The Best Secured Credit Cards of 2026

A secured credit card can be an incredibly useful tool if you want to improve your credit or establish it for the first time.

Secured credit cards require no credit check and are great for rebuilding credit.

For some, you don’t even need a bank account to get one.

And just a small amount of time using one (think one year or less) can make you eligible to move up to a regular credit card.

With secured credit cards, you’re required to put up a security deposit as collateral for the card. In most cases, this deposit dictates the amount of your credit limit.

Once you have a secured card, your usage of the card is reported to the major credit bureaus. If you keep your balance low and pay on time every month, this reporting will lead to a higher credit score for you.

You should consider a secured credit card if you have no credit or bad credit.

These are the options that we’d most recommend as the best secured credit cards available now:

Best Secured Credit Cards of 2025

| Credit Card | Notable Feature | Who It's Best For |

|---|---|---|

| Capital One Secured | A secured credit card with an extremely low initial deposit requirement to help rebuild credit immediately. | People who have poor credit and don't have a lot of cash for a big security deposit. |

| Chime Credit Builder Secured Visa Credit Card | No annual fees or interest charges. | People who can't put down a large security deposit. |

| OpenSky Secured Visa | Does not require a bank account. | People with bad credit who don't have a bank account. |

Capital One Platinum Secured Credit Card: Best for Building Good Credit

Capital One Platinum Secured Pros & Cons

| Pros | Cons |

|---|---|

|

|

When it comes to secured cards to build credit, the Capital One Platinum Securedis hard to beat because it requires a very low-security deposit.

That means:

You can get started with rebuilding your credit right away.

With a security deposit of just $49, you’ll qualify for a $200 starting credit limit. You can increase this limit with additional deposits at any time up to $3,000. This is a secured credit card with no annual fee.

Read the Capital One Platinum Secured editor’s review.

Chime Credit Builder Secured Visa Credit Card: Best for Low Fees

The Chime Credit Builder Secured Visa Credit Card is an excellent choice for anyone who is on a mission to build or re-establish good credit.

Unlike a traditional secured credit card, the Chime Credit Builder Secured Visa does not require a minimum security deposit. Rather, you must open a Chime Checking Account (no monthly fee; must have direct deposits) and have funds moved to the secured account to pay for purchases.

With no annual fee or interest charges, you can use this secured card without worrying about excessive costs to improve your credit score.

OpenSky Secured Visa: Best for People Without Checking Accounts

OpenSky Secured Visa Card Pros & Cons

| Pros | Cons |

|---|---|

|

|

If you’re looking for a secured credit card with no bank account, the OpenSky Secured Visa is ideal and doesn’t require a checking account to qualify.

This is great news for anyone who’s unable or unwilling to obtain a bank account.

Instead, you can submit your security deposit through a wire transfer, check, or money order. There’s an annual fee. Your credit limit can range from $200-$3,000.

Read the OpenSky Secured Visa Credit Card editor’s review.

How We Picked

We analyzed more than 20 secured credit cards offered by U.S. credit card issuers and compared their card fees, interest rates, and benefits.

These cards were ranked based on how each one would best help consumers obtain a secured credit line at the lowest cost. While some of the cards are from advertisers on MyBankTracker, they are truly the best options that we’d recommend even if they weren’t affiliated partners.

How Your Banking History Affects Ability to Get Secured Credit Cards

Why does it ever matter if you have a bank account to get a secured card?

Because most banks want to see a positive banking history before they approve any type of credit. Therefore, many people who’ve had mishaps with bank accounts in the past have to turn to prepaid debit cards as a result.

How does this all work? Just like how the FICO score works with measuring our credit history, we all have banking histories that are recorded.

ChexSystems is an agency that records consumer banking histories, and every consumer is entitled to one free ChexSystems report every year.

Examples of banking infractions that are recorded include check fraud, frequently bounced checks, excessive overdrafts, and negative account balances.

If you don’t have a checking account because of these or any other reasons, the secured credit cards that don’t require a checking account are a great alternative credit option that will help you improve credit.

