Can You Have Too Many Credit Cards?

How many credit cards can a person really have? Technically, there’s no limit on the number of credit cards you can have.

For those that are responsible with their credit cards and don’t pay interest, you could have quite a few credit cards.

On the other hand, credit cards can be dangerous. If your credit card habits include hitting your credit limit, you could have a hard time managing many credit cards.

In many cases, you very well could be denied if you apply for more cards.

The number of credit cards a person can have will depend on their financial situation and how they handle their credit.

Here are the extreme possibilities and how having many credit cards could affect you.

Why You May Choose to Apply for as Many Credit Cards as You Can Get

The credit card industry is heavily regulated, but there isn’t a law that limits how many credit cards a person may have. Laws don’t always have the final say, though.

Credit bureaus don’t limit the number of credit cards you can have, either. In fact, credit bureaus just collect information about your credit history.

So can you really get as many credit cards as you want? The true number of credit cards you could have isn’t unlimited.

To get new credit cards, you’ll have to find credit card issuers willing to give you new credit.

Finding willing issuers could get difficult after you’ve opened up a few cards. You don’t have to be discouraged, though.

Walter Cavanagh of Santa Clara, California currently holds the Guinness World Record for having 1,497 valid credit cards.

Cavanagh’s record is an example that anyone can open as many credit cards as they want and manage them responsibly.

You Decide How Many Credit Cards to Apply For

While having 1,497 credit cards could be an aspirational goal for some, for others it would be a total nightmare.

Thankfully, not everyone can get access to as many credit cards as they would like.

You’re the first person that gets to decide when you have too many credit cards.

Of course, you’re only the first person to decide if the credit card companies aren’t already denying your applications.

When you’re paying interest

Credit cards usually come with high APRs. Those high APRs mean carrying a balance could result in high interest charges.

This interest can quickly create a mess for your personal finances.

Chances are you already have too many credit cards if you’re carrying a balance from month to month.

If you reach the point where you know you have too much credit, quit applying for new credit cards.

You can even close your other credit cards until you’re down to a level you’re more comfortable with.

Who Else Decides When You Have Too Many Credit Cards?

Credit card issuers are the major player that has a say in how many credit cards you have. They can manage the number of cards you have in more than one way.

Issuers have the final say when it comes to approving or denying your applications for new credit cards.

Issuers will deny your applications if they don’t like what they see when they check your credit.

Example: Chase uses its 5/24 rule to deny people that they feel have too many credit cards.

To get approved for certain Chase credit cards, you must not have opened more than five new credit cards within the last 24 months.

What’s even more eye-opening is the fact that Chase doesn’t just consider their own credit cards in the calculation.

Instead, they count all credit cards you’ve opened regardless of the issuer.

Credit card issuers have another way to manage the number of credit cards you have open, as well.

If a bank is getting suspicious about your ability to handle credit, they can pull your credit report with a soft inquiry to check up on you.

If they don’t like what they see, they can lower your credit limits on your credit cards or close your accounts in the worst case scenario.

How Having More Credit Cards Affects Your Credit Score

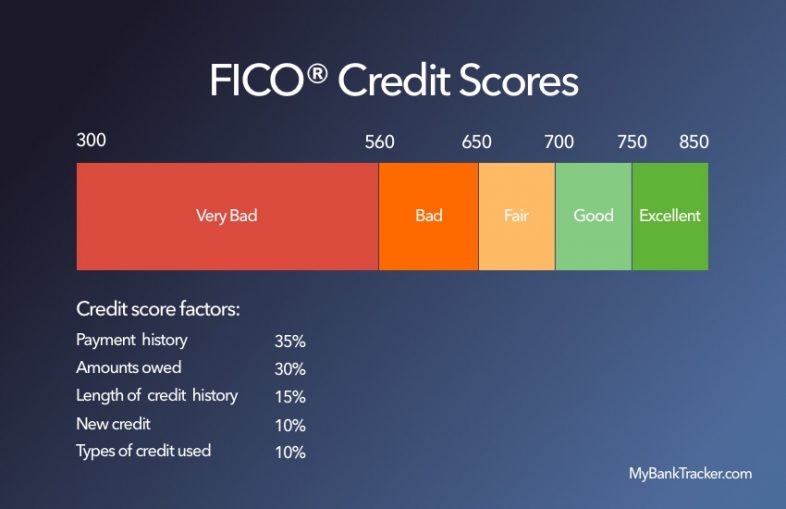

Your credit score is calculated based on the information on your credit report. Credit scoring formulas use five major categories to calculate your credit score.

