Can Utility Bills In Collections Hurt Your Credit Score?

Americans are responsible for more utility bills than ever these days.

Gas, water, internet, electricity, and phone bills can all be considered types of utility bills. If you’ve ever wondered whether failing to pay these bills can affect your credit the answer, in a word, is yes.

If you fail to pay your utility bills, the utility company is well within its rights to report you to credit agencies.

Your account can also be sent to collections. If that happens, collections agencies will start coming after you, demanding payment.

If you want to know more about how utilities and credit scores interact, this article will break things down.

Can Utility Bills Affect Your Credit Score?

Usually, when you think about your credit score, you think about it in terms of the ability to get a loan or credit card. You don’t think about your credit affecting other parts of your life.

While it’s true that utilities are different than credit lines, they’re not as different as they might seem.

How they’re similar

When you use a credit card, the card issuer pays the merchant on your behalf. Later you have to pay the card back. You receive the benefit up front and pay for it later.

Similarly, when you turn the lights on in your house, you use electricity. The electric company will send you a bill later, and you pay for the service then. You receive the service before pay for it.

Where they differ

If you pay your utilities on time, they are not reported to the credit bureaus and do not affect your credit.

This can be annoying, especially for people who are trying to build their credit score.

Even if you pay all your monthly bills on time, your credit score won’t improve unless one of those bills is related to a loan.

The way that a utility bill can affect your credit is if you stop paying the bill.

If you go long enough without paying the bill, the utility company will send your account to collections. This will be recorded on your credit report and hurt your credit score.

What Does It Mean When a Utility Bill Is In Collections?

When you owe money to someone, whether it be a friend or a company, that person or company has to convince you to pay the money back.

Companies usually do this by sending you a bill each month. If you don’t pay your utility bill, the company will turn off whatever service it provides for you.

If the cancellation of service isn’t enough to get you to pay your bill, the company has to find another way to make you pay the bill. Usually, the company does this by sending you letters reminding you of the delinquent account.

If you still fail to pay, the company will try to cut its losses. It will do this by selling your debt to a debt collection agency at a steep discount.

For example, if you owe $100, a collections agency may buy the right to pursue you for payment for as little as $5.

The company you originally owed gets something out of the deal. The collections agency gets the potential for a large profit if it can make you pay.

Collection agencies use a number of tactics to try to convince you to pay. If you have an account in collections, you should take the time to read up on how to handle debt collectors when they contact you.

How Utilities Can Damage Your Credit

Having an account in collections will have a negative effect on your credit score.

To understand how it will affect your credit, you’ll need to understand how credit scores are calculated.

How your credit score is calculated

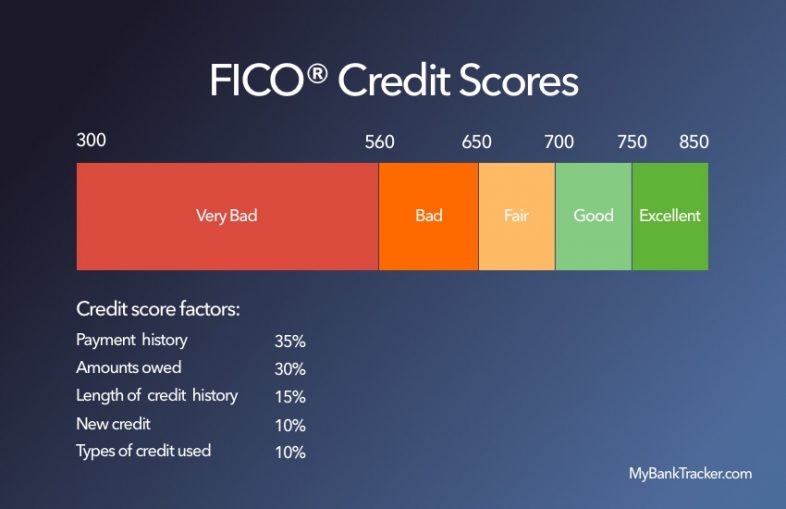

The two most important factors are your payment history and the amount of money you owe. The other three factors are all roughly equal in importance after that.

