How to Upgrade from the Chase Sapphire Preferred to Reserve

As two of the most popular travel rewards credit cards, Chase Sapphire Preferred and Chase Sapphire Reserve make it difficult for applicants to choose between them.

Chase Sapphire Preferred (see our Chase Sapphire Preferred Review) provides great travel rewards and benefits at an annual fee ($95) that is significantly less than that of Chase Sapphire Reserve ($550 – see our Chase Sapphire Reserve Review).

Over time, however, some Preferred card members may begin to realize that they could also make use of the benefits of the Reserve card.

Can you upgrade from Chase Sapphire Preferred to Reserve?

Yes, you can upgrade from Chase Sapphire Preferred to Chase Sapphire Reserve by phone (dial the number on the back of your existing Chase credit card) or online (through a secure message in your online account).

Are you one of these customers thinking about upgrading?

Here’s what you need to know before making a switch.

Chase Sapphire Preferred vs. Reserve

| Benefit | Preferred | Reserve |

|---|---|---|

| Annual fee | $95 | $550 |

| Rewards rates | 3x points on dining and 2x points ontravel; 1x point on all other purchases | 3x points on dining and travel; 1x point on all other purchases |

| Credits | $50 annual Ultimate Rewards hotel credit | $300 travel statement credits and $100 Global Entry/TSA Precheck membership credit |

| Lounge access | None | Priority Pass Select |

| Travel rewards redemption rate | 1.25 | 1.5 |

| Travel loyalty program transfers | Yes | Yes |

| Authorized user fee | $0 | $75 |

Why Choose Chase Sapphire Preferred?

At first glance, the Chase Sapphire Preferred might seem like the better credit card for you.

The annual fee is only $95.

By far the most attractive feature is the welcome bonus you can earn after meeting the spending requirement.

You can earn plenty of points on travel and dining.

Also, points are worth 25% more when you book travel through Chase Ultimate Rewards. This includes airfare, hotels, car rentals, and cruises.

You can even transfer your points to travel partners. These include United, British Airways, Hyatt, and Marriott.

Why Choose the Chase Sapphire Reserve?

If you’re happy with your Chase Sapphire Preferred card, you may not feel a need to upgrade to Sapphire Reserve. But don’t immediately dismiss the idea of a switch.

It’s important to understand how the Chase Sapphire Reserve credit card can offer the biggest bang for your buck travel-wise.

The card tends to offer a very attractive welcome bonus as well.

This card also includes a $300 annual travel credit. Also, cardholders can gain complimentary access to 1000+ VIP airport lounges worldwide. Plus, enjoy the elite hotel and special car rental privileges.

Points are worth 50% more when you book travel through Chase Ultimate Rewards. This is where the outshines the Sapphire Preferred.

Keep in mind that these added benefits aren’t without cost. One downside to upgrading to the Sapphire Reserve is the $550 annual fee.

Before you upgrade, consider how likely you are to use the extra benefits.

How to Upgrade from the Chase Sapphire Preferred to Reserve

Chase will no longer approve customers for more than one Sapphire credit card at a time.

With that being said, here’s what you can do if you have a Chase Sapphire Preferred card but feel the Sapphire Reserve card is a better fit for your wallet.

Request an upgrade to Sapphire Reserve

Contact customer service by phone to get an upgrade. Or, sign in to your Chase account and submit your request through secured online messaging.

In most cases, you’ll get a response in a few hours.

Approvals aren’t guaranteed. But the odds are in your favor if you’ve maintained a high credit score and you have a history of managing credit responsibly.

Be mindful of the fact that you must have your Chase Sapphire Preferred account for at least 13 months prior to requesting an upgrade.

While the Sapphire Reserve offers a sign-up bonus, you don’t qualify for these bonus points when upgrading from the Preferred card. These cards are in the same family and are considered the same product.

You will, however, gain immediate access to better benefits after the switch, namely a higher point value. This can make up for not getting the bonus points.

Apply as a new cardmember

The good news is there is a way to switch from the Sapphire Preferred to the Sapphire Reserve and get the bonus points. This involves skipping the upgrade and applying for the Reserve card.

First, you need to cancel your Sapphire Preferred credit card. Once you’ve closed this account, apply for the Sapphire Reserve credit card.

Keep in mind that this approach will only work if it’s been at least 24 months since you received your initial bonus points from the Preferred card.

If you close and apply for a new Sapphire account any sooner, you will be ineligible for the bonus.

Make sure you understand the possible repercussions of closing a credit card account. If you have other cards with high balances, closing your Sapphire Preferred card could cause a spike in your credit utilization ratio.

This can lower your credit score and make it harder to qualify for the Sapphire Reserve card.

Also, if the Sapphire Preferred is your oldest credit account, closing the card can make your credit history appear shorter. This can also cause slight damage to your credit score.

