How Much Does It Lower Your Credit Score to Check Your Credit?

It’s wise to keep an eye on all aspects of your financial life, including both your credit report and your credit score.

Your credit report aggregates all the data about your credit history. It shows your accounts, lines of credit, balances, the age of all credit in your name, and other account details. This information helps determine your credit score.

Quick answer: Your credit score isn’t hurt at all when you check your own credit score.

Your credit score is a 3-digit number that helps lenders and other financial institutions like credit card issuers assess what kind of borrower you may be.

The better your credit score, the less risk you pose to the lender — and therefore, the more likely you are to qualify for the credit you want at a better interest rate.

Your credit report and your credit score are both important to know and understand because they influence your personal finances.

You can — and should — request a copy of your credit report once a year for free from AnnualCreditReport.com.

You can review your reports and make sure all the information is accurate and free from mistakes.

Errors on your report can lower your credit score, so it’s worth taking the time to check for them and resolve any that you find.

Can Credit Checks Lower Your Credit Score?

This all sounds well and good until you remember that inquiries can lower your credit score.

It makes sense to ask: When does pulling your report negatively impact your credit score? And for that matter, what happens when you check the score itself?

In some cases, yes, checking your credit can cause your score to drop.

Whether you or your creditors check your score, generating lots of inquiries in a short amount of time can dramatically lower your score. Even one or two checks can lower it by a small amount.

Those cases are when there is a hard inquiry on your credit. But this isn’t the only way to pull your report or score to evaluate either.

There are other kinds of credit checks, known as soft inquiries. Each kind of inquiry has a different impact on your credit score.

What Is a Hard Inquiry Versus a Soft Inquiry?

Hard inquiries indicate you actively want more credit and occur when a lender or creditor checks your credit as part of their decision to extend or deny credit or let you borrow money.

In most cases, you need to authorize a hard inquiry before it happens. You give permission to a lender or credit card issuer to do a hard pull on your credit, so you should be fully aware when this happens.

Here are some cases that result in a hard inquiry on your credit:

- Applying for a personal, business, car, or another type of loan

- Applying for a credit card

- Applying for a mortgage

The other kind of credit inquiry is known as a soft inquiry. Soft inquiries don’t impact your credit score because they occur for reasons other than requesting new or more credit.

The following kinds of actions will cause a soft inquiry, and therefore won’t affect your score:

- Checking your own credit score

- Requesting a copy of your credit report

- Submitting to a background check

That’s good news: you can check both your credit report and your credit score without creating a black mark on either one. Take advantage of this!

Knowing your credit score can help you determine if you need to work to improve it (or if you need to keep up the good work and maintain it).

Reviewing your credit report allows you to make sure all the information in your name is correct.

It can even protect against fraud since you’ll spot any accounts you didn’t open and can act to resolve the issue right away.

Other cases of hard inquiry or soft inquiry aren’t as cut and dry as the above lists. With the following examples, whether the check is considered hard or soft varies:

- Applying for an apartment

- Renting a car

- Opening some accounts, like cable or utilities

- Buying a cell phone and committing to a contract

- Increasing your credit limit on existing accounts and cards

In these instances, be sure to ask the company you work with whether they’ll perform a hard inquiry on your credit report.

Here’s What Happens When Inquiries Hit Your Credit

To understand why inquiries — specifically, hard inquiries — can lower your score, it helps to understand your credit score a little better.

Credit scores are calculated by a formula created by FICO. There are other credit scores, but you want to focus on your FICO score. Right now, it’s the score used by 90% of lenders and creditors.

