The Best Robo-Advisors for Automated Investing in 2026

Robo-advisors help people build and manage an investment portfolio with little effort. They’ve made investing easy for people who may not have the time, knowledge, or inclination to manage a portfolio.

While robo-advisors all have the same goal, making investing more accessible and automatic, how they accomplish that goal can differ.

Some are focused on doing everything for you, while others let you customize your experience and investments a little more.

We analyzed 10 of the most popular robo-advisory services to settle on the three best robo-advisors of the year.

Compare the Best Robo-Advisors

| Details | Betterment | Wealthfront | Schwab Intelligent Portfolios |

|---|---|---|---|

| Annual fee | 0.25% (0.40% for Premium) | 0.25% | None |

| Accounts available | IRAs, SEP IRA, brokerage, and trusts | IRAs, SEP IRA, 401(k) rollover, 529 college savings, brokerage, and trusts | IRAs, SIMPLE IRA, SEP-IRA, brokerage, and trusts |

| Minimum investment | $0 ($100,000 for Premium) | $500 | $5,000 |

| Investment options | ETFs | ETFs | Schwab ETFs |

| Auto rebalancing | Yes | Yes | Yes |

| Tax-loss harvesting | Yes | Yes | Yes |

| Access to live advisor | Premium accounts only | No | Yes |

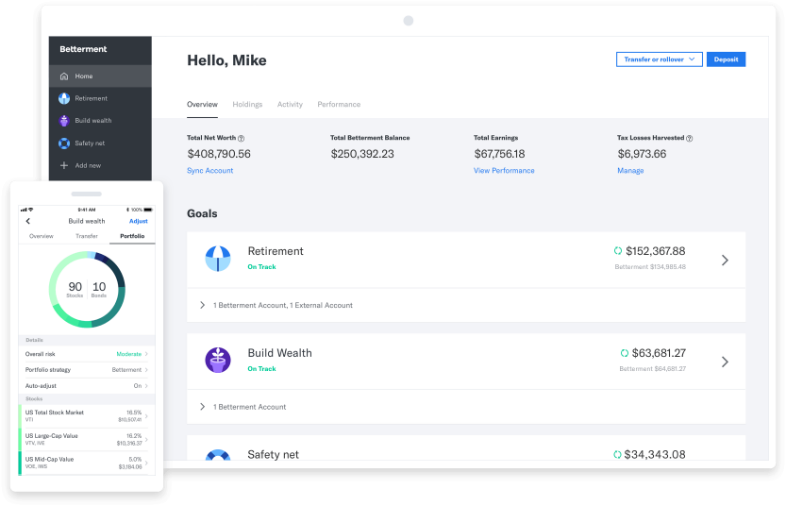

Betterment: Best for Designing Your Portfolio

Betterment is one of the significant robo-advisor companies that sprung up when robo-advisors first gained traction.

Betterment aims to offer a complete solution to your investment needs, including brokerage and IRA accounts.

Signing up is easy. All you have to do is answer some simple questions about your finances and goals, and Betterment will determine the correct portfolio allocation for you.

Then, Betterment automatically invests your money in a range of low-fee exchange-traded funds (ETFs), exposing you to a wide swath of the stock and bond markets.

Betterment also benefits hands-on investors, letting you design your portfolio while taking advantage of the robo-advisor software’s ability to optimize tax strategies and provide a clear picture of your investments.

Mobile apps are available on iOS and Android devices.

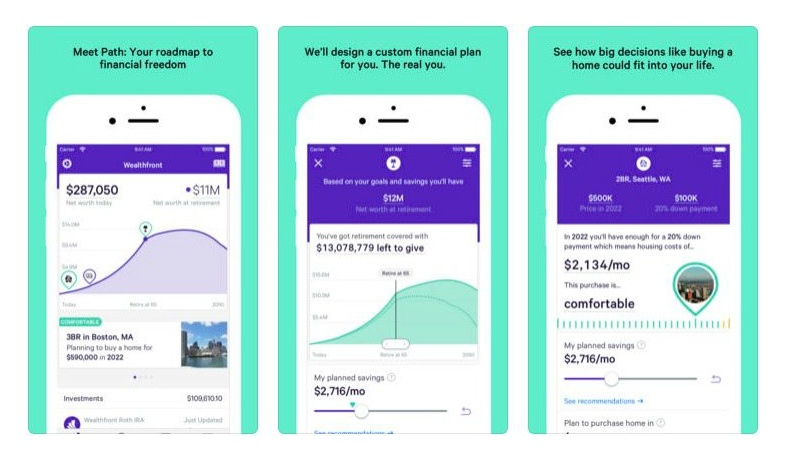

Wealthfront: Best for Mobile Account Management

Wealthfront is a robo-advisor designed to deliver a mobile-centric experience for beginner investors.