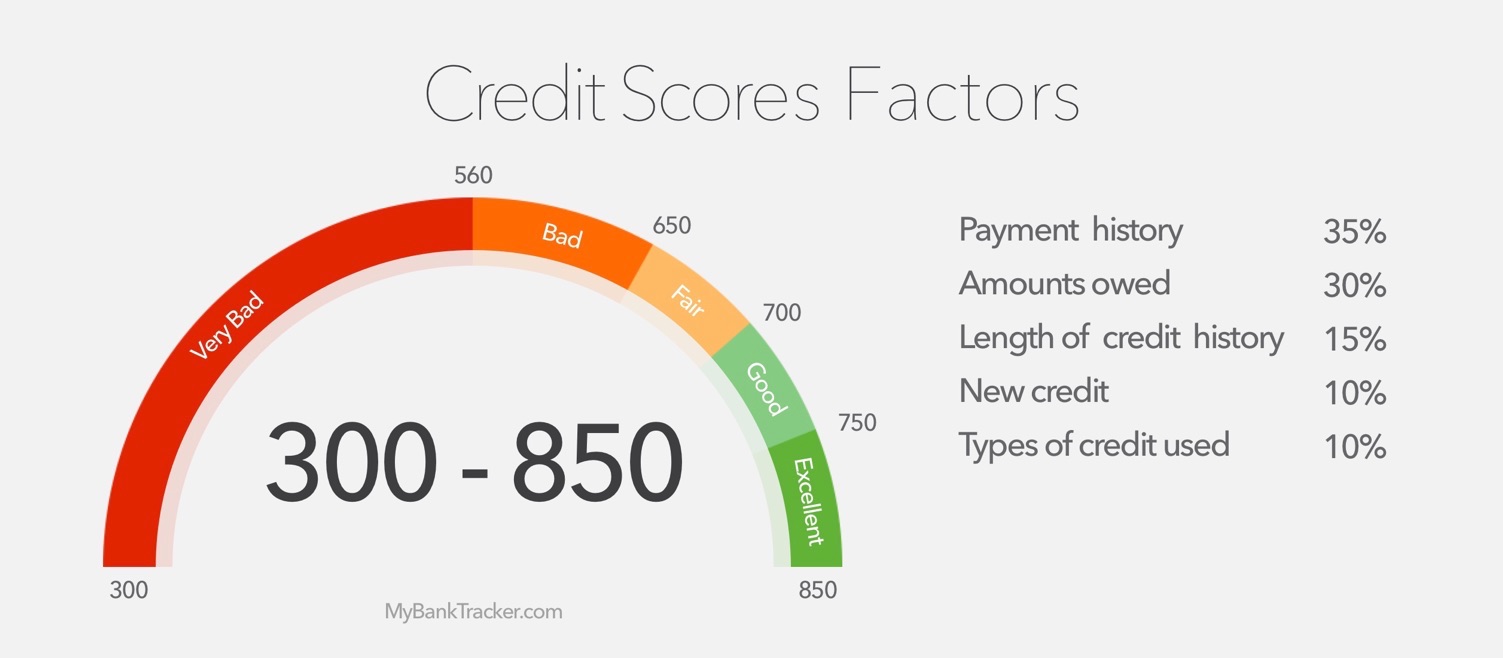

How Your FICO Credit Score Matters

FICO credit scores are the standard metric used by lenders to judge your creditworthiness.

In other words, FICO gives lenders an idea of whether or not you’re likely to default on a loan or line of credit.

Although FICO doesn’t disclose the exact formula used to calculate its credit scores, it does share the criteria that factor in.

These are the five factors that go into calculating your FICO score:

“Amounts owed” looks at your total balances divided by your total credit limit.

For example, a $1,000 balance on a credit card with a $10,000 limit means your debt utilization is at 10%. If you use a lower percentage of your available credit, your credit score will be higher. Keeping lower balances with higher credit limits will help decrease your credit utilization.

If you have a traditional credit card you can decrease your credit utilization by asking for a credit line increase. Secured card borrowers don’t have to do this. Instead, they can simply put down more on their security deposit and their credit limit will go up.

This is an easy way to improve this portion of your credit score (if you have the extra money to deposit).

How to Recover from Bad Credit Scores

Often simple things like late payments and missed payments, compounded over time, can cause your score to dip dangerously low. When things like this happen, your lender reports them to the three major U.S. credit bureaus.

Other actions that can hurt your score include unpaid bills, accounts in collections, bankruptcies, and foreclosures.

If this happens too often, your score will become so low that you won’t be able to qualify for traditional credit cards and loans. And, even if you do qualify, it will likely be at a much higher cost.

This is why it’s so important to work on improving a bad credit score. Secured credit cards can help. Improving your credit score doesn’t just qualify you for more credit in the future – but it can save you money on the credit you get. That’s long-term savings worth working for.

Secured Credit Cards Can Become Unsecured Cards

People that use secured cards to rebuild credit have the opportunity to become eligible for an upgrade to an unsecured card, but it depends on the issuer and whether or not your account is ready for this type of review.

If you want your account to be ready for this review, simply make all your payments on time and keep your monthly balance as low as possible. Your card issuer may then allow you to graduate to a traditional credit card.

