Simmons Visa Credit Card 2026 Review

There are many reasons you might choose a specific credit card, and in order to get the most value for your money, it’s important that you select the ones that are best for your particular needs.

Although a number of credit cards offer attractive bonuses and rewards programs designed to award card users with miles or points that can be redeemed for free flights or hotel stays, these aren’t the best cards for all users.

For instance, if you are currently working on paying debt down and typically carry balances from month to month, you can save more money with a low-interest credit cards like the Simmons Bank Visa Platinum Credit Card, even if it means you don’t get any rewards in return.

Also, if you are having difficulty paying down a balance because of a high APR, transferring those balances to a card with a lower APR can help you to pay it down faster and cost you less money.

That said, credit cards that focus on providing low interest rates rather than other fancy bells and whistles can help you gain control of and pay down debt, without costing a lot in interest.

Here are the other details you need to know about .

Simmons Bank Visa Platinum helps save money through a low APR

Simmons Visa Card Pros & Cons

- Good card for people who want to consolidate debt or make a large purchase with low-interest

- Low foreign transaction fee

- No annual fee or balance transfer fees

- Good if you carry a balance month-to-month

- Excellent credit required for approval

- No rewards or cash back

- Not available in every state

The best feature of the Simmons Bank Visa Platinum Credit Card is the low APR.

If you typically carry a balance from month to month, you save the most money with a credit card that charges the lowest amount of interest.

The APR with many other credit cards is, at least, around the 15% range, which can quickly add up, even if the card provides other perks and benefits.

With this card, you can be certain that you pay the least amount of interest when you use it.

No fee for transferring balances

Plus, there is no balance transfer fee, which is usually, at least, 3% of the balance transferred.

Because of the low APR and no balance transfer fee, you can save a significant amount of money by transferring balances from a card with a higher APR to this one, and paying it down at 7.50%.

Another part of the low-fee features that the card stands out for is the foreign transaction fee of 2%.

Although no foreign transaction fee for foreign purchases is best, this is, at least, lower than the 3% fee that other cards charge.

So, if you only make foreign transactions occasionally and can benefit from the low interest and other no-fee features of the card, the 2% foreign transaction fee may be a little better for your budget than others.

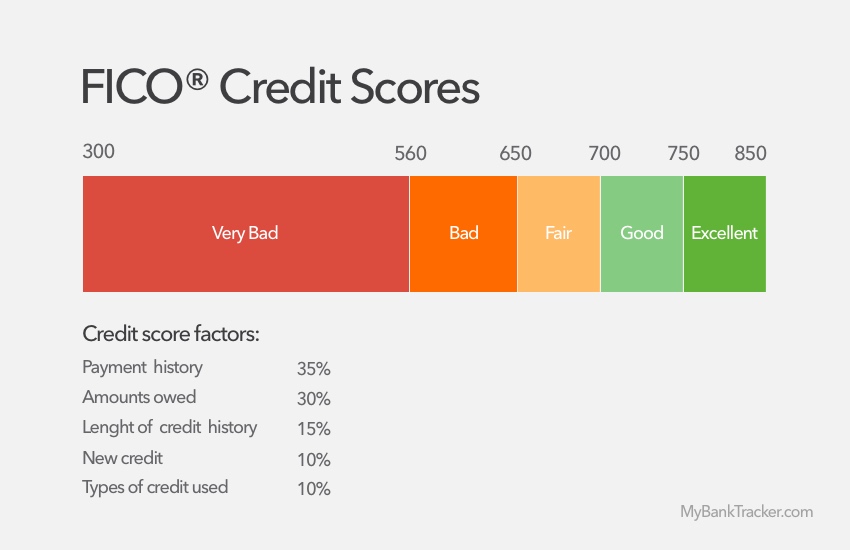

Excellent credit score required for approval

Because the Simmons Bank Visa Platinum card is known for providing lower interest rates than most other credit cards, it requires a slightly higher credit score.

The same high level of credit rating is often required from attractive rewards credit cards.

Simmons Bank Visa Platinum comes with travel perks

This card also includes other benefits that can help you to save money, such as the following:

Travel insurance

Even though it isn’t exclusively a travel credit card, this card includes travel accident insurance which provides $1,000,000 coverage in the event of accidental death or dismemberment while traveling on a common carrier ticket purchased with the card.

Car rental loss and damage waiver

You also get car rental loss/damage waiver so that you can waive the car insurance offered when you rent a car. This insurance covers the car rental against damage due to collision, theft, and vandalism

Calculating the Costs: Other Fees and the Interest Rate

Although there is no annual fee or balance transfer fee, you should be aware of other fees with this card. Other costs and fees to consider with the Simmons Bank Visa Platinum Credit Card include the following:

Simmons Bank Visa Platinum Credit Card

| Simmons Bank Visa® Platinum Credit Card | Fees |

|---|---|

| Cash advance fee | 3% (minimum $4 and maximum $50) |

| Late payment fee | an amount equal to late payment or $25, whichever is less |

| Returned payment fee | up to $25 |

| Foreign transaction fee | 2% |

The service fees on this card are nothing out of line compared to the service fees charged by most other credit cards

Final Verdict: Is the Simmons Platinum Visa Credit Card Worth Getting?

For being such a simple, plain-vanilla credit card, the Simmons Bank Visa Platinum is well-known because of its lower than normal interest rate.

Plus, it’s difficult to compete with no annual fee and no balance transfer fee. As far as low-interest credit cards go, this one is among the lowest available and has the fewest fees.

However, the Simmons Bank Visa Platinum isn’t for everyone.

If you typically pay your balances in full every month, you could be missing out on valuable rewards that are offered with other cards, even though they carry higher APRs.

Plus, if your spending falls primarily into a specific category, such as gas, groceries, or airfare with a particular airline, you can get a lot more for your money with cards that reward those purchases, if you avoid the higher interest rate by paying your entire balance every month.

Basically, if you don’t need to transfer a balance or take advantage of the low interest rates, you may not get much out of this card.

This card is best for those who typically carry balances from month to month and should rely more on a low-interest, low-fee credit card than cards that include extra rewards or benefits.

Also, if you are currently working on paying down a balance on a credit card with a high APR, you can break free and pay down your balance faster by transferring it to this card.

As an extra benefit to choosing this card for the transfer, you won’t pay a balance transfer fee, which is rare among credit cards.