How Secured Credit Cards Help to Build a Good Credit Score

Secured credit cards look like your typical credit cards and to others like prepaid debit.

They’re an entirely unique product, however, that requires a cash deposit as collateral. Like most credit cards, secured credit cards report your activity to credit agencies.

These cards are designed for people with bad credit. With responsible usage, you can repair your credit score in as little as 12 months.

Noticeable improvements can be seen in just six months.

Remember that these are still credit cards, so it is possible that you could hurt your credit score even more if you don’t use them wisely.

What is Considered Bad Credit

Bad credit can be the result of many circumstances. Commonly, your credit is damaged when you file bankruptcy, miss a payment, have an account in debt collection, and much more.

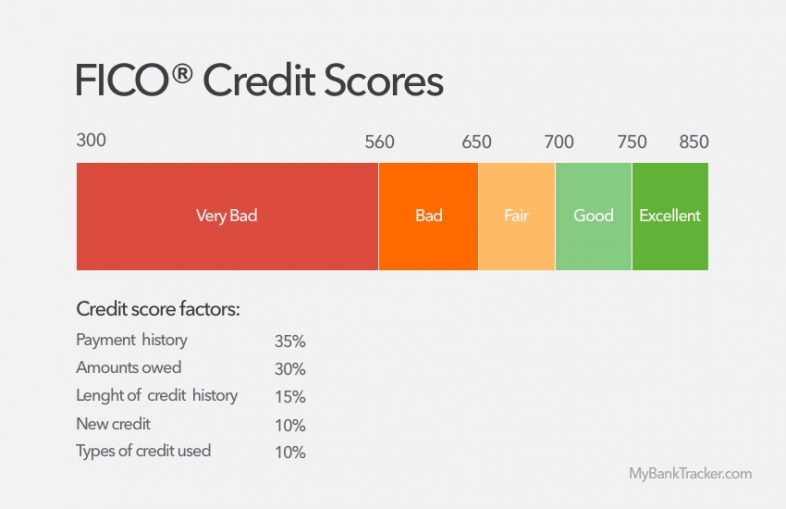

But, what exactly is a bad credit score? Using the FICO credit score model, a bad credit score ranges from 350 to 650. F

ICO credit scores are used by 90% of the largest U.S. lenders when approving or denying loan applications.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

It can be difficult to qualify for a traditional credit card with bad credit. This is why secured credit cards can be helpful for repairing bad credit. The security deposit makes it safer for credit card companies to lend to you.

The Differences Between Secured and Unsecured Cards

A typical credit card is unsecured. This means there’s no collateral held in exchange for credit. Based on trust, the lender offers to pay for your purchase upfront.

In return, you agree to pay them back with interest and minimum monthly payments.

The size of your credit line is determined by the lender — usually based on your credit score, income, and monthly housing expenses.

Secured credit cards, on the other hand, require a deposit for collateral before you can even use the card.

The initial deposits usually range from $250 to $500, though some can be found for as little as $49.

The deposits can go as high up as $10,000. More importantly, your secured card’s credit limit is the same as your security deposit. So, if you put down a larger deposit, you’ll have a larger credit line.

Some secured cards will offer to raise your credit limit without additional deposits. This perk is commonly the result of good behavior during the initial months of having the card.

Secured cards often do have annual fees, and it’s important to do your due diligence to find the card that works best for your situation.

Regardless of which card type you choose, do not let them upsell you on any additional programs or subscriptions like insurance.

Secured Credit Cards Are Very Different From Prepaid Cards

Although they seem similar on the outside, it’s important to know that a secured credit card and prepaid debit card are two entirely different products.

The cards you’ll see in stores amongst the gift cards are prepaid debit cards, which do not report to credit agencies and will not improve your credit.

Prepaid debit cards do have a use, however, in that most have a routing number that allows you to set up direct deposit.

To pay your credit card bills, you’re going to need a deposit account to pay with.

This is why secured credit and prepaid debit cards are often used hand-in-hand by people who either don’t have or can’t get a bank account.

Although there is often a monthly fee for prepaid debit cards, monthly direct deposits are usually enough to waive that fee.

How Credit Scores Are Affected

Most reputable banks will report both a secured and unsecured credit card balance and payment history to the three major credit bureaus. This is a question you need to ask before signing up for the card.

After a period of about a year, the card issuer will often convert a secured card to unsecured, either returning your deposit or applying it to your balance. This is when the card starts to help your credit.

Credit scores take many factors into account, including payment history, amounts owed, and credit history length. Here’s a breakdown of your credit score from MyFICO:

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you’ve requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

The two most important factors in your credit score (accounting for 65% total) are your payment history and amounts owed.

