Why Your Credit Scores Drop After Paying Off a Loan?

In the minds of most borrowers, paying off a loan should exhibit financial responsibility.

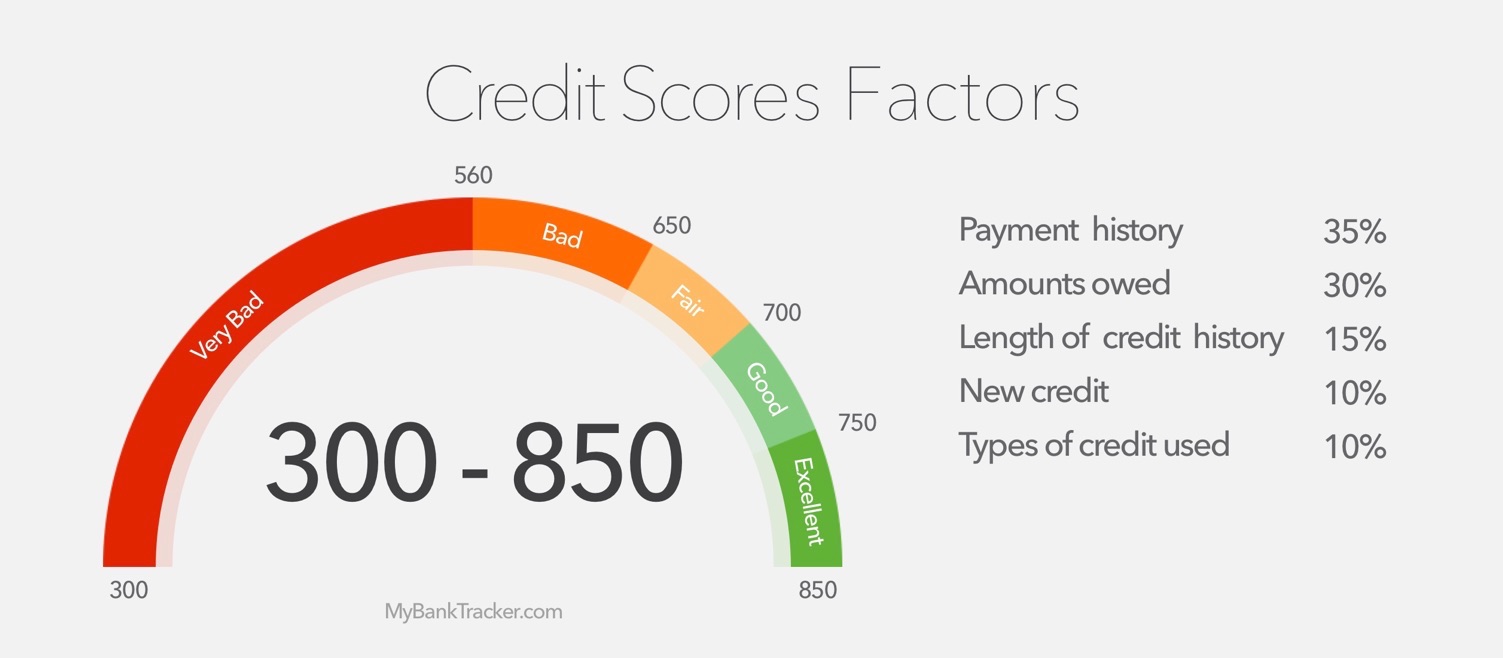

But, many borrowers who do so will see a drop in their credit scores. There is an explanation for that, and it has to do with how credit scores are calculated.

Q: Last week, I paid off my student loan (about one year earlier than scheduled). I checked my credit score recently (FICO via Experian, if that matters) and noticed my credit score actually fell from the last time that I checked it. Shouldn’t it increase instead? I’m worried because I’m looking for a mortgage soon.

– Donald P.

A: Experiencing a drop in your credit score is actually a very common occurrence when an installment loan (e.g., mortgage, auto loan and student loan) is paid off.

Luckily, in the long-term, there should be no major impact to your creditworthiness.

When your student loan is paid off, there are two factors that cause the decline in your credit score.

Firstly, there is the debt utilization ratio, which is calculated by dividing your total debt by your combined credit limits.

When an installment loan is paid off, the account is marked as closed on credit reports and the credit limit on that account is no longer recognized. This effectively removes a portion of your combined credit limit.

For example, you had a $1,000 balance on a credit card with a $5,000 credit limit and a $1,000 balance on a student loan with an original amount of $20,000 (which is noted as the credit limit of the account).

You had a 4% debt utilization ratio.

After paying off the student loan, and therefore erasing the account from the calculation, you now have a 20% debt utilization ratio. The higher debt utilization ratio depicts a riskier borrower.

With credit cards, which are considered revolving accounts, their credit limits remain factored into the formula even if the card balances are $0.

And, the average age of accounts is used to determine your credit scores — the older the accounts, the better your credit scores will be.

Although an account is closed, the age of the account is used to calculate the average age of accounts.

However, the closed account stops aging, so it can actually bring down the average age of your accounts.

Closed accounts with no negative history will be deleted in 10 years, after which the age of these accounts will no longer matter when calculating your credit scores.

The hit to your credit scores is temporary and they should rebound with time.

As for your plans to apply for a mortgage, it would be wise to cut down any existing debt and refrain from opening new credit lines in the next 3 to 6 months before making that move.