The Best Savings Accounts for Your Emergency Fund

A rainy day savings fund can be a lifesaver when you’re thrown a curveball. If you’ve committed to building up your emergency fund, the big question is where to put it.

Online banks offer a tempting combination of higher rates on savings deposits and fewer fees. But which savings account is the best?

We’ve analyzed more than 50 of the most popular savings accounts to determine which savings accounts are the best for emergency funds.

Best Accounts for Your Emergency Fund

Discover® Bank

Discover Bank has provided consistently-high savings rates with no fees for many years — a reliable online bank.

The online bank also offers great online and mobile banking features for easy access to your savings.

Read the Discover Bank Online Savings Account editor’s review.

American Express National Bank

American Express National Bank is another well-known online bank for keeping competitive savings rates at a consistent level.

There are no major frills with this savings account. With $0 to open and no monthly fees, customers can just focus on saving.

Read the American Express® High Yield Savings Account editor’s review.

Synchrony Bank

Synchrony Bank offers a market-leading savings rate on its online savings account — put it in the top spot for emergency funds.

There’s no minimum balance or monthly service fee to nibble away at the interest you’re earning.

If an emergency strikes, you’ve got several ways to tap your into your savings.

You can make withdrawals by phone, online or at the ATM. The High Yield Savings account comes with an optional ATM card for easy transactions at any Plus or Accel logo worldwide.

Synchrony Bank doesn’t charge any ATM fees and you can get up to $5 in domestic ATM fees refunded each statement cycle.

If you have Diamond Reward status in the Synchrony Bank Perks program, ATM fee refunds are unlimited.

CIT Bank

CIT Bank is another online bank that ranks among the best for savers. If you’re looking for a place to park your emergency fund, the Premier High Yield Savings account delivers a high interest rate.

You’ll need $100 to open an account but there are no account opening or maintenance fees to contend with.

This account has the same $100 minimum deposit and you won’t pay a monthly maintenance fee.

One thing to note about CIT Bank, however: you don’t get an ATM or debit card with either savings option.

If you need to use your emergency fund, you’ll have to schedule an ACH transfer, request a check or set up a wire transfer. That makes Synchrony Bank the better choice if you value the convenience of being able to get cash quickly at the ATM.

CIT Bank does have its own mobile app. You can use the app to check your balances, transfer funds between accounts or make mobile check deposits to add to your savings.

How Much Should You Save in an Emergency Fund?

If you’re just starting out with saving an emergency fund, this is an important question to consider.

Financial experts often vary in their idea of what constitutes a solid emergency fund.

For some, it may be 3 to 6 months’ worth of expenses. For others, it may be closer to 12 worth of expenses to feel comfortable.

A good target to aim for in the beginning is $1,000.

This isn’t a huge amount but it’s large enough to help you cover most minor emergencies, like your car breaking down or an unexpected co-pay at the doctor if you get sick.

Ideal Size of an Emergency Fund

| To start... | Ideal goal... | Super safe... |

|---|---|---|

| $1,000 | 3-6 months of essential expenses | 12 months of expenses |

Calculate the size of your emergency fund

Once you get that initial $1,000 saved, you can think about how big you’d like your emergency fund to eventually be.

If you think three months is too little but 12 months is too much, you could aim for the middle and stash away 9 months’ worth of savings instead.

Remember to look closely at your budget so you know what your minimum baseline is for spending each month.

Your emergency fund should be enough to cover your must-pay expenses, including:

- Housing

- Utilities

- Food at home

Add up the total cost of those three expenses to find out what you need — at a minimum — on a monthly basis.

When in doubt, it’s better to err on the side of caution and aim to save more, rather than less.

How to Build Your Financial Cushion

Nailing down a number for emergency savings was the first step. Now you have to create a plan for actually creating it.

The simplest way to do it is to commit to saving a certain amount each month automatically.

If you’re paid biweekly, for example, you could schedule an automatic transfer from checking to savings each payday until you hit your savings target.

If you want to speed up your savings progress, you can set a specific deadline for building your emergency fund.