Your debt-to-credit ratio with revolving credit lines (i.e. – credit cards) is a large contributing factor to the amounts owed.

Keeping even a secured credit card with small payments and paying it off in full every month is one of the single most effective methods of improving your credit score within six months to a year.

Although you’ll be paying it off in full each month, keep in mind that your FICO credit score will still likely reflect the month-end balance, while reporting it’s paid current.

Tip: You can manually pay off a large part of your balance before the statement cycle ends. This will reduce the balance that is reported to credit bureaus. It will appear as if you’re using less of your credit line.

Considerations for Using Secured Credit

It’s important to understand the bad financial habits that got you bad credit in the first place. If you don’t change them, you can repeat them with your secured card.

It’s not an instant “get out of jail free” card, but rather a ticket to walk the path back to good credit. Here are some problems you’ll run into with secured credit cards:

Generating more debt

After having spent $500 to secure a credit card, you look at your $500 limit a little different.

It’s easy to think “well it’s my money I already paid,” but that’s not what it was. That $500 was your bet that you can be a responsible spender. Just because you have a credit card doesn’t mean you have to use it.

Retain it as a card to be used for gas, and pay it off every single month.

Remember, spending only $300 on a $1,000 limit already pushes you to a 30% credit utilization ratio. That’s as high you’ll ever want it to be.

Late payments

You cannot miss a payment with any credit card or loan. Remember the chart above – payment behavior is the biggest factor of your credit score.

You need to get in the habit of scheduling auto-payments as often as possible and always ensuring there’s money in the account when those payments hit.

Late payments will impact your credit score negatively for at least six months.

Missing payments

Once you start blowing off payments, you’ll find yourself in the collections process, which, if you’re reading this, I assume you’re familiar with.

Your phone starts ringing, and messages are left practically daily as emails and mail pour in showing you’re past due.

The credit card gets shut off, sometimes after only 30 days – sometimes 60.

You lose your deposit, and the account is closed on your credit report, undoing any good and forcing you to start over from the beginning with another deposit and another company.

The Best Secured Credit Cards

For those salivating to find out which secured credit cards will best help repair their credit, here are five of our favorites:

Capital One Platinum Secured Credit Card

Most secured cards set a credit limit equal to the deposit, but, if your credit and income are good enough, the Capital One Platinum Secured Credit Card

will let you deposit as little as $49 or $99 to get a $200 spending limit.

Of course, if your credit is bad, you’ll have to pay the $200, but even that is one of the lowest fees around.

Capital One reports to all three credit bureaus, and you can even make partial payments for up to 80 days on the initial deposit.

In addition to being the cheapest secured card to start, Capital One will consider you automatically for a higher credit limit in as little as six months. This makes it the fastest credit-repairing card on this list.

Read Capital Obe Secured MasterCard Editor’s Review

OpenSky Secured Visa Credit Card

Like USAA, the doesn’t ever transition to an unsecured card.

However, like Capital One, the is a great option for those with bad credit or lacking a bank account.

Most secured credit cards still check FICO credit scores, and many require you to have a bank account.

This is where prepaid debit cards come in handy, as they provide a routing and account number to be utilized as a deposit account.

The annual fee for this secured card is $35, and there’s no credit check needed to obtain one. Although OpenSky doesn’t check credit scores, it still reports to all three credit bureaus.

Read OpenSky Secured Visa Credit Card Editor’s Review

USAA Secured Card Platinum Visa

Unlike other secured credit cards, USAA puts your deposit to work for you.

When you open a USAA Secured Card Platinum Visa, your $250-$5000 deposit is used to open a two-year certificate of deposit, the balance of which becomes your limit.

Although the CD earns a variable interest rate, it’s not much. To raise your credit limit, you’ll need to deposit more in the CD, which is a great savings tool.

The card also comes with a $35 annual fee, but it’s worth it to obtain USAA benefits like rental car protection, fraud protection, and more.

Veterans and active duty military are likely already familiar with USAA, but you don’t have to be in the armed forces to get a secured credit card with a low APR. USAA reports to all three credit bureaus.

Discover It Secured Credit Card

What makes the Discover It Secured Credit Card so unique is its rewards program with no annual fee.

Both of these features combined make the Discover It Secured Credit Card the best secured card for people who want to earn rewards and build good credit.

If you can qualify, this card offers 2% cash back per quarter on up to $1000 worth of spending on restaurants and gas and 1% for all other spending.

With disciplined spending, this could be a great bonus, though reward cards have their downsides. Discover reports to all three credit bureaus.

Conclusion

For the most part, secured credit cards look and work just like a regular credit.

The biggest difference is that you need to put down a security deposit.

Otherwise, you can use the card as you normally would with any credit card. Over time, you’ll improve your credit score as long as you make your payments on time.