The other alternative would be to close your secured credit card and open an unsecured credit card when your credit has improved. However, you may not want to take this route.

Opening a new credit card and closing a credit card are actions that can hurt your credit scores – at least temporarily. Applying for new credit can have a slight impact on your credit score if the application behavior makes it seem like you need new credit a little too much.

Meanwhile, a closed credit card account will stop aging. That affects the “length of credit history” criteria of the FICO credit score calculation.

Why Secured Cards Need Security Deposits

Because secured credit cards are tied to collateral, lenders are more willing to lend to borrowers with imperfect credit.

Usually, your security deposit sets the amount you’ll have as a credit limit. You can usually increase your limit by increasing your deposit (which can be done at any time).

When your card issuer gets your security deposit, they’ll place it in a deposit account. This is money that you don’t have access to until or if you close your card. (If your balance is zero when you close your card, you’ll get a refund on your deposit.)

You may also receive your deposit back if your issuer upgrades you to an unsecured credit card.

Tips on Using Secured Cards

Anyone can use a secured credit card to create a credit history or to repair broken credit simply by using their card responsibly. This is an easy, accessible way to build good credit to eventually qualify for traditional credit cards at low interest rates.

It’s important to find the right secured card that suits your lifestyle and financial needs. Remember, this is a chance to get in control of your credit.

To make the most informed choice, keep these factors in mind:

1. Secured credit cards are not prepaid debit cards

It can be easy to confuse secured credit cards and prepaid debit cards. After all, they both require you to put down a deposit before you can use them. Here’s the difference:

On a debit card that you’ve deposited $1,000 on, the money is depleted until you reach zero dollars. Think of it like a gift card – they work the same way. But on a secured credit card, the credit limit you set is held by your card issuer as collateral.

Even though that deposit you put down is cash, you’re still making your purchases on credit. Your deposit, in the case of a secured credit card, is simply insurance for the lender. If you default, they can keep that money. If you don’t, you get it back when you close the card.

2. Ensure your payments are reported to credit bureaus

What would be the point of using a secured credit card if your credit behavior went unnoticed?

Unfortunately, some secured credit card providers don’t report your activity to TransUnion, Experian, or Equifax. This nullifies your credit improvement efforts. In this case, your secured card is no better than a debit card.

Before you select a secured card, check first with the issuing bank or company to see if they conduct credit reporting. Without it, you can be making your monthly payments on time and it won’t make one difference to your credit score.

3. Watch out for scams

Signing up for any random secured credit card could subject you to an assortment of scams.

For example, many cardholders discover that they can only use their card to purchase unwanted items from a specific website or catalog. Of course, you won’t be told this until after you’ve made your deposit.

You should also watch out for any card that requires you to call a 900 number. These scammers make their money charging for the phone call (often up to $50) and won’t issue you a card in the end. Always do your research on a card before you apply.

4. Read the fine print on fees and security deposits

Don’t get stuck with a secured credit card that doesn’t have a policy on deposits or payment periods. You could be at a loss if you make a large security deposit and discover you can only get it back by closing your account.

Likewise, always confirm what the payment grace period is. A typical unsecured card will give you this period (for example, two weeks from the statement date) to make a minimum payment without interest.

But if your card doesn’t offer one, you’ll owe interest on your balance the second you put money on the card.

5. Don’t keep secured credit cards forever

Responsible use of a secured credit card should eventually qualify you for a traditional, unsecured card. Even better, you may be eligible for traditional credit card quicker than you might think.

You can use your secured card for as long as you like. But remember that, with most secured cards, you won’t receive benefits like cash back, rewards points, or other rewards inherent to many traditional credit cards.

It’s up to you to keep checking your credit and applying for unsecured credit cards as your score improves. Soon, you’ll be approved for one with the excellent credit you built thanks to the help of your secured credit card.

6. Earn cash back while building good credit

Cash back is a type of reward that allows you to accumulate money back for using your card. Usually, you can redeem your cash back through check, direct deposit, or a statement credit. Keep in mind that these cards do sometimes impose limits on cash back earnings.

With credit card rewards such as cash back, it’s important to note that the rewards are given based on where you make the purchase – not what you buy. If you earn a higher cash back rate at gas stations, for instance, everything you buy at a gas station (e.g., snacks, beverages, gift cards and more) counts.

One thing to keep in mind with cash back rewards cards is that carrying a balance month to month removes the benefit you’ll get with cash back rewards. If you’re paying more in interest than you’re getting in cash back, then there’s really no benefit to you in the end.

Therefore, a cash back secured credit card is ideal for people who are able to pay their balance in full each month.