For example, let’s say you want to save $10,000 in 12 months. You’d need to save $833 a month and some change to get there on time.

Go back to your budget to see if that’s doable. If not, you may have to adjust the timing or look for ways to boost your monthly savings amount. Some of the possibilities for finding extra money to save include:

- Cutting out one expense from your monthly budget

- Saving any windfalls, like your tax refund or bonus from work

- Depositing your cash back credit card rewards into savings

- Saving any leftover money that you budgeted for expenses but didn’t spend

- Find additional streams of income

What Makes a Savings Account Good for An Emergency Fund?

With so many savings accounts to choose from, it’s important to recognize what makes one better than another for you personally.

What to look for:

- No monthly maintenance fee

- Great online and mobile banking

- High interest rate

- Optional ATM card

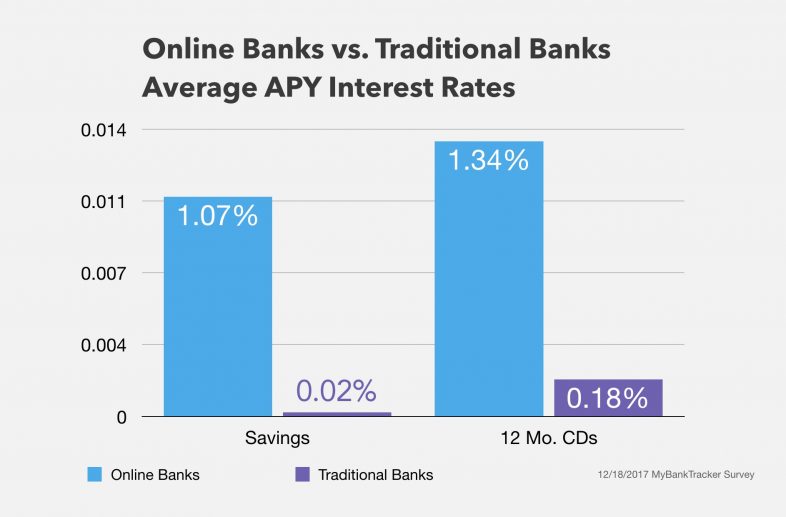

Generally, online banks are going to be preferable to traditional brick-and-mortar banks when it comes to interest rates and fees.

They may also feature lower minimum deposits to open an account, or have no minimum opening deposit at all.

In terms of access, it really depends on what you’re comfortable with. For some savers, an ATM card is a must-have so they can get to their money when they truly need. For others, it could be a temptation to make unnecessary withdrawals.

That brings us to the next question, which is: when is it okay to pull money out of your emergency fund?

When It Makes Sense to Use Your Emergency Fund

Generally, emergency funds are designed to help you cover unexpected expenses so you don’t have to turn to a credit card or loan. But not every unplanned expense is an emergency.

Some of the things it might be appropriate to use your emergency fund for include:

- Tow truck service if your car breaks down

- Paying a plumber to repair a broken pipe

- Paying the dentist for an emergency tooth repair

- Taking care of an emergency visit to the vet because your pet gets sick

- Putting in a new heating and air system because yours conks out

- Meeting the deductible on your homeowner’s policy because you had to file a claim for storm damage

- Covering your day to day living expenses temporarily if you lose your job, or an illness or natural disaster keeps you from going into work

These are things you can’t necessarily predict or prevent. Emergencies can be big or small but they’re usually things outside of your control.

You wouldn’t use your emergency fund, however, to pay for holiday shopping or a vacation. It’s smarter to set up separate savings accounts for those goals.

It’s smarter to set up separate savings accounts for those goals.

If you’re not sure whether something is an emergency, ask yourself three things:

- Is the expense unexpected?

- Is it something that’s necessary?

- Is it something that needs to be paid right away?

If the answer to all three questions is ‘yes’, then it’s okay to use your emergency fund. But once the emergency is over, make it your goal to replenish your savings as quickly as possible so you’re not caught off-guard in case another one comes along.

But once the emergency is over, make it your goal to replenish your savings as quickly as possible so you’re not caught off-guard in case another one comes along.