Which factors affect your credit?

An account in collections indicates that you’ve failed to make on-time payments on your bills. This will affect the payment history portion of your credit. Because payment history is the most important part of your credit, it’s easy to see why having an account in collections is a bad thing.

The amount in collections will also affect the impact on your credit score. Having a bill for $40 in collections is much less serious than having a bill for $4,000 in collections.

What’s the effect of a utility bill in collections?

It’s difficult to know exactly how much your credit score will drop if you have an account enter collection.

The effect is determined by how good your credit currently is, and the size of the bill. If you have good credit, your score has more room to drop, so it will drop more than someone who already has poor credit.

If you already have one account in collections, adding another one also won’t cause as large a dip.

How old the collections account is will also change the impact on your score. Newer accounts will have a larger impact. Old collections accounts will have a lesser effect on your credit score.

In the end, it’s not unusual to see your credit score drop by as much as 100 points if you have an account enter collection.

That’s enough to move you from the category of having excellent credit to having poor credit, significantly impacting your ability to borrow money.

What to Do With a Utility Bill in Collections

If you have an account sent to collections, it’s important to know how to handle the situation.

Debt collectors are notorious for being difficult to deal with. Many will resort to intimidation and unethical or illegal tactics to make you pay.

Confirm the debt

The first thing that you need to do when a debt collector contacts you is to remember never to admit responsibility to the debt.

If you admit responsibility, you will have to pay it, even if you later find out the debt isn’t yours.

Instead, demand that the collections agency sends you proof that you owe the money and that the agency has the legal right to collect on the debt.

It’s not unusual for debt collection agencies to contact the wrong person when trying to collect.

Some agencies might also re-sell debt they’ve purchased but still, contact you. This could result in multiple agencies trying to collect on the same debt.

If the debt collection agency is unable to prove that you owe the money, or that it is authorized to collect, it will have to remove the account from your credit report.

If you’re not ready to handle a call from a collections agency, don’t be afraid to not speak to the collector.

Tell the person that you’re busy and cannot take the call, then hang up. This will give you time to formulate a plan. Just make sure not to put off the conversation for too long. You’ll have to face it eventually.

How to Pay Off Old Utility Bills

If the debt collector is able to prove that you owe the outstanding utility bill, it’s time to start working with the debt collections agency.

Remember that collections agencies buy your debt for pennies on the dollar. They don’t expect to get paid in full for most or even many of the debts they purchase. Use that to your advantage.

Try to negotiate to set up a payment plan. If you can’t pay the full amount at once, set up a plan where you make monthly payments for a set amount of time until the debt is paid off. You can also try to settle for less than you owe.

For example, if you owe $1,000, ask the debt collector if you can settle the debt for $600. This can potentially save you a lot of money.

If you do negotiate with the collections agency, get everything in writing. A verbal agreement is not worth much in court, so you might later find that you still owe money to the agency, even though you fulfilled your end of a verbal agreement.

Having it in writing makes it easier to prove.

Can You Remove a Utility Bill In Collections?

An account in collections will disappear from your credit report seven years after the delinquency date of the account.

The delinquency date is the date when you first failed to pay the bill. So long as you never brought the account back into good standing, the account falls off your credit report seven years from that date.

You can also negotiate what is known as a pay-for-delete when you talk to the collections agency.

Tell the agency that you’ll pay what you owe, but only if it removes the collections report from your credit report.

Many will be willing to do this, and it will have a big impact on your credit score.

Conclusion

Utility bills, like any kind of bill, can be sent to collections. If that happens, it can have a big effect on your credit score.

Do your best to make timely payments on your bills, but if you do have an account enter collection, make sure you know what to do.