Here’s how having many credit cards could impact your credit scoring categories according to the FICO credit scoring model.

Keep in mind, having many credit cards and applying for many new credit cards would have different impacts on your credit score. Similarly, any action could impact many portions of your credit score.

While an action may hurt one category, it could improve other categories. The improvement could more than offset the negative impact in the first category.

Payment history

Your payment history is the largest part of your credit score at 35 percent. Whether you make your payments on time technically has nothing to do with how many credit cards you have.

As long as you continue making every single payment on time, having many credit cards won’t negatively impact this part of your score at all.

Unfortunately, juggling many credit cards means you could miss a payment. If that happens, your credit score could get dinged for the missed payments.

That’s why it’s super important to have a system in place to either auto pay your credit cards or make sure you never miss a payment.

How much you owe

The second largest part of your credit score (30 percent) is based on how much you owe, commonly called credit utilization.

The credit scoring model wants to see how much of your available credit you’re using.

Usually, the lower your balances are as a percent of your credit limits, the better you’ll score in this category.

Having many credit cards could help keep a low credit utilization ratio as long as you keep your balances low on each credit card.

On the other hand, having many maxed out credit cards can definitely hurt your credit score in a major way.

Length of credit history

The length of your credit history accounts for 15 percent of your credit score. This category is one where applying for multiple new credit cards could hurt your score.

Credit scoring models like to see a long credit history and a long average age of credit. As long as you keep your first few cards open, you’ll have the long credit history portion covered.

Getting many new credit cards will lower your average account age, though, which will likely damage this portion of your credit score.

Credit mix

Credit mix accounts for just 10 percent of your credit score.

Credit mix is calculated by taking a look at your mix of different types of credit accounts. Some examples include credit cards, installment loans, mortgages, and finance company accounts.

It is unknown whether having a large number of credit cards could hurt this portion of your score.

FICO says credit mix isn’t a crucial factor when it comes to calculating your credit score in most cases.

They do say it is important if you don’t have much other information to calculate a credit score, though.

New credit

New credit also accounts for 10 percent of your credit score.

Having many credit card accounts won’t hurt this portion of your score if they’ve been open for a while and you haven’t applied for any new accounts lately.

Applying for multiple new credit cards in a short period of time would definitely hurt this portion of your credit score.

Of course, other factors that change based on new credit you obtain, such as overall credit utilization ratio, could improve your score more than the decrease you’d see from applying for new credit.

What Happens If You Don’t Use a Card for a Long Time?

Chances are you won’t carry 10 or more credit cards in your wallet or purse with you everywhere you go.

Instead, some will end up in a desk drawer at home and only get used rarely, if ever. What happens to those credit cards?

Many credit card issuers will eventually close an account with no activity on it as these accounts don’t provide any profit for the issuer.

If you aren’t making transactions, paying interest, paying fees or making money for the issuer in some way, there may not be a business case for the issuer to keep the card open.

So how can you avoid having an issuer close your credit card due to inactivity?

Use once in a while

One way is to keep track of when you’ve made your last purchase on a card.

Once you’ve gone a few months without making a purchase on the card, break it out and buy something to keep the account active.

Set up automatic payments on them

Another less labor-intensive way to keep your cards open is to put a small bill with autopay, such as Netflix, on each card you don’t plan on using for a while.

If you decide to do this, you may want to consider automatically making at least the minimum payment on the cards with these autopay bills to make sure a missing statement doesn’t wind up with a late payment and a damaged credit score.

You Decide

Opening many credit cards can result in great benefits or it could financially destroy you.

Ultimately, it’s up to you to only apply for as many credit cards as you can responsibly manage.

Your personal credit card limit could be as high as 1,497 cards or as low as none at all. Either way, it’s up to you to make sure you don’t let things get out of control.