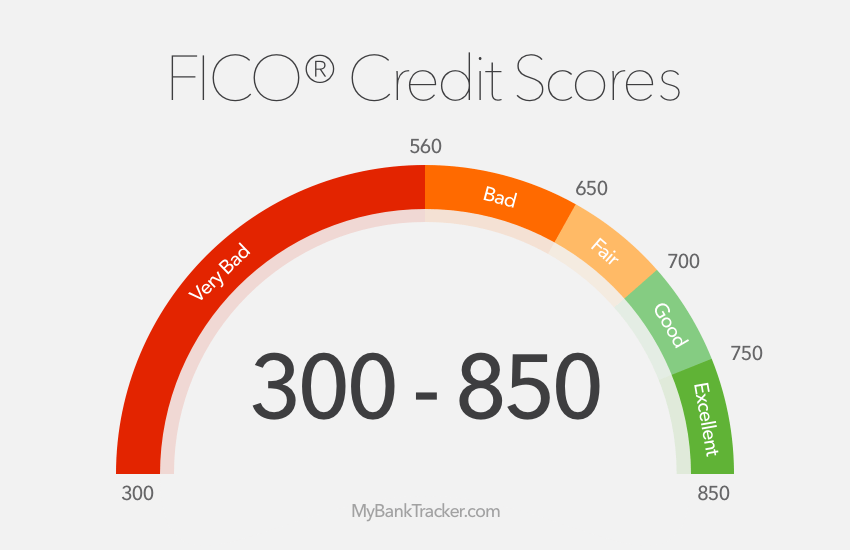

Your credit score lives on a scale from 300 to 850. A score of 300 to 560 is considered very bad credit, while 560 to about 650 is poor.

Average credit scores exist in the 650 to 700 range, and good to excellent credit is anything above 700 (with the best scores being 750 or higher).

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

FICO doesn’t disclose the exact formula used to calculate your score, but we do know it was developed after collecting predictive analytics from credit users. This data reasonably predicts what you’re likely to do in the future, based on particular past financial behaviors.

The past financial behaviors that FICO finds important can give you an idea of how you end up with your credit score. Five factors that go into calculating your score include the following:

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you've requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

These five factors give hints as to what you need to focus on to build and maintain a good credit score.

Since payment history makes up 35% of your credit score, for example, paying your bills on time and in full is likely to be the single biggest determinant of your score.

But that’s not to say the other factors don’t matter. And this is where hard inquiries on your credit can lower that credit score.

Hard inquiries are one factor within the larger area of “new inquiries,” which account for 10% of your credit score. When you, a lender, or another entity generates a hard inquiry on your credit, it will likely lower your score by about five points.

That’s pretty insignificant in the grand scheme of things. You can rebuild your score after an inquiry by making sure you keep balances low, use 30% or less of your available credit per statement cycle, and make all payments in full and by their due dates.

But remember, this is just referring to a single inquiry. Hard inquiries can cause trouble when many of them hit your credit at the same time.

Multiple hard inquiries in a short period of time will decrease your credit score much more dramatically. It also makes it appear as if you’re desperate to borrow, which signals a red flag to risk-averse borrowers.

As far as soft inquiries go? Remember, they don’t affect your credit score at all. Soft inquiries shouldn’t raise too much concern. It’s the hard ones you need to watch.

How Long Hard Inquiries Hang Around

Hard inquiries are considered “negative” information because they lower your credit score (either slightly, by five points, or dramatically, if you generate a lot of hard pulls in a short amount of time).

As such, they do appear on your credit report for others to see. Hard inquiries stay in your credit file for two years. But they can only impact your credit score for 12 months.

Other kinds of negative information will exist on your credit report for seven years. This includes any accounts sent to collections, financial judgments against you, and bankruptcy filings.

Avoid Lots of Hard Inquiries to Protect Your Credit Score

Some hard inquiries into your credit are inevitable. If you apply for a loan or a credit card, the lender, bank, or credit card issuer will do a hard pull to evaluate your credit history and score.

But remember, a single inquiry only lowers your credit score by about five points. So if you know you want to shop around for the best interest rate on a loan, for example, plan ahead.

Multiple hard inquiries that hit your credit within a 14-day window count as a single inquiry. This protects your score from dramatically dropping while it allows you to evaluate your lending options.

You can also avoid hard inquiries just by asking. If, for example, you want to increase your credit limit, call your credit card issuer.

Talk to a customer service representative and explain that you’d like to increase your credit limit — but only if you can do so without the issuer performing a hard inquiry.

In many cases, the company will agree. You just need to ask.

Finally, try to carefully manage when you apply for new credit or request limit increases. Opening a new account every year will not negatively impact your credit the way opening six accounts in three months will.

Taking these actions can help minimize how many hard inquiries hit your account.

That, in turn, allows you to handle the inquiries and the very small drop in your score when you need to get a new credit card, apply for a loan, or let another company check your credit.