why you need to use one of these apps in the first place.

If you have questions, it can be reassuring to have a second opinion or the help of a tax professional.

TurboTax and H&R Block tend to provide the best service when it comes to getting help with your taxes through one of these apps.

With TurboTax, you can contact your tax specialist right through the app to ask any questions you have.

The specialist will respond to your inquiries in real-time.

They can even draw directly on your screen, making it easy to understand their advice.

H&R Block also offers a team of tax experts that you can contact right through the app should you need help.

If you have a lot of trouble with filing your taxes, you can also visit an H&R Block location in your area.

Because you can import and export your data from the app to an H&R Block tax preparation location, it’s easy to get in-person help without wasting time.

TaxAct and TaxSlayer both offer knowledge bases and FAQ pages. TaxSlayer customers have access to free unlimited phone and email support while TaxSlayer Premium customers get to speak with tax professions and live chat help.

This can take a while, forcing you to stop working on your taxes while you wait for help.

Who Should Not Use These Apps?

Being able to file your taxes from your phone is convenient, but it’s not right for all taxpayers.

For example, taxpayers who have very complicated tax situations probably should not use one of these apps.

While you might be able to handle it through the app, uploading all the necessary documents and entering the required data could get cumbersome.

Imagine entering data from two-dozen different forms using your phone’s keyboard. Filing from a PC might be easier.

People who are very uncomfortable with taxes should also probably avoid these apps.

While they do their best to hold your hand and make filing taxes easy, there are in-person services that will do almost all of the filing for you.

While these services can be expensive, they’re great for people who cannot manage on their own, or who just want the helping hand.

What About Tax Code Changes?

From a year to year basis, the tax code can change.

The good news is that you don’t have to worry about such issues with the tax software.

Rest assured that the tax apps will be updated accordingly.

The tax preparation companies have plenty of time to ensure that the software reflects the appropriate tax rules for that filing year.

What Happens After You’ve Filed?

After you’ve filed, it’s time to play the waiting game. The IRS collects tax-returns from every adult in the United States, so it can take some time to process your return.

All four apps will track your tax return’s status for you, so you can know what’s going on with your taxes at all times.

You can also use the IRS2Go app, available for iOS, Android, and Kindle Fire OS.

The app is the official app of the Internal Revenue Service. You can use it to check your refund status, make payments, get helpful tips, and get tax preparation assistance.

You can use the IRS2Go app no matter which software you used to file.

Conclusion

Filing your taxes can be hard work, but there’s a variety of apps that will make it easier.

Consider using one of them so that you can work on your taxes while you’re on the go.

Don’t forget to put part of that tax refund into a savings account for yourself.