You can invest from anywhere just by using the Wealthfront app.

Wealthfront’s platform leverages Modern Portfolio Theory to invest your money in stocks, bonds, real estate, and exchange-traded funds to help you reach your financial goals.

To provide further assistance to people who are just beginning to invest, Wealthfront launched a product called Path.

Path is a mobile financial planning tool that can help you visualize your financial accounts, spending habits, and how your decisions impact your present and future financial situation.

You can explore what-if scenarios or check Path to see if you’re on the right path.

Mobile apps are available on iOS and Android devices.

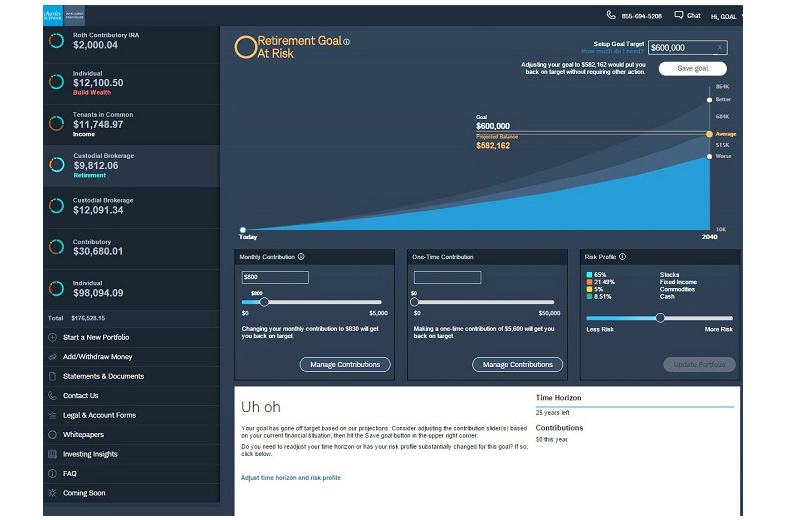

Schwab Intelligent Portfolios: Best for Investing Tools

Schwab Intelligent Portfolios is the robo-advisory arm of the major financial company Charles Schwab.

The program comes with all the benefits of working with Schwab, including meager fees. Most robo-advisors charge a fee for their services.

Schwab charges no advisory fees, account service fees, or commissions, making it great for people looking to keep costs low.

You also get full access to Schwab’s other tools. You can use Schwab’s research tools to help you take a more hands-on approach to your investing.

If you want help visualizing your goals, Schwab’s Goal Tracker can help you view your portfolio, its performance, and how it might perform.

Mobile apps are available on iOS and Android devices.

Marcus Invest: Best for New Investors

Marcus Invest aims to get investors started immediately with automated investing through three different portfolio strategies.

The ETF-based portfolios include:

- Core: For investors who prefer to have their portfolio track the market

- Impact: For investors who support sustainable and environment-friendly business practices

- Smart Beta: For investors who are willing to accept more risk for higher potential returns

Available accounts include individual taxable brokerage accounts, joint taxable brokerage accounts, traditional IRAs, Roth IRAs, and SEP IRAs.

The annual advisory fee is 0.35% of the total assets managed.

Marcus Invest will automatically maintain the set asset allocation and rebalance your portfolio. Additionally, Marcus Invest will sell assets to ensure the lowest taxable gains — for tax efficiency purposes.

Please read our review of the Marcus Invest platform.

SoFi Invest: Best for Low Fees

The Automated Investing platform from SoFi Invest stands out with one significant advantage: no advisory or management fees. This is possible because SoFi sponsors ETFs that may comprise your managed portfolio. Portfolios can range from very safe to aggressive, depending on your risk tolerance and financial goals.

Additionally, SoFi Invest will rebalance your portfolio automatically to maintain the proper asset allocation over time.

Investors can manage their portfolios with ease thanks to a full-fledged mobile app.

Please read our full review of the SoFi Invest platform.

How We Picked

We chose these three companies from a list of the 15 most popular robo-advisors on the market.

When comparing the different companies, here are the factors that we considered.

Robo-Advisors That We Analyzed

| Robo-Advisor | Best Feature |

|---|---|

| Betterment | $0 minimum investment. |

| Wealthfront | Can integrate with your banks accounts. |

| Schwab Intelligent Portfolios | Low overall fee policy. |

| Wealthsimple | Socially-responsible investing. |

| SigFig | Ability to manage accounts at other brokerage firms. |

| FutureAdvisor | Access to a human advisor if needed. |

| M1 Finance | No account or trading fees. |

| Vanguard Personal Advisor | Low-cost option at a popular fund company. |

| Fidelity Go | Begin investing with just $10. |

Annual fees

One of the top things we looked at when comparing robo-advisors is their fee structures.