How to Handle Your Chase Ultimate Rewards Points

Only you can decide whether to cancel your Sapphire Preferred and apply for Chase Sapphire Reserve — or request an upgrade. In either case, it’s important that you don’t lose your Chase Ultimate Reward points.

- Phone number for Chase Sapphire Preferred customers: 1-800-493-3319

Redeem remaining points

Unfortunately, closing your Chase Sapphire Preferred can mean forfeiting unused Ultimate Reward Points.

If you’re considering getting rid of the card, redeem any remaining points before closing the account.

Transfer unused points

If you’re unable to redeem your points — and you have another Chase credit card — one workaround is transferring unused points to this card account.

You can also transfer your Chase Ultimate Rewards to airline or hotel partners before closing the account.

Does your spouse have a card that will earn you Chase Ultimate Rewards? If so, transfer your points to their card before closing the account to still enjoy the rewards.

Downgrade to another Chase card

Another option is downgrading your Sapphire Preferred to a Chase card that has no annual fees. Perhaps to the Chase Freedom Unlimited credit card.

Chase doesn’t approve customers for more than one Sapphire card. But you can get a Sapphire card and another card in the Chase family.

Understand that while you’re able to transfer points when downgrading from a Sapphire Preferred to a card in the freedom line, points will not have the same value as before.

Still, losing value is better than forfeiting all of your points.

Upgrade and keep your points

The good news about upgrading is that you don’t lose or forfeit reward points. Your Ultimate Reward points will transfer over once you upgrade your account.

If you’re thinking about an upgrade, hold off on redeeming points until you complete the transfer. This way, you’ll get more value for your points.

Remember, you’re eligible for a 50% bonus when booking travel through Chase Ultimate Rewards with the Sapphire Reserve. You only get a 25% bonus when booking travel with your Sapphire Preferred.

How Upgrading Affects Your Credit

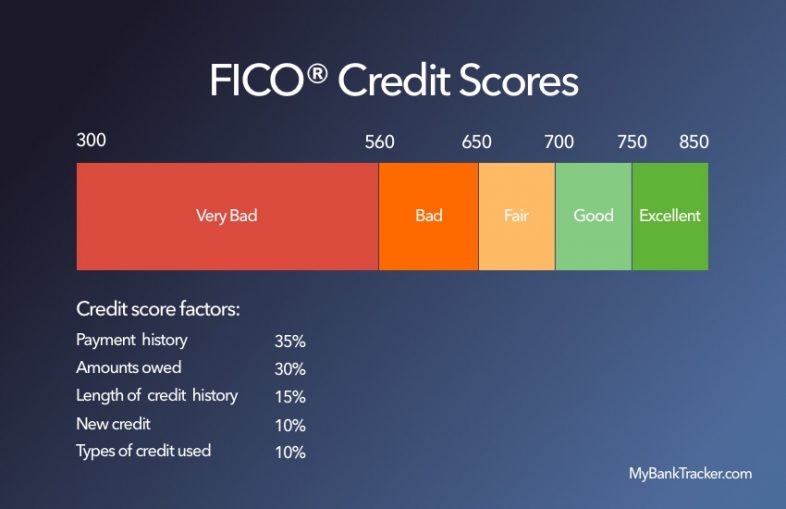

Make sure you understand how upgrading or applying for a new card affects your credit. Getting approved for the Sapphire Reserve requires an excellent credit history.

In fact, the average FICO score of those approved is around 785, according to Chase.

A good credit score and credit history determine your credit limit, as well as your interest rate.

But it isn’t enough to have excellent credit. Chase takes other factors into consideration when deciding whether to approve an applicant. Your chances of approval are higher if you have a low credit utilization ratio.

This is the total amount of your revolving debt compared to your credit limits. This ratio should not exceed 30%.

Chase also uses a “5/24 rule” when deciding whether to approve an application. In other words, you must have fewer than five new credit cards during the previous 24 months.

You may be ineligible for an upgrade or a new card if you have recently made late payments on your credit report.

Check your credit report and credit score before requesting an upgrade. Or before applying for a new account.

Dispute errors, pay your bills on time, and pay down balances if you have a high credit utilization ratio.

Conclusion

The and the are both excellent options.

The Sapphire Preferred has a lower annual fee, which is more desirable. Therefore, you may hesitate to apply for the Sapphire Reserve due to its $550 annual fee.

But remember, this card also includes a $300 annual travel credit. If you’re a big traveler looking to maximize your rewards, the Sapphire Reserve is the better card.

Then again, you might be new to the Sapphire family and don’t travel as much. In this case, the Chase Sapphire Preferred is a greater starter card.

Use the card for one or two years, see how you like it, and then consider an upgrade at a later time.