Fees are significant when it comes to investing. Investing is a marathon based on the long-term compounding of your money.

Fees also compound over time, so what seems like a small fee can take a massive bite out of your account’s balance over long periods.

To see the impact of investment fees, consider this example:

You invest $10,000 today, with plans to withdraw the money 25 years from now when you retire. Your investment earns 8% yearly, and you have $68,484.75 after 25 years.

If your robo-advisor charged a 0.25% fee, you would instead have $64,629.67 after 25 years, which is nearly $4,000 less.

Most robo-advisors charge account management fees or annual fees of some kind. The fee format for each service can vary.

Some charge a flat amount for accounts of a specific size, and others charge a percentage of the invested assets. Others will change the rate as your account’s balance grows.

Generally, you’ll pay less on a percentage basis as your balance grows, but keeping note of how much you pay is essential.

The robo-advisors that fared best in our reviews were the ones that charged the lowest average fees.

Account types offered

Investing can be complicated for several reasons.

Finding money in your budget is complex, and deciding what to invest adds to the difficulty. Further complicating matters is that you can open many different types of investment accounts.

You might want a taxable brokerage account, an IRA, a Roth IRA, or a SEP IRA.

Each type of account has its own rules, benefits, and restrictions.

That means that any company offering that type of account has to be equipped to manage them, so not all robo-advisors provide all kinds of budgets.

Most robo-advisors offer taxable brokerage accounts and basic retirement accounts such as traditional and Roth IRAs.

More unusual accounts, like self-employment retirement accounts, trusts, or employer 401(k) accounts, are offered by far fewer robo-advisors.

When you use a robo-advisor, the software has to be able to view and access all of your investments to work optimally. If you have assets with another company, the robo-advisor won’t be able to view and manage those funds, so it won’t perform to the best of its ability.

For that reason, we looked for robo-advisors that let you open various account types, making it easy to keep your money in one place.

Fund selection

Most robo-advisors work by investing your money in various Exchange Traded Funds (ETFs).

ETFs are like mutual funds in that they provide a way to diversify your investment while having the convenience of purchasing shares in one entity.

The ETFs a robo-advisor invests in are essential to its service.

For one, not all ETFs that aim to track the same portion of the market perform the same.

Some ETFs may miss their benchmark, so you want a robo-advisor that invests in tested ETFs that have shown that they can track their benchmark indices accurately.

ETFs also charge management fees of their own. Robo-advisors that invest in low-fee ETFs have the advantage as they keep your money working for you.

Portfolio design and customization

A robo-advisor’s portfolio design method is another essential part of the experience.

Some robo-advisors will design your portfolio for you based on your answer to questions it asks. These questions help the software determine your goals, needs, and risk tolerance.

Other robo-advisors give you a choice of portfolios and let you pick the one you like. These robo-advisors give you some flexibility when choosing your investments, but they’ll still handle the menial processes of purchasing the assets for you.

Finally, some robo-advisors let you design your portfolio down to the individual securities you hold.

Which is best for you depends on what you’re looking for. Some people want a set-it-and-forget-it solution, while others want to be more hands-on.

Companies that can hold your hand but give you the freedom to customize when you see fit do the best in our reviews.

Rebalancing

Rebalancing is an essential part of any investment strategy.

It is the process of selling some of your better-performing investments to purchase more shares of your worse-performing investments to ensure that your asset allocation remains in the range you want.

Robo-advisors handle rebalancing differently. You want to find a robo-advisor that handles it automatically while minimizing trading fees or taxes.

Tax-loss harvesting

One feature that many robo-advisors offer is their ability to tax-loss harvest automatically.

Tax-loss harvesting is selling investments that have dropped in value to take advantage of tax deductions for investment losses and reinvesting that money.

Robo-advisory companies regularly claim that their tax-loss harvesting systems will earn you more money than you pay in management fees.

Efficient tax loss harvesting can improve your portfolio’s performance, so look for robo-advisors that provide this service.

Access to experts

Even with a robo-advisor handling your investments, sometimes you want to talk to a natural person to get an expert opinion about your financial situation.

You may be planning to buy a house or put together a retirement plan. Whatever it is, a robo-advisor can’t answer questions about your unique situation.

All it can do is invest your money through a preset program or formula.

Many robo-advisory companies offer a team of financial experts (usually certified financial professionals) who can help you talk about your financial goals so that you can determine your priorities.

Having an expert who can help you learn more about investing and designing goals can help you take full advantage of a robo-advisor.

That gives companies that offer the chance to work with these experts a leg up.

Methodology

We evaluated over 20 robo-advisory platforms, including those offered by brokerages, banks, and financial services providers. The criteria for choosing the best robo-advisors include fees, investment options, portfolio design, digital experiences, access to certified financial professionals, and other services such as rebalancing and tax-loss harvesting.